Finding the best affordable car insurance can be a daunting task, especially with the multitude of options available and the ever-changing landscape of insurance costs. Understanding the factors that influence premiums, comparing quotes from multiple providers, and utilizing smart strategies for saving money are crucial steps in securing affordable coverage. This guide will equip you with the knowledge and resources to navigate the world of car insurance and find the best fit for your needs and budget.

From exploring different types of coverage and understanding their benefits to learning how to negotiate rates and leverage your driving history and credit score, we’ll cover the essential aspects of finding affordable car insurance. We’ll also delve into the advantages of bundling insurance policies and provide a list of reputable insurance companies known for affordability.

Understanding Affordable Car Insurance

Finding affordable car insurance can feel like a daunting task, but it doesn’t have to be. By understanding the factors that influence your premiums and taking steps to reduce them, you can secure the coverage you need without breaking the bank.

Factors Influencing Car Insurance Costs

Several factors determine your car insurance premiums. These include:

- Your driving history: This is one of the most significant factors. A clean driving record with no accidents or violations will lead to lower premiums. Conversely, having accidents or traffic tickets will increase your premiums.

- Your age and gender: Younger drivers, especially those under 25, typically pay higher premiums due to their higher risk of accidents. Gender also plays a role, with men generally paying more than women.

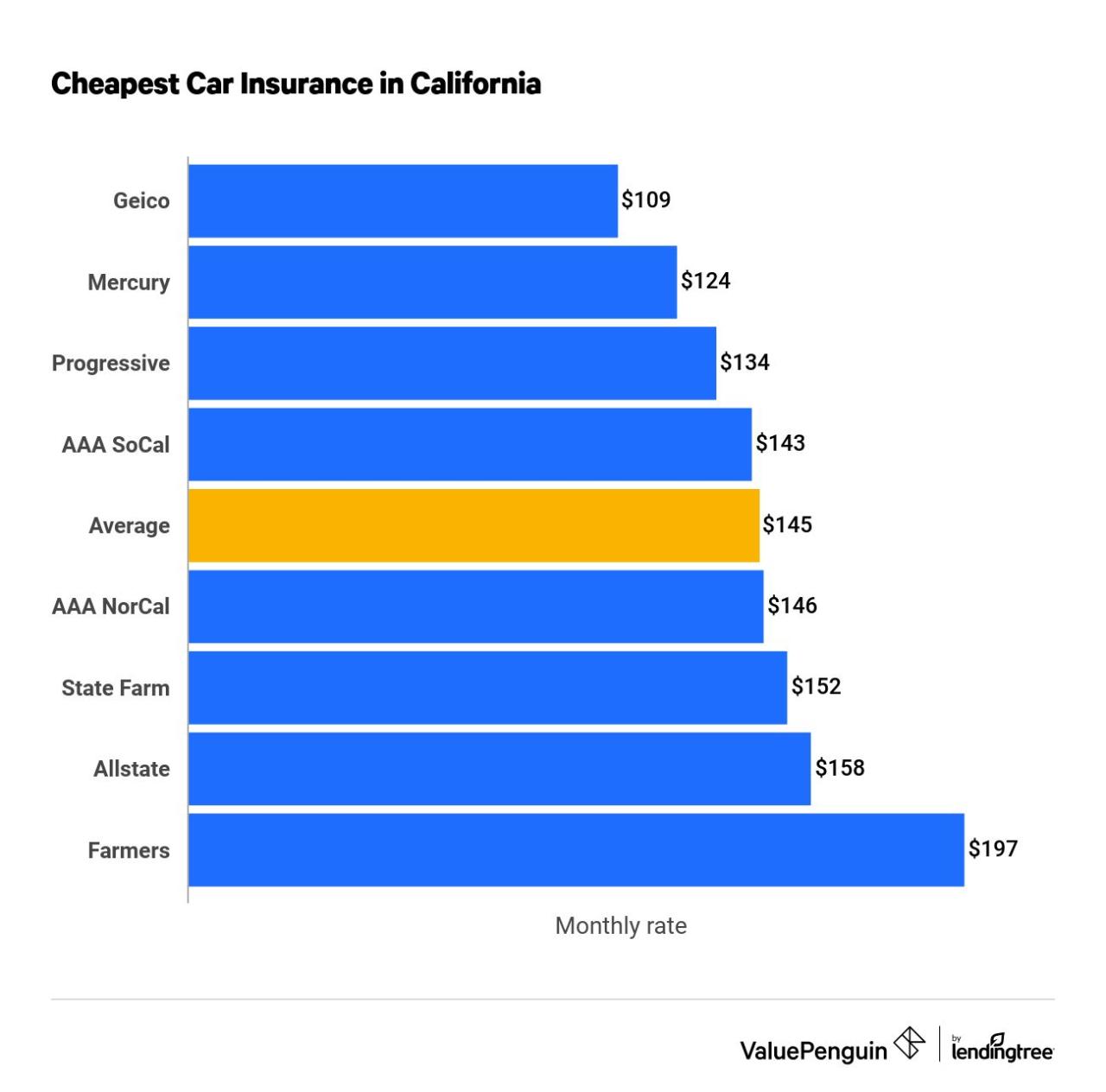

- Your location: Car insurance rates vary by location. Areas with higher crime rates, traffic congestion, or a greater number of accidents generally have higher premiums.

- Your vehicle: The make, model, and year of your car can significantly impact your insurance costs. High-performance vehicles, luxury cars, and newer models often have higher premiums due to their higher repair costs and theft risk.

- Your coverage options: The type and amount of coverage you choose will also affect your premiums. Comprehensive and collision coverage offer more protection but come at a higher cost. You can often save money by choosing higher deductibles or opting for less comprehensive coverage if you have an older car with a lower value.

Comparing Quotes from Multiple Insurance Providers, Best affordable car insurance

It is essential to compare quotes from multiple insurance providers to find the best rates. Each company uses different algorithms to calculate premiums, so you may find significant variations in pricing.

- Online comparison tools: Several websites allow you to enter your information and receive quotes from multiple insurance companies simultaneously. This saves you time and effort.

- Contact insurance agents: You can also contact insurance agents directly to get quotes and discuss your coverage options.

- Ask for discounts: Many insurance companies offer discounts for safe driving, good student records, bundling multiple policies, or having safety features in your car.

Tips for Reducing Car Insurance Premiums

There are several steps you can take to reduce your car insurance premiums:

- Maintain a clean driving record: This is the most effective way to lower your premiums. Avoid speeding, reckless driving, and other traffic violations.

- Consider a higher deductible: A higher deductible means you pay more out of pocket in case of an accident but can lower your premiums significantly.

- Shop around for discounts: Ask your insurance company about available discounts, such as good student, safe driver, or multi-policy discounts.

- Improve your credit score: Your credit score can impact your car insurance premiums in some states. Improving your credit score can lead to lower premiums.

- Consider a less expensive car: If you are buying a new car, choosing a less expensive model can lower your insurance premiums.

- Install safety features: Some safety features, such as anti-theft devices or anti-lock brakes, can qualify you for discounts.

Key Considerations for Choosing Affordable Car Insurance

Choosing the right car insurance policy can be a daunting task, but understanding the different types of coverage and their benefits is crucial in finding an affordable plan that meets your needs. Here’s a breakdown of key considerations for making an informed decision.

Types of Car Insurance Coverage

Understanding the various types of car insurance coverage is essential to determine which options are necessary for your situation.

- Liability Coverage: This is the most basic type of car insurance and is required by law in most states. It protects you financially if you cause an accident that injures another person or damages their property. Liability coverage is divided into two parts:

- Bodily Injury Liability: This covers medical expenses, lost wages, and other damages resulting from injuries you cause to others in an accident.

- Property Damage Liability: This covers repairs or replacement costs for damage you cause to another person’s vehicle or property.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. It’s typically optional, but it’s often recommended for newer or more expensive vehicles.

- Comprehensive Coverage: This coverage protects your vehicle against damages caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. It’s also optional, but it’s often recommended for newer or more expensive vehicles.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. It can help pay for your medical expenses, lost wages, and vehicle repairs.

- Personal Injury Protection (PIP): This coverage, also known as no-fault insurance, pays for your medical expenses and lost wages regardless of who is at fault in an accident. It’s required in some states.

Essential Coverage Options for Most Drivers

While each driver’s needs may vary, there are certain coverage options that are generally considered essential for most individuals:

- Liability Coverage: This is crucial as it protects you from significant financial repercussions if you cause an accident. The minimum required liability coverage limits vary by state, but it’s generally recommended to have higher limits than the minimum to ensure adequate protection.

- Collision and Comprehensive Coverage: These coverage options are typically recommended for newer or more expensive vehicles, as they can help offset the costs of repairs or replacement in the event of an accident or damage from other events. If you have an older vehicle with a lower value, you might choose to forgo these coverages and rely on your savings to cover repairs.

- Uninsured/Underinsured Motorist Coverage: This coverage is essential to protect yourself in the unfortunate event that you’re involved in an accident with an uninsured or underinsured driver. It’s always a good idea to have this coverage, as it can help you recover your losses.

Benefits of Optional Coverage

While essential coverage options provide basic protection, there are several optional coverage options that can offer additional benefits, depending on your individual needs and circumstances.

- Roadside Assistance: This coverage provides assistance in situations such as flat tires, dead batteries, or lockouts. It can be particularly helpful for drivers who frequently travel long distances or live in remote areas.

- Rental Car Coverage: This coverage helps pay for a rental car while your vehicle is being repaired after an accident. It can be a valuable option if you rely on your vehicle for work or other essential activities.

- Gap Insurance: This coverage protects you from financial loss if your vehicle is totaled and your insurance payout is less than the amount you owe on your loan or lease. It’s typically recommended for newer vehicles that depreciate quickly.

- Medical Payments Coverage: This coverage pays for medical expenses for you and your passengers, regardless of who is at fault in an accident. It’s optional but can be a valuable addition to your policy if you want extra protection.

Finding the Best Affordable Car Insurance Providers

Finding the right car insurance provider can be a daunting task, especially when you’re looking for the most affordable option. Many factors can influence the cost of car insurance, including your driving history, location, vehicle type, and coverage needs. This section will guide you through the process of finding reputable and affordable car insurance providers.

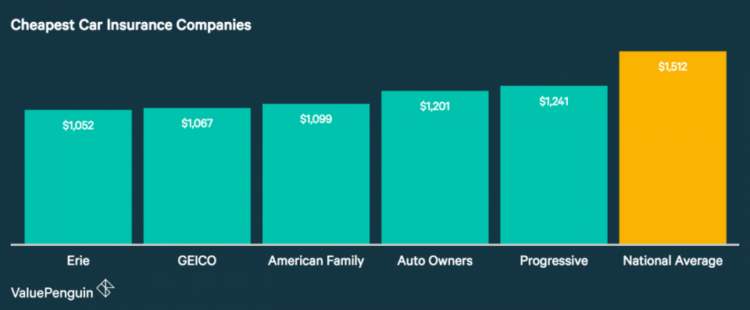

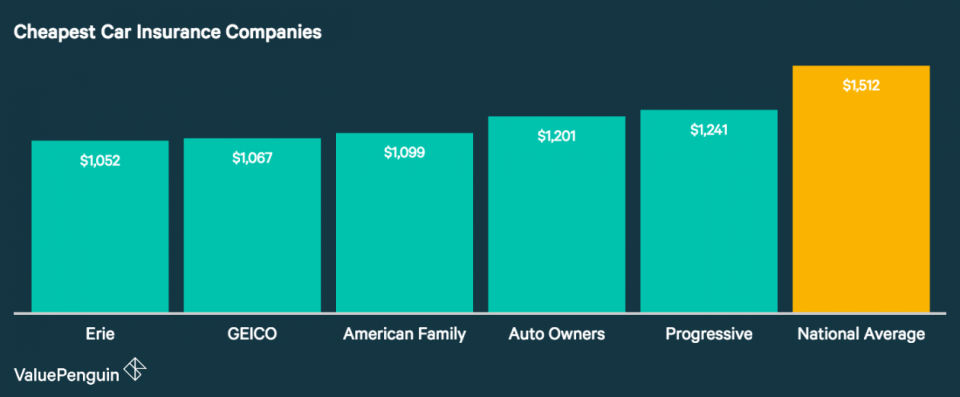

Comparing Affordable Car Insurance Providers

Comparing different car insurance providers is crucial to finding the best deal. It’s important to consider the coverage options, average premiums, and customer reviews when evaluating providers. Here are some reputable car insurance companies known for affordability:

| Company Name | Coverage Options | Average Premiums | Customer Reviews |

|---|---|---|---|

| Geico | Comprehensive, Collision, Liability, Personal Injury Protection, Uninsured/Underinsured Motorist | $1,200 – $1,500 per year | 4.5/5 stars |

| Progressive | Comprehensive, Collision, Liability, Personal Injury Protection, Uninsured/Underinsured Motorist | $1,300 – $1,600 per year | 4.2/5 stars |

| State Farm | Comprehensive, Collision, Liability, Personal Injury Protection, Uninsured/Underinsured Motorist | $1,400 – $1,700 per year | 4.3/5 stars |

| USAA | Comprehensive, Collision, Liability, Personal Injury Protection, Uninsured/Underinsured Motorist | $1,100 – $1,400 per year (for military members and their families) | 4.8/5 stars |

| Liberty Mutual | Comprehensive, Collision, Liability, Personal Injury Protection, Uninsured/Underinsured Motorist | $1,250 – $1,550 per year | 4.0/5 stars |

Remember, these are just a few examples, and premiums can vary based on individual circumstances. It’s essential to obtain quotes from multiple providers to compare prices and coverage options.

Tips for Saving Money on Car Insurance

Car insurance is a necessity for most drivers, but it can also be a significant expense. However, there are several strategies you can employ to reduce your premiums and save money on car insurance. By understanding the factors that influence your rates and implementing smart practices, you can significantly lower your annual costs.

Negotiating Car Insurance Rates

Negotiating car insurance rates can be a powerful way to save money. Insurance companies are often willing to negotiate, especially if you have a good driving record and are willing to shop around for the best deal. Here are some tips for negotiating car insurance rates:

- Shop Around: Get quotes from multiple insurance companies to compare rates and coverage options. This allows you to identify the most competitive offers available.

- Bundle Policies: Combining your car insurance with other policies, such as homeowners or renters insurance, can often lead to significant discounts.

- Increase Your Deductible: A higher deductible means you pay more out of pocket in case of an accident, but it can also lower your premiums. This strategy can be beneficial if you are confident in your ability to handle a higher deductible.

- Ask for Discounts: Insurance companies offer various discounts, such as good driver discounts, safe driver discounts, and discounts for anti-theft devices. Be sure to inquire about all available discounts and provide any relevant documentation to qualify.

- Negotiate After Renewal: Once your policy is up for renewal, contact your insurer and inquire about potential discounts or rate adjustments based on your current driving record and other factors.

Impact of Driving History and Credit Score

Your driving history and credit score play a crucial role in determining your car insurance premiums. Insurance companies use these factors to assess your risk profile and determine the likelihood of you filing a claim.

- Driving History: A clean driving record with no accidents or violations will result in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions can significantly increase your rates.

- Credit Score: Your credit score is a reflection of your financial responsibility, and insurance companies often use it as a proxy for risk assessment. Individuals with good credit scores tend to be considered lower risk and are typically offered lower premiums.

Benefits of Bundling Car Insurance

Bundling your car insurance with other insurance policies, such as homeowners, renters, or life insurance, can offer several benefits.

- Cost Savings: Insurance companies often offer discounts to customers who bundle multiple policies with them. These discounts can be substantial, saving you a significant amount of money on your overall insurance costs.

- Convenience: Bundling policies simplifies your insurance management. You only need to deal with one insurer for all your coverage needs, making it easier to track your policies, pay premiums, and file claims.

- Streamlined Service: Bundling your policies can streamline your insurance experience. You can often access a single point of contact for all your insurance needs, simplifying communication and resolving issues.

Additional Resources for Affordable Car Insurance: Best Affordable Car Insurance

Finding the right car insurance policy can feel overwhelming, but several resources can help you navigate the process and find the best deals. These resources provide valuable tools, information, and support to make informed decisions about your car insurance.

Online Resources and Tools

Online resources and tools can streamline the car insurance quote process, allowing you to compare multiple options quickly and easily.

- Insurance Comparison Websites: Websites like NerdWallet, Policygenius, and The Zebra allow you to enter your information once and receive quotes from multiple insurance companies. This simplifies the comparison process and saves you time.

- Insurance Company Websites: Most insurance companies have user-friendly websites where you can get personalized quotes, manage your policy, and access other services. This provides a direct connection with the insurer and allows you to explore their specific offerings.

- Mobile Apps: Many insurance companies offer mobile apps that allow you to manage your policy, file claims, and access other features on the go. These apps provide convenience and accessibility for policyholders.

Working with an Insurance Broker

Insurance brokers can act as intermediaries between you and insurance companies, helping you find the best policy for your needs.

- Advantages:

- Access to Multiple Carriers: Brokers have relationships with various insurance companies, giving you access to a wider range of options and potentially better rates.

- Expert Advice: Brokers can provide personalized advice based on your individual circumstances, helping you understand different policy features and choose the best coverage.

- Negotiation Power: Brokers can leverage their relationships with insurance companies to negotiate better rates and terms on your behalf.

- Disadvantages:

- Broker Fees: Some brokers charge fees for their services, which can add to the overall cost of your insurance.

- Limited Control: While brokers can provide valuable guidance, you ultimately make the final decision about your insurance policy.

Tips for Navigating the Car Insurance Buying Process

The car insurance buying process can be daunting, but these tips can help you make informed decisions and find the best policy for your needs.

- Shop Around: Get quotes from multiple insurance companies to compare rates and coverage options. Don’t settle for the first quote you receive.

- Review Your Coverage Needs: Consider your individual circumstances, such as your driving history, vehicle type, and location, to determine the appropriate level of coverage.

- Consider Discounts: Ask about available discounts, such as safe driver, good student, or multi-car discounts, to lower your premium.

- Read the Fine Print: Carefully review the policy details, including deductibles, limits, and exclusions, to understand your coverage.

- Ask Questions: Don’t hesitate to ask questions about anything you don’t understand. Insurance companies and brokers are there to help you.

Closure

Ultimately, finding the best affordable car insurance requires a proactive approach and a willingness to explore your options. By utilizing the information and resources provided in this guide, you can make informed decisions, secure adequate coverage, and ensure that you’re getting the most value for your money. Remember, car insurance is an essential investment in your safety and financial well-being, and taking the time to find the right policy can pay dividends in the long run.

Question & Answer Hub

How often should I review my car insurance policy?

It’s generally recommended to review your car insurance policy at least annually, or even more frequently if you experience significant life changes, such as getting married, having children, moving to a new location, or purchasing a new car.

What are the common discounts offered by car insurance companies?

Common discounts include good driver discounts, safe driver discounts, multi-car discounts, bundling discounts (combining car insurance with other policies like home or renters insurance), and discounts for safety features in your car, such as anti-theft devices or airbags.

What is the difference between liability insurance and collision insurance?

Liability insurance covers damages you cause to another person or their property in an accident, while collision insurance covers damages to your own vehicle in an accident, regardless of who is at fault.

What are the benefits of using an insurance broker?

Insurance brokers can help you compare quotes from multiple insurance companies, explain different coverage options, and negotiate better rates. They can also provide valuable advice and support throughout the car insurance buying process.