Best car insurance is essential for protecting yourself financially in case of an accident, theft, or other unforeseen events. Understanding your coverage needs and comparing different insurance providers is crucial to finding the best value for your money.

This guide will help you navigate the complexities of car insurance, from understanding the different types of coverage to identifying key features that make a provider stand out. We’ll also provide tips for saving money on your premiums and avoiding common mistakes that can leave you underinsured.

Understanding Car Insurance Basics

Car insurance is an essential financial safety net that protects you and your vehicle in case of accidents, theft, or other unforeseen events. It’s a contract between you and an insurance company, where they agree to cover certain financial losses in exchange for regular premium payments. Understanding the different types of coverage and how premiums are calculated is crucial for choosing the right policy for your needs.

Types of Car Insurance Coverage

Different types of car insurance coverage offer protection for various situations. Here’s a breakdown of common types:

- Liability Coverage: This is the most basic and usually mandatory type of coverage. It protects you financially if you’re responsible for an accident that causes damage to another person’s property or injuries. Liability coverage typically covers:

- Bodily Injury Liability: Covers medical expenses, lost wages, and other damages for injuries caused to others in an accident.

- Property Damage Liability: Covers the cost of repairs or replacement of another person’s vehicle or property damaged in an accident.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. You’ll have to pay a deductible, which is the amount you pay out-of-pocket before the insurance company covers the rest.

- Comprehensive Coverage: This coverage protects your vehicle from damages caused by events other than accidents, such as theft, vandalism, fire, hail, or natural disasters. Like collision coverage, you’ll have to pay a deductible.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages. It covers medical expenses, lost wages, and other damages.

- Personal Injury Protection (PIP): This coverage pays for your medical expenses and lost wages, regardless of who is at fault in an accident. It’s often required in some states.

Factors Influencing Car Insurance Premiums

Car insurance premiums are calculated based on various factors, including:

- Age and Driving History: Younger drivers with less experience typically pay higher premiums due to higher risk. A clean driving record with no accidents or violations can lead to lower premiums.

- Vehicle Type: The make, model, year, and value of your vehicle affect premiums. Expensive or high-performance cars are generally more expensive to insure.

- Location: Premiums can vary based on your location. Areas with higher accident rates or crime rates often have higher insurance premiums.

- Driving Habits: Factors like annual mileage, commuting distance, and driving habits (e.g., driving during peak hours) can influence premiums.

- Credit Score: In some states, insurance companies may consider your credit score as a factor in determining premiums.

Benefits of Adequate Car Insurance Coverage

Having adequate car insurance coverage provides significant benefits in various situations:

- Accidents: In case of an accident, car insurance can cover medical expenses, vehicle repairs, and other damages, protecting you from financial hardship.

- Theft: Comprehensive coverage protects you from financial loss if your vehicle is stolen. It can cover the cost of replacing your vehicle or compensate for the loss.

- Natural Disasters: Comprehensive coverage can help cover repairs or replacement costs if your vehicle is damaged by events like floods, earthquakes, or tornadoes.

- Legal Protection: Liability coverage can help pay for legal fees and court costs if you’re sued after an accident.

Finding the Best Car Insurance for Your Needs

Finding the right car insurance policy is essential for protecting yourself financially in case of an accident or other unforeseen event. With numerous providers offering a wide range of coverage options and prices, navigating the car insurance landscape can be overwhelming. This section will guide you through the process of finding the best car insurance for your needs, helping you make informed decisions that align with your budget and requirements.

Comparing Car Insurance Providers

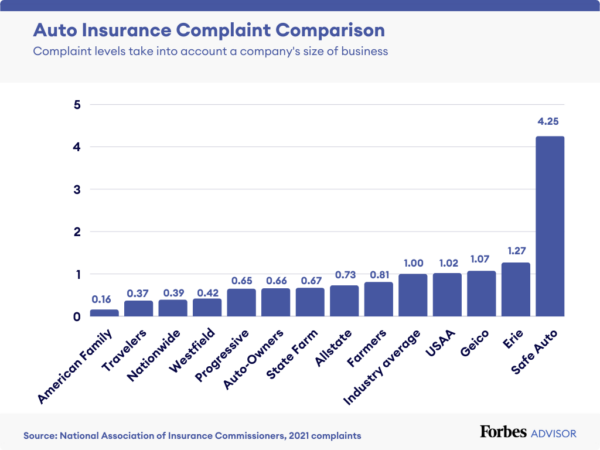

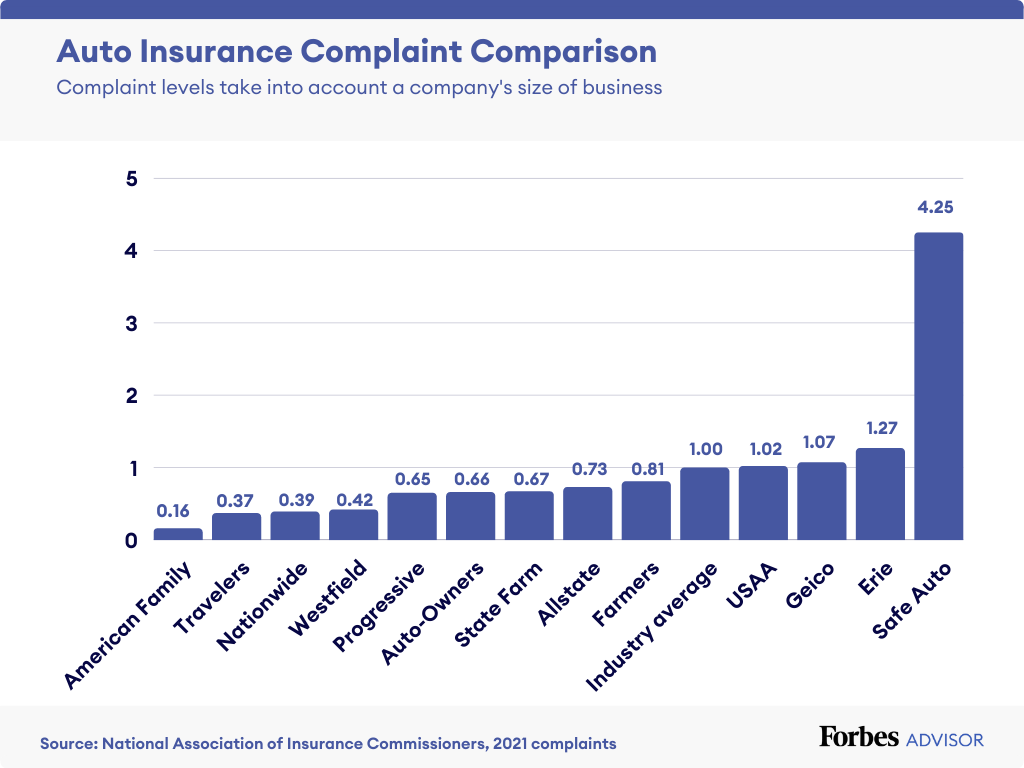

Choosing the right car insurance provider is crucial for securing adequate coverage at a reasonable price. Several factors should be considered when comparing providers:

- Coverage Options: Each provider offers different types of coverage, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage. It’s important to understand the types of coverage available and choose a provider that offers the coverage you need.

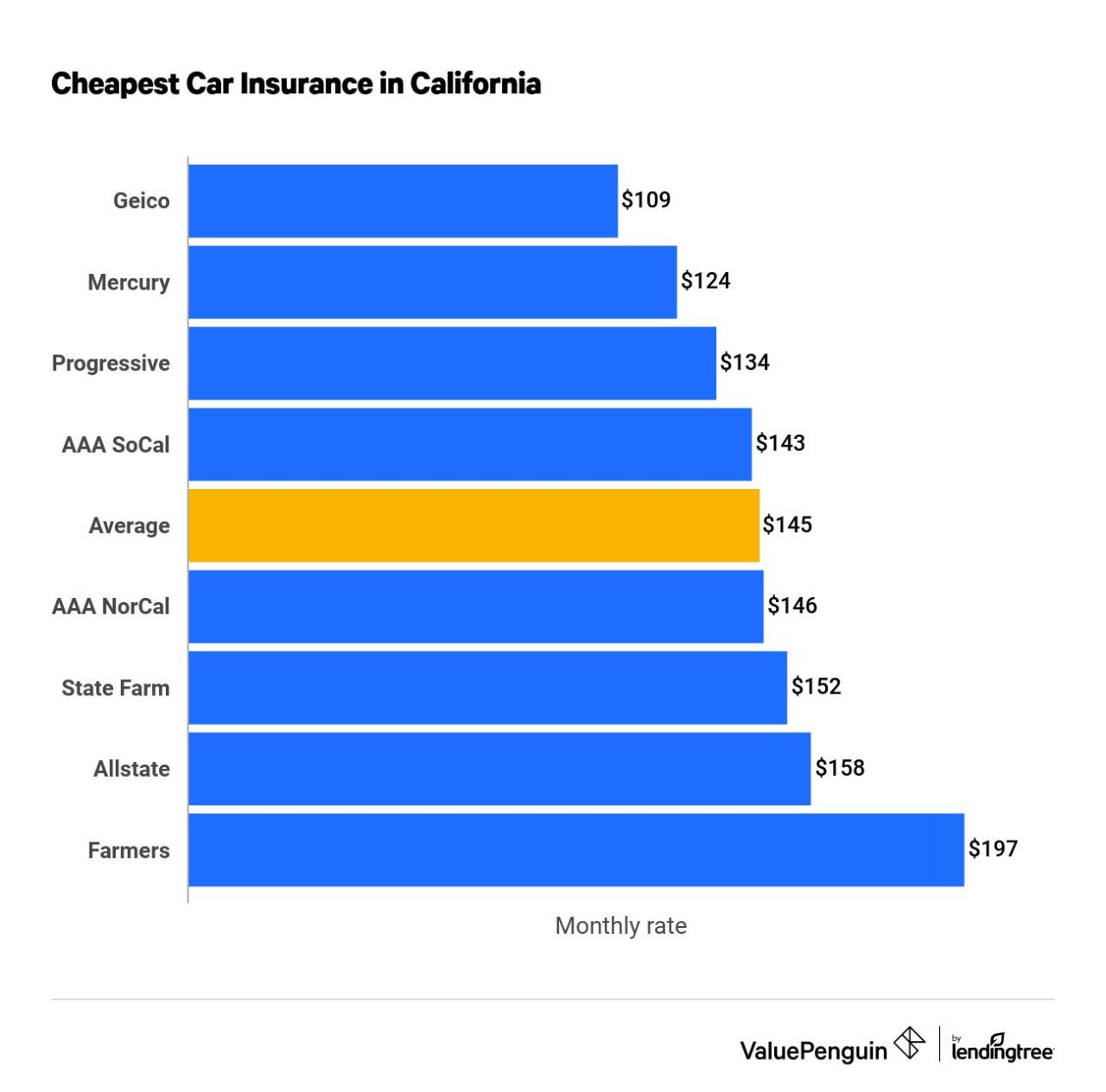

- Pricing: Car insurance premiums can vary significantly between providers. Getting quotes from multiple providers allows you to compare prices and find the most affordable option. Factors like your driving history, vehicle type, location, and coverage level can influence your premium.

- Customer Service: Excellent customer service is essential when dealing with an insurance company. Look for providers with a reputation for responsiveness, helpfulness, and efficiency in handling claims and inquiries.

- Claims Handling: The claims process can be stressful, so it’s important to choose a provider known for its smooth and hassle-free claims handling. Research providers’ claims satisfaction ratings and customer reviews to gauge their efficiency and fairness in resolving claims.

Getting Accurate Car Insurance Quotes

To get accurate car insurance quotes, follow these tips:

- Provide Accurate Information: When requesting quotes, be honest and accurate with your personal information, including your driving history, vehicle details, and desired coverage levels. Inaccurate information can lead to incorrect quotes and potential problems later.

- Get Quotes from Multiple Providers: Compare quotes from at least three to five different providers to ensure you are getting the best possible rates. You can use online comparison websites or contact providers directly.

- Consider Bundling: Many providers offer discounts for bundling your car insurance with other insurance policies, such as homeowners or renters insurance. Ask about these discounts when getting quotes.

- Shop Around Regularly: Car insurance rates can fluctuate over time. It’s advisable to shop around for better rates at least every year or two to ensure you are getting the best deal.

Negotiating Better Car Insurance Rates

While car insurance rates are determined by several factors, there are ways to negotiate better rates:

- Improve Your Driving Record: Maintaining a clean driving record is crucial for securing lower premiums. Avoid traffic violations and accidents, as these can significantly increase your rates.

- Increase Your Deductible: A higher deductible means you pay more out of pocket in case of an accident, but it can lead to lower premiums. Consider raising your deductible if you are comfortable with the financial responsibility.

- Ask About Discounts: Many providers offer discounts for various factors, including good student discounts, safe driver discounts, multi-car discounts, and loyalty discounts. Ask about these discounts and ensure you are taking advantage of all eligible ones.

- Consider Pay-As-You-Go Insurance: Some providers offer pay-as-you-go insurance plans, where your premium is based on your actual driving habits. If you drive less frequently, this type of plan could lead to lower premiums.

Reviewing Your Car Insurance Policy Regularly

It’s crucial to review your car insurance policy regularly to ensure it meets your current needs and reflects any changes in your circumstances.

- Review Your Coverage Levels: As your life changes, your insurance needs may change as well. If you purchase a new car, add a driver to your policy, or make significant changes to your lifestyle, review your coverage levels to ensure they are adequate.

- Check for Discounts: Regularly check for available discounts and ensure you are taking advantage of all eligible ones. Some discounts may require you to update your policy information or provide additional documentation.

- Compare Rates: Even if you are satisfied with your current provider, it’s a good practice to compare rates with other providers every year or two to ensure you are getting the best deal.

Key Features to Consider

Choosing the right car insurance provider is not just about the price. It’s about finding a company that offers the features and services that align with your specific needs and driving habits. This means looking beyond the premium and considering the extra benefits that can make a real difference when you need them most.

Discount Programs, Best car insurance

Discount programs are a valuable way to save money on your car insurance premiums. These programs often reward safe driving habits, responsible vehicle ownership, and other positive factors.

Here are some common types of car insurance discounts:

- Good Driver Discounts: Awarded to drivers with a clean driving record, typically with no accidents or traffic violations within a specified period.

- Safe Driver Discounts: Offered to drivers who complete defensive driving courses or have telematics devices installed in their vehicles that track their driving behavior.

- Multi-Car Discounts: Granted when you insure multiple vehicles with the same insurance company.

- Multi-Policy Discounts: Applied when you bundle your car insurance with other insurance policies, such as homeowners or renters insurance, with the same provider.

- Loyalty Discounts: Rewarded to long-term customers who have been with the same insurance company for a certain period.

- Payment Discounts: Often available for paying your premiums in full or setting up automatic payments.

Roadside Assistance

Roadside assistance is a valuable feature that can provide peace of mind knowing you have help when you need it.

- Emergency Towing: Provides towing services to your nearest repair shop or to a location of your choice if your vehicle breaks down or is involved in an accident.

- Flat Tire Changes: Offers assistance with changing a flat tire, including providing a spare tire and tools if needed.

- Battery Jump-Starts: Provides a jump-start if your car battery dies.

- Fuel Delivery: Delivers fuel to your vehicle if you run out of gas.

- Lockout Service: Helps you gain access to your vehicle if you lock yourself out.

Mobile App Functionality

Mobile apps have become an integral part of managing car insurance. They offer convenience and efficiency, allowing you to access your policy information, file claims, and communicate with your insurance provider from your smartphone.

- Policy Management: View your policy details, make changes, and manage payments.

- Claim Filing: Report accidents and submit claims directly through the app.

- Roadside Assistance: Request roadside assistance services with a few taps on your phone.

- Digital ID Cards: Access and share your insurance card digitally.

- Real-Time Tracking: Some apps provide real-time tracking of your vehicle’s location.

Coverage Options

The coverage options you choose significantly impact your car insurance cost and the level of protection you have.

- Liability Coverage: This coverage protects you financially if you cause an accident that injures someone or damages their property. It typically includes bodily injury liability and property damage liability. The higher your liability limits, the more expensive your insurance will be, but you’ll have greater financial protection in case of an accident.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in a collision, regardless of fault. If you have an older vehicle, you may choose to waive collision coverage and save on premiums, as the cost of repairs may exceed the vehicle’s value.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by non-collision events, such as theft, vandalism, fire, hail, or natural disasters. If you have a newer or more expensive vehicle, comprehensive coverage is generally recommended to ensure adequate protection against these risks.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your losses. It can help cover medical expenses, lost wages, and property damage.

Comparing Car Insurance Providers

When comparing car insurance providers, it’s crucial to consider not only the price but also the features and services offered. Here’s a table comparing some popular car insurance providers based on key features:

| Provider | Discount Programs | Roadside Assistance | Mobile App Functionality | Coverage Options | Strengths |

|---|---|---|---|---|---|

| Provider A | Good Driver, Multi-Car, Multi-Policy | Towing, Battery Jump-Starts, Flat Tire Changes | Policy Management, Claim Filing, Roadside Assistance | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist | Wide range of discounts, comprehensive mobile app functionality, strong customer service |

| Provider B | Safe Driver, Loyalty, Payment | Towing, Flat Tire Changes, Lockout Service | Policy Management, Claim Filing, Digital ID Cards | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist | Competitive pricing, user-friendly mobile app, extensive coverage options |

| Provider C | Good Driver, Multi-Car, Multi-Policy, Safe Driver | Towing, Battery Jump-Starts, Fuel Delivery | Policy Management, Claim Filing, Roadside Assistance, Real-Time Tracking | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist | Wide range of discounts, comprehensive roadside assistance, advanced mobile app features |

Avoiding Common Mistakes

Choosing the right car insurance can be a complex process, and many people make mistakes that can cost them dearly in the long run. It’s essential to understand common pitfalls and take steps to avoid them.

Overlooking Coverage Gaps

It’s crucial to carefully evaluate your coverage needs and ensure your policy adequately protects you in various situations. Many people mistakenly believe that basic liability coverage is sufficient, but this can leave them financially vulnerable in case of an accident. For example, if you’re involved in an accident that causes significant damage to another vehicle or injuries, your liability coverage may not be enough to cover the costs.

“Liability coverage only protects you against claims made by others, not against damage to your own vehicle.”

Here are some essential coverage types to consider:

- Collision Coverage: This coverage pays for repairs to your vehicle if it’s damaged in an accident, regardless of who’s at fault.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage.

Accepting the First Quote

Comparing quotes from multiple insurers is essential to find the best value for your money. Many people accept the first quote they receive without shopping around, which can lead them to overpay for their insurance.

“Insurance premiums can vary significantly between different companies, even for the same coverage.”

Here are some tips for comparing quotes:

- Use an online comparison tool: These tools allow you to quickly compare quotes from multiple insurers side-by-side.

- Contact insurers directly: Call or visit different insurers to get personalized quotes and discuss your specific needs.

- Review policy details carefully: Don’t just focus on the premium; make sure you understand the coverage details and any exclusions.

Falling Prey to Misleading Marketing Tactics

Insurance companies often use marketing tactics that can be misleading or confusing. It’s essential to be aware of these tactics and avoid making decisions based on them.

“Some insurers may advertise low premiums but have hidden fees or limitations that can significantly increase your costs.”

Here are some common misleading marketing tactics to watch out for:

- “Free” quotes: While getting a quote is usually free, some insurers may try to upsell you on additional products or services.

- “Guaranteed” discounts: Be wary of claims of guaranteed discounts, as they may have strict eligibility criteria or be limited to specific coverage types.

- “Limited-time offers”: These offers may create a sense of urgency but often have little real value.

Inadequate Coverage and Financial Losses

Failing to have adequate car insurance can lead to significant financial losses in case of an accident. Here are some examples of situations where inadequate coverage can be costly:

- A driver without collision coverage is involved in an accident and their vehicle is totaled. They will have to pay for the repairs or replacement out of pocket.

- A driver with only liability coverage is involved in an accident that causes serious injuries to the other driver. Their liability coverage may not be enough to cover the medical expenses and legal fees, leaving them personally liable for the remaining costs.

- A driver without uninsured/underinsured motorist coverage is hit by a driver without insurance. They will be responsible for covering their own medical expenses and vehicle repairs.

Tips for Saving Money on Car Insurance: Best Car Insurance

Car insurance is a necessary expense for most vehicle owners, but it can also be a significant financial burden. Fortunately, there are several strategies you can employ to reduce your premiums and save money. By understanding the factors that influence your insurance rates and implementing effective strategies, you can significantly lower your costs without compromising your coverage.

Lowering Your Premiums

- Maintain a Good Driving Record: Your driving history is a major factor in determining your insurance rates. Avoiding accidents, traffic violations, and DUI offenses will significantly reduce your premiums.

- Bundle Your Policies: Insurance companies often offer discounts for bundling multiple policies, such as car insurance, homeowners insurance, or renters insurance. By combining your policies with the same provider, you can enjoy substantial savings.

- Explore Discounts: Many insurance companies offer a variety of discounts, including good student discounts, safe driver discounts, and multi-car discounts. Take the time to research and inquire about available discounts that you may qualify for.

- Increase Your Deductible: A higher deductible means you’ll pay more out of pocket in case of an accident, but it will lower your premium. Carefully consider your financial situation and risk tolerance when choosing a deductible.

- Shop Around for Quotes: Don’t settle for the first insurance quote you receive. Compare rates from multiple insurance providers to find the best deal. Online comparison tools can make this process quick and easy.

Improving Your Driving Habits

- Practice Defensive Driving: By anticipating potential hazards and reacting appropriately, you can reduce the risk of accidents and keep your premiums low.

- Avoid Distracted Driving: Distracted driving, such as texting or talking on the phone while driving, is a major cause of accidents. Focus on the road and avoid distractions to maintain a safe driving environment.

- Maintain Your Vehicle: Regular maintenance, such as oil changes and tire rotations, can help prevent breakdowns and accidents, which can impact your insurance rates.

Enhancing Vehicle Safety Features

- Install Anti-theft Devices: Vehicles equipped with anti-theft devices, such as alarms or GPS tracking systems, are less likely to be stolen, which can lead to lower insurance premiums.

- Consider Safety Features: Modern vehicles often come with advanced safety features like lane departure warnings, automatic emergency braking, and blind spot monitoring. These features can reduce the risk of accidents and potentially lower your insurance costs.

Resources and Tools for Comparison

- Online Comparison Websites: Websites like Insurify, Policygenius, and NerdWallet allow you to compare car insurance quotes from multiple providers in one place, saving you time and effort.

- Insurance Agent Consultation: An independent insurance agent can provide personalized advice and help you find the best policy for your needs.

Last Recap

By understanding your needs, comparing options, and being an informed consumer, you can secure the best car insurance that provides the protection you deserve while fitting comfortably within your budget. Remember, taking the time to research and choose wisely can save you significant financial stress in the long run.

FAQ Corner

How often should I review my car insurance policy?

It’s a good practice to review your policy at least once a year, or whenever there’s a significant life change like a new car, a change in your driving history, or a move to a new location.

What is a deductible and how does it affect my insurance premiums?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums, while lower deductibles lead to higher premiums.

What is the difference between liability and collision coverage?

Liability coverage protects you financially if you cause an accident that injures someone or damages their property. Collision coverage covers damage to your own vehicle in an accident, regardless of who is at fault.