Average car insurance Florida is a topic that often sparks curiosity, especially for those living in the Sunshine State. Navigating the world of car insurance can be daunting, but understanding the key factors that influence premiums can help you find the best coverage at an affordable price. From understanding the unique challenges of Florida’s driving environment to exploring the impact of your personal driving history and vehicle choices, this guide provides insights into the world of car insurance in Florida.

Florida’s car insurance landscape is shaped by a unique blend of factors. The state’s high population density, frequent severe weather events, and a significant number of uninsured drivers contribute to higher insurance costs. Furthermore, Florida’s “no-fault” insurance system, which requires all drivers to carry Personal Injury Protection (PIP) coverage, adds another layer of complexity. Understanding these factors is crucial for making informed decisions about your car insurance needs.

Understanding Car Insurance in Florida

Florida’s unique environment and driving conditions contribute to higher car insurance costs than in many other states. The state’s high population density, frequent severe weather events, and a significant number of uninsured drivers all play a role in driving up premiums.

Car Insurance Coverage in Florida

Car insurance coverage protects drivers and their vehicles from financial losses in the event of an accident or other covered events. Florida offers various types of car insurance coverage, each designed to address specific risks.

- Liability Coverage: This coverage is mandatory in Florida and protects you financially if you cause an accident that results in injury or damage to another person or their property. Liability coverage pays for the other party’s medical bills, lost wages, and property damage up to your policy limits.

- Collision Coverage: This optional coverage pays for repairs or replacement of your vehicle if it’s damaged in a collision with another vehicle or object. Collision coverage also covers damage caused by hitting a deer or other animal.

- Comprehensive Coverage: This optional coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, fire, hail, or floods.

- Personal Injury Protection (PIP): This mandatory coverage in Florida pays for your medical expenses and lost wages if you’re injured in an accident, regardless of who is at fault. PIP coverage is limited to $10,000 per person.

Mandatory Coverage Requirements

Florida requires all drivers to carry a minimum amount of liability insurance, known as “financial responsibility.” This minimum coverage includes:

- $10,000 for bodily injury or death per person.

- $20,000 for bodily injury or death per accident.

- $10,000 for property damage per accident.

In addition to liability coverage, Florida also requires drivers to carry PIP coverage. The minimum PIP coverage requirement is $10,000 per person. While these minimum coverage requirements are the law, it’s crucial to consider your individual needs and financial situation when deciding on your car insurance coverage.

Factors Affecting Average Car Insurance Costs

Understanding the factors that influence car insurance premiums in Florida is crucial for making informed decisions about your coverage. Several variables contribute to the average cost of car insurance, and understanding these factors can help you find the best policy for your needs.

Driving History

Your driving history plays a significant role in determining your car insurance premiums. Insurance companies assess your risk based on your past driving record, considering factors like:

- Accidents: Each accident you’ve been involved in, regardless of fault, increases your risk profile, leading to higher premiums.

- Traffic Violations: Speeding tickets, reckless driving citations, and DUI convictions significantly impact your insurance rates.

- Claims History: Even if you weren’t at fault, filing a claim can increase your premiums as it indicates a higher likelihood of future claims.

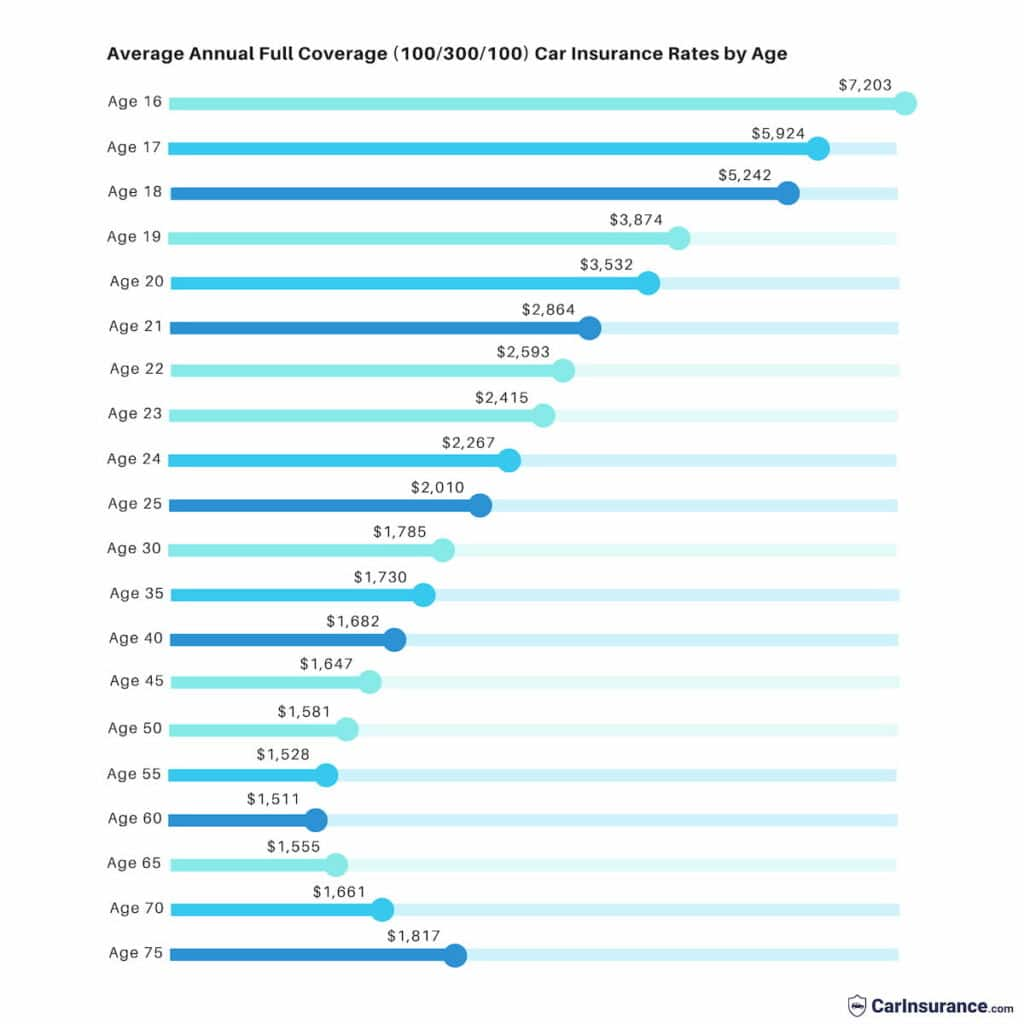

Age

Age is a significant factor in car insurance pricing. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. Insurance companies recognize this higher risk and adjust premiums accordingly. As you age and gain experience, your premiums tend to decrease.

Gender

Historically, insurance companies have considered gender as a factor in pricing. However, in many states, including Florida, it’s now illegal to use gender as a primary factor in determining insurance rates. While gender may still be considered indirectly, its impact is limited.

Vehicle Type

The type of vehicle you drive significantly impacts your insurance premiums. Insurance companies consider factors such as:

- Vehicle Value: More expensive vehicles are more costly to repair or replace, leading to higher insurance premiums.

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and stability control, are generally considered safer and may qualify for lower premiums.

- Performance: High-performance vehicles, known for their speed and power, are often associated with higher risk and higher premiums.

- Theft Risk: Certain vehicle models are more prone to theft, leading to higher insurance costs.

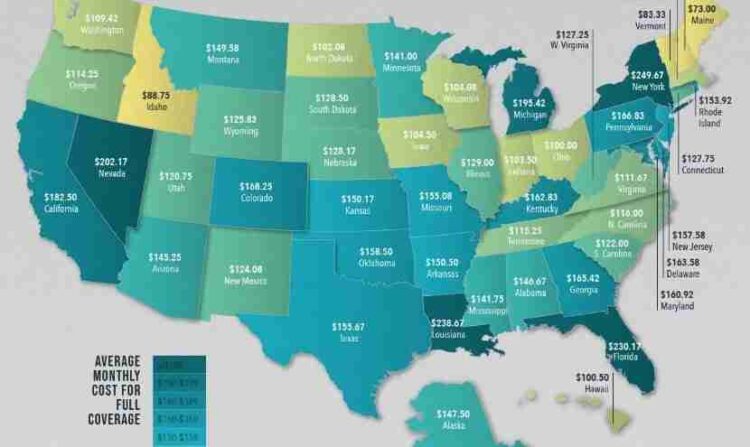

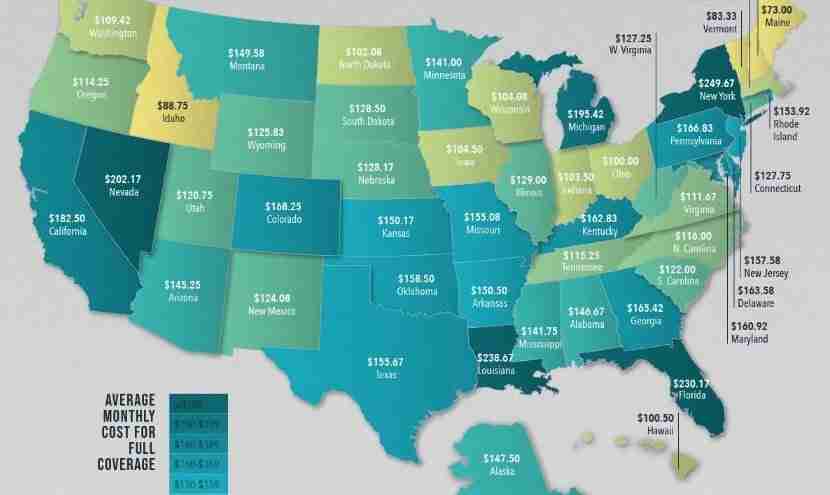

Location

Your location in Florida significantly impacts your car insurance premiums. Factors that influence rates include:

- Population Density: Areas with higher population densities often have more traffic congestion and a higher risk of accidents, leading to higher insurance premiums.

- Crime Rates: Locations with higher crime rates, including car theft, tend to have higher insurance premiums.

- Weather Conditions: Areas prone to severe weather events, such as hurricanes and floods, may have higher insurance rates.

Credit Score

In many states, including Florida, insurance companies can use your credit score as a factor in determining your car insurance premiums. A good credit score indicates financial responsibility, which is often correlated with responsible driving behavior. Individuals with lower credit scores may face higher premiums.

Finding Affordable Car Insurance in Florida

Finding affordable car insurance in Florida can be challenging, but it’s essential to protect yourself financially in case of an accident. Florida has a high rate of car accidents, making it even more important to have adequate coverage.

Comparing Quotes from Multiple Insurance Providers

To find the best rates, comparing quotes from multiple insurance providers is crucial. This allows you to see a range of prices and coverage options, helping you make an informed decision. Many online comparison websites simplify this process by allowing you to enter your information once and receive quotes from multiple insurers.

Strategies for Lowering Car Insurance Premiums, Average car insurance florida

Several strategies can help lower your car insurance premiums in Florida.

- Increase Your Deductible: A higher deductible means you pay more out of pocket in case of an accident, but it can significantly lower your premium. Consider your financial situation and risk tolerance when choosing a deductible.

- Bundle Insurance Policies: Bundling your car insurance with other policies, such as homeowners or renters insurance, can often lead to discounts. Insurers offer bundled packages to encourage customers to buy multiple policies from them.

- Take Defensive Driving Courses: Completing a defensive driving course can demonstrate your commitment to safe driving and earn you a discount on your insurance premiums. These courses teach valuable skills and techniques to help you avoid accidents.

- Maintain a Good Driving Record: Your driving history significantly impacts your insurance rates. Avoid traffic violations, accidents, and other driving offenses to keep your premiums low.

- Choose a Safe Car: The type of car you drive influences your insurance premiums. Vehicles with safety features like anti-theft systems, airbags, and stability control are often considered safer and may qualify for discounts.

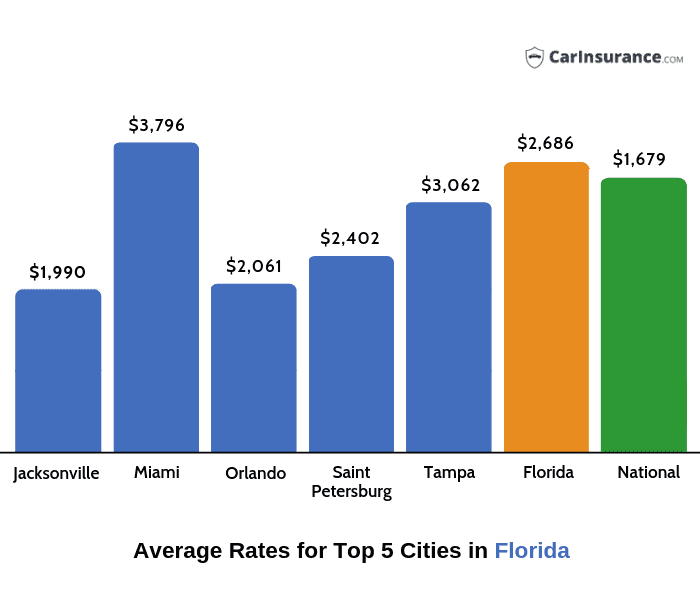

Average Car Insurance Rates in Florida

The average car insurance rates in Florida vary depending on several factors, including demographics. Here’s a table comparing average car insurance rates for different demographics:

| Demographic | Average Annual Premium |

|---|---|

| Young Drivers (Under 25) | $2,500 – $3,500 |

| Older Drivers (Over 65) | $1,500 – $2,500 |

| Drivers with Good Credit | $1,800 – $2,800 |

| Drivers with Poor Credit | $2,500 – $3,500 |

| Drivers with a Clean Driving Record | $1,500 – $2,500 |

| Drivers with Traffic Violations | $2,500 – $3,500 |

Note: These are just average rates, and your actual premium may vary based on your individual circumstances.

Understanding Florida’s No-Fault Insurance System

Florida operates under a “no-fault” insurance system, meaning that after a car accident, drivers are primarily responsible for covering their own medical expenses and lost wages, regardless of who caused the accident. This system is designed to streamline the claims process and reduce litigation, but it has its own unique set of rules and implications.

Personal Injury Protection (PIP) Coverage

In Florida’s no-fault system, Personal Injury Protection (PIP) coverage plays a crucial role. It is a mandatory insurance coverage that provides benefits for medical expenses, lost wages, and other related costs incurred by the policyholder and their passengers, regardless of fault.

PIP coverage provides benefits up to $10,000 per person, and it covers 80% of reasonable and necessary medical expenses, up to a maximum of $2,500 for lost wages. The remaining 20% of medical expenses can be covered by the at-fault driver’s liability insurance or through other health insurance plans.

PIP coverage is mandatory for all drivers in Florida.

Impact on Accident Claims

Florida’s no-fault system affects how accident claims are filed and resolved. Here’s a breakdown:

- Filing a Claim: After an accident, you file a claim with your own insurance company, regardless of who caused the accident.

- Benefits: Your PIP coverage will pay for your medical expenses and lost wages, up to the coverage limits.

- Liability Claims: If your injuries are severe or your PIP benefits are exhausted, you may be able to file a liability claim against the at-fault driver to recover additional damages.

- Threshold for Liability Claims: To file a liability claim in Florida, you must meet a “threshold” requirement. This means you must demonstrate that your injuries meet certain criteria, such as:

- Permanent injury

- Significant and permanent scarring or disfigurement

- Loss of a bodily function

Navigating Florida’s Insurance Market

Florida’s car insurance market is a complex landscape, with various insurance companies vying for your business. Navigating this market effectively requires understanding your rights and responsibilities, as well as knowing how to resolve any issues that may arise.

The Role of the Florida Office of Insurance Regulation (OIR)

The Florida Office of Insurance Regulation (OIR) plays a crucial role in overseeing the state’s insurance market. The OIR is responsible for ensuring that insurance companies operate fairly and transparently, protecting consumers from unfair practices.

Filing Complaints Against Insurance Companies

If you have a complaint against an insurance company, you can file it with the OIR. The OIR investigates complaints and takes action against insurance companies that violate state regulations. You can file a complaint online, by mail, or by phone.

Resources for Drivers

The OIR provides a wealth of resources for drivers to learn more about their rights and responsibilities regarding car insurance in Florida. These resources include:

- The OIR’s website, which offers information on car insurance, including a guide to understanding your policy.

- The OIR’s consumer hotline, which provides answers to questions about car insurance and helps resolve disputes with insurance companies.

- The OIR’s publications, which provide detailed information on various aspects of car insurance in Florida.

End of Discussion

Finding the right car insurance in Florida requires a proactive approach. By understanding the factors that influence premiums, comparing quotes from multiple providers, and exploring strategies to lower costs, you can secure the best coverage for your needs without breaking the bank. Remember, knowledge is power when it comes to car insurance, and by arming yourself with the right information, you can confidently navigate the Florida insurance market.

Top FAQs: Average Car Insurance Florida

What are the mandatory car insurance coverages in Florida?

Florida requires drivers to carry a minimum of $10,000 in Personal Injury Protection (PIP) coverage and $10,000 in Property Damage Liability (PDL) coverage.

How does my credit score affect my car insurance premiums?

Insurance companies use credit scores as a factor in determining premiums, as those with good credit history tend to be more responsible drivers. A lower credit score could result in higher insurance rates.

What are some tips for lowering my car insurance premiums?

Consider increasing your deductible, bundling your insurance policies, taking a defensive driving course, and maintaining a good driving record to lower your premiums.