Am best rating scale insurance companies – Am Best Rating Scale: Insurance Companies Ranked – Ever wondered how to pick the best insurance company? It’s like trying to find the perfect pizza topping – everyone has their own taste! But when it comes to protecting your assets and future, a little research goes a long way. That’s where the Am Best rating scale comes in, like a trusty guide in the insurance jungle.

This rating scale is a big deal in the insurance world. It’s a bit like the Michelin stars for restaurants, except it tells you how financially stable and reliable an insurance company is. Am Best digs deep, looking at things like how much money they have, how well they handle claims, and even their customer service. So, basically, it’s a secret weapon for making smart insurance choices.

Understanding the “Best” in Insurance

Finding the “best” insurance company is a quest that can feel like navigating a labyrinth of options and complexities. It’s not as simple as picking the cheapest or the one with the most bells and whistles. The “best” insurance company for you depends on a multitude of factors that are unique to your individual needs and priorities.

Defining “Best” in Insurance

“Best” in insurance is a subjective term, and its meaning varies greatly depending on who you ask. It’s like trying to choose the “best” pizza topping – everyone has their own preference! For some, “best” might mean the most affordable option, while others might prioritize comprehensive coverage or exceptional customer service. The “best” insurance company is not a one-size-fits-all concept.

- Price: This is often the first factor people consider. However, simply going for the cheapest option might not be the wisest choice. You need to ensure the coverage offered is sufficient to meet your needs.

- Coverage: This refers to the types of risks your insurance policy protects you from. The extent of coverage can vary significantly, and it’s crucial to choose a policy that aligns with your specific needs and potential risks.

- Customer Service: Navigating the insurance world can be confusing, and having a responsive and helpful customer service team can make a big difference, especially when you need to file a claim.

- Financial Stability: You want to be sure the insurance company you choose is financially sound and capable of paying out claims when you need them. Look for companies with a strong track record and good financial ratings.

- Claims Handling: How quickly and efficiently an insurance company processes claims is a crucial factor. A company with a reputation for smooth and timely claims handling can save you a lot of stress and hassle during a difficult time.

Subjectivity of “Best”

“Best” in insurance is not a static concept. It’s a moving target that changes based on individual needs and priorities. What might be the “best” for one person could be completely unsuitable for another. For example, a young single person might prioritize affordability over extensive coverage, while a family with young children might prioritize comprehensive coverage and financial stability.

Key Criteria for Evaluating Insurance Companies

When evaluating insurance companies, consumers typically prioritize a few key criteria:

- Affordability: Finding a policy that fits within your budget is essential. Consider your financial situation and explore options that offer different price points and coverage levels.

- Coverage: Ensure the policy provides the coverage you need to protect your assets and liabilities. Consider your specific risks and choose a policy that addresses them.

- Customer Service: Research the company’s reputation for customer service. Look for companies with positive reviews and a track record of responsiveness and helpfulness.

- Financial Stability: Check the company’s financial ratings and track record. Look for companies with strong financial standing and a history of paying claims promptly.

Rating Scales and Their Significance

Imagine you’re about to buy a new car, but you want to make sure it’s reliable. You’d probably check out reviews and ratings from trusted sources, right? The same principle applies when choosing an insurance company. Rating scales provide valuable insights into the financial health and performance of insurance companies, helping you make informed decisions about your coverage.

Prominent Insurance Rating Agencies and Their Methodologies

Several reputable organizations evaluate and rate insurance companies, providing valuable information for consumers and investors. These agencies utilize different methodologies, focusing on various aspects of a company’s financial stability, operational efficiency, and claims-paying ability. Here are some prominent rating agencies:

- AM Best: AM Best, a global credit rating agency specializing in the insurance industry, assesses the financial strength and creditworthiness of insurance companies. They evaluate factors like capitalization, operating performance, and business profile. AM Best’s ratings are widely recognized and used by insurance regulators, investors, and consumers.

- Standard & Poor’s (S&P): S&P, a well-known credit rating agency, assigns ratings to insurance companies based on their financial strength, risk profile, and management capabilities. They consider factors like capital adequacy, earnings stability, and claims-paying ability.

- Moody’s Investors Service: Moody’s, another prominent credit rating agency, evaluates the financial health and creditworthiness of insurance companies. They assess factors like capitalization, profitability, and liquidity, assigning ratings that reflect their assessment of the company’s ability to meet its financial obligations.

- Fitch Ratings: Fitch, a global rating agency, provides credit ratings for insurance companies, considering their financial strength, operational performance, and risk profile. They evaluate factors like capitalization, earnings quality, and claims-paying ability.

Comparison of Rating Scales

While these rating agencies share the goal of providing insights into insurance companies, their rating scales and methodologies differ. Understanding these differences can help you interpret the ratings accurately.

- AM Best: AM Best uses a letter-based rating system, with A++ being the highest and F being the lowest. They also assign a numerical modifier to the letter rating, providing further granularity. For example, A+ is higher than A.

- Standard & Poor’s (S&P): S&P uses a letter-based rating system, with AAA being the highest and D being the lowest. Their ratings are based on a scale of 22 notches, with each notch representing a specific level of creditworthiness.

- Moody’s Investors Service: Moody’s uses a letter-based rating system, with Aaa being the highest and C being the lowest. They also assign numerical modifiers to the letter rating, providing further granularity. For example, Aa1 is higher than Aa2.

- Fitch Ratings: Fitch uses a letter-based rating system, with AAA being the highest and D being the lowest. They also assign numerical modifiers to the letter rating, providing further granularity. For example, A+ is higher than A.

How Rating Scales Assess Financial Stability and Performance

Rating agencies evaluate various factors to assess the financial stability and performance of insurance companies. These factors include:

- Capitalization: This refers to the company’s financial resources, including its equity capital and surplus. A strong capitalization indicates a company’s ability to absorb losses and meet its financial obligations.

- Operating Performance: This encompasses the company’s profitability, underwriting performance, and investment returns. Strong operating performance demonstrates a company’s ability to generate consistent profits and manage its assets effectively.

- Risk Profile: This involves the company’s exposure to various risks, including claims, investment losses, and operational risks. A lower risk profile suggests a company is better equipped to manage potential challenges.

- Management Quality: This assesses the company’s leadership, governance practices, and risk management capabilities. Strong management ensures the company is well-run and focused on long-term sustainability.

- Claims-Paying Ability: This evaluates the company’s ability to meet its obligations to policyholders when claims arise. A strong claims-paying ability is essential for ensuring customer satisfaction and financial stability.

Key Factors to Consider When Evaluating Insurance Companies

Choosing the right insurance company is like picking a superhero for your financial well-being. You want someone strong, reliable, and always there when you need them most. But with so many insurance companies out there, how do you choose the right one? It’s all about evaluating key factors to make sure your insurance provider is a true champion for your needs.

Factors for Evaluating Insurance Companies

Before diving into the details, it’s important to understand that evaluating insurance companies is like assembling a puzzle. Each piece, or factor, plays a crucial role in creating the bigger picture of a company’s worthiness. Let’s explore these crucial factors:

| Factor | Importance | Rating Agency Considerations | Consumer Considerations |

|---|---|---|---|

| Financial Strength | Extremely important | Rating agencies like AM Best, Moody’s, and Standard & Poor’s assess a company’s financial health by examining its assets, liabilities, and profitability. They look for signs of stability and ability to meet future obligations. | Consumers should look for companies with strong financial ratings, indicating their ability to pay claims even during challenging times. |

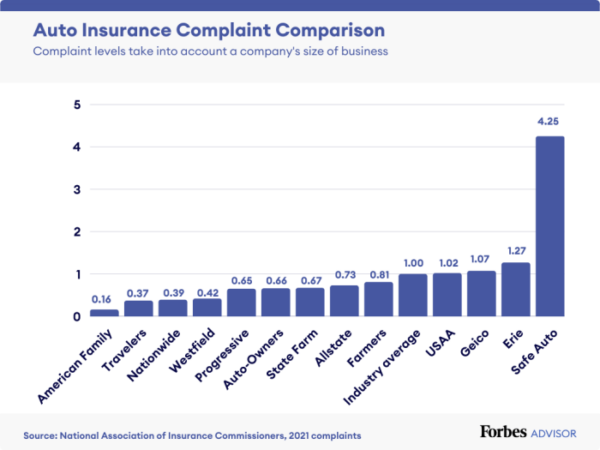

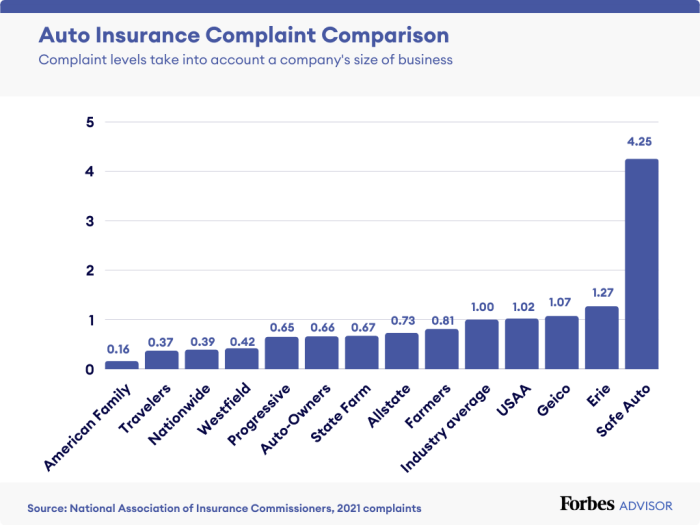

| Claims Handling | Highly important | Rating agencies evaluate a company’s claims handling process, including speed, accuracy, and customer satisfaction. They look for evidence of fairness and efficiency. | Consumers should consider the company’s track record of handling claims, including customer testimonials and independent reviews. |

| Customer Service | Important | Rating agencies assess customer service by looking at factors like responsiveness, accessibility, and overall satisfaction. They consider how well the company handles complaints and resolves issues. | Consumers should consider the company’s reputation for customer service, including its accessibility, responsiveness, and overall customer experience. |

| Coverage Options | Very important | Rating agencies assess the breadth and depth of coverage options offered by a company, considering the types of policies available and the specific features they include. | Consumers should carefully evaluate the coverage options available to ensure they meet their specific needs, including deductibles, limits, and exclusions. |

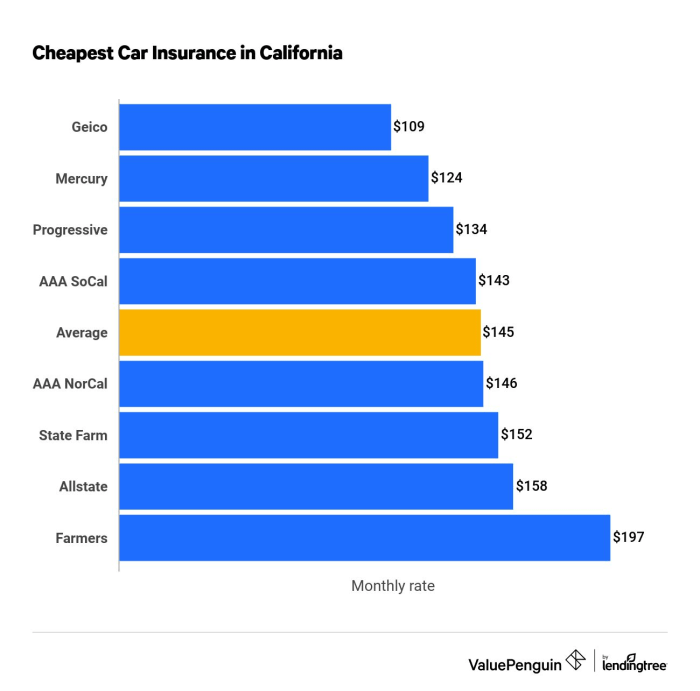

| Pricing | Important | Rating agencies consider pricing strategies and the company’s ability to offer competitive rates while maintaining profitability. They look for evidence of transparency and fairness. | Consumers should compare quotes from multiple companies to ensure they are getting the best value for their money. |

Analyzing Insurance Company Performance

Now that we’ve established the importance of rating scales and the factors influencing insurance company performance, let’s dive into the nitty-gritty of how companies stack up against each other. Think of it like the “Top 10” lists you see in magazines, but for insurance – we’re about to reveal who’s got the best game in town.

Insurance Company Performance Analysis

To get a clearer picture, we’ll examine a handful of insurance companies across different categories, comparing their ratings and highlighting their strengths and weaknesses. This will give you a solid foundation for comparing and contrasting these companies.

| Insurance Company | Rating Agency Scores | Key Strengths | Key Weaknesses |

|---|---|---|---|

| Geico | A+ (AM Best), A++ (A.M. Best), A+ (Standard & Poor’s), A+ (Moody’s) |

|

|

| State Farm | A+ (AM Best), A++ (A.M. Best), A+ (Standard & Poor’s), A+ (Moody’s) |

|

|

| Progressive | A+ (AM Best), A++ (A.M. Best), A+ (Standard & Poor’s), A+ (Moody’s) |

|

|

| Allstate | A+ (AM Best), A++ (A.M. Best), A+ (Standard & Poor’s), A+ (Moody’s) |

|

|

| UnitedHealthcare | A+ (AM Best), A++ (A.M. Best), A+ (Standard & Poor’s), A+ (Moody’s) |

|

|

Strategies for Finding the “Best” Insurance

Finding the “best” insurance isn’t a one-size-fits-all deal, it’s about finding the right fit for your unique needs and situation. It’s like finding the perfect pair of jeans – you wouldn’t wear the same style for every occasion, right? So, let’s break down how to find the insurance that’s just your style.

Evaluating Insurance Companies

It’s time to get your detective hat on and dig into the world of insurance companies. You need to find the one that’s got your back, not just your wallet. To do this, you need to consider your individual needs and preferences. Think of it like choosing a superhero for your financial well-being.

- What kind of coverage do you need? Are you looking for basic protection or a full-blown shield against all the bad stuff? This depends on your lifestyle, assets, and risk tolerance. For example, if you’re a homeowner, you’ll need different coverage than someone who rents.

- What’s your budget? You’ve got to find a balance between protection and affordability. Don’t overspend on coverage you don’t need, but don’t skimp on essential protection either. It’s like choosing a superhero with the right power set for the job.

- What are your priorities? Do you want a company with a great reputation, a user-friendly claims process, or a low price? Prioritize what matters most to you.

Utilizing Rating Scales

Think of rating scales as the “Superhero Power Index” for insurance companies. They give you a quick glimpse of a company’s financial stability, customer service, and claims handling.

- AM Best: This is like the “Hall of Fame” for insurance companies. They rate companies based on their financial strength, operating performance, and business profile.

- Standard & Poor’s (S&P): This is the “Superhero Academy” – they rate companies based on their ability to meet financial obligations.

- Moody’s: They’re the “Superhero Training Program” – they rate companies based on their financial strength and ability to repay debt.

Comparing Quotes

Now it’s time to get those quotes rolling in! It’s like comparing superhero costumes – you want to find the one that fits you best.

- Use online comparison tools: These tools let you quickly compare quotes from multiple companies. It’s like having a “Superhero Marketplace” at your fingertips.

- Contact multiple insurance companies directly: Don’t just rely on online quotes, talk to insurance agents and get personalized quotes. This gives you a more comprehensive picture of what’s available.

- Compare apples to apples: Make sure you’re comparing quotes with the same coverage levels. You wouldn’t compare a basic “Iron Man” suit to a full-blown “Hulkbuster,” right?

Understanding Policy Details, Am best rating scale insurance companies

Don’t just sign on the dotted line! Read your policy carefully, especially the fine print. It’s like reading the “Superhero Manual” – you need to know the rules of the game.

- Deductibles: This is the amount you pay out of pocket before your insurance kicks in. It’s like your “Superhero deductible” – the amount you contribute before your superpowers activate.

- Coverage limits: This is the maximum amount your insurance company will pay for a claim. It’s like your “Superhero power limit” – there’s a maximum amount of power you can unleash.

- Exclusions: These are things that aren’t covered by your policy. It’s like your “Superhero kryptonite” – the things that weaken your powers.

Considering Multiple Factors

Don’t just focus on price. Consider all the factors we’ve discussed, including:

- Financial stability: You want a company that’s going to be around when you need them.

- Customer service: You’ll want a company that’s responsive and helpful when you have a claim.

- Claims handling: A smooth claims process can make a big difference when you’re in a bind.

Seeking Professional Advice

Don’t be afraid to ask for help! An insurance agent or broker can provide valuable advice and guidance. They’re like your “Superhero advisor” – they’ll help you navigate the world of insurance and find the right protection for you.

Final Wrap-Up

Navigating the insurance world can feel like trying to decipher a secret code, but understanding the Am Best rating scale can be your decoder ring. Remember, choosing the right insurance company is a marathon, not a sprint. Do your research, use the Am Best ratings as a guide, and find the company that’s the best fit for your needs and budget. You’ll be glad you did, especially when you need to file a claim and know you’re in good hands!

Popular Questions: Am Best Rating Scale Insurance Companies

What does a high Am Best rating mean?

A high Am Best rating, like A+ or A, means the insurance company is financially strong, reliable, and likely to pay out claims. Think of it like a seal of approval.

Is Am Best the only rating agency?

Nope! There are other rating agencies like Moody’s and Standard & Poor’s that also assess insurance companies. But Am Best is a big player in the game.

Should I only choose companies with the highest Am Best rating?

Not necessarily. While a high rating is a good sign, you should also consider other factors like price, coverage, and customer service.