- Factors Influencing Car Insurance Costs in Florida

- Average Car Insurance Costs in Florida by City

- Types of Car Insurance Coverage in Florida

- Tips for Lowering Car Insurance Costs in Florida: Average Cost Of Car Insurance In Florida

- Finding the Best Car Insurance Rates in Florida

- Conclusive Thoughts

- FAQ Section

Average cost of car insurance in Florida can vary significantly depending on factors like your driving record, vehicle type, and location. Florida’s unique climate and high population density contribute to higher insurance rates compared to other states. Understanding the factors that influence insurance costs and exploring strategies to lower your premiums can save you money in the long run.

This guide delves into the average cost of car insurance in Florida, exploring key factors that impact premiums, providing city-specific cost breakdowns, and offering practical tips to save money. We’ll also cover the different types of coverage available, helping you make informed decisions about your insurance needs.

Factors Influencing Car Insurance Costs in Florida

Florida’s unique demographics, climate, and driving conditions significantly impact car insurance rates. Understanding these factors is crucial for drivers to make informed decisions about their insurance coverage.

Florida’s Demographics and Climate

Florida’s large population, particularly of retirees and tourists, contributes to a higher density of vehicles on the road. This increased traffic density raises the risk of accidents, leading to higher insurance premiums. Additionally, Florida’s warm and humid climate can exacerbate road conditions, increasing the likelihood of accidents due to factors like hydroplaning and tire blowouts.

Traffic Congestion and Accident Rates, Average cost of car insurance in florida

Florida’s major metropolitan areas, like Miami, Orlando, and Tampa, experience significant traffic congestion, which contributes to increased accident rates. This is due to the higher volume of vehicles on the road, leading to more opportunities for collisions. As a result, insurance companies consider traffic congestion and accident rates in their risk assessments, ultimately impacting premiums.

Driving Records

Driving records play a significant role in determining car insurance premiums. Insurance companies analyze a driver’s history of accidents, traffic violations, and driving-related offenses to assess their risk.

- Accidents: Drivers involved in accidents, regardless of fault, are generally considered higher risk and may face higher premiums. The severity of the accident and the number of claims filed can also influence the increase in premiums.

- Traffic Violations: Violations like speeding tickets, running red lights, or driving under the influence significantly increase insurance premiums. Insurance companies view these violations as indicators of risky driving behavior.

- Driving-Related Offenses: More serious offenses, such as DUI or reckless driving, can result in significantly higher premiums or even denial of coverage. Insurance companies consider these offenses as major risk factors.

Car Theft Rates and Cost of Repairs

Florida’s car theft rates are relatively high compared to other states. This factor contributes to higher insurance premiums as insurers must factor in the risk of vehicle theft and the potential costs of replacing or repairing stolen vehicles. Additionally, the high cost of repairs in Florida, driven by factors like labor costs and parts availability, can also influence premiums.

Vehicle Type and Value

Insurance companies assess risk based on the type and value of the vehicle.

- Vehicle Type: Sports cars, luxury vehicles, and high-performance vehicles are generally considered higher risk due to their potential for higher speeds and more severe accidents. As a result, they may have higher insurance premiums.

- Vehicle Value: The value of a vehicle is a significant factor in determining insurance premiums. More expensive vehicles require higher coverage amounts, leading to higher premiums. Insurance companies consider the cost of replacement or repair in case of an accident or theft.

Average Car Insurance Costs in Florida by City

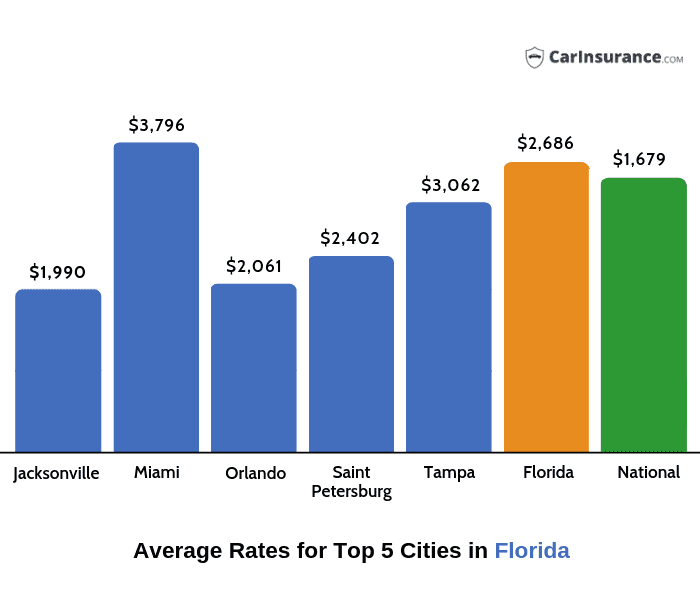

Car insurance premiums can vary significantly across different cities in Florida, influenced by factors like traffic density, crime rates, and the prevalence of accidents. Understanding these variations can help you find the best rates for your specific location.

Average Car Insurance Costs in Major Florida Cities

The following table displays average annual car insurance premiums for minimum coverage and full coverage in major Florida cities. These figures are based on data from various insurance comparison websites and industry reports, providing a general overview of costs.

| City | Average Annual Premium | Minimum Coverage Cost | Average Cost for Full Coverage |

|---|---|---|---|

| Miami | $2,500 | $1,200 | $3,800 |

| Orlando | $2,200 | $1,000 | $3,400 |

| Tampa | $2,000 | $900 | $3,100 |

| Jacksonville | $1,800 | $800 | $2,800 |

Note: These figures are averages and may vary based on individual factors such as driving history, vehicle type, and chosen insurance provider.

Types of Car Insurance Coverage in Florida

Florida law requires all drivers to carry certain types of car insurance coverage to protect themselves and others on the road. Understanding the different types of coverage available is crucial for making informed decisions about your car insurance policy.

Types of Car Insurance Coverage

Car insurance policies in Florida typically include a variety of coverage options. These coverages provide financial protection in the event of an accident or other incidents involving your vehicle. Here is a breakdown of the common types of car insurance coverage:

| Coverage Type | Description | Purpose |

|---|---|---|

| Liability Coverage | Liability coverage protects you financially if you are at fault in an accident that causes damage to another person’s property or injuries to another person. | Covers the costs of repairs to the other driver’s vehicle, medical bills, and other expenses related to the accident. |

| Collision Coverage | Collision coverage covers the cost of repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. | Protects you from the financial burden of repairing or replacing your vehicle after an accident. |

| Comprehensive Coverage | Comprehensive coverage protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, natural disasters, or falling objects. | Provides financial protection against damage to your vehicle from events that are not covered by collision coverage. |

| Uninsured/Underinsured Motorist Coverage | Uninsured/underinsured motorist coverage protects you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your damages. | Provides financial protection for your medical bills, lost wages, and other expenses if you are injured in an accident caused by an uninsured or underinsured driver. |

| Personal Injury Protection (PIP) | Personal Injury Protection (PIP) coverage covers your own medical expenses, lost wages, and other expenses related to injuries sustained in an accident, regardless of who is at fault. | Provides financial protection for your own medical expenses and lost wages, even if you are at fault in the accident. |

| Medical Payments Coverage | Medical payments coverage provides coverage for medical expenses for you and your passengers, regardless of who is at fault in an accident. | Offers financial protection for medical expenses incurred by you and your passengers, even if you are not at fault in the accident. |

Minimum Coverage Requirements in Florida

Florida law mandates that all drivers carry a minimum amount of liability coverage. These minimum requirements are designed to ensure that drivers have adequate financial protection to cover the costs of accidents they may cause.

Florida’s minimum car insurance requirements are:

* Bodily Injury Liability: $10,000 per person / $20,000 per accident

* Property Damage Liability: $10,000 per accident

* Personal Injury Protection (PIP): $10,000 per person

* Uninsured Motorist Coverage: $10,000 per person / $20,000 per accident

It is important to note that while these are the minimum requirements, they may not be enough to cover all of your potential financial liabilities in the event of an accident. It is generally advisable to carry higher coverage limits to ensure adequate protection.

Tips for Lowering Car Insurance Costs in Florida: Average Cost Of Car Insurance In Florida

Florida has a reputation for high car insurance costs, but there are several strategies you can implement to reduce your premiums. By taking proactive steps to improve your driving habits, manage your coverage, and leverage available discounts, you can significantly lower your insurance expenses.

Improve Your Driving Habits

Your driving record is a major factor in determining your car insurance rates. By maintaining a safe driving history, you can significantly reduce your premiums. Here are some tips for improving your driving habits:

- Avoid Traffic Violations: Every speeding ticket, reckless driving citation, or DUI conviction will increase your insurance rates. Drive cautiously and obey traffic laws to maintain a clean driving record.

- Take Defensive Driving Courses: Completing a defensive driving course can demonstrate to insurers that you are committed to safe driving practices. Many insurance companies offer discounts for completing these courses. Check with your insurer to see if they offer this benefit.

- Maintain a Safe Driving Record: Avoid accidents, as they can dramatically increase your insurance premiums. Drive defensively and be aware of your surroundings to minimize the risk of accidents.

Manage Your Coverage

Adjusting your coverage levels and deductibles can significantly impact your insurance costs. Consider the following:

- Increase Your Deductible: A higher deductible means you’ll pay more out of pocket in the event of an accident, but you’ll receive lower premiums. Choose a deductible you can comfortably afford, but don’t go too high.

- Review Your Coverage: Ensure you have adequate coverage for your needs, but avoid unnecessary coverage that adds to your premium. For example, if you have an older car, you may not need collision or comprehensive coverage.

- Consider Dropping Unnecessary Coverage: Evaluate your coverage and determine if you can safely drop any unnecessary coverage. For instance, if you have a car loan, you may be required to have collision and comprehensive coverage, but if you own your car outright, you might be able to drop those coverages and save money.

Leverage Discounts

Insurance companies offer various discounts to help policyholders save money. Take advantage of these discounts to reduce your premiums:

- Safe Driver Discounts: Maintaining a clean driving record can qualify you for significant discounts. Be a safe driver to ensure you qualify for these discounts.

- Multi-Car Discounts: If you insure multiple vehicles with the same company, you can often receive a discount on your premiums. Bundle your policies to take advantage of this savings opportunity.

- Good Student Discounts: Students with good grades may be eligible for discounts on their car insurance. Check with your insurer to see if they offer this discount.

- Anti-theft Device Discounts: Installing anti-theft devices in your car can make it less appealing to thieves, and insurers often reward policyholders with discounts for having these devices.

- Pay in Full Discounts: Paying your car insurance premium in full upfront can sometimes result in a discount. Check with your insurer to see if they offer this option.

Maintain a Good Credit Score

While it may seem counterintuitive, your credit score can influence your car insurance premiums. Insurance companies use your credit history to assess your risk. A good credit score can help you secure lower insurance rates.

- Check Your Credit Score: Regularly monitor your credit score and take steps to improve it if necessary. You can access your credit score for free from various websites.

- Pay Your Bills on Time: Late payments can negatively impact your credit score. Make sure you pay all your bills on time to maintain a good credit history.

- Limit New Credit Applications: Each time you apply for new credit, a hard inquiry is made on your credit report, which can slightly lower your score. Limit the number of new credit applications you submit.

Finding the Best Car Insurance Rates in Florida

Finding the best car insurance rates in Florida involves comparing quotes from different insurance companies and understanding the factors that influence those rates. This process can be overwhelming, but with the right approach, you can find affordable coverage that meets your needs.

Comparing Car Insurance Companies in Florida

Understanding the services offered by major car insurance companies in Florida can help you make an informed decision. Each company has its own strengths and weaknesses, and it’s crucial to compare them based on your specific requirements.

- State Farm: Known for its extensive network of agents and comprehensive coverage options, State Farm offers a wide range of discounts, including good driver, safe driver, and multi-policy discounts.

- Geico: A popular choice for its competitive rates and user-friendly online platform, Geico offers a variety of discounts, including multi-car, good student, and defensive driving discounts.

- Progressive: Renowned for its innovative features, such as its “Name Your Price” tool, Progressive provides flexible coverage options and discounts, including multi-policy, safe driver, and good student discounts.

- Allstate: Allstate offers a range of discounts, including multi-policy, good driver, and safe driver discounts. It’s known for its strong customer service and claims handling processes.

- USAA: Exclusive to military personnel and their families, USAA is known for its excellent customer service, competitive rates, and a wide range of discounts, including good driver, safe driver, and multi-policy discounts.

Factors to Consider When Choosing an Insurance Provider

When selecting an insurance provider, it’s essential to consider factors beyond just the price. Factors like coverage options, customer service, and claims handling can significantly impact your overall experience.

- Coverage Options: Different insurance companies offer various coverage options, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage. It’s crucial to choose a provider that offers the coverage you need at a price you can afford.

- Customer Service: Having access to responsive and helpful customer service is crucial, especially during a claim. Look for companies with positive customer reviews and a track record of providing excellent support.

- Claims Handling: A smooth and efficient claims process is essential. Research companies known for their quick and fair claim handling procedures, as this can save you time and stress in case of an accident.

Obtaining Car Insurance Quotes

Getting quotes from multiple providers is essential for finding the best car insurance rates. Several online tools and resources can help you compare quotes from different companies.

- Online Comparison Websites: Websites like Policygenius, The Zebra, and Insurance.com allow you to compare quotes from various insurers in one place. This simplifies the process and helps you find the most competitive rates.

- Directly Contact Insurance Companies: Contact insurance companies directly to request quotes. This allows you to discuss your specific needs and get personalized recommendations.

- Use Your Existing Insurance Agent: If you have an existing insurance agent, ask them to provide quotes from different companies. They can help you compare options and find the best coverage for your needs.

Conclusive Thoughts

By understanding the factors that influence car insurance costs in Florida and implementing smart strategies, you can find the best insurance coverage at a price that fits your budget. Remember, comparing quotes from multiple insurers, maintaining a good driving record, and taking advantage of discounts can significantly reduce your premiums. Armed with this knowledge, you can confidently navigate the world of Florida car insurance and find the best deal for your specific needs.

FAQ Section

How often do car insurance rates change in Florida?

Car insurance rates can fluctuate in Florida based on various factors like changes in risk assessments, legislative updates, and market conditions. It’s generally recommended to review your insurance policy and rates annually to ensure you’re getting the best value.

Are there any specific car insurance requirements for drivers in Florida?

Yes, Florida law requires all drivers to carry a minimum level of liability insurance coverage. This includes bodily injury liability, property damage liability, and personal injury protection (PIP).

What are some common discounts offered by car insurance companies in Florida?

Many insurance companies offer discounts in Florida for factors like safe driving, good credit, multi-car policies, and anti-theft devices. It’s worth inquiring about available discounts when getting quotes.

How can I file a car insurance claim in Florida?

Most insurance companies provide online claim filing options, phone support, or mobile app functionality. You’ll typically need to provide details about the accident, including the date, time, location, and involved parties.