Are there non profit health insurance companies – Are there nonprofit health insurance companies? You betcha! While you might be used to hearing about big insurance giants, there’s a whole other world of nonprofit health insurance providers out there. These companies aren’t driven by profits, but by a mission to make healthcare more accessible and affordable. Think of them as the superheroes of healthcare, fighting for the little guy and making sure everyone gets the care they need.

Nonprofit health insurance companies come in all shapes and sizes, from national giants like Kaiser Permanente to smaller, community-based organizations. They offer a variety of plans and benefits, and often focus on specific populations or regions. So, whether you’re looking for a plan that fits your budget or one that provides specialized care, there’s a good chance a nonprofit insurer has got your back.

Understanding Nonprofit Health Insurance

Nonprofit health insurance companies, also known as not-for-profit health insurers, play a crucial role in the healthcare landscape. They differ significantly from their for-profit counterparts in terms of their structure, mission, and operations.

Characteristics of Nonprofit Health Insurers, Are there non profit health insurance companies

Nonprofit health insurers are distinguished by several key characteristics that set them apart from for-profit insurers. These include:

- Mission-Driven Focus: Nonprofit health insurers prioritize the well-being of their members and the community. Their primary goal is to provide affordable and accessible healthcare, often serving underserved populations.

- Tax-Exempt Status: Nonprofit health insurers are typically tax-exempt organizations, meaning they do not pay federal income taxes. This exemption allows them to reinvest profits back into their operations and services, further enhancing their ability to serve their members.

- Transparency and Accountability: Nonprofit health insurers are held to a high standard of transparency and accountability. They are required to disclose their financial information and governance practices to ensure public trust and oversight.

- Community Involvement: Nonprofit health insurers often engage in community outreach programs and initiatives to address health disparities and improve the overall health of their communities.

Mission and Goals of Nonprofit Health Insurance Organizations

The mission and goals of nonprofit health insurance organizations are fundamentally different from those of for-profit insurers. While for-profit insurers focus on maximizing profits, nonprofit health insurers prioritize the following:

- Improving Access to Healthcare: Nonprofit health insurers strive to make healthcare accessible to all individuals, regardless of their financial status or health condition. They often offer affordable plans and services to underserved communities, including low-income families, individuals with pre-existing conditions, and those living in rural areas.

- Promoting Health Equity: Nonprofit health insurers recognize the importance of health equity and work to eliminate disparities in healthcare access and outcomes. They invest in programs and initiatives that address social determinants of health, such as poverty, education, and housing, to create a more equitable healthcare system.

- Enhancing Quality of Care: Nonprofit health insurers prioritize the quality of care provided to their members. They work with healthcare providers to improve patient outcomes, reduce medical errors, and promote preventive care.

- Advocating for Health Policy Reform: Nonprofit health insurers often engage in advocacy efforts to promote policies that improve the healthcare system and benefit their members. They advocate for increased access to affordable healthcare, expanded coverage, and reforms that address systemic inequities.

Types of Nonprofit Health Insurance

Nonprofit health insurance companies operate with a mission to provide affordable and accessible healthcare, often focusing on specific populations or communities. These organizations are structured differently than for-profit insurers, and their financial goals are driven by their mission rather than maximizing shareholder profits.

Nonprofit health insurance models are diverse and offer unique advantages and limitations. Here’s a breakdown of some of the most common types:

Health Maintenance Organizations (HMOs)

HMOs are known for their managed care approach, emphasizing preventive care and cost-effectiveness. They typically operate with a network of providers, requiring members to use in-network healthcare professionals for most services. HMOs may offer lower premiums compared to other models but might have stricter limitations on out-of-network coverage.

A well-known example of a nonprofit HMO is Kaiser Permanente, which operates as a non-profit health plan and healthcare provider system. Kaiser Permanente offers comprehensive health insurance coverage and provides its own healthcare facilities and physicians, creating a vertically integrated system.

Preferred Provider Organizations (PPOs)

PPOs offer more flexibility than HMOs, allowing members to seek care from both in-network and out-of-network providers. While in-network care is generally cheaper, PPOs offer coverage for out-of-network services, although at higher costs. PPOs often have higher premiums than HMOs but provide greater choice and flexibility.

Blue Cross Blue Shield (BCBS) is a prominent example of a nonprofit PPO provider. It operates through a network of independent, locally owned and operated Blue Cross and Blue Shield plans across the United States, offering a variety of health insurance plans including PPOs.

Point-of-Service (POS) Plans

POS plans combine elements of HMOs and PPOs, providing a network of providers but allowing members to access out-of-network care at a higher cost. POS plans typically require members to choose a primary care physician (PCP) within the network, but offer more flexibility than HMOs in accessing out-of-network services.

Humana, a leading nonprofit health insurance company, offers POS plans as part of its diverse portfolio. Humana is known for its focus on Medicare and Medicaid coverage, providing a wide range of health insurance options for seniors and low-income individuals.

Indemnity Plans

Indemnity plans, also known as “fee-for-service” plans, offer the greatest flexibility to members, allowing them to choose any healthcare provider without restrictions. However, these plans typically have higher premiums and out-of-pocket costs. Members pay for services upfront and then submit claims for reimbursement.

Although less common in the current market, some nonprofit organizations may offer indemnity plans. These plans might be particularly attractive to individuals seeking greater control over their healthcare choices, even at a higher financial cost.

Access and Coverage: Are There Non Profit Health Insurance Companies

Nonprofit health insurance companies aim to provide affordable and accessible healthcare to individuals and families, particularly those who might struggle to access traditional insurance options. However, it’s important to understand the nuances of their accessibility and coverage to make informed decisions.

Accessibility to Different Demographics

Nonprofit health insurance plans are often designed to cater to specific demographics, such as low-income families, individuals with pre-existing conditions, or those in rural areas. They might offer:

- Community Health Centers: These centers provide healthcare services, including insurance plans, to underserved communities. They often offer sliding-scale fees based on income, making healthcare more affordable for low-income individuals.

- Faith-Based Organizations: Many faith-based organizations operate health insurance plans, often targeting their congregations or communities. They might offer discounted premiums or specific benefits tailored to their community’s needs.

- State-Specific Programs: Some states have their own nonprofit health insurance programs, like the Children’s Health Insurance Program (CHIP), which provides coverage to children from low-income families.

Coverage Options Offered by Nonprofit Insurers

Nonprofit insurers offer various plan types, similar to for-profit insurers, but with a focus on affordability and essential coverage:

- Health Maintenance Organizations (HMOs): HMOs typically have a network of doctors and hospitals you must use for most services. They often have lower premiums but may have stricter coverage limitations.

- Preferred Provider Organizations (PPOs): PPOs offer more flexibility than HMOs, allowing you to see doctors outside their network, although at a higher cost. They often have higher premiums but provide more coverage options.

- Point-of-Service (POS) Plans: POS plans combine features of both HMOs and PPOs. They typically have a network of providers but offer some flexibility to see out-of-network doctors.

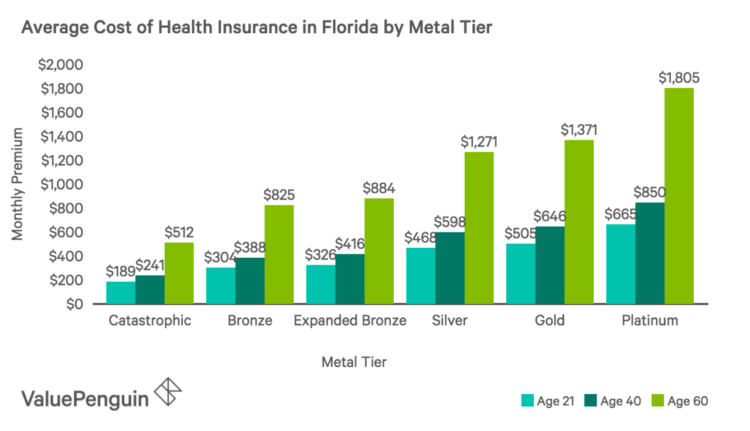

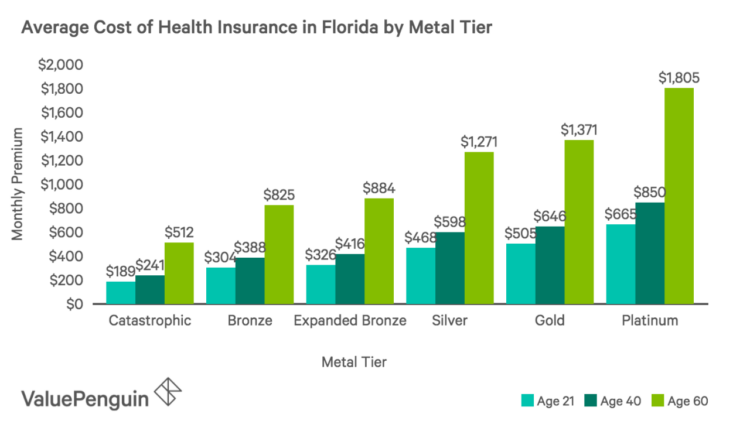

Affordability of Nonprofit Health Insurance Plans

Nonprofit health insurance plans are generally considered more affordable than for-profit plans, especially for individuals and families with lower incomes. They often offer:

- Subsidies and Tax Credits: Many nonprofit plans qualify for government subsidies or tax credits, reducing the cost of premiums for eligible individuals.

- Sliding-Scale Fees: Some nonprofit organizations offer sliding-scale fees for their services, including insurance plans, based on income, making healthcare more accessible to low-income families.

- Community-Based Pricing: Nonprofit insurers may prioritize community needs and offer lower premiums for residents of specific areas or demographics.

Final Thoughts

So, the next time you’re shopping for health insurance, don’t just assume you’re stuck with the big guys. Take a look at the world of nonprofit health insurance providers. You might be surprised by what you find! These companies are dedicated to making healthcare work for everyone, and they could be the key to unlocking affordable, accessible healthcare for you and your family.

Questions Often Asked

Are nonprofit health insurance companies regulated?

Yes, nonprofit health insurance companies are subject to the same regulations as for-profit insurers. They must comply with state and federal laws governing health insurance.

Can I get a tax break for using a nonprofit health insurance company?

While nonprofit health insurance companies are not directly associated with tax breaks, the premiums you pay for health insurance are generally tax deductible. You should consult with a tax professional to determine your specific tax situation.

How can I find a nonprofit health insurance company in my area?

You can search for nonprofit health insurance companies online using search engines or health insurance comparison websites. You can also contact your state’s insurance department or the National Association of Insurance Commissioners for assistance.