- Understanding Car Insurance Costs in Florida

- Average Car Insurance Costs in Florida

- Factors Affecting Individual Car Insurance Costs: Average Car Insurance Cost In Florida

- Tips for Lowering Car Insurance Costs in Florida

- Resources and Information for Florida Drivers

- Closing Summary

- Key Questions Answered

Average car insurance cost in Florida is a significant expense for many residents, and understanding the factors that influence these costs is crucial. Florida’s unique demographics, driving conditions, and no-fault insurance system all play a role in shaping insurance rates. From the average cost for different vehicle types to the impact of individual driving history, this guide will equip you with the knowledge to navigate the complexities of car insurance in the Sunshine State.

This guide delves into the key factors that determine car insurance costs in Florida, including individual driving history, vehicle characteristics, and coverage options. It also provides practical tips for lowering your premiums and valuable resources to help you make informed decisions about your car insurance.

Understanding Car Insurance Costs in Florida

Florida is known for its sunshine and beaches, but it also has a reputation for high car insurance costs. Understanding the factors influencing these costs is crucial for Florida drivers.

Factors Influencing Car Insurance Costs in Florida

Several factors contribute to the high car insurance rates in Florida. These include:

- High Number of Accidents: Florida has a high rate of car accidents, which directly impacts insurance premiums. This is partly due to a large population of drivers, a significant number of tourists, and a high number of uninsured drivers.

- High Number of Claims: The state also sees a high number of insurance claims, which further contributes to rising costs. This is attributed to the state’s “no-fault” insurance system, which allows individuals to file claims for their own injuries, regardless of who is at fault.

- High Cost of Healthcare: Florida has a relatively high cost of healthcare, which increases the cost of medical claims associated with car accidents. This is partly due to the state’s large population of seniors, who tend to have higher healthcare needs.

- Natural Disasters: Florida is prone to natural disasters such as hurricanes, which can cause significant damage to vehicles and increase insurance claims. This risk is factored into insurance premiums.

- Fraudulent Claims: The state has a history of insurance fraud, which further inflates insurance costs. Insurance companies must account for these fraudulent claims when setting premiums.

Florida’s Unique Demographics and Driving Conditions

Florida’s unique demographics and driving conditions significantly impact car insurance costs.

- Large Senior Population: Florida has a large population of senior citizens, who are more likely to be involved in accidents due to age-related factors. Insurance companies adjust premiums to account for this increased risk.

- High Tourist Traffic: Florida’s tourism industry attracts millions of visitors annually. Tourists are often unfamiliar with local roads and driving conditions, which can increase the likelihood of accidents.

- Heavy Traffic Congestion: Florida’s major cities experience heavy traffic congestion, which increases the risk of accidents and makes it more difficult to avoid them.

- Warm Climate: Florida’s warm climate encourages year-round driving, leading to more miles driven and a higher likelihood of accidents.

Florida’s No-Fault Insurance System

Florida’s no-fault insurance system, also known as Personal Injury Protection (PIP), requires all drivers to carry a minimum amount of PIP coverage.

This system allows individuals to file claims for their own injuries, regardless of who is at fault.

This system aims to simplify the claims process and reduce lawsuits. However, it has also contributed to higher insurance costs due to:

- Increased Number of Claims: The no-fault system has led to a significant increase in the number of claims filed, as individuals can claim benefits for their own injuries even if they are not at fault.

- Higher Claim Costs: The system also encourages higher claim costs, as individuals can seek treatment for injuries that may not be as severe.

- Insurance Fraud: The no-fault system has also been a target for insurance fraud, as individuals can take advantage of the system to file fraudulent claims for injuries.

Average Car Insurance Costs in Florida

The cost of car insurance in Florida can vary significantly depending on factors such as your driving record, the type of vehicle you drive, and your location. However, understanding average costs can help you get a general idea of what to expect when shopping for insurance.

Average Car Insurance Costs by Vehicle Type

Here’s a breakdown of average annual car insurance costs for different vehicle types in Florida:

- Sedans: $2,000 – $2,500

- SUVs: $2,500 – $3,000

- Trucks: $2,800 – $3,500

- Sports Cars: $3,000 – $4,000

- Luxury Cars: $3,500 – $5,000

It’s important to note that these are just averages, and your actual cost may be higher or lower depending on the specific factors mentioned earlier.

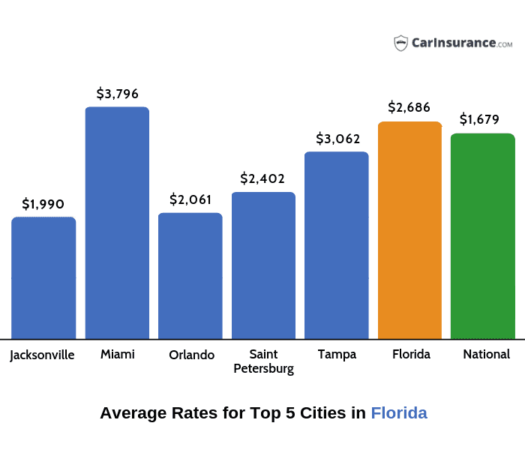

Average Car Insurance Costs by City

Here’s a table comparing average car insurance costs across major cities in Florida:

| City | Average Cost (Annual) | Minimum Coverage | Full Coverage |

|---|---|---|---|

| Miami | $2,300 | $1,500 | $3,000 |

| Tampa | $2,100 | $1,400 | $2,800 |

| Orlando | $2,000 | $1,300 | $2,700 |

| Jacksonville | $1,900 | $1,200 | $2,500 |

These figures are based on data from the Insurance Information Institute and other reputable sources. They provide a general overview of average car insurance costs in Florida, but it’s always recommended to get quotes from multiple insurance companies to find the best rates for your specific needs.

Factors Affecting Individual Car Insurance Costs: Average Car Insurance Cost In Florida

Car insurance premiums in Florida, like in any other state, are influenced by a variety of factors that are unique to each individual driver and their vehicle. These factors help insurance companies assess the risk associated with insuring a particular driver, ultimately determining the cost of their premiums.

Driving History

A driver’s history behind the wheel plays a crucial role in determining their car insurance premiums. Insurance companies analyze a driver’s past driving record, including accidents, traffic violations, and driving convictions, to assess their risk.

- Accidents: Drivers who have been involved in accidents, especially those deemed at fault, are considered higher risk and are likely to face higher premiums. The severity of the accident, the number of accidents, and the time elapsed since the last accident all factor into the calculation.

- Traffic Violations: Traffic violations like speeding tickets, reckless driving, and DUI convictions are also major factors that can significantly increase insurance premiums. These violations indicate a higher risk of future accidents and, therefore, result in higher premiums.

- Driving Convictions: More serious offenses like driving under the influence (DUI) or driving with a suspended license can lead to significantly higher premiums, sometimes even making it difficult to find insurance coverage.

Maintaining a clean driving record is essential for keeping insurance premiums low. Drivers with a history of accidents or violations should consider defensive driving courses or other measures to demonstrate their commitment to safe driving practices.

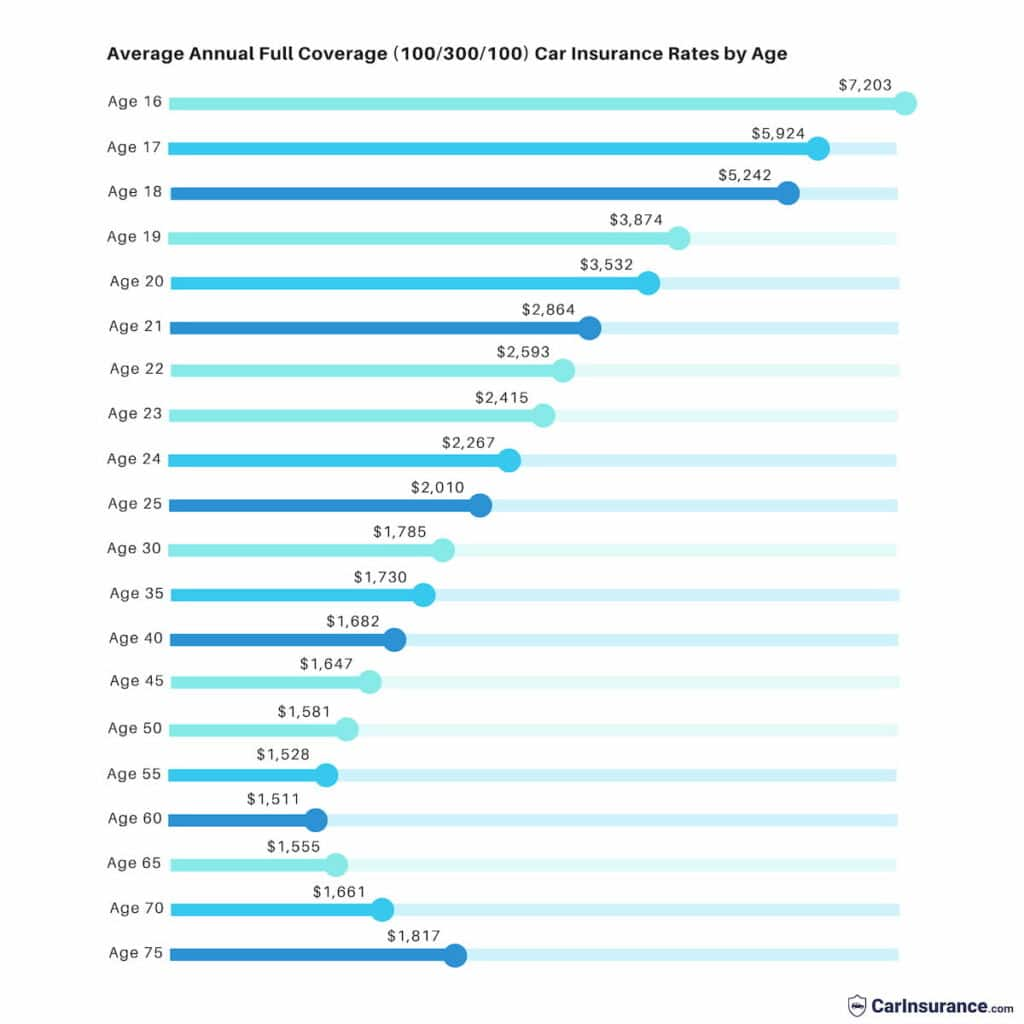

Age, Average car insurance cost in florida

Age is another significant factor that impacts car insurance premiums. Generally, younger drivers are considered higher risk due to their lack of experience and higher propensity for accidents. Conversely, older drivers are often considered lower risk, as they tend to have more driving experience and safer driving habits.

- Young Drivers: Drivers under the age of 25 are often subject to higher premiums, especially in the first few years after obtaining their license. This is because younger drivers have less experience on the road and are statistically more likely to be involved in accidents.

- Older Drivers: Drivers over the age of 65 often benefit from lower premiums, as they have accumulated more driving experience and have a lower accident rate. However, it’s important to note that certain medical conditions or cognitive decline in older drivers can also impact their premiums.

It’s important to note that these are general trends, and individual circumstances can vary. For example, a young driver with an excellent driving record may receive lower premiums than an older driver with a history of accidents.

Credit Score

While it may seem surprising, credit score is increasingly being used by insurance companies to determine car insurance premiums. This practice, known as “credit-based insurance scoring,” is based on the premise that individuals with good credit history are more likely to be responsible drivers.

- Good Credit Score: Drivers with good credit scores are generally considered lower risk and may qualify for lower premiums.

- Poor Credit Score: Conversely, drivers with poor credit scores may face higher premiums, as they are perceived as higher risk by insurance companies.

It’s important to understand that credit-based insurance scoring is not universally accepted, and some states have regulations limiting its use. Drivers with concerns about their credit score impacting their insurance premiums should consult with their insurance agent to understand their state’s regulations and explore options to improve their credit score.

Vehicle Make, Model, and Safety Features

The type of vehicle you drive also plays a significant role in determining your car insurance premiums. Insurance companies consider factors like the vehicle’s make, model, safety features, and overall value when calculating premiums.

- Vehicle Make and Model: Some vehicle makes and models are statistically more prone to accidents or thefts, which can lead to higher premiums.

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and electronic stability control, are generally considered safer and may qualify for lower premiums.

- Vehicle Value: The value of your vehicle is also a factor, as higher-value vehicles are more expensive to repair or replace in case of an accident.

Choosing a vehicle with a good safety rating and advanced safety features can help lower your insurance premiums.

Coverage Options

The amount and type of coverage you choose will also impact your insurance premiums.

- Liability Coverage: This coverage is mandatory in Florida and protects you financially if you are at fault in an accident that causes injury or damage to another person or property. Higher liability limits typically result in higher premiums.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in a collision, regardless of fault. Choosing a higher deductible can help lower your premiums.

- Comprehensive Coverage: This coverage protects your vehicle against damage from events other than collisions, such as theft, vandalism, or natural disasters. Choosing a higher deductible can help lower your premiums.

It’s important to choose coverage options that meet your individual needs and budget. Consult with your insurance agent to understand the different coverage options and their impact on your premiums.

Tips for Lowering Car Insurance Costs in Florida

Lowering your car insurance costs in Florida requires a strategic approach that involves understanding your insurance needs and exploring available options. By implementing a combination of these strategies, you can potentially reduce your premiums significantly.

Improving Your Driving Record

A clean driving record is a significant factor in determining your car insurance premiums. Any traffic violations or accidents can lead to higher premiums.

- Avoid traffic violations: Speeding tickets, reckless driving, and DUI offenses can dramatically increase your insurance rates. Practice defensive driving techniques and follow traffic laws to maintain a clean record.

- Take a defensive driving course: Completing a defensive driving course can demonstrate your commitment to safe driving and may earn you a discount on your insurance premiums.

- Report any accidents promptly: If you are involved in an accident, even a minor one, report it to your insurance company immediately. Delaying reporting can negatively impact your claim and potentially increase your future premiums.

Increasing Deductibles

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Increasing your deductible can lead to lower premiums.

- Consider your risk tolerance: Before increasing your deductible, assess your financial situation and determine how much you can afford to pay out of pocket in case of an accident.

- Calculate potential savings: Compare the premium reductions offered for different deductible amounts to determine if the savings outweigh the increased out-of-pocket expenses.

Exploring Discounts

Insurance companies offer various discounts to lower premiums.

- Good student discount: If you are a full-time student with a good academic record, you may qualify for a discount.

- Safe driver discount: Maintaining a clean driving record for a specified period can qualify you for a discount.

- Multi-car discount: If you insure multiple vehicles with the same company, you may receive a discount.

- Multi-policy discount: Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can also result in savings.

- Anti-theft device discount: Installing anti-theft devices in your vehicle, such as an alarm system or GPS tracker, can reduce your insurance premiums.

Shopping Around for the Best Rates

Comparing quotes from multiple insurance companies is crucial to finding the best rates.

- Utilize online comparison tools: Websites and apps allow you to enter your information and compare quotes from various insurance providers.

- Contact insurance agents directly: Reach out to insurance agents in your area to discuss your needs and obtain personalized quotes.

- Review policy details carefully: When comparing quotes, ensure you understand the coverage details, deductibles, and any limitations or exclusions.

Resources and Information for Florida Drivers

Navigating the world of car insurance in Florida can feel overwhelming, but there are resources available to help you make informed decisions and protect your rights.

Reputable Insurance Companies in Florida

Finding the right insurance company is crucial for securing the best coverage at a reasonable price. Florida is home to numerous insurance providers, both large and small. Here are some of the most reputable companies operating in the state:

- State Farm

- Geico

- Progressive

- Allstate

- USAA

- Florida Peninsula Insurance Company

- Citizens Property Insurance Corporation

This list is not exhaustive, and the best company for you will depend on your individual needs and circumstances. It’s essential to compare quotes from multiple companies before making a decision.

Florida Department of Financial Services (DFS)

The Florida Department of Financial Services (DFS) plays a vital role in protecting consumers’ rights and ensuring a fair and competitive insurance market. The DFS regulates insurance companies, investigates complaints, and educates consumers about their insurance rights and responsibilities.

Filing a Complaint with the DFS

If you have an issue with your insurance company, you can file a complaint with the DFS. The DFS will investigate your complaint and attempt to resolve the issue between you and the insurance company. You can file a complaint online, by phone, or by mail.

- Online: Visit the DFS website and follow the instructions to submit a complaint online.

- Phone: Call the DFS Consumer Helpline at (877) 693-5237.

- Mail: Send a written complaint to:

Florida Department of Financial Services

Consumer Helpline

200 East Gaines Street

Tallahassee, FL 32399-0300

When filing a complaint, be sure to include as much detail as possible, including the name of the insurance company, your policy number, and a description of the issue. The DFS will provide you with a case number and keep you updated on the status of your complaint.

Closing Summary

By understanding the factors that influence car insurance costs in Florida, you can take proactive steps to manage your premiums. Remember to shop around for the best rates, explore discounts, and stay informed about changes in the insurance landscape. With a little effort, you can find affordable car insurance that meets your specific needs and protects you on the road.

Key Questions Answered

What are the cheapest car insurance companies in Florida?

The cheapest car insurance companies in Florida vary depending on individual factors. It’s best to compare quotes from multiple insurers to find the most affordable option for your specific needs.

How can I get a discount on my car insurance in Florida?

Many insurers offer discounts for safe driving records, good credit scores, multiple policy bundles, and vehicle safety features. It’s important to inquire about available discounts when getting quotes.

What is the minimum car insurance coverage required in Florida?

Florida requires drivers to have Personal Injury Protection (PIP) coverage of $10,000 and Property Damage Liability (PDL) coverage of $10,000. However, it’s generally recommended to have higher coverage limits for greater protection.