- Factors Influencing Full Coverage Car Insurance Costs in Florida

- Average Full Coverage Car Insurance Costs in Florida: Average Cost Of Full Coverage Car Insurance In Florida

- Tips for Saving on Full Coverage Car Insurance in Florida

- Common Car Insurance Claims in Florida

- End of Discussion

- FAQ Overview

Average cost of full coverage car insurance in Florida can vary greatly depending on a number of factors, including your age, driving history, credit score, the type of car you drive, and where you live. Understanding these factors and how they impact your insurance premiums can help you make informed decisions about your coverage and potentially save money.

This guide will delve into the key factors that influence full coverage car insurance costs in Florida, provide insights into average premiums across different cities, car types, and insurance providers, and offer valuable tips for saving on your insurance. We’ll also explore common car insurance claims in Florida and discuss the importance of understanding coverage limits and policy terms.

Factors Influencing Full Coverage Car Insurance Costs in Florida

The cost of full coverage car insurance in Florida is influenced by a multitude of factors. Understanding these factors can empower individuals to make informed decisions about their insurance coverage and potentially reduce their premiums.

Demographics

Demographic factors play a significant role in determining insurance premiums. These factors are often associated with risk assessments, as insurance companies consider them to be reliable indicators of potential claims.

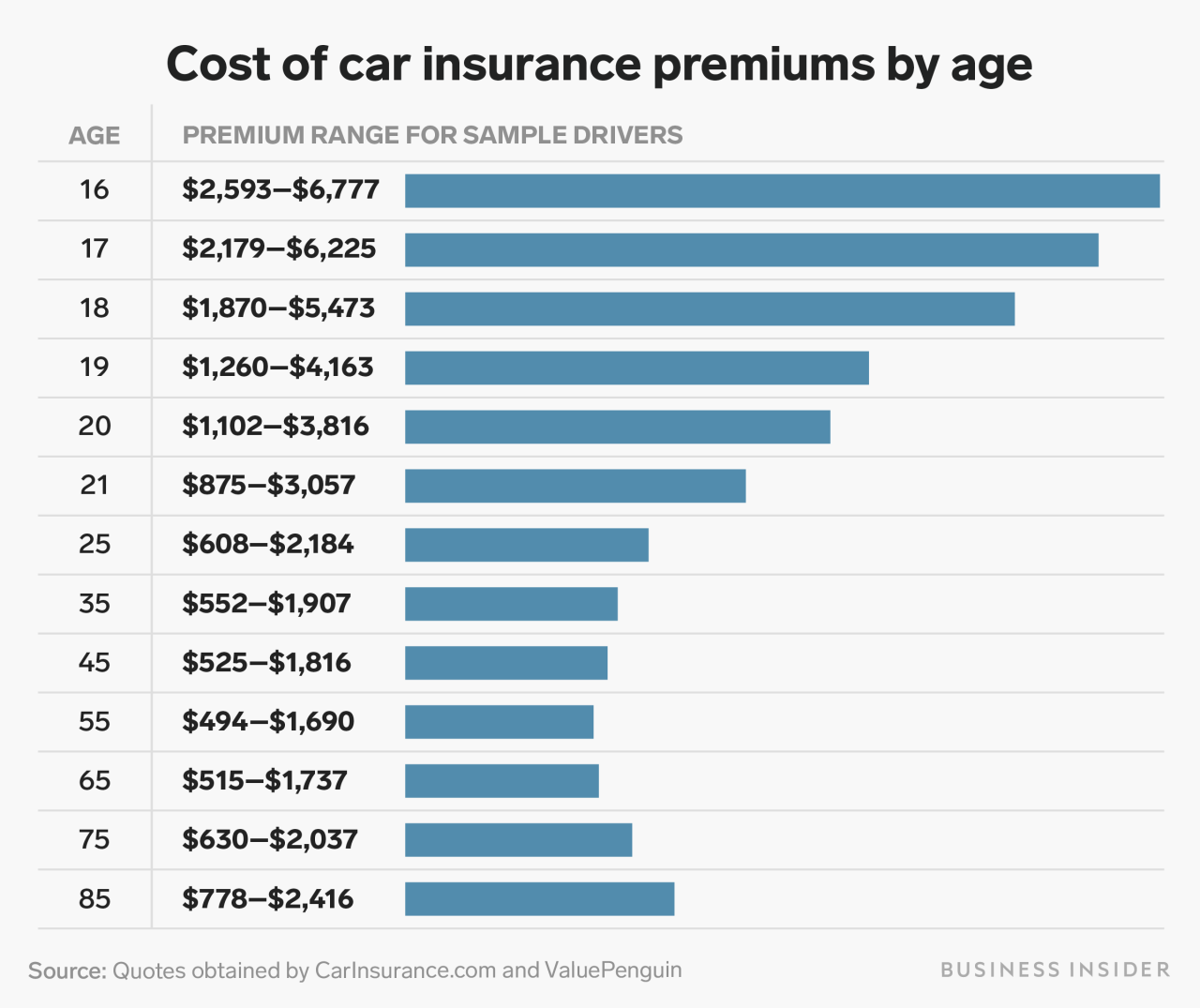

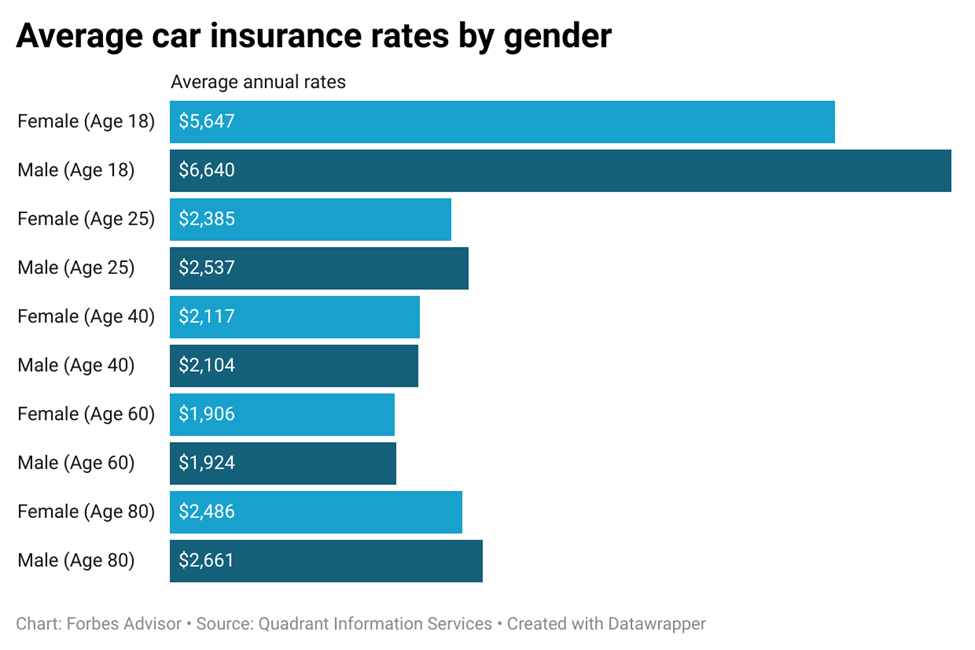

- Age: Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. This higher risk is reflected in their insurance premiums, which are typically higher than those for older drivers. As drivers gain experience and age, their premiums generally decrease.

- Driving History: A clean driving record is crucial for securing lower insurance premiums. Drivers with a history of accidents, traffic violations, or DUI convictions are considered higher risk and will likely face higher premiums. Conversely, drivers with no accidents or violations enjoy lower premiums.

- Credit Score: While it may seem counterintuitive, credit scores are often used by insurance companies to assess risk. Individuals with good credit scores are generally considered more responsible and financially stable, which translates to lower insurance premiums. Poor credit scores, on the other hand, can result in higher premiums.

Vehicle Characteristics

The type of vehicle you drive also influences your insurance premiums. Insurance companies consider several vehicle characteristics to assess the potential for accidents and repair costs.

- Make and Model: Certain car makes and models are known for their safety features, reliability, and overall performance. Vehicles with a history of frequent accidents or high repair costs may result in higher insurance premiums.

- Year: Newer vehicles typically have advanced safety features and are less prone to mechanical issues, which can lead to lower insurance premiums. Older vehicles, however, may have higher premiums due to their age and potential for breakdowns or safety concerns.

- Safety Features: Vehicles equipped with safety features such as anti-lock brakes, airbags, and electronic stability control are generally considered safer and may result in lower insurance premiums. Insurance companies often offer discounts for vehicles with these features.

Location and Driving Environment

Your location and the surrounding driving environment can significantly impact your insurance premiums. Insurance companies consider the risk of accidents and claims based on these factors.

- Urban vs. Rural: Urban areas with high population density, heavy traffic, and limited parking spaces often have higher accident rates. As a result, insurance premiums in urban areas tend to be higher than those in rural areas with lower population density and less congested roads.

- Traffic Congestion: Areas with high traffic congestion increase the likelihood of accidents. Insurance companies may consider traffic congestion levels when calculating premiums, as higher congestion levels often translate to higher premiums.

Insurance Company Policies and Coverage Options

The insurance company you choose and the coverage options you select can also influence your premiums. Insurance companies have different pricing structures, discounts, and coverage options, which can significantly impact the overall cost of your insurance.

- Company Policies: Each insurance company has its own underwriting criteria, pricing models, and risk assessments. These factors can lead to variations in premiums even for similar drivers and vehicles. Comparing quotes from multiple insurance companies is crucial to find the best rates.

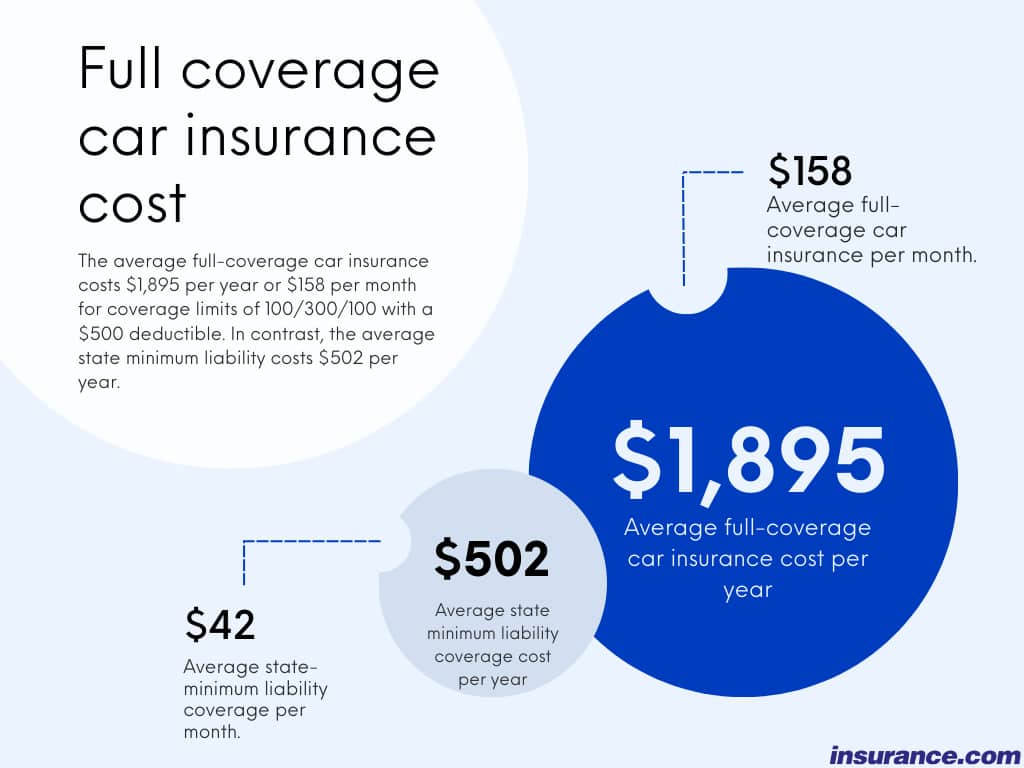

- Coverage Options: The level of coverage you choose, such as comprehensive, collision, and liability, will directly impact your premium. Higher coverage levels, which provide greater protection in case of an accident, generally result in higher premiums. Conversely, lower coverage levels will result in lower premiums.

- Discounts: Insurance companies often offer discounts for various factors, such as good driving history, safety features, multiple vehicles insured, and bundling insurance policies. Taking advantage of these discounts can significantly reduce your premiums.

Average Full Coverage Car Insurance Costs in Florida: Average Cost Of Full Coverage Car Insurance In Florida

The cost of full coverage car insurance in Florida can vary significantly depending on a number of factors, including your location, driving history, vehicle type, and insurance provider. This section provides a detailed breakdown of average full coverage car insurance costs in Florida, considering different aspects like location, vehicle type, and insurance providers.

Average Full Coverage Car Insurance Costs by Major Cities in Florida

The cost of full coverage car insurance can vary significantly depending on the city in Florida. Here are some average full coverage car insurance costs for major cities in Florida:

| City | Average Full Coverage Car Insurance Cost |

|—|—|

| Miami | $2,500 |

| Tampa | $2,000 |

| Orlando | $1,800 |

| Jacksonville | $1,600 |

| Fort Lauderdale | $2,200 |

These are just average costs, and your actual insurance premiums may be higher or lower depending on your individual circumstances.

Average Full Coverage Car Insurance Costs by Vehicle Type

The type of vehicle you drive can also significantly impact your full coverage car insurance costs. Here are some average full coverage car insurance costs for different vehicle types in Florida:

| Vehicle Type | Average Full Coverage Car Insurance Cost |

|—|—|

| Sedan | $1,800 |

| SUV | $2,200 |

| Truck | $2,500 |

Average Full Coverage Car Insurance Costs by Insurance Provider

The insurance provider you choose can also affect your full coverage car insurance costs. Here are some average full coverage car insurance costs for different insurance providers in Florida:

| Insurance Provider | Average Full Coverage Car Insurance Cost |

|—|—|

| State Farm | $1,700 |

| Geico | $1,600 |

| Progressive | $1,900 |

| Allstate | $2,000 |

| USAA | $1,500 |

These are just average costs, and your actual insurance premiums may be higher or lower depending on your individual circumstances.

Average Full Coverage Car Insurance Costs by Coverage Level

The level of coverage you choose can also affect your full coverage car insurance costs. Here are some average full coverage car insurance costs for different coverage levels in Florida:

| Coverage Level | Average Full Coverage Car Insurance Cost |

|—|—|

| Liability Only | $800 |

| Liability + Collision | $1,500 |

| Liability + Comprehensive | $1,600 |

| Full Coverage (Liability + Collision + Comprehensive) | $2,000 |

It’s important to note that these are just average costs and your actual insurance premiums may be higher or lower depending on your individual circumstances.

Tips for Saving on Full Coverage Car Insurance in Florida

Finding affordable full coverage car insurance in Florida can be a challenge, but there are several strategies you can employ to reduce your premiums. By taking proactive steps to improve your driving history, manage risk factors, and explore discounts, you can significantly lower your insurance costs.

Improving Driving History and Reducing Risk Factors

A clean driving record is essential for securing lower insurance rates. Maintaining a safe driving history can dramatically impact your premiums.

- Avoid Traffic Violations: Every traffic violation, from speeding tickets to parking violations, can increase your insurance premiums.

- Maintain a Safe Driving Record: A history of accidents, even minor ones, can significantly increase your insurance rates.

- Complete a Defensive Driving Course: Completing a defensive driving course can demonstrate your commitment to safe driving and may qualify you for discounts.

Bundling Insurance Policies

Combining your auto insurance with other insurance policies, such as homeowners or renters insurance, can lead to significant savings.

- Home and Auto Bundling: Insurers often offer discounts when you bundle your home and auto insurance policies.

- Other Insurance Bundles: Explore bundling options for other insurance policies, such as life insurance or health insurance, with your auto insurer.

Increasing Deductibles and Exploring Discounts

Increasing your deductible can lower your premium, but it also means you’ll pay more out of pocket if you need to file a claim.

- Higher Deductibles: A higher deductible means you’ll pay more out of pocket if you need to file a claim, but it can result in lower premiums.

- Discounts: Explore available discounts, such as good student discounts, safe driver discounts, and multi-car discounts.

Shopping for the Best Insurance Rates and Comparing Quotes, Average cost of full coverage car insurance in florida

Getting quotes from multiple insurers is crucial to finding the best rates.

- Online Comparison Tools: Use online comparison tools to quickly compare quotes from various insurers.

- Direct Contact with Insurers: Contact insurers directly to get personalized quotes and discuss your specific needs.

- Review Policy Details: Carefully review policy details, including coverage limits, deductibles, and discounts, before making a decision.

Common Car Insurance Claims in Florida

Florida, a state renowned for its sunny weather and bustling roads, also experiences a significant number of car accidents. Understanding common car insurance claims in Florida is crucial for both drivers and insurance companies. These claims provide insights into prevalent accident types, driving habits, and potential risks.

Most Frequent Types of Car Insurance Claims

The following table highlights the most common types of car insurance claims in Florida:

| Claim Type | Description | Frequency |

|---|---|---|

| Collision | Damage to your vehicle resulting from a collision with another vehicle or object. | High |

| Comprehensive | Damage to your vehicle caused by events other than collisions, such as theft, vandalism, or natural disasters. | Moderate |

| Personal Injury Protection (PIP) | Covers medical expenses and lost wages for you and your passengers, regardless of fault. | Very High |

| Property Damage Liability | Covers damages to another person’s property, including their vehicle. | High |

| Bodily Injury Liability | Covers medical expenses and other damages for injuries sustained by others in an accident caused by you. | High |

| Uninsured/Underinsured Motorist (UM/UIM) | Protects you if you are involved in an accident with a driver who has no insurance or insufficient coverage. | Moderate |

Filing a Car Insurance Claim in Florida

The process of filing a car insurance claim in Florida is relatively straightforward. Here’s a general Artikel:

- Report the accident to the police: This is crucial for documentation and potential legal proceedings.

- Contact your insurance company: Notify them of the accident and provide details, including the date, time, location, and parties involved.

- Gather information: Collect information from the other driver(s), including their insurance details, driver’s license information, and contact information.

- File a claim: Complete the necessary paperwork and submit it to your insurance company. This typically involves providing a detailed account of the accident, including photos and witness statements.

- Cooperate with the insurance company: Provide any requested documentation and participate in any necessary inspections or assessments.

Common Claim Denial Reasons and Dispute Resolution Strategies

While most claims are processed smoothly, some may be denied. Here are some common reasons for claim denial:

- Policy exclusions: Certain events or situations may not be covered by your policy. For example, if you were driving under the influence of alcohol or drugs, your claim might be denied.

- Lack of evidence: Without sufficient evidence, such as police reports, witness statements, or photos, your claim may be rejected.

- Failure to comply with policy terms: If you didn’t report the accident promptly or failed to cooperate with the insurance company, your claim could be denied.

If your claim is denied, you have several options for dispute resolution:

- Appeal the decision: Contact your insurance company and request a review of their decision.

- Mediation: An impartial third party can help you and the insurance company reach a settlement.

- Arbitration: A neutral party will hear both sides of the dispute and make a binding decision.

- Litigation: As a last resort, you can file a lawsuit against your insurance company.

Understanding Coverage Limits and Policy Terms for Claim Settlement

It’s crucial to understand the limits and terms of your car insurance policy before you need to file a claim. This ensures you know what you are covered for and what you can expect from your insurance company.

- Coverage limits: These specify the maximum amount your insurance company will pay for a specific type of claim. For example, your bodily injury liability coverage might have a limit of $100,000 per person or $300,000 per accident.

- Deductible: This is the amount you pay out of pocket before your insurance company starts paying for a claim. A higher deductible generally results in lower premiums.

- Exclusions: These are specific situations or events that are not covered by your policy. For example, your policy might exclude coverage for damage caused by wear and tear or if you were driving a vehicle not listed on your policy.

Understanding these key elements will help you make informed decisions and avoid potential surprises during the claim settlement process.

End of Discussion

By understanding the factors that influence car insurance costs in Florida, you can make informed choices about your coverage and potentially save money on your premiums. Remember to shop around, compare quotes, and consider bundling your insurance policies to secure the best rates. Armed with this knowledge, you can navigate the world of car insurance with confidence and find the right coverage for your needs.

FAQ Overview

What is full coverage car insurance?

Full coverage car insurance typically refers to a combination of liability, collision, and comprehensive coverage. It provides financial protection against a wide range of risks, including accidents, theft, vandalism, and natural disasters.

How often should I review my car insurance policy?

It’s recommended to review your car insurance policy at least annually, or even more frequently if you experience significant life changes, such as a new car purchase, a change in driving history, or a move to a new location.

What are some common discounts available for car insurance in Florida?

Common car insurance discounts in Florida include good driver discounts, safe driver discounts, multi-car discounts, and bundling discounts for combining home and auto insurance.

What should I do if my car insurance claim is denied?

If your car insurance claim is denied, carefully review the denial reason and the terms of your policy. If you believe the denial is unjustified, you can appeal the decision or contact the Florida Department of Financial Services for assistance.