Average car insurance cost florida – Average car insurance cost in Florida sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The Sunshine State boasts a unique blend of factors that impact car insurance premiums, making it a fascinating subject to explore. From the ever-present threat of hurricanes to a high concentration of uninsured drivers, Florida’s car insurance landscape is distinct and demanding a thorough understanding.

This comprehensive guide delves into the intricacies of car insurance in Florida, exploring the key factors that influence costs, providing tips for finding affordable coverage, and navigating the state’s unique no-fault system. Whether you’re a seasoned driver or a newcomer to the state, understanding the ins and outs of Florida car insurance is crucial for making informed decisions and protecting your financial well-being.

Understanding Car Insurance Costs in Florida

Florida is known for its beautiful beaches, vibrant culture, and warm weather. However, the state also faces unique challenges that can significantly impact car insurance costs.

Factors Influencing Car Insurance Costs in Florida

Several factors contribute to the higher average car insurance costs in Florida.

- Hurricane Risk: Florida is highly susceptible to hurricanes, which can cause widespread damage to vehicles. Insurance companies factor in this risk by charging higher premiums.

- High Population Density: Florida has a large and growing population, leading to increased traffic congestion and a higher frequency of accidents.

- Large Number of Uninsured Drivers: Florida has a relatively high percentage of uninsured drivers, which can increase the financial burden on insured drivers when accidents occur.

- Fraudulent Claims: Unfortunately, Florida has experienced a history of insurance fraud, which can drive up costs for all policyholders.

Florida’s No-Fault Insurance System

Florida operates under a no-fault insurance system, which means that drivers are required to file claims with their own insurance company, regardless of who is at fault in an accident. This system is designed to speed up the claims process and reduce litigation.

Personal Injury Protection (PIP) Coverage

Florida’s no-fault system requires drivers to carry Personal Injury Protection (PIP) coverage, which pays for medical expenses and lost wages following an accident, regardless of fault. PIP coverage can be a significant factor in car insurance premiums.

Florida’s PIP coverage is a minimum requirement for all drivers, with a minimum coverage limit of $10,000.

- Impact on Costs: The amount of PIP coverage chosen can significantly impact insurance premiums. Higher PIP coverage limits will result in higher premiums.

- Choice of Coverage: Drivers can choose between “80/20” and “100/0” PIP coverage options. The “80/20” option allows drivers to sue for pain and suffering only if their medical expenses exceed 80% of the PIP coverage limit. The “100/0” option eliminates the ability to sue for pain and suffering.

Factors Affecting Individual Car Insurance Premiums

Your individual car insurance premiums in Florida are determined by a variety of factors. These factors are assessed by insurance companies to determine your risk level as a driver, ultimately impacting the price you pay for coverage.

Driving History

Your driving history is a crucial factor in determining your car insurance rates. A clean driving record with no accidents or violations will generally result in lower premiums. Conversely, a history of accidents, traffic violations, or even DUI convictions can significantly increase your insurance costs.

For instance, a driver with a DUI conviction might face a premium increase of up to 30%, depending on the severity of the offense and the insurance company.

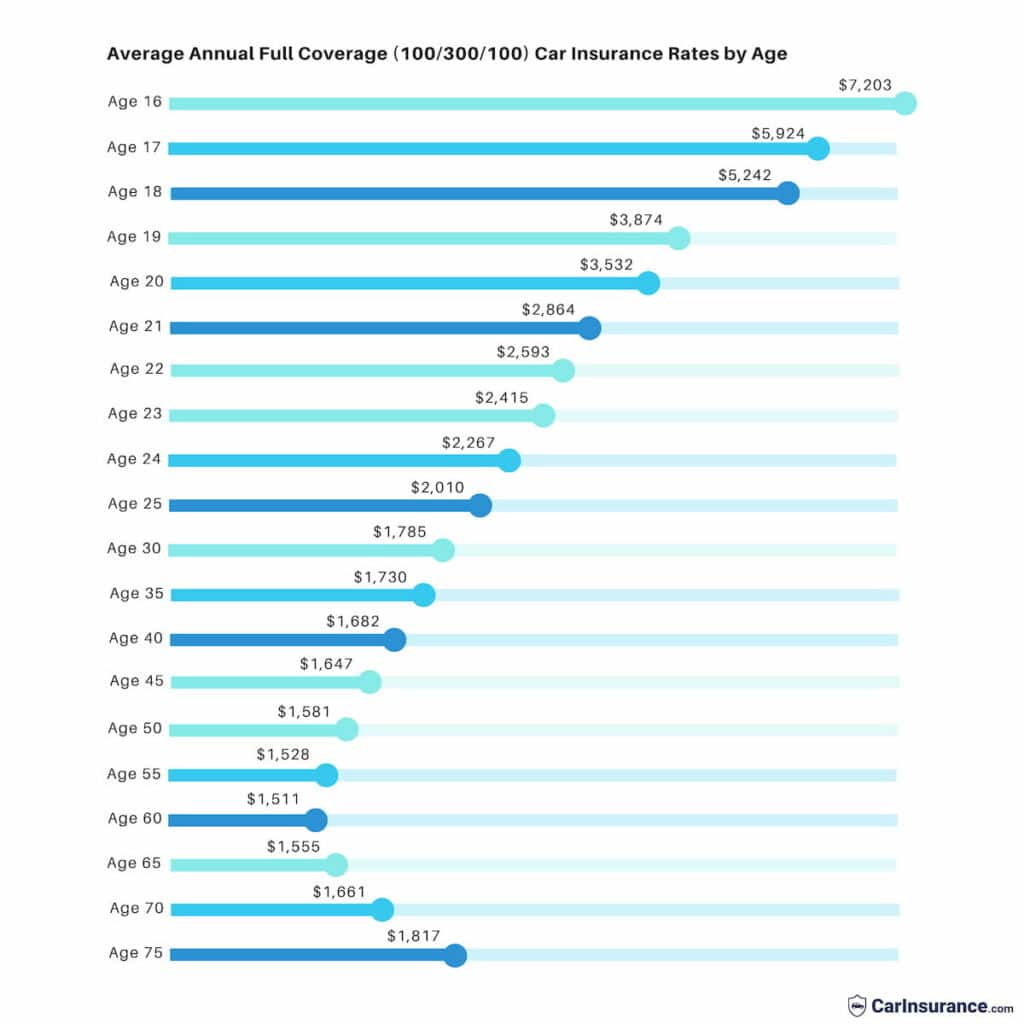

Age

Age is another significant factor influencing car insurance premiums. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. As a result, insurance companies often charge higher premiums for younger drivers. However, premiums tend to decrease as drivers age and gain more experience behind the wheel.

For example, the average car insurance cost for a 20-year-old in Florida is about $2,500 per year, while the average cost for a 40-year-old is around $1,800.

Vehicle Type

The type of vehicle you drive also plays a role in determining your insurance premiums. Luxury vehicles, high-performance cars, and expensive SUVs are generally more expensive to insure due to their higher repair costs and greater risk of theft.

For instance, insuring a luxury sedan like a BMW 5 Series might cost significantly more than insuring a mid-size sedan like a Toyota Camry, even if the drivers have similar driving records.

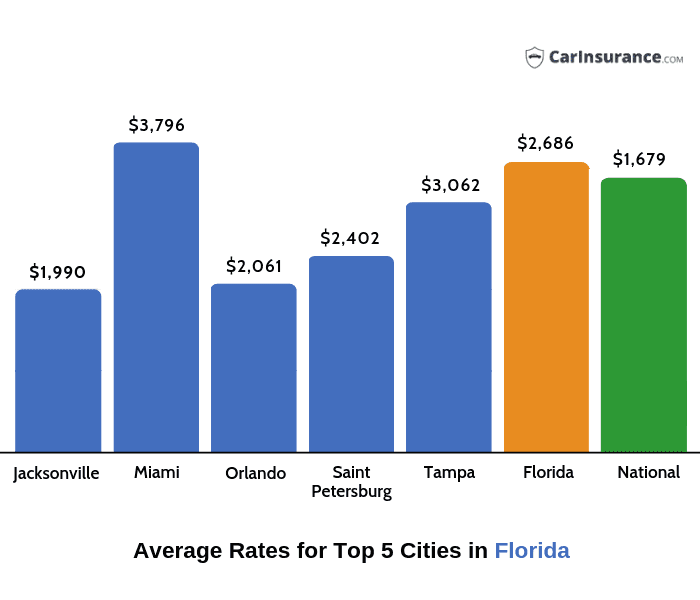

Location, Average car insurance cost florida

Your location in Florida can also affect your car insurance premiums. Areas with higher crime rates or more congested traffic tend to have higher insurance costs. This is because the risk of accidents and theft is greater in these areas.

For example, drivers in Miami-Dade County, which has a higher crime rate than other parts of Florida, might pay higher premiums than drivers in more rural areas.

Finding Affordable Car Insurance in Florida

Finding affordable car insurance in Florida can be a challenging task, given the state’s high insurance rates. However, with some effort and strategic planning, you can significantly reduce your premiums and secure a policy that fits your budget.

Shopping Around for Quotes

It is essential to compare quotes from multiple insurance providers to find the most competitive rates. This process involves contacting different insurance companies, providing them with your personal information and vehicle details, and requesting quotes. Online comparison websites can streamline this process by allowing you to enter your information once and receive quotes from various insurers.

Considering Discounts

Insurance companies offer various discounts to lower your premiums. These discounts can be based on your driving record, vehicle features, or other factors. Some common discounts include:

- Good Driver Discount: This discount is awarded to drivers with a clean driving record, free of accidents or traffic violations.

- Safe Driving Course Discount: Completing a defensive driving course can demonstrate your commitment to safe driving and qualify you for a discount.

- Multi-Car Discount: If you insure multiple vehicles with the same insurer, you may qualify for a multi-car discount.

- Bundling Discount: Insurers often offer discounts when you bundle your car insurance with other policies, such as homeowners or renters insurance.

- Anti-theft Device Discount: Installing anti-theft devices in your car, such as alarms or GPS tracking systems, can reduce your premiums.

- Good Student Discount: Students with good grades may qualify for a discount, as they are statistically less likely to be involved in accidents.

Negotiating Rates

Once you have received quotes from different insurers, you can negotiate rates to try and secure a better deal. You can point out your clean driving record, any discounts you qualify for, and your willingness to increase your deductible to lower your premiums.

Comparing Car Insurance Rates in Florida

Here is a table comparing car insurance rates from different providers in Florida:

| Insurance Provider | Average Annual Premium |

|---|---|

| State Farm | $1,500 |

| Geico | $1,400 |

| Progressive | $1,350 |

| Allstate | $1,600 |

| USAA | $1,200 |

Note: These rates are estimates and may vary depending on your individual circumstances, such as your age, driving record, and vehicle type.

Benefits of Bundling Car Insurance

Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can offer significant cost savings. This is because insurers often offer discounts for bundling multiple policies. Bundling also simplifies your insurance management by consolidating your policies with a single provider.

Understanding Florida’s No-Fault System

Florida operates under a “no-fault” insurance system, which means that drivers are primarily responsible for covering their own medical expenses and lost wages following an accident, regardless of who caused it. This system aims to streamline the claims process and reduce litigation.

How Florida’s No-Fault System Works

Under Florida’s no-fault system, each driver is required to carry Personal Injury Protection (PIP) coverage, which pays for medical expenses and lost wages up to a certain limit. The PIP coverage is triggered regardless of who is at fault for the accident.

Benefits of Florida’s No-Fault System

- Faster Claims Processing: No-fault claims are typically processed more quickly than traditional fault-based claims because the focus is on covering the injured party’s expenses rather than determining fault.

- Reduced Litigation: By requiring drivers to cover their own expenses, the no-fault system aims to reduce the number of lawsuits filed after accidents, which can save time and money for all parties involved.

- Guaranteed Coverage: Regardless of who is at fault, drivers with PIP coverage are guaranteed to have their medical expenses and lost wages covered up to the policy limits.

Limitations of Florida’s No-Fault System

- Limited Coverage: PIP coverage has limits on the amount of medical expenses and lost wages it will cover. If expenses exceed these limits, the injured party may have to pursue a separate claim against the at-fault driver.

- Potential for Abuse: Some individuals may try to take advantage of the no-fault system by filing fraudulent claims or exaggerating their injuries.

- Higher Insurance Premiums: Florida’s no-fault system can contribute to higher insurance premiums due to the costs associated with covering all medical expenses and lost wages, regardless of fault.

Examples of No-Fault Insurance Claims

- Scenario 1: A driver is rear-ended at a stoplight. Both drivers have PIP coverage. The driver who was rear-ended can file a PIP claim to cover their medical expenses and lost wages, even if the other driver was at fault. The at-fault driver’s insurance company will likely cover the other driver’s expenses up to the policy limits.

- Scenario 2: A driver runs a red light and causes a collision. The driver who was hit has PIP coverage and files a claim. Their PIP coverage will pay for their medical expenses and lost wages, even though the other driver was at fault. However, if their expenses exceed the PIP coverage limits, they may have to pursue a separate claim against the at-fault driver’s insurance company.

Outcome Summary

Navigating the complexities of car insurance in Florida requires a proactive approach. By understanding the factors that influence premiums, comparing quotes from different providers, and taking advantage of available discounts, you can find affordable coverage that meets your needs. Remember, staying informed about your insurance policy, including the no-fault system and claims procedures, empowers you to navigate any unforeseen situations with confidence. Florida’s car insurance landscape may be unique, but with the right knowledge and strategies, you can secure the protection you deserve.

Q&A: Average Car Insurance Cost Florida

What are the main factors that affect car insurance premiums in Florida?

Several factors influence car insurance premiums in Florida, including your driving history, age, vehicle type, location, and credit score.

How does Florida’s no-fault insurance system work?

Florida operates under a no-fault insurance system, where drivers are primarily responsible for covering their own medical expenses after an accident, regardless of who is at fault. This system utilizes Personal Injury Protection (PIP) coverage, which provides benefits for medical treatment, lost wages, and other expenses.

What are some tips for finding affordable car insurance in Florida?

To find affordable car insurance in Florida, consider shopping around for quotes, taking advantage of discounts like good driver discounts, safe driving courses, and multi-car discounts, and bundling your car insurance with other insurance policies.