AM Best ratings of insurance companies are like the Oscars of the insurance world. They’re the ultimate seal of approval, letting you know which companies are rock solid and which ones might be a little shaky. Think of it as a cheat sheet for finding the best protection for your assets, whether it’s your car, your home, or your health.

These ratings are based on a ton of factors, like how financially stable the company is, how well they handle claims, and even how happy their customers are. It’s like a big, complex report card that tells you how good a company is at doing what they say they’ll do. And knowing this stuff can be a game changer when it comes to picking the right insurance company for you.

Understanding Insurance Company Ratings

Choosing the right insurance company can be a real headache, especially when you’re trying to figure out which one is the most reliable. That’s where insurance company ratings come in! These ratings are like a guidebook, helping you navigate the insurance jungle and pick a company that’s got your back.

Rating Agencies and Their Methodologies

Insurance company ratings are assigned by independent agencies that assess the financial strength and operational performance of insurance companies. These agencies use different methodologies, but they all aim to provide consumers with a clear picture of a company’s ability to pay claims and remain financially stable. Here are some of the major rating agencies and how they do their thing:

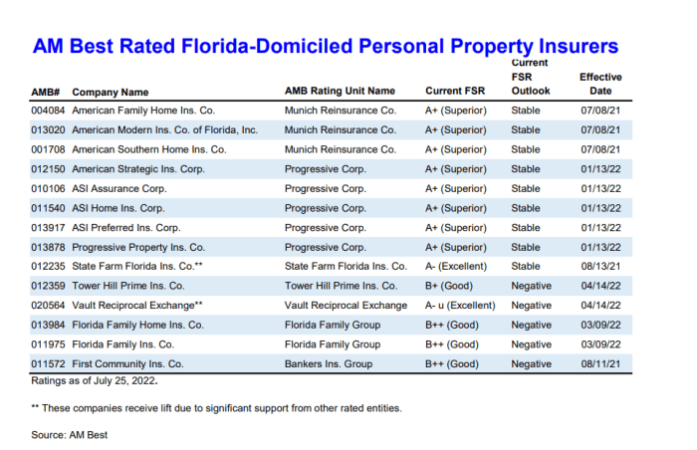

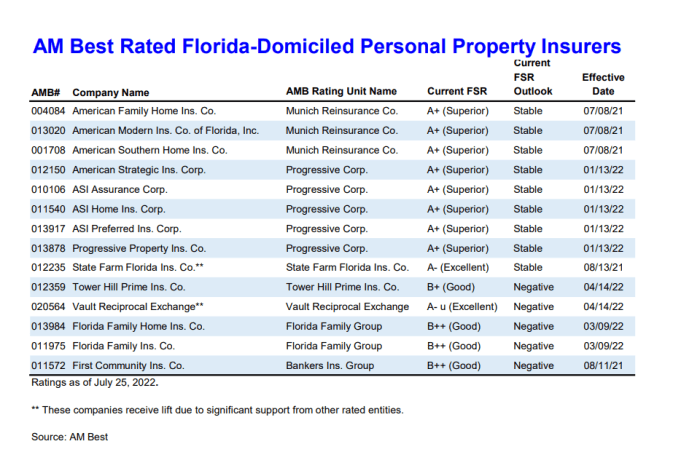

- AM Best: This agency has been around for over a century and is a go-to source for insurance company ratings. They use a financial strength rating system that ranges from A++ (Superior) to D (Weak). AM Best considers factors like an insurance company’s underwriting performance, claims handling, and overall financial strength.

- Standard & Poor’s (S&P): S&P is another big name in the ratings game. They assign credit ratings to insurance companies based on their financial strength and ability to meet their obligations. Their ratings range from AAA (Highest) to D (Lowest). S&P focuses on a company’s capital adequacy, earnings, and risk management.

- Moody’s Investors Service: Moody’s is another major rating agency that uses a system of letter grades to evaluate insurance companies. Their ratings range from Aaa (Highest) to C (Lowest). Moody’s takes into account a company’s financial strength, profitability, and risk profile.

- Fitch Ratings: Fitch Ratings is another agency that plays a key role in the insurance world. They assign ratings based on their assessment of a company’s financial strength, operational performance, and risk management. Their ratings range from AAA (Highest) to D (Lowest).

Key Factors Considered in Ratings

Think of insurance company ratings as a report card. They look at several factors to give you a clear picture of how well a company is doing. Here’s a breakdown of the main ingredients in the rating recipe:

- Financial Stability: This is like the company’s bank account. Rating agencies look at things like how much money a company has in reserve, its profitability, and its ability to handle unexpected losses. A financially stable company is more likely to be able to pay your claims when you need them.

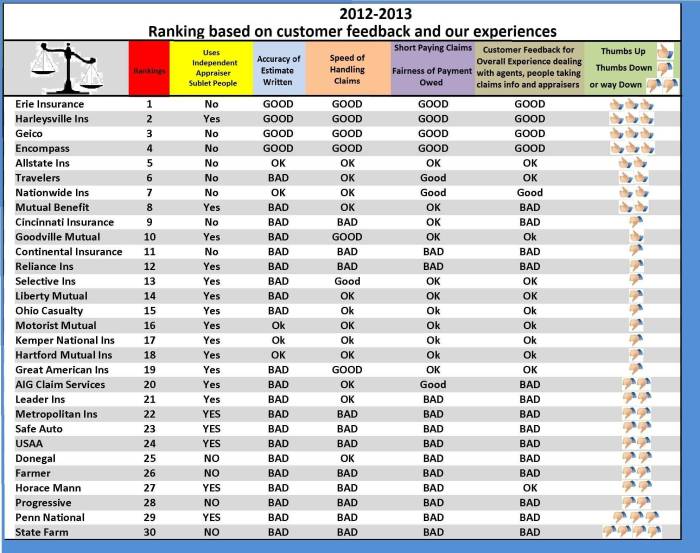

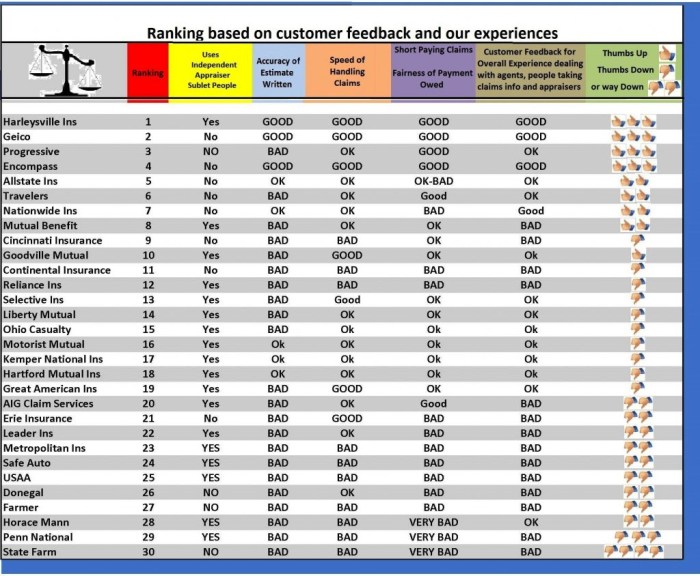

- Claims Handling: This is all about how well a company handles your claims when you need to file one. Rating agencies consider things like how quickly claims are processed, how fairly they are handled, and how satisfied customers are with the claims process. A company with a good claims handling record is more likely to be there for you when you need them most.

- Customer Satisfaction: You want to feel good about your insurance company, right? Rating agencies take customer satisfaction into account, looking at things like how easy it is to do business with a company, how responsive they are to your questions, and how well they resolve any issues you might have. A company with high customer satisfaction is likely to provide a positive experience.

- Regulatory Compliance: Insurance companies are subject to a bunch of regulations, and rating agencies want to make sure they’re playing by the rules. They look at things like how well a company complies with state and federal laws, and how well they manage their regulatory obligations. A company that’s in good standing with regulators is more likely to be trustworthy and reliable.

Interpreting Rating Systems

So, you’ve got your insurance company ratings, but what do they actually mean? It’s like deciphering a secret code, right? Don’t worry, we’re here to break it down for you. We’ll show you how to interpret those ratings and what they tell you about the financial strength and stability of your insurance company.

Understanding Rating Scales

Different rating agencies use various scales, but they all have one thing in common: they assess an insurance company’s financial health and ability to pay claims. Let’s take a look at A.M. Best’s financial strength ratings as an example. They use a letter-based system, starting with A++ (Superior) and going down to D (Under Supervision). The higher the rating, the better the company’s financial standing.

- A++ (Superior): These companies are considered the most financially sound and have a strong track record of paying claims. They’re like the A-list celebrities of the insurance world.

- A+ (Excellent): Still in the top tier, these companies are also considered very strong financially and have a high level of risk-taking capacity. They’re the reliable, dependable stars of the insurance world.

- A (Excellent): These companies are well-established and have a solid financial track record. They’re like the solid, dependable performers of the insurance world.

- B++ (Good): These companies are considered financially sound, but may have some limitations in their financial strength. They’re like the up-and-coming stars of the insurance world.

- B+ (Good): These companies are considered financially sound, but may have some limitations in their financial strength. They’re like the up-and-coming stars of the insurance world.

- B (Fair): These companies have some weaknesses in their financial strength, but are still considered capable of meeting their obligations. They’re like the “still-got-it” stars of the insurance world.

- C (Marginal): These companies have significant weaknesses in their financial strength and may have difficulty meeting their obligations. They’re like the “one-hit wonders” of the insurance world.

- D (Under Supervision): These companies are under regulatory supervision due to serious financial difficulties. They’re like the “canceled” stars of the insurance world.

Comparing Rating Systems

While A.M. Best is a widely recognized rating agency, it’s not the only one. Others like Standard & Poor’s, Moody’s, and Fitch Ratings also provide their own assessments. Each agency has its own unique methodology and rating scale, so it’s important to understand how they differ.

| Rating Agency | Rating Scale | Key Differences |

|---|---|---|

| A.M. Best | A++ to D | Focuses on financial strength and operational performance |

| Standard & Poor’s | AAA to D | Emphasizes long-term creditworthiness and financial stability |

| Moody’s | Aaa to C | Prioritizes debt ratings and credit risk assessment |

| Fitch Ratings | AAA to D | Combines financial strength, creditworthiness, and operational factors |

Finding Best-Rated Insurance Companies

You’re looking for the best insurance coverage, but with so many companies out there, it’s like trying to find a needle in a haystack! Don’t worry, we’ve got you covered! We’ll help you navigate the world of insurance ratings and find the perfect company for your needs.

Resources and Tools for Finding Best-Rated Insurance Companies

Finding the best-rated insurance companies is like searching for the perfect pizza topping – it depends on what you’re looking for! Luckily, there are tons of resources and tools to help you out.

Here are some of the top players in the insurance rating game:

- AM Best: AM Best is like the “Consumer Reports” of the insurance world, providing ratings based on financial strength and operating performance. They’re known for their thorough analysis and detailed reports, which can be a bit intense, but they’re the gold standard for many.

- Standard & Poor’s (S&P): S&P is another big name in the rating game, offering financial strength ratings based on a company’s ability to meet its financial obligations. Think of them as the “Wall Street Journal” of insurance ratings.

- Moody’s Investors Service: Moody’s is like the “Forbes” of insurance ratings, providing financial strength ratings based on a company’s creditworthiness. They’re known for their focus on long-term financial stability.

- J.D. Power: J.D. Power is like the “Yelp” of insurance, focusing on customer satisfaction ratings based on customer surveys. They’re great for getting a sense of how happy people are with their insurance company.

- Consumer Reports: Consumer Reports is like the “Good Housekeeping Seal of Approval” for insurance, providing ratings based on a combination of factors, including financial strength, customer satisfaction, and claims handling. They’re a good all-around resource for comparing companies.

In addition to these rating agencies, there are also comparison websites that can help you find the best deals:

- Policygenius: Policygenius is like the “Amazon Prime” of insurance, offering a quick and easy way to compare quotes from multiple companies. They’re a one-stop shop for all your insurance needs.

- NerdWallet: NerdWallet is like the “Money Magazine” of insurance, providing unbiased reviews and comparisons of different insurance companies. They’re a great resource for getting the lowdown on different companies.

- Insurify: Insurify is like the “Expedia” of insurance, allowing you to compare quotes from multiple companies in one place. They’re a great way to find the best price for your needs.

Top-Rated Insurance Companies by Category, Am best ratings of insurance companies

So, you’ve got your tools, now it’s time to find the best insurance company for your specific needs. Here are some of the top-rated companies in different categories, based on various rating agencies’ assessments:

Car Insurance

- USAA: USAA is like the “VIP” of car insurance, known for its excellent customer service and competitive rates, especially for military families. They’re a highly-rated company with a strong reputation for financial stability.

- State Farm: State Farm is like the “classic” of car insurance, offering a wide range of coverage options and a strong network of agents. They’re a reliable choice with a solid financial rating.

- Geico: Geico is like the “discount” of car insurance, known for its catchy commercials and affordable rates. They’re a popular choice for budget-conscious drivers.

Home Insurance

- Amica Mutual: Amica Mutual is like the “luxury” of home insurance, known for its excellent customer service and high-quality coverage. They’re a highly-rated company with a strong reputation for financial stability.

- Chubb: Chubb is like the “high-end” of home insurance, offering specialized coverage for high-value homes and a strong focus on risk management. They’re a reputable company with a strong financial rating.

- Erie Insurance: Erie Insurance is like the “regional” of home insurance, known for its strong customer service and competitive rates in certain areas. They’re a reliable choice with a solid financial rating.

Health Insurance

- Kaiser Permanente: Kaiser Permanente is like the “all-in-one” of health insurance, offering a combination of health insurance and healthcare services. They’re a large and well-respected company with a strong financial rating.

- Blue Cross Blue Shield: Blue Cross Blue Shield is like the “national” of health insurance, offering a wide range of plans and a strong network of providers. They’re a reliable choice with a solid financial rating.

- UnitedHealthcare: UnitedHealthcare is like the “diverse” of health insurance, offering a wide range of plans and coverage options to meet different needs. They’re a large and well-established company with a strong financial rating.

Evaluating Ratings in Context

Don’t get blinded by those shiny stars! Just like choosing the best pizza topping, picking an insurance company based solely on ratings can be a recipe for disaster. Sure, ratings give you a general idea of how a company stacks up, but they’re just one piece of the puzzle. Think of it like a movie review: a 5-star rating doesn’t guarantee you’ll love the film, right?

Individual Needs and Preferences

Rating systems are like those “best of” lists you see in magazines: they offer a starting point, but your personal preferences are the real deal-breakers. Insurance is a very personal thing. What’s “best” for your neighbor might not be the best for you. Think about your specific needs:

- Coverage: Are you looking for basic coverage or do you need bells and whistles like flood or earthquake insurance? Different companies specialize in different types of coverage.

- Price: How much are you willing to pay for your insurance? Companies with higher ratings might have higher premiums. You’ll need to balance those ratings with your budget.

- Customer service: Some companies have stellar ratings, but their customer service is a nightmare. Read online reviews and ask around to get a feel for how responsive and helpful a company is.

- Claims process: This is where things get real. How easy is it to file a claim? How long does it take to get paid? These are crucial factors to consider, especially if you’re dealing with a major loss.

Limitations of Rating Systems

Remember, those ratings aren’t a crystal ball. They’re based on historical data, which can be a bit like looking at last year’s fashion trends – they might not be relevant today. Rating systems can also have their own biases, like:

- Focus on financial stability: Some systems prioritize a company’s financial strength, but that doesn’t necessarily translate into excellent customer service or fair claims handling.

- Limited data: Ratings are often based on a limited set of data, which might not reflect the full picture of a company’s performance.

- Weighting of factors: Different rating agencies use different formulas and weight factors differently. This can lead to discrepancies in how companies are ranked.

Different Ratings for the Same Company

Let’s say you’re looking at a company with a “B” rating from one agency and an “A” rating from another. What gives? It’s like comparing apples and oranges! Different agencies use different methodologies, so their ratings are not directly comparable. For example:

| Rating Agency | Rating | Focus |

|---|---|---|

| Agency A | B | Financial strength and claims handling |

| Agency B | A | Customer service and policyholder satisfaction |

It’s important to understand the nuances of each rating system and what factors they prioritize. This will help you interpret the ratings in a more informed way.

Factors Beyond Ratings

Okay, so you’ve done your homework and checked out the ratings of different insurance companies. That’s awesome, but don’t think you’re done yet! Just like your favorite celebrity, there’s more to the story than just the headlines. Ratings are a great starting point, but you need to dig deeper to find the perfect insurance fit for you.

Price

Price is a major factor in any insurance decision. Think of it like choosing a burger – you want something tasty and affordable. But remember, sometimes the cheapest burger isn’t always the best. Compare quotes from different insurance companies and consider the coverage options they offer. Don’t just go for the lowest price; make sure you’re getting the protection you need.

Coverage Options

You wouldn’t wear the same outfit to a concert and a job interview, right? Insurance is similar – different types of coverage are needed for different situations. Think about your specific needs and choose a policy that fits your lifestyle. Maybe you need more liability coverage if you’re a homeowner, or perhaps you need comprehensive coverage if you drive a brand new car. Make sure the policy you choose covers your specific needs, not just the basics.

Customer Service

This is like having a good friend – you want someone who’s there for you when you need them. Research how insurance companies handle customer service. Check online reviews, talk to friends and family, and see how responsive they are to inquiries. You want an insurance company that’s easy to get in touch with, understands your concerns, and provides helpful solutions.

Claims Experience

Okay, nobody wants to file a claim, but it’s important to know how an insurance company handles them. Check their track record for claims processing speed and customer satisfaction. Look for reviews and stories from people who have filed claims with that company. You want an insurance company that’s reliable and fair when it comes to settling claims.

Last Point: Am Best Ratings Of Insurance Companies

So, next time you’re shopping for insurance, don’t just go for the cheapest deal. Check out the AM Best ratings and see how the companies stack up. It’s like having a secret weapon in your insurance arsenal, helping you make smart choices and feel confident about your coverage.

Key Questions Answered

How often are AM Best ratings updated?

AM Best ratings are regularly reviewed and updated, typically on a quarterly basis. They may be adjusted based on changes in the company’s financial performance, operational practices, or the overall economic environment.

Do all insurance companies have AM Best ratings?

Not all insurance companies have AM Best ratings. The ratings are assigned to companies that participate in the AM Best rating process and meet their criteria.

Are AM Best ratings the only factor to consider when choosing an insurance company?

While AM Best ratings are a valuable indicator, they are not the only factor to consider. You should also assess factors like price, coverage options, customer service, and claims experience.