Average car insurance cost is a crucial factor to consider when budgeting for your vehicle. It’s not just a number on a bill; it’s a reflection of your risk profile, the car you drive, and the coverage you need. This comprehensive guide explores the factors influencing car insurance costs, provides a state-by-state breakdown of average premiums, and offers practical tips for lowering your insurance bill.

Understanding the complexities of car insurance is essential for making informed decisions. From age and driving history to vehicle type and location, various factors play a significant role in determining your insurance premium. This guide will delve into these aspects, providing valuable insights to help you navigate the world of car insurance.

Factors Influencing Car Insurance Costs

Car insurance premiums are determined by a complex interplay of various factors. Understanding these factors can help you make informed decisions to potentially lower your insurance costs.

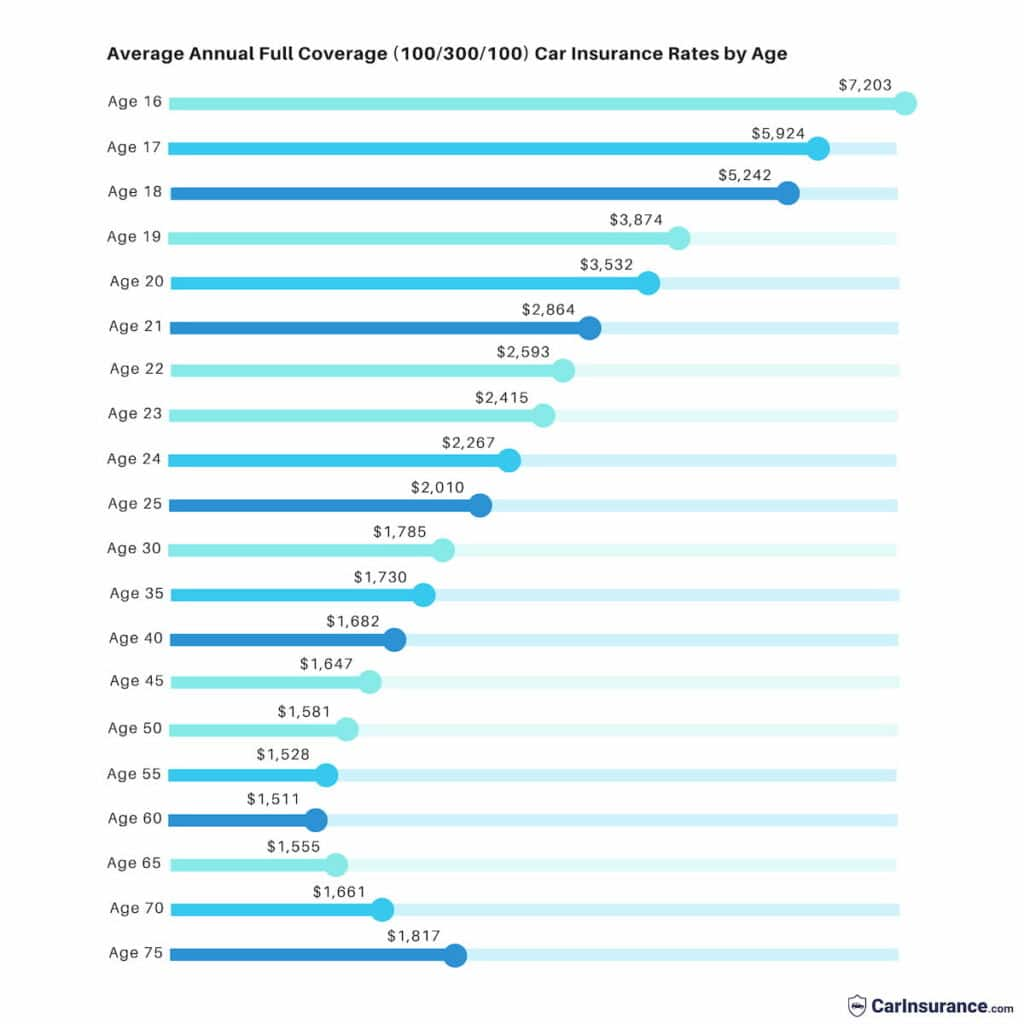

Age

Your age plays a significant role in your car insurance premium. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. This higher risk translates into higher premiums. As you age and gain experience, your risk profile decreases, leading to lower premiums.

Driving History

Your driving history is a major factor in determining your car insurance rates. A clean driving record with no accidents, violations, or traffic tickets will generally result in lower premiums. However, any incidents, such as speeding tickets or accidents, can significantly increase your rates. Insurance companies view these events as indicators of higher risk.

Vehicle Type, Average car insurance cost

The type of vehicle you drive heavily influences your car insurance costs. Sports cars and luxury vehicles are generally more expensive to repair and replace, making them riskier for insurance companies. These factors contribute to higher premiums for such vehicles. Conversely, smaller, less expensive cars typically have lower premiums.

Location

Your location, specifically the city or state where you reside, plays a crucial role in determining your car insurance rates. Areas with higher population density and traffic congestion tend to have more accidents, leading to higher premiums. Additionally, states with stricter insurance regulations or higher average repair costs can also influence your premiums.

Driving Habits

Your driving habits, such as your mileage and driving style, can also affect your car insurance costs. Drivers who commute long distances or drive frequently in high-risk areas, such as busy city centers, are considered higher risk and may face higher premiums. Additionally, aggressive driving habits, such as speeding or tailgating, can increase your risk profile and lead to higher premiums.

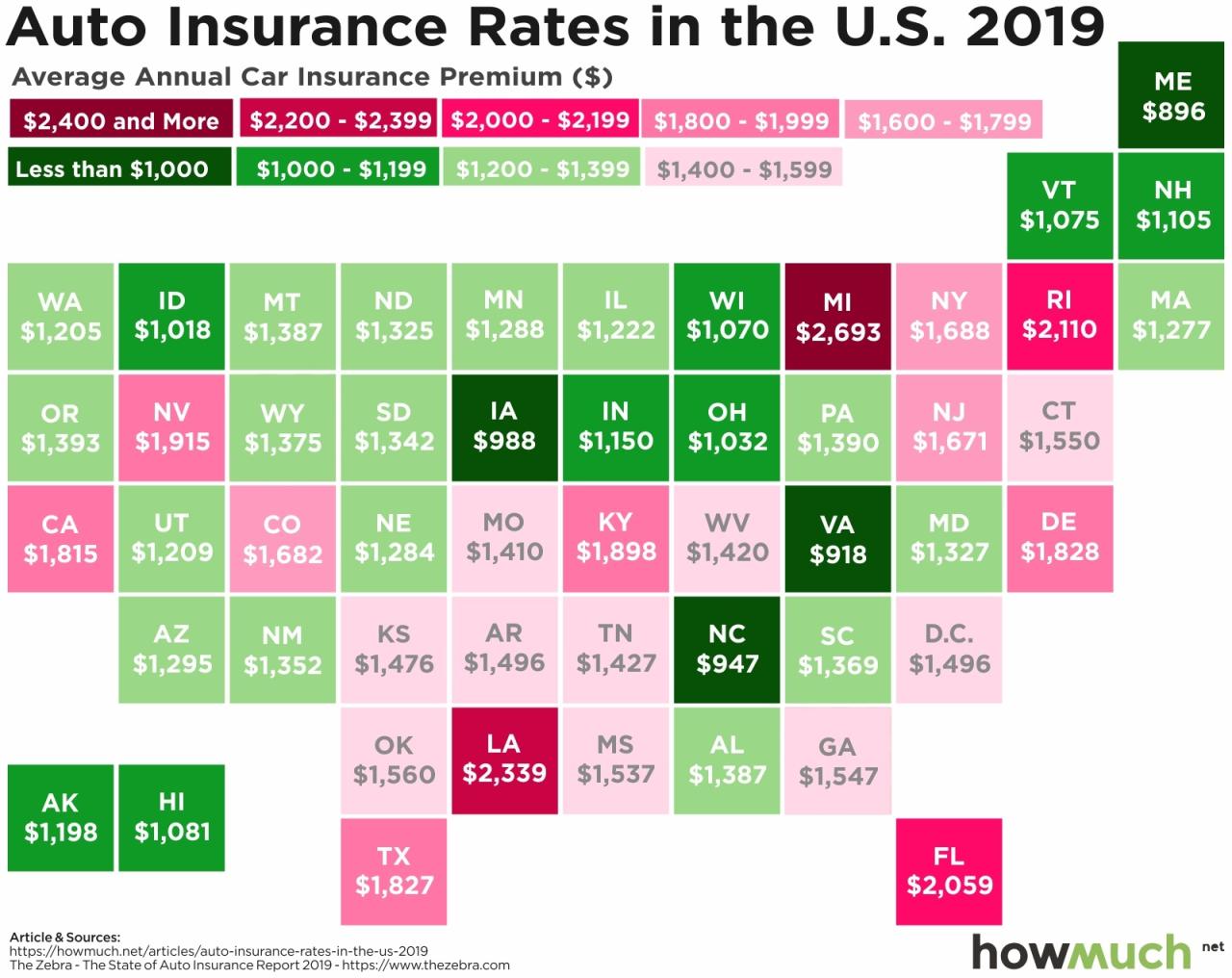

Average Car Insurance Costs by State

Car insurance premiums can vary significantly from state to state. This variation is due to a number of factors, including the cost of living, the number of accidents, and the amount of traffic congestion. Understanding the average car insurance costs by state can help you make informed decisions about your insurance coverage.

Average Car Insurance Costs by State

The table below shows the average annual car insurance premium for each state in the United States. The data is based on a study by the Insurance Information Institute (III). The table also shows the minimum and maximum coverage limits required by each state.

| State | Average Annual Premium | Minimum Coverage | Maximum Coverage |

|---|---|---|---|

| Alabama | $1,511 | $25,000/$50,000 | $25,000/$50,000 |

| Alaska | $2,184 | $25,000/$50,000 | $25,000/$50,000 |

| Arizona | $1,764 | $15,000/$30,000 | $25,000/$50,000 |

| Arkansas | $1,392 | $25,000/$50,000 | $25,000/$50,000 |

| California | $2,047 | $15,000/$30,000 | $30,000/$60,000 |

| Colorado | $1,595 | $25,000/$50,000 | $25,000/$50,000 |

| Connecticut | $2,127 | $20,000/$40,000 | $20,000/$40,000 |

| Delaware | $1,635 | $15,000/$30,000 | $25,000/$50,000 |

| Florida | $2,404 | $10,000/$20,000 | $10,000/$20,000 |

| Georgia | $1,722 | $25,000/$50,000 | $25,000/$50,000 |

| Hawaii | $2,319 | $20,000/$40,000 | $20,000/$40,000 |

| Idaho | $1,342 | $25,000/$50,000 | $25,000/$50,000 |

| Illinois | $1,823 | $20,000/$40,000 | $20,000/$40,000 |

| Indiana | $1,385 | $25,000/$50,000 | $25,000/$50,000 |

| Iowa | $1,299 | $20,000/$40,000 | $20,000/$40,000 |

| Kansas | $1,355 | $25,000/$50,000 | $25,000/$50,000 |

| Kentucky | $1,478 | $25,000/$50,000 | $25,000/$50,000 |

| Louisiana | $1,869 | $15,000/$30,000 | $25,000/$50,000 |

| Maine | $1,842 | $25,000/$50,000 | $25,000/$50,000 |

| Maryland | $1,878 | $20,000/$40,000 | $20,000/$40,000 |

| Massachusetts | $2,038 | $20,000/$40,000 | $20,000/$40,000 |

| Michigan | $2,112 | $20,000/$40,000 | $20,000/$40,000 |

| Minnesota | $1,589 | $30,000/$60,000 | $30,000/$60,000 |

| Mississippi | $1,346 | $25,000/$50,000 | $25,000/$50,000 |

| Missouri | $1,484 | $25,000/$50,000 | $25,000/$50,000 |

| Montana | $1,518 | $25,000/$50,000 | $25,000/$50,000 |

| Nebraska | $1,325 | $25,000/$50,000 | $25,000/$50,000 |

| Nevada | $1,855 | $15,000/$30,000 | $25,000/$50,000 |

| New Hampshire | $1,677 | $25,000/$50,000 | $25,000/$50,000 |

| New Jersey | $1,955 | $15,000/$30,000 | $25,000/$50,000 |

| New Mexico | $1,694 | $25,000/$50,000 | $25,000/$50,000 |

| New York | $2,059 | $25,000/$50,000 | $25,000/$50,000 |

| North Carolina | $1,563 | $25,000/$50,000 | $25,000/$50,000 |

| North Dakota | $1,237 | $25,000/$50,000 | $25,000/$50,000 |

| Ohio | $1,549 | $25,000/$50,000 | $25,000/$50,000 |

| Oklahoma | $1,428 | $25,000/$50,000 | $25,000/$50,000 |

| Oregon | $1,756 | $25,000/$50,000 | $25,000/$50,000 |

| Pennsylvania | $1,725 | $15,000/$30,000 | $25,000/$50,000 |

| Rhode Island | $2,087 | $25,000/$50,000 | $25,000/$50,000 |

| South Carolina | $1,653 | $25,000/$50,000 | $25,000/$50,000 |

| South Dakota | $1,258 | $25,000/$50,000 | $25,000/$50,000 |

| Tennessee | $1,456 | $25,000/$50,000 | $25,000/$50,000 |

| Texas | $1,905 | $30,000/$60,000 | $30,000/$60,000 |

| Utah | $1,492 | $25,000/$50,000 | $25,000/$50,000 |

| Vermont | $1,964 | $25,000/$50,000 | $25,000/$50,000 |

| Virginia | $1,688 | $25,000/$50,000 | $25,000/$50,000 |

| Washington | $1,928 | $25,000/$50,000 | $25,000/$50,000 |

| West Virginia | $1,527 | $25,000/$50,000 | $25,000/$50,000 |

| Wisconsin | $1,561 | $25,000/$50,000 | $25,000/$50,000 |

| Wyoming | $1,435 | $25,000/$50,000 | $25,000/$50,000 |

As you can see, there is a wide range of average car insurance premiums across the United States. The highest average premium is in Florida, while the lowest average premium is in North Dakota.

Factors Contributing to State-to-State Variations in Car Insurance Costs

Several factors contribute to the differences in average car insurance costs across states. These include:

- Cost of Living: States with a higher cost of living tend to have higher car insurance premiums. This is because the cost of repairing or replacing a vehicle is higher in these states. For example, the cost of living in New York City is significantly higher than in rural Iowa. As a result, car insurance premiums are generally higher in New York than in Iowa.

- Number of Accidents: States with a higher number of car accidents tend to have higher car insurance premiums. This is because insurance companies have to pay out more claims in these states. States with a higher number of accidents are more likely to have a higher number of claims.

- Traffic Congestion: States with a lot of traffic congestion tend to have higher car insurance premiums. This is because there is a higher risk of accidents in these states. States with a higher number of accidents are more likely to have a higher number of claims.

- State Laws and Regulations: Different states have different laws and regulations regarding car insurance. These laws can affect the cost of car insurance. For example, some states require drivers to carry a higher minimum amount of liability coverage. Other states have laws that limit the amount of money that insurance companies can charge for certain types of coverage.

- Insurance Company Competition: States with a higher number of insurance companies competing for customers tend to have lower car insurance premiums. This is because insurance companies have to offer lower prices to attract customers.

Understanding Car Insurance Coverage Options

Car insurance is essential for protecting yourself financially in the event of an accident. It provides coverage for various expenses related to accidents, injuries, and damage to your vehicle. Understanding the different types of car insurance coverage is crucial to ensure you have the right protection for your specific needs.

Types of Car Insurance Coverage

Car insurance policies typically include several types of coverage, each designed to address specific situations. Here’s a breakdown of the most common types:

- Liability Coverage: This is the most basic type of car insurance, and it’s required in most states. Liability coverage protects you financially if you cause an accident that results in injuries or damage to another person’s property. It covers the costs of:

- Medical expenses for the other driver and passengers

- Property damage to the other vehicle or property

- Legal fees and court costs

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. Collision coverage is optional but can be beneficial if you have a newer car or a car loan.

- Comprehensive Coverage: Comprehensive coverage protects your vehicle against damage caused by events other than accidents, such as:

- Theft

- Vandalism

- Fire

- Natural disasters

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

- Personal Injury Protection (PIP): PIP coverage, also known as no-fault insurance, covers your medical expenses and lost wages after an accident, regardless of who is at fault. This coverage is mandatory in some states.

- Medical Payments Coverage (Med Pay): Med Pay coverage is similar to PIP but provides more limited coverage. It pays for medical expenses for you and your passengers, regardless of who is at fault, but it doesn’t cover lost wages.

Comparing Car Insurance Coverage Options

It’s helpful to compare the key features and benefits of different car insurance coverage options to make an informed decision. The following table provides a summary:

| Coverage Type | Benefits | Cost |

|---|---|---|

| Liability Coverage | Protects you financially if you cause an accident that results in injuries or damage to another person’s property. | Typically the most affordable coverage. |

| Collision Coverage | Pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. | Can be more expensive, especially for newer cars. |

| Comprehensive Coverage | Protects your vehicle against damage caused by events other than accidents, such as theft, vandalism, fire, and natural disasters. | Can be more expensive, especially for cars with high value. |

| Uninsured/Underinsured Motorist Coverage | Protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages. | Typically a relatively affordable addition to your policy. |

| Personal Injury Protection (PIP) | Covers your medical expenses and lost wages after an accident, regardless of who is at fault. | Can be more expensive, especially if you have a high income. |

| Medical Payments Coverage (Med Pay) | Pays for medical expenses for you and your passengers, regardless of who is at fault. | Typically less expensive than PIP. |

Choosing the Right Coverage

The right car insurance coverage depends on your individual needs and circumstances. Consider these factors when deciding which coverage to purchase:

- Your driving history: If you have a history of accidents or traffic violations, you may need higher liability coverage.

- The value of your vehicle: If you have a newer or more expensive car, you may want to consider collision and comprehensive coverage.

- Your financial situation: If you have a limited budget, you may need to prioritize the most essential coverage, such as liability.

- Your state’s laws: Some states have mandatory coverage requirements, such as liability and PIP.

Tips for Lowering Car Insurance Premiums

You may be surprised to learn that there are several ways to reduce your car insurance costs. From improving your driving habits to taking advantage of discounts, there are steps you can take to lower your premiums and save money.

Maintaining a Good Driving Record

A clean driving record is one of the most important factors in determining your car insurance premiums. Insurance companies consider you a lower risk if you haven’t been involved in any accidents or received traffic violations. Here are some tips for maintaining a good driving record:

- Avoid speeding and other traffic violations: These violations can significantly increase your insurance premiums.

- Be cautious and defensive while driving: This will help you avoid accidents and maintain a clean driving record.

- Take a defensive driving course: These courses can help you learn safe driving techniques and may even qualify you for a discount on your car insurance.

Choosing a Safe Vehicle

The type of car you drive also plays a role in determining your car insurance premiums. Insurance companies consider safer vehicles to be lower risk and may offer lower premiums for them. Here are some factors to consider when choosing a safe vehicle:

- Safety ratings: Look for vehicles with high safety ratings from organizations like the Insurance Institute for Highway Safety (IIHS) and the National Highway Traffic Safety Administration (NHTSA).

- Anti-theft features: Cars with anti-theft features, such as alarms and immobilizers, are less likely to be stolen, which can result in lower insurance premiums.

- Fuel efficiency: Fuel-efficient vehicles may be eligible for discounts from some insurance companies.

Increasing Your Deductible

Your deductible is the amount of money you agree to pay out of pocket in the event of an accident before your insurance coverage kicks in. A higher deductible generally means lower premiums. Here are some things to consider when deciding on your deductible:

- Your financial situation: Make sure you can afford to pay the deductible if you need to file a claim.

- Your risk tolerance: If you are comfortable with a higher deductible, you can save money on your premiums.

- The frequency of claims: If you have a history of filing claims, it may be wise to keep a lower deductible.

Taking Advantage of Discounts

Many car insurance companies offer discounts to their policyholders. Here are some common discounts:

- Good student discount: This discount is available to students with good grades.

- Safe driver discount: This discount is available to drivers with a clean driving record.

- Multi-car discount: This discount is available to policyholders who insure multiple vehicles with the same company.

- Multi-policy discount: This discount is available to policyholders who bundle their car insurance with other types of insurance, such as homeowners or renters insurance.

- Loyalty discount: This discount is available to policyholders who have been with the same company for a certain period of time.

- Pay-in-full discount: This discount is available to policyholders who pay their premiums in full upfront.

- Telematics discount: This discount is available to policyholders who allow their insurance company to track their driving habits through a telematics device.

Bundling Car Insurance with Other Types of Insurance

Bundling your car insurance with other types of insurance, such as homeowners or renters insurance, can often result in significant savings. This is because insurance companies offer discounts to policyholders who bundle their policies.

“Bundling your car insurance with other types of insurance can save you money on your premiums.”

Choosing the Right Car Insurance Provider

Finding the right car insurance provider can feel overwhelming, especially considering the multitude of options available. However, with careful research and consideration of your specific needs, you can secure a policy that provides the right coverage at a reasonable price.

Factors to Consider When Choosing a Car Insurance Provider

When selecting a car insurance company, it’s crucial to assess several key factors that directly impact your overall experience and satisfaction. These factors help you make an informed decision and choose a provider that aligns with your priorities.

- Price: The cost of car insurance is a major consideration for most people. It’s essential to compare quotes from multiple providers to find the most competitive rates. However, remember that the cheapest option may not always be the best, especially if it compromises coverage.

- Coverage: Different insurance companies offer varying levels of coverage, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Determine the coverage you need based on your driving habits, the value of your car, and your risk tolerance.

- Customer Service: Good customer service is essential, particularly when you need to file a claim or have questions about your policy. Research customer reviews and ratings to gauge the company’s responsiveness and helpfulness.

- Financial Stability: Ensure the insurance company you choose is financially stable and has a strong track record of paying claims. You can check the company’s financial ratings with agencies like AM Best or Standard & Poor’s.

- Discounts: Many insurance companies offer discounts for safe driving, good student status, multiple car insurance, and other factors. Explore available discounts to potentially reduce your premiums.

Comparing Services and Features

Car insurance providers offer a range of services and features, each designed to cater to specific needs and preferences. It’s essential to compare these offerings to determine which provider best suits your individual requirements.

- Online Services: Many insurance companies offer online platforms for managing your policy, paying premiums, and filing claims. Consider the user-friendliness and features of these platforms.

- Mobile Apps: Mobile apps can provide convenient access to your policy information, claim assistance, and other services. Look for apps with intuitive interfaces and robust functionalities.

- 24/7 Customer Support: Some providers offer 24/7 customer support, providing assistance whenever you need it. Evaluate the availability and responsiveness of their support channels, such as phone, email, and live chat.

- Claim Process: The claims process can be stressful, so it’s important to choose a provider with a straightforward and efficient process. Research the company’s claim handling reputation and customer feedback on their experience.

- Additional Features: Some insurance companies offer additional features, such as roadside assistance, rental car reimbursement, and accident forgiveness. These features can provide peace of mind and added value to your policy.

Tips for Finding the Best Car Insurance Provider

Finding the best car insurance provider requires a strategic approach, considering your specific needs and priorities. Here are some tips to help you navigate the process:

- Get Multiple Quotes: Obtain quotes from several insurance companies to compare prices and coverage options. Online comparison tools can streamline this process.

- Read Reviews: Check customer reviews and ratings to gain insights into the company’s reputation, customer service, and claim handling experience.

- Ask Questions: Don’t hesitate to ask questions about the policy, coverage options, discounts, and claim process. A clear understanding will help you make an informed decision.

- Consider Your Needs: Evaluate your individual driving habits, risk tolerance, and financial situation to determine the coverage and features that best suit your needs.

- Negotiate: Don’t be afraid to negotiate with insurance companies to potentially lower your premiums. Highlight your good driving record, safety features in your car, and other factors that might qualify you for discounts.

Conclusive Thoughts

Ultimately, finding the right car insurance policy involves balancing cost, coverage, and provider reputation. By understanding the factors influencing premiums, exploring coverage options, and utilizing available discounts, you can secure the best possible protection for your vehicle and your finances. This guide provides a foundation for making informed decisions and securing the right insurance for your needs.

Question & Answer Hub: Average Car Insurance Cost

How often should I review my car insurance rates?

It’s a good practice to review your car insurance rates annually, or even more frequently if there are significant life changes, such as a new car, a move to a different state, or a change in your driving record.

What is a good credit score for car insurance?

While credit scores are not used in all states, they can influence your car insurance rates in some areas. Generally, a higher credit score can lead to lower insurance premiums.

What is the difference between liability and collision coverage?

Liability coverage protects you financially if you cause an accident, covering the other driver’s injuries and property damage. Collision coverage covers damage to your own vehicle in an accident, regardless of fault.

Can I get car insurance without a car?

Yes, you can often get car insurance without a car, particularly if you’re planning to purchase a vehicle soon. This is known as “non-owned auto insurance” and can provide coverage if you’re driving a borrowed or rented car.