Am Best rating insurance companies is a hot topic, especially when you’re trying to find the best coverage for your needs. It’s like picking the perfect playlist for a road trip – you want something that’s got a good beat, but also fits your vibe. You’re not just looking for the highest rating, you’re looking for a company that’s got your back, you know?

Choosing the right insurance company is a big deal, and it’s not always as simple as picking the one with the best rating. You’ve got to consider things like your individual needs, your coverage preferences, and your financial situation. It’s like finding the right pair of shoes – you want something that’s comfortable, stylish, and fits your personality.

Understanding “Best” in Insurance: Am Best Rating Insurance Companies

Finding the “best” insurance company can feel like a mission impossible. It’s like trying to find the perfect pair of jeans – everyone’s got their own unique style and needs.

The Subjectivity of “Best”

“Best” is a relative term when it comes to insurance. What’s best for one person might not be best for another. It all boils down to your individual needs, coverage preferences, and financial situation.

- Individual Needs: Are you a young, healthy individual with a limited budget? Or are you a family with a mortgage and young children? Your needs will dictate the type of insurance you need and the features that are most important to you.

- Coverage Preferences: Do you want basic coverage or are you looking for comprehensive protection? Do you need specific riders or endorsements? Your preferences will determine the insurance company that best aligns with your needs.

- Financial Situation: Your budget will play a significant role in your insurance choices. Some companies offer lower premiums but might have limited coverage options. Others might have higher premiums but provide more comprehensive protection.

The Limitations of Rankings

While insurance rankings and “best” lists can be helpful starting points, they shouldn’t be your only guide. Here’s why:

- Rankings are often based on limited criteria: They might prioritize factors like financial strength or customer satisfaction, but may not consider all aspects that are important to you.

- Rankings can be biased: They might be influenced by advertising or partnerships, leading to a skewed representation of the insurance market.

- Rankings don’t account for your specific needs: What’s ranked “best” for one person might not be the best fit for you.

“Best” Varies by Insurance Type

The definition of “best” changes depending on the type of insurance you’re looking for.

- Health Insurance: The “best” health insurance plan depends on your health needs, medical history, and budget. Some plans offer extensive coverage but have high premiums, while others might have lower premiums but limited coverage.

- Auto Insurance: The “best” auto insurance company depends on your driving history, the type of car you drive, and your location. Some companies offer discounts for good drivers, while others might have lower rates in certain areas.

- Home Insurance: The “best” home insurance policy depends on the value of your home, the level of coverage you need, and your location. Some companies offer discounts for safety features, while others might have lower rates in areas with lower risk of natural disasters.

Key Factors for Rating Insurance Companies

Rating agencies play a crucial role in helping consumers navigate the complex world of insurance. These agencies evaluate insurance companies based on various factors to determine their financial strength, customer satisfaction, and overall reliability. By understanding these key factors, consumers can make informed decisions about which insurance company best suits their needs.

Financial Stability, Am best rating insurance companies

Financial stability is paramount when choosing an insurance company. Rating agencies assess a company’s financial health by analyzing several key metrics:

- Capital and Surplus: This represents the company’s financial cushion, indicating its ability to meet claims and other obligations. A higher capital and surplus ratio suggests a stronger financial position.

- Investment Performance: Rating agencies evaluate the company’s investment strategy and returns. A well-diversified investment portfolio with solid returns is a positive indicator.

- Underwriting Performance: This assesses the company’s ability to price insurance policies accurately and manage risk effectively.

- Operating Expenses: Rating agencies consider the company’s efficiency in managing its operations, including administrative costs and marketing expenses.

Customer Service

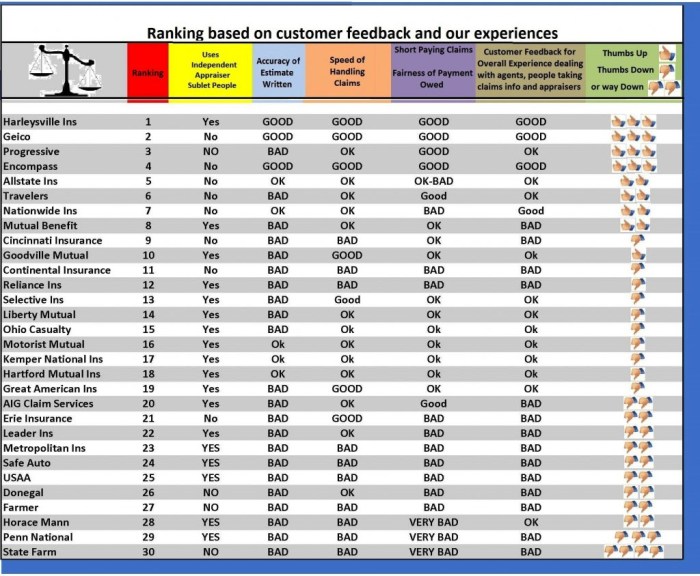

Excellent customer service is essential for a positive insurance experience. Rating agencies consider factors such as:

- Response Time: How quickly does the company respond to inquiries and claims?

- Accessibility: Are there multiple ways to contact the company, such as phone, email, and online chat?

- Friendliness and Professionalism: Do customers feel treated with respect and understanding?

- Complaint Resolution: How effectively does the company address customer complaints?

Claims Handling

A company’s claims handling process is crucial for a smooth and fair experience when a claim is filed. Rating agencies assess:

- Claims Processing Speed: How quickly does the company process claims and make payments?

- Transparency: Is the claims process clear and understandable?

- Fairness: Does the company settle claims fairly and in a timely manner?

- Customer Satisfaction: Are customers satisfied with the claims handling process?

Coverage Options

The breadth and depth of coverage options offered by an insurance company are critical factors to consider. Rating agencies evaluate:

- Policy Features: Does the company offer a range of coverage options to meet different needs?

- Flexibility: Can customers customize their policies to fit their specific circumstances?

- Value: Do the coverage options offer good value for the price?

- Innovation: Does the company offer innovative coverage options or features?

Rating Agencies and Methodologies

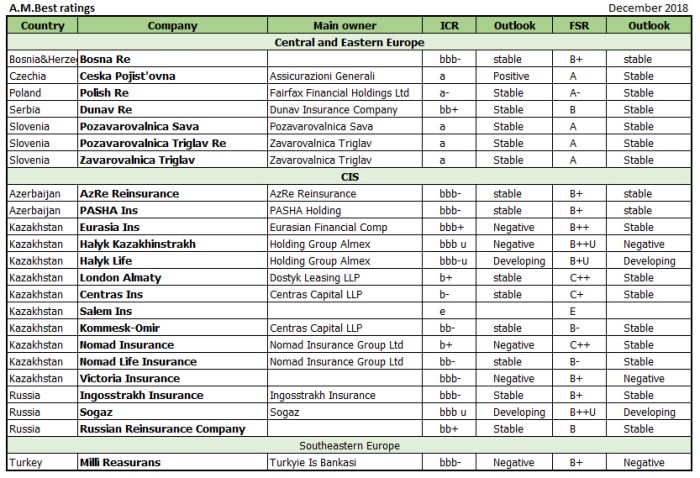

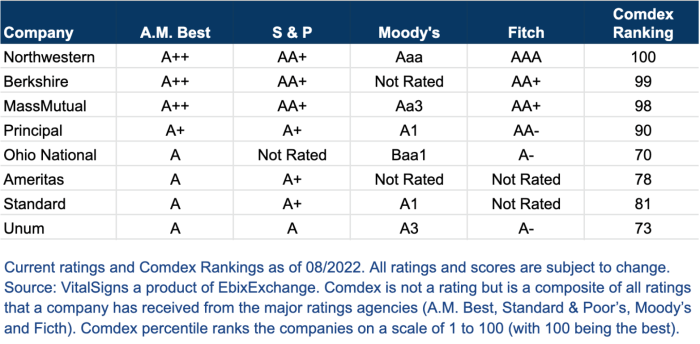

Several rating agencies specialize in evaluating insurance companies, each with its own methodology.

- AM Best: A leading rating agency, AM Best uses a comprehensive financial analysis, considering factors like capital adequacy, underwriting performance, and operating efficiency.

- Standard & Poor’s (S&P): S&P focuses on a company’s financial strength, its ability to meet its obligations, and its overall risk profile.

- Moody’s: Moody’s uses a similar approach to S&P, focusing on financial strength, risk management, and the company’s overall creditworthiness.

- Fitch Ratings: Fitch evaluates companies based on their financial strength, their ability to meet their obligations, and their management quality.

Key Factors for Different Types of Insurance

The relative importance of different factors can vary depending on the type of insurance. For example, financial stability might be more critical for life insurance than for homeowners insurance.

| Type of Insurance | Financial Stability | Customer Service | Claims Handling | Coverage Options |

|---|---|---|---|---|

| Life Insurance | High | Medium | Medium | High |

| Homeowners Insurance | Medium | Medium | High | High |

| Auto Insurance | Medium | High | High | Medium |

| Health Insurance | High | High | High | High |

Epilogue

Finding the best insurance company is a journey, not a destination. It’s about understanding your needs, researching your options, and making informed decisions. It’s like navigating a maze, but with the right tools and information, you can find your way to the perfect coverage. So, buckle up, and let’s get started!

Essential FAQs

How often does Am Best update its ratings?

Am Best updates its ratings on a regular basis, typically annually or more frequently if there are significant changes in a company’s financial performance or operations.

What are the different rating categories used by Am Best?

Am Best uses a letter-based rating system, with A++ being the highest and D being the lowest. The ratings reflect a company’s overall financial strength, operating performance, and business profile.

Can a company’s rating change over time?

Yes, a company’s rating can change over time based on various factors, including changes in financial performance, regulatory environment, or industry trends.

Is an Am Best rating the only factor to consider when choosing an insurance company?

No, while an Am Best rating is a good indicator of a company’s financial stability, it’s not the only factor to consider. You should also evaluate customer service, claims handling, and coverage options.