Average cost for car insurance in florida – Average car insurance cost in Florida can be a significant expense for residents, influenced by a range of factors including driving history, age, vehicle type, and location. Florida’s unique driving environment, with its high population density and hurricane risks, adds another layer of complexity to insurance pricing. Understanding the factors that impact your car insurance costs in Florida can help you make informed decisions about your coverage and potentially save money.

This guide will delve into the average cost of car insurance in Florida, exploring the key factors that influence premiums, comparing costs to other states, and providing tips for finding affordable coverage. We’ll also discuss Florida’s unique insurance regulations and how they affect your insurance rates.

Factors Influencing Car Insurance Costs in Florida

Several factors influence the cost of car insurance in Florida. Understanding these factors can help you make informed decisions to potentially lower your premiums.

Driving History

Your driving history plays a significant role in determining your car insurance rates. Insurance companies assess your driving record to evaluate your risk profile. This includes factors such as:

- Accidents: A history of accidents, especially at-fault accidents, increases your insurance premiums. The severity and frequency of accidents also contribute to the rise in premiums.

- Traffic Violations: Speeding tickets, DUI convictions, and other traffic violations can significantly raise your insurance rates. These violations indicate a higher risk of future accidents.

- Years of Driving Experience: Drivers with less experience are generally considered higher risks. As you gain experience, your insurance premiums may decrease.

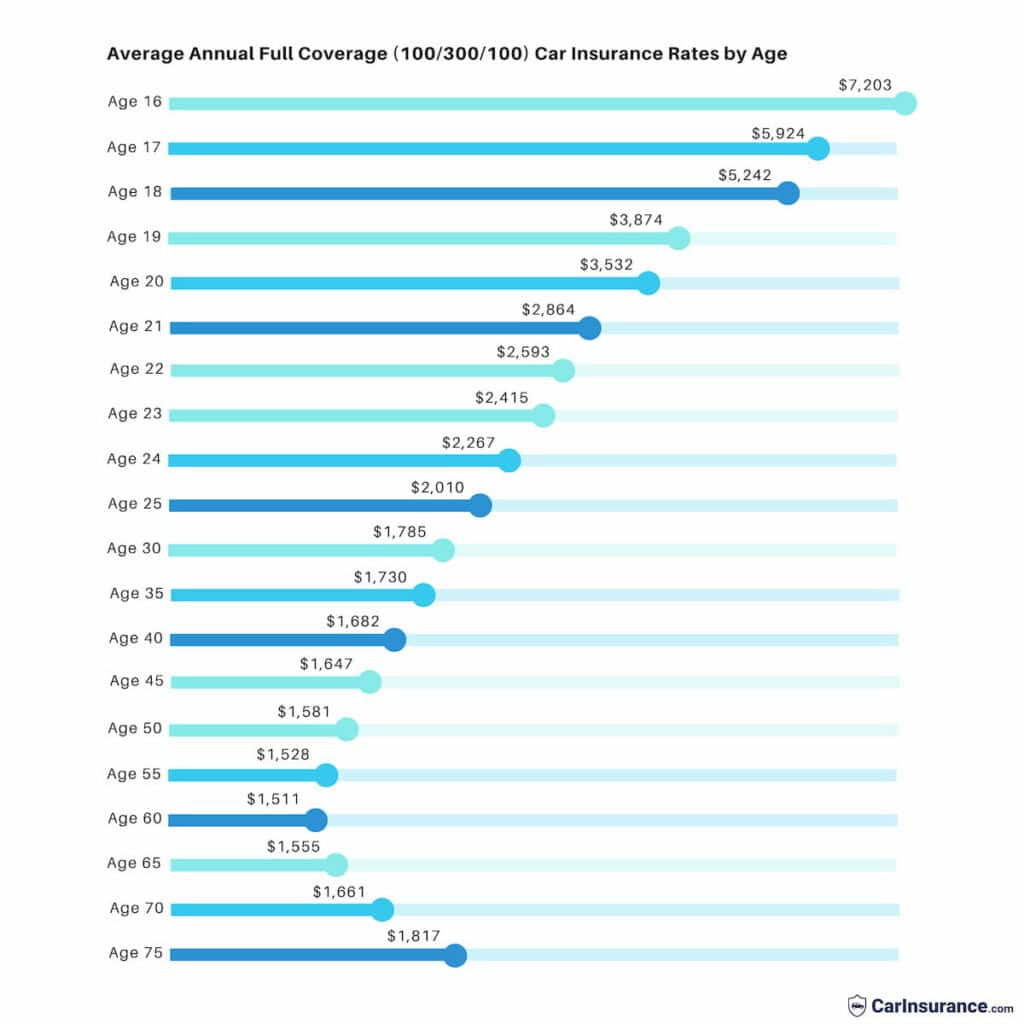

Age

Age is another critical factor influencing car insurance costs. Younger drivers, especially teenagers, are statistically more likely to be involved in accidents. Insurance companies often charge higher premiums for younger drivers due to their inexperience and higher risk. As you age, your premiums may decrease as you gain experience and become a less risky driver.

Vehicle Type

The type of vehicle you drive also affects your insurance premiums. Certain vehicles are more expensive to repair or replace, making them more costly to insure.

- Make and Model: High-performance cars, luxury vehicles, and sports cars often have higher insurance rates due to their higher repair costs and potential for theft.

- Safety Features: Cars equipped with advanced safety features, such as anti-lock brakes, airbags, and electronic stability control, may qualify for discounts. These features can reduce the severity of accidents, leading to lower insurance premiums.

Location

Your location in Florida can significantly impact your car insurance costs. Factors like population density, crime rates, and the frequency of accidents influence insurance premiums.

- Urban Areas: Urban areas with high population density and traffic congestion often have higher insurance rates due to the increased risk of accidents.

- Hurricane Risk: Florida’s susceptibility to hurricanes significantly impacts insurance costs. Coastal areas with a higher risk of hurricane damage face higher premiums.

Florida’s Unique Driving Conditions

Florida’s unique driving conditions, such as high population density, traffic congestion, and hurricane risks, contribute to higher car insurance rates.

- High Population Density: Florida’s high population density leads to increased traffic volume and congestion, increasing the likelihood of accidents. This factor contributes to higher insurance premiums.

- Hurricane Risk: Florida’s vulnerability to hurricanes significantly impacts insurance costs. Hurricane damage can lead to widespread vehicle damage, forcing insurance companies to pay higher claims. As a result, insurance premiums are higher in hurricane-prone areas.

Average Car Insurance Costs in Florida

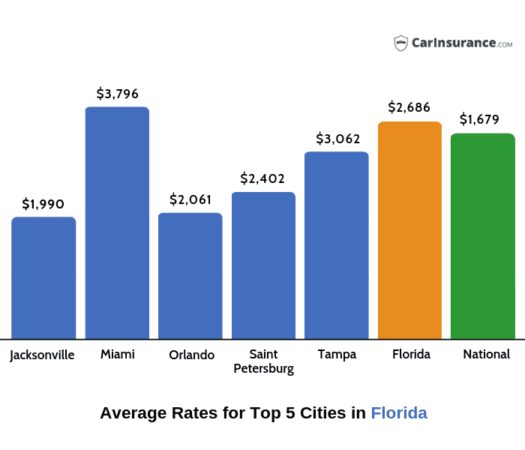

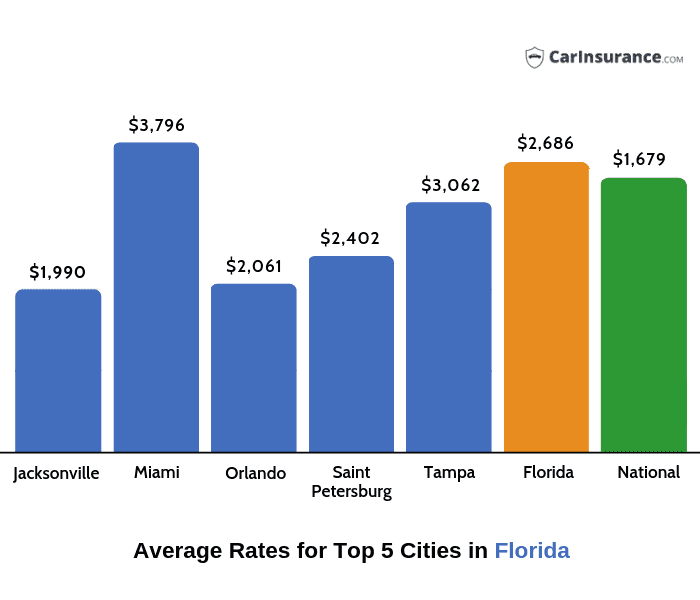

Florida has a reputation for being a costly state for car insurance. Several factors contribute to this, including a high population density, a large number of uninsured drivers, and a high frequency of accidents.

Average Annual Car Insurance Costs in Florida

The average annual cost of car insurance in Florida is around $2,500, according to recent data from the National Association of Insurance Commissioners (NAIC). However, this is just an average, and the actual cost you pay will depend on several factors, including your driving history, the type of car you drive, your age, and your location.

Here is a breakdown of average annual car insurance costs in Florida for different coverage levels:

- Liability Only: $1,000 – $1,500

- Liability and Collision: $1,500 – $2,500

- Full Coverage: $2,000 – $3,500

Comparison of Car Insurance Costs in Florida to Other States

Florida has some of the highest car insurance rates in the country. According to the NAIC, the average annual cost of car insurance in the United States is around $1,500. This means that Floridians pay about 67% more than the national average.

Here is a table comparing the average annual cost of car insurance in Florida to other states:

| State | Average Annual Cost |

|---|---|

| Florida | $2,500 |

| Michigan | $2,300 |

| Pennsylvania | $2,200 |

| New Jersey | $2,100 |

| Texas | $1,900 |

| United States Average | $1,500 |

Types of Car Insurance Coverage and Average Costs

There are several different types of car insurance coverage available in Florida. Each type of coverage provides different protection, and the cost of each type of coverage will vary depending on your individual needs and risk factors.

Here is a brief description of the different types of car insurance coverage and their average costs:

- Liability Coverage: This type of coverage is required by law in Florida. It protects you financially if you are at fault in an accident that causes injury or damage to others. The average cost of liability coverage in Florida is around $1,000 – $1,500 per year.

- Collision Coverage: This type of coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. The average cost of collision coverage in Florida is around $500 – $1,000 per year.

- Comprehensive Coverage: This type of coverage pays for repairs or replacement of your vehicle if it is damaged by something other than an accident, such as theft, vandalism, or a natural disaster. The average cost of comprehensive coverage in Florida is around $300 – $600 per year.

- Uninsured/Underinsured Motorist Coverage: This type of coverage protects you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your losses. The average cost of uninsured/underinsured motorist coverage in Florida is around $100 – $200 per year.

- Personal Injury Protection (PIP): This type of coverage pays for medical expenses and lost wages if you are injured in an accident, regardless of who is at fault. PIP coverage is required by law in Florida. The average cost of PIP coverage in Florida is around $200 – $400 per year.

Finding Affordable Car Insurance in Florida

Finding affordable car insurance in Florida requires careful planning and research. While Florida’s car insurance rates are among the highest in the nation, there are strategies to help you save money. By comparing quotes, exploring discounts, and considering different coverage levels, you can find a policy that fits your budget without compromising on essential protection.

Comparing Quotes

Getting quotes from multiple insurance companies is crucial for finding the best deal. Online comparison websites and insurance brokers can simplify this process. By entering your personal information and vehicle details, you can receive quotes from various providers within minutes.

- Online Comparison Websites: Websites like Insurance.com, Policygenius, and The Zebra allow you to compare quotes from multiple insurers simultaneously. They often provide additional information about each company, including customer reviews and financial ratings.

- Insurance Brokers: Insurance brokers work with multiple insurance companies and can help you find the best coverage options for your needs. They can also negotiate rates on your behalf.

Exploring Discounts

Insurance companies offer various discounts to reduce your premiums. These discounts can be significant, so it’s worth exploring all available options.

- Safe Driving Discounts: Maintaining a clean driving record with no accidents or traffic violations can earn you a discount.

- Good Student Discounts: Students with good grades may qualify for a discount.

- Bundling Discounts: Combining your car insurance with other policies, such as homeowners or renters insurance, can lead to a significant discount.

- Loyalty Discounts: Some insurers offer discounts to customers who have been with them for a certain period.

- Vehicle Safety Features Discounts: Vehicles equipped with anti-theft devices, airbags, and other safety features may qualify for discounts.

- Payment Discounts: Paying your premium in full or setting up automatic payments can sometimes lead to a discount.

Considering Different Coverage Levels

The level of coverage you choose significantly impacts your premium. Understanding your needs and risks can help you select the right coverage without overpaying.

- Liability Coverage: This coverage protects you financially if you cause an accident that injures someone or damages their property. It’s usually required by law.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who’s at fault.

- Comprehensive Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged by something other than an accident, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your losses.

Reputable Car Insurance Providers in Florida

The following table provides a list of reputable car insurance providers in Florida, along with their average rates and coverage options. These rates are estimates and may vary based on individual factors such as driving history, vehicle type, and location.

| Insurance Company | Average Annual Premium | Coverage Options |

|---|---|---|

| State Farm | $2,000 | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Medical Payments, Personal Injury Protection (PIP), Rental Car Coverage, Roadside Assistance |

| Geico | $1,800 | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Medical Payments, Personal Injury Protection (PIP), Rental Car Coverage, Roadside Assistance |

| Progressive | $1,900 | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Medical Payments, Personal Injury Protection (PIP), Rental Car Coverage, Roadside Assistance |

| Allstate | $2,100 | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Medical Payments, Personal Injury Protection (PIP), Rental Car Coverage, Roadside Assistance |

| USAA | $1,700 | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Medical Payments, Personal Injury Protection (PIP), Rental Car Coverage, Roadside Assistance |

Getting a Car Insurance Quote

To get a car insurance quote, you’ll typically need to provide the following information:

- Personal Information: Name, address, date of birth, driving history, and contact information.

- Vehicle Information: Year, make, model, and VIN number.

- Driving History: Details about your driving record, including any accidents or traffic violations.

- Coverage Preferences: The types and levels of coverage you desire.

Selecting a Policy

Once you’ve received quotes from multiple insurers, carefully compare the coverage options, premiums, and customer service ratings. Consider the following factors when selecting a policy:

- Price: Choose a policy that fits your budget.

- Coverage: Ensure the policy provides the coverage you need to protect yourself and your vehicle.

- Customer Service: Select an insurer with a reputation for excellent customer service.

- Financial Stability: Choose an insurer with a strong financial rating to ensure they can pay claims if you need them.

Understanding Florida’s Insurance Regulations: Average Cost For Car Insurance In Florida

Florida has a unique set of insurance regulations that significantly impact car insurance costs. Understanding these regulations is crucial for drivers in the state to make informed decisions about their coverage and find the best rates.

Minimum Coverage Requirements

Florida requires all drivers to carry a minimum amount of liability insurance to protect themselves and others in case of an accident. This minimum coverage, known as “financial responsibility,” includes:

- Bodily Injury Liability: $10,000 per person/$20,000 per accident. This covers injuries to others in an accident you cause.

- Property Damage Liability: $10,000 per accident. This covers damage to property of others in an accident you cause.

Drivers can choose to purchase additional coverage beyond the minimum requirements, such as:

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related costs for you and your passengers, regardless of who is at fault. Florida’s PIP law is a “no-fault” system, meaning you can file a claim with your own insurance company even if you are at fault for the accident. The minimum PIP coverage required in Florida is $10,000.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of fault. You can choose to waive collision coverage if your vehicle is older or has a lower value.

- Comprehensive Coverage: This coverage pays for damage to your vehicle caused by events other than accidents, such as theft, vandalism, or natural disasters. You can choose to waive comprehensive coverage if your vehicle is older or has a lower value.

No-Fault Insurance

Florida is a no-fault insurance state, which means that drivers are primarily responsible for covering their own injuries and losses after an accident, regardless of who is at fault. This system is designed to reduce the number of lawsuits and expedite the claims process. However, it also has implications for car insurance costs.

Role of the Florida Department of Financial Services

The Florida Department of Financial Services (DFS) is responsible for regulating the insurance industry in the state, including car insurance. The DFS sets minimum coverage requirements, monitors insurance rates, and investigates complaints against insurance companies. The DFS also plays a role in ensuring that insurance companies are financially stable and able to pay claims.

Impact of Florida’s Insurance Regulations on Car Insurance Costs, Average cost for car insurance in florida

Florida’s insurance regulations have a significant impact on car insurance costs. The no-fault system, for example, can lead to higher premiums because insurance companies must pay for medical expenses and other losses, even if the policyholder is at fault. Additionally, the high number of uninsured drivers in Florida can increase premiums for insured drivers, as insurance companies must factor in the risk of accidents with uninsured motorists.

“Florida’s unique insurance regulations, including the no-fault system and the high number of uninsured drivers, can significantly impact car insurance costs.”

Epilogue

Navigating the world of car insurance in Florida can feel like driving through a maze. By understanding the factors that influence your premiums, comparing quotes from different insurers, and taking advantage of available discounts, you can find the best possible coverage at a price that fits your budget. Remember to review your policy regularly and make adjustments as needed to ensure you have the right level of protection.

Essential Questionnaire

What are the minimum car insurance requirements in Florida?

Florida requires all drivers to have at least $10,000 in Personal Injury Protection (PIP) coverage and $10,000 in Property Damage Liability (PDL) coverage. You can choose to have more coverage, but these are the minimums.

How can I get a free car insurance quote in Florida?

Most car insurance companies offer free online quotes. Simply visit their website, enter your information, and they will provide you with a customized quote.

What are some common discounts offered by car insurance companies in Florida?

Common discounts include good driver discounts, safe driver discounts, multi-car discounts, and discounts for bundling home and auto insurance.

What are some tips for lowering my car insurance costs in Florida?

Consider increasing your deductible, improving your credit score, taking a defensive driving course, and comparing quotes from multiple insurers.