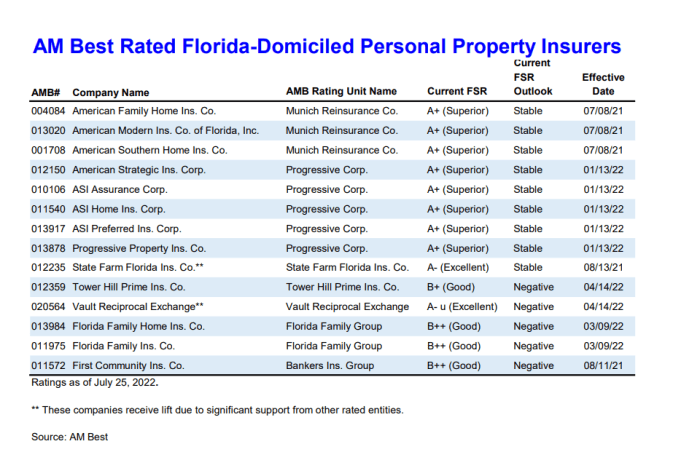

AM Best rating for insurance companies is like the “cool kid” badge in the insurance world. It’s a big deal, and knowing what it means can help you make smarter decisions about your coverage. Think of it like the “A+” you got in high school, but for insurance companies – it shows they’re financially stable and trustworthy.

AM Best, a global credit rating agency, evaluates insurance companies based on their financial strength, operating performance, and business profile. They assign ratings, ranging from A++ (super strong) to D (in trouble), which give you a glimpse into the insurer’s ability to pay out claims when you need them most. It’s like having a financial “report card” for each insurance company, so you can pick the one that’s got your back.

AM Best Ratings and the Future of the Insurance Industry

AM Best ratings are a cornerstone of the insurance industry, providing crucial insights into the financial strength and creditworthiness of insurers. These ratings play a significant role in guiding investors, regulators, and policyholders alike. As the insurance landscape continues to evolve, driven by technological advancements and shifting market dynamics, the influence of AM Best ratings is likely to become even more prominent.

The Impact of Market Conditions and Technology on AM Best Ratings

The insurance industry is constantly adapting to new challenges and opportunities. The rise of digital technologies, changing consumer preferences, and evolving regulatory landscapes are all influencing how insurers operate. These factors can have a direct impact on AM Best ratings.

For example, the adoption of artificial intelligence (AI) and machine learning (ML) in underwriting and claims processing can lead to greater efficiency and lower costs for insurers. However, it also presents new risks, such as data security breaches and the potential for algorithmic bias. Insurers that effectively manage these risks and leverage technology to improve their operations are likely to receive higher AM Best ratings.

Similarly, the increasing prevalence of climate change and natural disasters poses significant challenges for insurers. Those companies that demonstrate strong risk management practices, including robust catastrophe modeling and reinsurance strategies, will be better positioned to navigate these risks and maintain strong AM Best ratings.

AM Best Ratings as a Tool for Evaluating Financial Health, Am best rating for insurance companies

AM Best ratings are based on a comprehensive assessment of an insurer’s financial strength, operating performance, and business profile. These ratings provide a valuable framework for evaluating the financial health of insurers and can be used by various stakeholders to make informed decisions.

Investors can use AM Best ratings to assess the creditworthiness of insurers before making investment decisions. Regulators can use these ratings to monitor the financial stability of the insurance industry and ensure that insurers are meeting capital adequacy requirements. Policyholders can use AM Best ratings to select insurers with a strong track record of financial stability and the ability to fulfill their obligations.

AM Best Rating Categories and Their Implications

AM Best assigns a variety of ratings to insurance companies, reflecting their financial strength and operating performance. These ratings are categorized into different tiers, each with specific implications for the insurance industry.

| Rating Category | Description | Implications |

|---|---|---|

| A++ (Superior) | Insurers with the strongest financial strength and operating performance. | Strongest financial stability, high creditworthiness, and ability to withstand economic downturns. |

| A+ (Superior) | Insurers with very strong financial strength and operating performance. | High financial stability, strong creditworthiness, and ability to withstand economic downturns. |

| A (Excellent) | Insurers with strong financial strength and operating performance. | Solid financial stability, good creditworthiness, and ability to withstand moderate economic downturns. |

| A- (Excellent) | Insurers with strong financial strength and operating performance. | Solid financial stability, good creditworthiness, and ability to withstand moderate economic downturns. |

| B++ (Good) | Insurers with good financial strength and operating performance. | Moderate financial stability, fair creditworthiness, and ability to withstand mild economic downturns. |

| B+ (Good) | Insurers with good financial strength and operating performance. | Moderate financial stability, fair creditworthiness, and ability to withstand mild economic downturns. |

| B (Fair) | Insurers with adequate financial strength and operating performance. | Limited financial stability, fair creditworthiness, and limited ability to withstand economic downturns. |

| B- (Fair) | Insurers with adequate financial strength and operating performance. | Limited financial stability, fair creditworthiness, and limited ability to withstand economic downturns. |

| C++ (Marginal) | Insurers with marginal financial strength and operating performance. | Weak financial stability, poor creditworthiness, and limited ability to withstand economic downturns. |

| C+ (Marginal) | Insurers with marginal financial strength and operating performance. | Weak financial stability, poor creditworthiness, and limited ability to withstand economic downturns. |

| C (Weak) | Insurers with weak financial strength and operating performance. | Very weak financial stability, poor creditworthiness, and limited ability to withstand economic downturns. |

| C- (Weak) | Insurers with weak financial strength and operating performance. | Very weak financial stability, poor creditworthiness, and limited ability to withstand economic downturns. |

| D (Very Weak) | Insurers with very weak financial strength and operating performance. | Extremely weak financial stability, poor creditworthiness, and high risk of default. |

| E (Under Review) | Insurers under review for potential rating changes. | Uncertain financial stability and creditworthiness. |

| F (Failed) | Insurers that have failed to meet their financial obligations. | High risk of default, potential insolvency, and limited ability to fulfill policy obligations. |

Closure: Am Best Rating For Insurance Companies

Understanding AM Best ratings can help you feel confident about your insurance choices. It’s like having a secret weapon for navigating the insurance world. You’ll be able to pick a company that’s not just reliable, but also has the financial strength to be there for you when you need it most. So, before you sign on the dotted line, take a peek at that AM Best rating – it could be the difference between a smooth ride and a bumpy one!

FAQ Compilation

What happens if an insurance company gets a low AM Best rating?

A low rating might mean the company is facing financial challenges, which could impact their ability to pay claims. It’s a good idea to research further and consider other options.

Can AM Best ratings change over time?

Absolutely! AM Best regularly reviews and updates ratings based on the company’s performance and the market environment. So, it’s important to check the most recent ratings before making a decision.

Where can I find AM Best ratings?

You can find AM Best ratings on their website, and many insurance companies also display their ratings on their own websites.

Are all AM Best ratings created equal?

While a high rating is generally a good sign, it’s important to understand the nuances of each rating category. Read the detailed explanations on the AM Best website to get a complete picture.