Average cost of car insurance florida is a topic that many residents are interested in, especially given the state’s unique driving environment and insurance market. Florida is known for its high population density, frequent traffic, and susceptibility to natural disasters, all of which can influence car insurance rates. This comprehensive guide will delve into the factors that determine car insurance costs in Florida, providing insights into the state’s insurance landscape, tips for saving money, and essential information for navigating the claims process.

Understanding the factors that contribute to car insurance costs in Florida is crucial for making informed decisions about your coverage. From demographics and driving habits to vehicle type and location, numerous elements influence your premiums. This guide will provide a detailed breakdown of these factors, helping you understand how they impact your car insurance costs and enabling you to take proactive steps to minimize your expenses.

Factors Influencing Car Insurance Costs in Florida: Average Cost Of Car Insurance Florida

Car insurance premiums in Florida are influenced by a multitude of factors, ensuring that each driver pays a rate reflective of their individual risk profile. These factors encompass demographic characteristics, driving habits, vehicle type, and geographical location.

Demographics

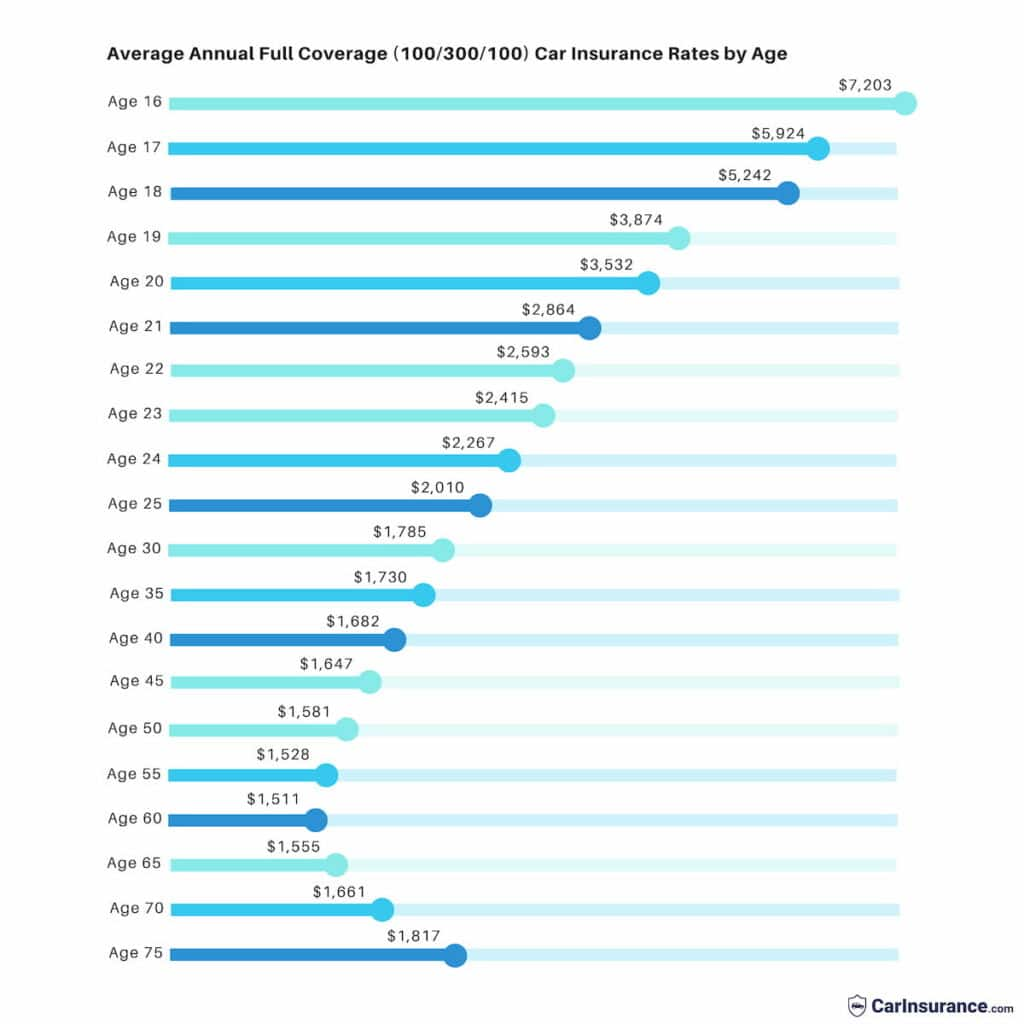

Demographics play a significant role in determining car insurance rates. Insurers consider factors such as age, gender, and driving history to assess the likelihood of an insured individual being involved in an accident.

- Age: Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents due to inexperience and risk-taking behavior. Therefore, they typically pay higher premiums. Conversely, older drivers, often considered more experienced and cautious, may enjoy lower rates.

- Gender: Historically, men have been associated with a higher risk of accidents than women. However, this gap is narrowing, and some insurers are moving towards gender-neutral pricing.

- Driving History: Drivers with a clean driving record, free from accidents, violations, or claims, are seen as lower risk and often qualify for lower premiums. Conversely, drivers with a history of accidents, speeding tickets, or DUI convictions are considered higher risk and may face higher premiums.

Driving Habits

Driving habits are another crucial factor influencing car insurance rates. Insurers consider factors such as miles driven and driving record to assess the likelihood of an insured individual being involved in an accident.

- Miles Driven: Drivers who commute long distances or frequently drive in congested areas are more likely to be involved in accidents due to increased exposure to potential hazards. Insurers often offer discounts for low-mileage drivers.

- Driving Record: As mentioned previously, a clean driving record with no accidents, violations, or claims is associated with lower premiums. Conversely, drivers with a history of accidents, speeding tickets, or DUI convictions may face higher premiums.

Vehicle Type

The type of vehicle you drive plays a significant role in determining car insurance costs. Factors such as make, model, and safety features are considered by insurers to assess the likelihood of an accident and the potential cost of repairs.

- Make and Model: Certain car models are known for their safety features, reliability, and overall performance, while others are associated with higher repair costs and a greater likelihood of accidents. For example, luxury cars and sports cars often have higher premiums due to their higher repair costs and perceived risk.

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and stability control, are generally considered safer and may qualify for discounts.

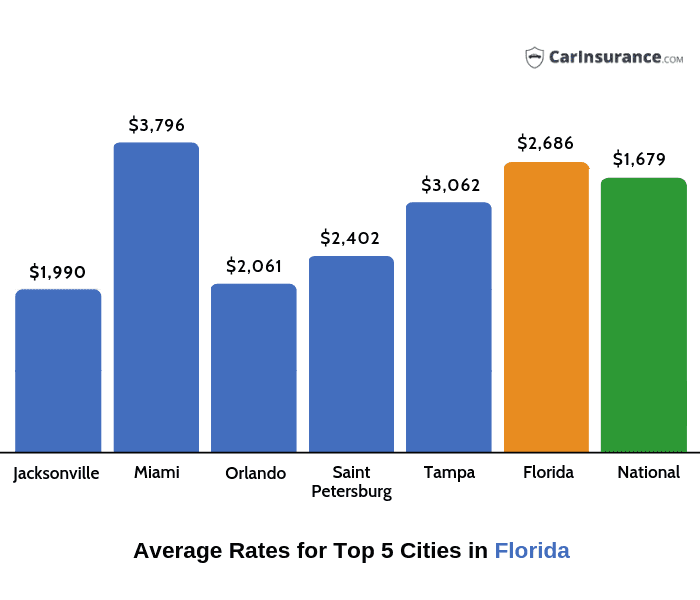

Location and Zip Code

Your location and zip code can significantly impact your car insurance rates. Insurers consider factors such as traffic density, crime rates, and the frequency of accidents in a particular area.

- Traffic Density: Areas with high traffic density are often associated with an increased risk of accidents due to congestion and driver frustration.

- Crime Rates: Areas with high crime rates may experience more car thefts and vandalism, which can lead to higher insurance premiums.

- Frequency of Accidents: Areas with a high frequency of accidents are considered higher risk and may have higher insurance rates.

Understanding Florida’s Insurance Market

Florida’s car insurance market is unique and complex, influenced by various factors including the state’s high population density, susceptibility to natural disasters, and a no-fault insurance system. Understanding the key players and regulations within this market is crucial for drivers seeking affordable and comprehensive coverage.

Major Car Insurance Providers in Florida

Several major car insurance providers operate in Florida, offering a range of coverage options to meet diverse needs. These companies compete fiercely for market share, leading to varying premiums and policy features.

- State Farm: One of the largest insurance providers in the U.S., State Farm holds a significant market share in Florida. They offer a comprehensive range of coverage options and are known for their customer service.

- GEICO: Known for its extensive advertising and competitive pricing, GEICO has gained considerable popularity in Florida. They offer a wide array of coverage options and are known for their user-friendly online platforms.

- Progressive: Progressive is another major player in the Florida car insurance market, known for its innovative pricing models and customized coverage options. They offer a variety of discounts and are known for their online tools and resources.

- Allstate: Allstate is a well-established insurance provider with a strong presence in Florida. They offer a comprehensive range of coverage options and are known for their commitment to customer satisfaction.

- Florida Peninsula Insurance Company: This company specializes in providing insurance to Florida residents, particularly those who have difficulty obtaining coverage from other insurers due to factors such as prior claims or high-risk profiles.

Types of Car Insurance Coverage in Florida

Florida law mandates several types of car insurance coverage for all drivers. These coverages provide financial protection against various risks associated with driving.

- Liability Coverage: This coverage is mandatory in Florida and protects drivers from financial responsibility for injuries or damages they cause to others in an accident. It includes bodily injury liability and property damage liability coverage.

- Collision Coverage: This optional coverage protects drivers against damage to their own vehicle in a collision, regardless of fault. It covers repairs or replacement costs up to the vehicle’s actual cash value.

- Comprehensive Coverage: This optional coverage protects drivers against damage to their own vehicle from non-collision events such as theft, vandalism, fire, or natural disasters. It covers repairs or replacement costs up to the vehicle’s actual cash value.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This optional coverage protects drivers from financial losses when they are involved in an accident with an uninsured or underinsured driver. It covers medical expenses, lost wages, and property damage.

Florida’s No-Fault Insurance System

Florida operates a no-fault insurance system, where drivers are primarily responsible for covering their own medical expenses after an accident, regardless of fault. This system aims to reduce litigation and expedite claims processing.

Personal Injury Protection (PIP): Florida’s no-fault system requires drivers to carry Personal Injury Protection (PIP) coverage, which covers medical expenses, lost wages, and other related costs up to a specified limit. This coverage is mandatory for all drivers, regardless of whether they are at fault for an accident.

Role of the Florida Office of Insurance Regulation

The Florida Office of Insurance Regulation (OIR) is the state agency responsible for overseeing the car insurance market in Florida. The OIR plays a crucial role in ensuring fair and competitive pricing, protecting consumers from unfair practices, and promoting financial stability within the insurance industry.

- Rate Regulation: The OIR reviews and approves insurance rate filings to ensure they are reasonable and justified. They consider factors such as claims history, operating expenses, and market competition.

- Consumer Protection: The OIR investigates complaints against insurance companies and takes action to address unfair or deceptive practices. They also provide information and resources to consumers about their insurance rights and options.

- Financial Stability: The OIR monitors the financial solvency of insurance companies to ensure they can meet their obligations to policyholders. They also have the authority to take action to protect policyholders in the event of an insurer’s insolvency.

Tips for Saving on Car Insurance in Florida

Car insurance in Florida can be expensive, but there are several strategies you can use to lower your premiums. By understanding the factors that influence your rates and taking advantage of available discounts, you can significantly reduce your annual costs.

Common Discounts Offered by Car Insurance Companies in Florida

Discounts are a significant way to reduce your car insurance premiums. Here are some common discounts offered by car insurance companies in Florida:

- Good Driver Discount: This discount is awarded to drivers with a clean driving record, meaning no accidents or traffic violations for a certain period. The discount amount varies depending on the insurer and your driving history.

- Safe Driver Discount: This discount is similar to the good driver discount but may consider additional factors like your driving habits, such as speeding or aggressive driving, as tracked by telematics devices.

- Multi-Policy Discount: Insurance companies often offer discounts when you bundle multiple policies, such as car insurance, homeowners insurance, or renters insurance, with the same provider.

- Anti-theft Device Discount: Installing anti-theft devices in your car, such as alarms or GPS tracking systems, can make your car less attractive to thieves and qualify you for a discount.

- Student Discount: Some insurance companies offer discounts to students who maintain good grades, are enrolled in college, or have a certain GPA.

- Senior Discount: Drivers over a certain age may qualify for a discount, as they tend to have fewer accidents.

- Military Discount: Active military personnel or veterans may be eligible for discounts.

- Loyalty Discount: Some insurers reward long-term customers with discounts for staying with them for a certain period.

Comparing Car Insurance Quotes

Comparing quotes from different insurance providers is essential to find the best rates. Here’s a step-by-step guide:

- Gather your information: Before requesting quotes, have your driver’s license, vehicle information (make, model, year), and current insurance policy details readily available.

- Use online comparison tools: Several websites and apps allow you to compare quotes from multiple insurance companies simultaneously. Popular options include websites like Bankrate, NerdWallet, and QuoteWizard.

- Contact insurance companies directly: You can also contact insurance companies directly to request quotes. This allows you to discuss your specific needs and ask questions about their policies.

- Compare quotes carefully: Once you have received quotes from multiple insurers, compare the coverage, deductibles, and premiums to find the best value for your needs.

- Review policy details: Before finalizing your decision, carefully review the policy details, including the coverage limits, exclusions, and any additional fees.

Negotiating Car Insurance Rates

While comparing quotes is crucial, you can also try to negotiate your car insurance rates with insurers. Here are some tips:

- Be prepared to switch providers: Let the insurance company know that you’re shopping around and are willing to switch if they don’t offer a competitive rate.

- Highlight your good driving record: Emphasize your clean driving history and any discounts you qualify for.

- Consider increasing your deductible: Increasing your deductible can lower your premium, but make sure you can afford to pay the higher deductible if you need to file a claim.

- Ask about discounts: Inquire about any discounts you may be eligible for, such as good driver, safe driver, multi-policy, or student discounts.

- Be polite and persistent: While negotiating, be respectful and persistent in your request for a lower rate.

Bundling Car Insurance with Other Types of Insurance

Bundling your car insurance with other types of insurance, such as homeowners or renters insurance, can save you money. Here are the benefits:

- Multi-policy discounts: As mentioned earlier, bundling policies often qualifies you for significant discounts. This is because insurance companies reward customers who consolidate their insurance needs with them.

- Convenience: Having all your insurance policies with one provider simplifies your insurance management. You have one point of contact for all your insurance needs, making it easier to track premiums, make payments, and file claims.

- Streamlined claims process: When you bundle your policies, the claims process can be smoother. Your insurer will handle all aspects of your claims, regardless of whether it’s for your car, home, or renters insurance.

Common Car Insurance Claims in Florida

Florida’s unique climate and high population density contribute to a variety of common car insurance claims. Understanding these claims can help drivers in the state better prepare for potential risks and navigate the claims process effectively.

Types of Car Insurance Claims in Florida

Florida drivers file claims for a range of reasons, with some being more frequent than others. Here’s a breakdown of the most common types of car insurance claims in Florida:

- Collision: This type of claim covers damage to your vehicle when it collides with another vehicle, object, or even a stationary object. Collision claims are particularly common in Florida due to the high volume of traffic and potential for accidents caused by inclement weather.

- Comprehensive: This coverage protects against damage to your vehicle caused by events other than collisions, such as theft, vandalism, natural disasters, and animal strikes. In Florida, comprehensive claims are often filed due to hurricane damage, flooding, and theft.

- Property Damage Liability: This coverage protects you financially if you are at fault in an accident that damages another person’s property, such as their vehicle or belongings. Property damage liability claims are common in Florida due to the high volume of traffic and potential for accidents.

- Bodily Injury Liability: This coverage protects you financially if you are at fault in an accident that injures another person. Bodily injury liability claims are common in Florida due to the high volume of traffic and potential for accidents.

- Personal Injury Protection (PIP): Florida is a no-fault insurance state, meaning that your own insurance company will cover your medical expenses and lost wages after an accident, regardless of who was at fault. PIP claims are very common in Florida, as drivers are required to carry at least $10,000 in PIP coverage.

The Car Insurance Claims Process in Florida

The claims process in Florida typically involves the following steps:

- Report the Accident: Contact your insurance company as soon as possible after an accident. You should provide them with details of the accident, including the date, time, location, and any injuries.

- Gather Documentation: Collect any relevant documentation, such as police reports, witness statements, and photographs of the damage.

- Submit the Claim: File your claim with your insurance company, providing them with all necessary documentation.

- Negotiate a Settlement: Your insurance company will assess the damage and negotiate a settlement amount. You may need to provide additional information or documentation during this process.

- Receive Payment: Once the settlement is agreed upon, your insurance company will issue payment for the covered damages.

Natural Disasters and Car Insurance Claims in Florida

Florida is known for its susceptibility to hurricanes and other natural disasters, which can significantly impact car insurance claims. Hurricanes can cause widespread damage to vehicles, leading to a surge in claims. The claims process may be delayed due to the high volume of claims and the need for extensive repairs.

Avoiding Car Insurance Scams and Fraud in Florida, Average cost of car insurance florida

Car insurance scams and fraud are unfortunately prevalent in Florida. Here are some tips to avoid falling victim to these schemes:

- Be Wary of Unsolicited Offers: Be cautious of unsolicited offers for car insurance or discounts, as they may be scams.

- Verify the Identity of Claims Adjusters: Always verify the identity of any claims adjusters who contact you, especially if they come to your home. Ask for identification and contact your insurance company to confirm their legitimacy.

- Report Suspicious Activity: If you suspect fraud or a scam, report it to your insurance company and the Florida Department of Financial Services.

Final Review

Navigating the complexities of car insurance in Florida can be daunting, but with the right knowledge and resources, you can make informed choices to protect yourself financially while staying within budget. By understanding the factors that influence insurance costs, exploring available discounts, and comparing quotes from different providers, you can secure the best possible coverage at a price that fits your needs. Remember to review your policy regularly and stay informed about any changes in the Florida insurance market to ensure you have the right coverage for your situation.

Essential FAQs

What are some common discounts offered by car insurance companies in Florida?

Common discounts in Florida include good driver, safe driver, multi-policy, and bundling discounts.

How can I get the best car insurance rate in Florida?

Compare quotes from multiple providers, consider discounts, and negotiate with insurance companies.

What are the most frequent types of car insurance claims filed in Florida?

Collision, theft, and property damage are among the most common claims.

How does Florida’s no-fault insurance system work?

Florida’s no-fault system requires drivers to file claims with their own insurer, regardless of fault, for personal injury protection (PIP) coverage.