Average cost of car insurance in Canada is a significant expense for most drivers, and understanding the factors that influence these costs is crucial. From age and driving history to vehicle type and coverage options, numerous elements contribute to the final price tag. This comprehensive guide explores the average cost of car insurance across different provinces, provides insights into obtaining quotes, and offers practical tips for reducing premiums.

Navigating the world of car insurance can be overwhelming, with a wide range of factors influencing the final cost. Understanding the key variables, from individual driving habits to provincial regulations, empowers consumers to make informed decisions and find the best coverage at the most affordable price. This guide aims to demystify the process, providing valuable information and resources to help Canadians secure the right insurance for their needs.

Factors Influencing Car Insurance Costs in Canada: Average Cost Of Car Insurance In Canada

Car insurance premiums in Canada are influenced by a variety of factors, some of which are within your control and others that are not. Understanding these factors can help you make informed decisions to potentially lower your insurance costs.

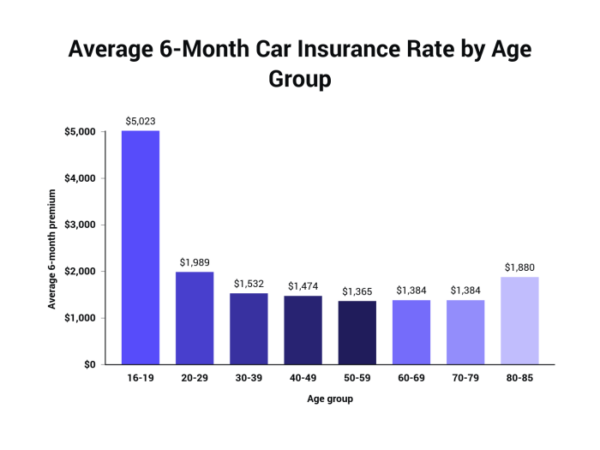

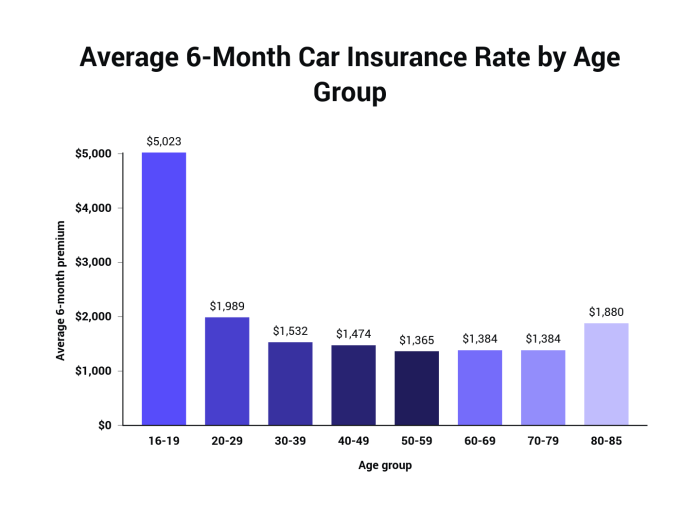

Age

Your age is a significant factor in determining your car insurance premiums. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. Insurance companies view them as higher risk, resulting in higher premiums. As you gain experience and reach your mid-20s, your premiums typically decrease. However, drivers over 65 may see a slight increase in premiums due to potential health concerns that could affect their driving abilities.

Driving History

Your driving history plays a crucial role in determining your car insurance rates. A clean driving record with no accidents or traffic violations will lead to lower premiums. However, any accidents, speeding tickets, or DUI convictions will increase your premiums. The severity and frequency of these incidents will directly impact your insurance costs. For example, a minor fender bender might result in a small premium increase, while a DUI conviction could lead to a significant jump in rates.

Location

Where you live significantly influences your car insurance premiums. Cities with higher population densities and traffic volumes tend to have higher insurance rates due to a greater risk of accidents. Areas with higher crime rates or a history of vehicle theft also see higher premiums. Conversely, rural areas with lower traffic volumes and crime rates often have lower insurance costs.

Vehicle Type, Model, and Safety Features

The type, model, and safety features of your vehicle can significantly impact your car insurance premiums. Sports cars and high-performance vehicles are generally considered higher risk due to their potential for speed and accidents. Luxury cars often have higher repair costs, leading to higher premiums. Conversely, vehicles with safety features like anti-lock brakes, airbags, and stability control are often rewarded with lower premiums as they are deemed safer and less likely to be involved in accidents.

Driving Habits

Your driving habits, such as the number of miles you drive annually and your driving record, can also influence your car insurance premiums. Drivers who commute long distances or frequently drive in high-traffic areas may see higher premiums due to an increased risk of accidents. A safe driving record with no accidents or violations can help lower your premiums.

Insurance Coverage

The type and amount of insurance coverage you choose also impact your car insurance costs. Comprehensive and collision coverage, which protect you against damage to your vehicle from various incidents, are typically more expensive than liability coverage, which protects you against financial losses resulting from accidents you cause. However, having higher coverage limits generally leads to higher premiums.

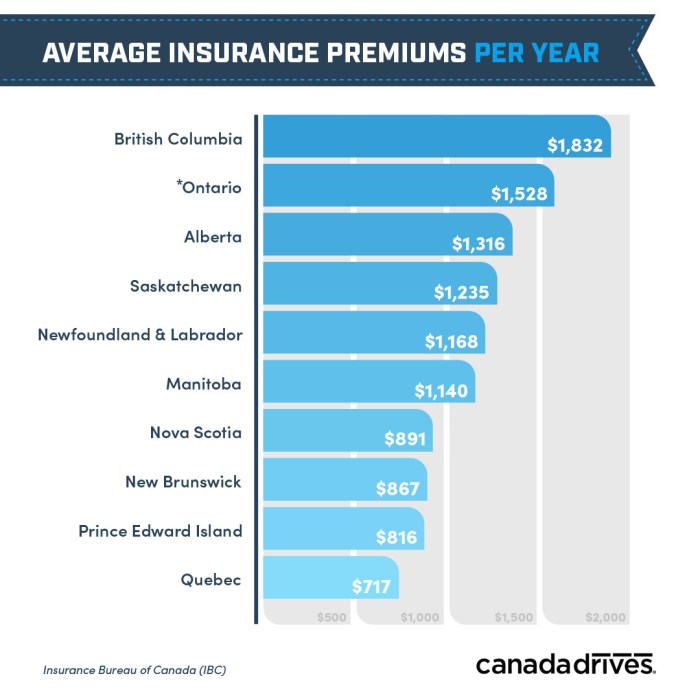

Average Car Insurance Costs by Province

Car insurance costs can vary significantly across Canada, depending on a range of factors. Understanding these variations can help you compare insurance rates and find the best deal for your needs. This section will provide an overview of average car insurance costs in each Canadian province, highlighting key factors contributing to these differences.

Average Car Insurance Costs by Province

The table below presents average annual car insurance costs for basic and comprehensive coverage in each Canadian province.

| Province | Average Basic Coverage Cost | Average Comprehensive Coverage Cost |

|---|---|---|

| Alberta | $1,200 | $1,800 |

| British Columbia | $1,500 | $2,200 |

| Manitoba | $1,000 | $1,600 |

| New Brunswick | $1,100 | $1,700 |

| Newfoundland and Labrador | $1,300 | $1,900 |

| Nova Scotia | $1,200 | $1,800 |

| Ontario | $1,400 | $2,000 |

| Prince Edward Island | $1,000 | $1,600 |

| Quebec | $1,300 | $1,900 |

| Saskatchewan | $1,100 | $1,700 |

| Yukon | $1,600 | $2,300 |

| Northwest Territories | $1,700 | $2,400 |

| Nunavut | $1,800 | $2,500 |

It is important to note that these figures are averages and actual costs can vary based on individual factors such as driving history, vehicle type, and location within the province.

Factors Contributing to Provincial Variations in Car Insurance Costs

Car insurance costs vary across provinces due to a combination of factors, including:

* Traffic Density and Accident Rates: Provinces with higher traffic density and accident rates tend to have higher insurance premiums. This is because insurance companies need to cover more claims in these areas.

* Cost of Living: Provinces with higher costs of living, such as British Columbia and Ontario, often have higher insurance premiums due to increased repair costs and medical expenses.

* Insurance Regulations: Provincial regulations can impact insurance rates. For example, some provinces have stricter requirements for coverage, which can increase premiums.

* Competition in the Insurance Market: The level of competition in the insurance market can also affect prices. Provinces with a more competitive market may have lower premiums.

* Fraudulent Claims: Provinces with higher rates of fraudulent claims can see higher premiums as insurance companies need to account for these costs.

Understanding Car Insurance Quotes

Obtaining car insurance quotes from different providers is a crucial step in finding the best coverage at an affordable price. Understanding the process and factors that influence the price of a quote will empower you to make informed decisions.

Factors Influencing Car Insurance Quote Prices

The price of your car insurance quote is determined by a variety of factors. These factors are assessed by insurance companies to evaluate your risk profile, ultimately determining your premium.

- Driving History: Your driving record is a primary factor. Accidents, traffic violations, and even driving experience play a significant role in determining your risk level. A clean driving record generally results in lower premiums.

- Vehicle Information: The make, model, year, and safety features of your vehicle are crucial. Newer vehicles with advanced safety features often come with lower insurance premiums due to their inherent safety and lower risk of accidents.

- Location: Where you live significantly impacts your insurance costs. Areas with higher crime rates, traffic congestion, and accident frequency generally have higher insurance premiums.

- Coverage: The type and amount of coverage you choose will directly influence your premium. Comprehensive and collision coverage offer more protection but come at a higher cost.

- Deductible: Your deductible is the amount you pay out of pocket in case of an accident before your insurance kicks in. A higher deductible usually translates to lower premiums.

- Age and Gender: Statistically, younger and inexperienced drivers are considered higher risk. Similarly, gender can also play a role, with some insurers offering discounts to female drivers.

- Credit Score: In some provinces, your credit score can impact your insurance premiums. This is because a good credit score is often associated with responsible financial behavior.

Comparing Quotes from Multiple Insurers

Comparing quotes from multiple insurers is essential to ensure you’re getting the best possible deal. Each insurer uses different algorithms and factors to calculate premiums, leading to varying quotes.

- Online Comparison Websites: Several websites allow you to compare quotes from multiple insurers simultaneously. This saves you time and effort in contacting each insurer individually.

- Directly Contact Insurers: You can also contact insurers directly to obtain quotes. This allows you to discuss your specific needs and ask questions about their policies.

Tips for Negotiating Lower Car Insurance Premiums

While you can’t control all factors affecting your premium, you can take steps to negotiate lower premiums.

- Bundle Your Policies: Combining your car insurance with home, renters, or other insurance policies can often result in discounts.

- Ask for Discounts: Many insurers offer discounts for safe driving, good student records, and other factors. Be sure to inquire about these discounts.

- Increase Your Deductible: Raising your deductible can lead to lower premiums. However, make sure you can afford to pay the deductible if you need to file a claim.

- Shop Around Regularly: Insurance rates can fluctuate over time. It’s a good idea to compare quotes annually to ensure you’re still getting the best deal.

- Consider Telematics Programs: Some insurers offer telematics programs that track your driving habits. If you’re a safe driver, you may qualify for discounts based on your driving data.

Tips for Reducing Car Insurance Costs

Lowering your car insurance premiums can significantly impact your budget. By understanding the factors that influence your insurance costs and implementing smart strategies, you can save money without compromising your coverage.

Maintaining a Clean Driving Record

A clean driving record is crucial for securing lower car insurance premiums. Insurance companies view drivers with a history of accidents or traffic violations as higher risk, leading to increased premiums.

- By driving safely and adhering to traffic regulations, you can minimize the risk of accidents and maintain a clean driving record.

- This includes avoiding speeding, distracted driving, and driving under the influence of alcohol or drugs.

- If you have a history of accidents or violations, consider taking defensive driving courses to improve your driving skills and potentially lower your premiums.

Discounts for Safe Driving

Many insurance companies offer discounts for safe driving practices.

- These discounts can be substantial and can significantly reduce your premiums.

- Some common discounts include:

- Good Student Discount: This discount is typically offered to students who maintain a certain GPA or academic standing.

- Safe Driver Discount: This discount is awarded to drivers who have a clean driving record for a specific period.

- Defensive Driving Course Discount: Completing a defensive driving course can demonstrate your commitment to safe driving and potentially earn you a discount.

Anti-theft Devices

Installing anti-theft devices in your vehicle can make it less attractive to thieves and lower your insurance premiums.

- These devices can include alarms, immobilizers, GPS trackers, and other security features.

- By reducing the risk of theft, you can potentially qualify for a discount on your car insurance.

Increasing Deductibles

Your deductible is the amount you pay out of pocket in case of an accident before your insurance coverage kicks in.

- Increasing your deductible can lower your monthly premiums, as you are essentially taking on more financial responsibility.

- However, it’s important to consider your financial situation and ensure you can afford the higher deductible if you need to file a claim.

- For example, if you increase your deductible from $500 to $1000, you might see a 10-15% reduction in your monthly premiums.

Resources for Finding Affordable Car Insurance

Finding the most affordable car insurance policy in Canada can be a challenging task, especially with the numerous insurance providers and varying coverage options available. However, utilizing various resources can simplify your search and help you find the best deal for your needs.

Online Car Insurance Comparison Websites

Online car insurance comparison websites are valuable tools that allow you to quickly compare quotes from multiple insurance providers in one place. These platforms streamline the process, saving you time and effort.

- Ratehub.ca: Ratehub.ca is a popular comparison website that offers quotes from various insurance providers, including major and regional companies.

- InsuranceHotline.com: InsuranceHotline.com provides a comprehensive platform for comparing car insurance quotes from numerous insurers.

- Kanetix.ca: Kanetix.ca is another reputable comparison website that allows you to get quotes from a wide range of insurance providers.

Major Car Insurance Providers in Canada, Average cost of car insurance in canada

It is essential to be aware of the major car insurance providers in Canada, as they often offer competitive rates and various coverage options.

- Intact Insurance: Intact Insurance is one of the largest insurance providers in Canada, offering a wide range of insurance products, including car insurance.

- Desjardins Insurance: Desjardins Insurance is a major insurance provider in Quebec and offers various insurance products, including car insurance.

- TD Insurance: TD Insurance is a subsidiary of TD Bank and offers car insurance, home insurance, and other insurance products.

- RSA Insurance: RSA Insurance is a global insurance company with a significant presence in Canada, offering various insurance products, including car insurance.

- Belairdirect: Belairdirect is a direct insurance provider that offers car insurance and other insurance products online and over the phone.

Government Resources for Car Insurance

While the government does not directly provide car insurance, it offers resources and information that can assist individuals in understanding their insurance options.

- Financial Consumer Agency of Canada (FCAC): The FCAC provides information and resources to help consumers understand their insurance rights and responsibilities.

- Provincial and Territorial Insurance Bureaus: Each province and territory has an insurance bureau that regulates the insurance industry within its jurisdiction. These bureaus provide information on insurance requirements and consumer protection.

Types of Car Insurance Providers

Understanding the different types of car insurance providers can help you choose the provider that best suits your needs.

- Traditional Insurance Companies: These companies offer a wide range of insurance products and typically have a strong brand reputation and extensive agent networks. They often provide personalized service and have established claims processes. However, their premiums may be higher compared to other types of providers.

- Direct Insurance Companies: These companies sell insurance directly to consumers, eliminating the need for agents. They often offer lower premiums due to reduced overhead costs but may have limited customer service options.

- Brokerage Firms: Brokerage firms act as intermediaries between consumers and insurance companies. They can help you compare quotes from multiple providers and find the best deal for your needs. However, they may charge a fee for their services.

Final Wrap-Up

Ultimately, finding affordable car insurance in Canada requires a combination of research, comparison, and proactive steps to minimize risk. By understanding the factors that influence premiums, obtaining multiple quotes, and implementing strategies to reduce costs, drivers can navigate the insurance landscape with confidence and secure the best value for their money. This guide provides a solid foundation for making informed decisions, empowering Canadians to take control of their car insurance expenses.

Quick FAQs

What is the average cost of car insurance in Canada?

The average cost of car insurance in Canada varies significantly depending on factors like province, age, driving history, and vehicle type. It’s best to get quotes from multiple insurers to find the best rates for your situation.

How often should I review my car insurance rates?

It’s a good idea to review your car insurance rates annually, or even more frequently if you experience significant life changes like a change in driving habits, vehicle ownership, or your driving record.

What are some common car insurance discounts?

Common car insurance discounts include safe driving courses, anti-theft devices, multi-car policies, and good student discounts. Check with your insurer to see what discounts you qualify for.