Finding the best car insurance companies can be a daunting task, especially with so many options available. But, navigating this landscape is crucial to securing the right coverage at the best possible price. Understanding your insurance needs, considering factors like financial stability and customer service, and exploring top-rated companies are all essential steps in this process.

This guide delves into the world of car insurance, providing insights on key factors to consider, reputable companies to explore, and strategies for getting the best value for your money. From understanding the different types of coverage to navigating the intricacies of policy language, we’ll equip you with the knowledge you need to make informed decisions and find the insurance plan that perfectly suits your needs.

Understanding Car Insurance Needs

Car insurance is a crucial aspect of owning a vehicle. It provides financial protection in case of accidents, theft, or other unforeseen events. Understanding your insurance needs is essential to ensure you have the right coverage at an affordable price.

Factors Affecting Car Insurance Premiums

Several factors influence how much you pay for car insurance. Knowing these factors can help you make informed decisions to potentially lower your premiums.

- Driving Record: Your driving history, including accidents, traffic violations, and driving experience, significantly impacts your premium. A clean driving record typically results in lower premiums.

- Vehicle Type: The make, model, and year of your vehicle play a crucial role in determining your insurance cost. Luxury or high-performance vehicles are generally more expensive to insure due to their higher repair costs and potential for higher risk.

- Location: Where you live can influence your premiums. Areas with higher crime rates or more frequent accidents tend to have higher insurance costs.

- Coverage Levels: The amount of coverage you choose, such as liability limits and comprehensive and collision coverage, directly impacts your premium. Higher coverage levels generally mean higher premiums.

- Age and Gender: Younger and inexperienced drivers often pay higher premiums, as they are statistically more likely to be involved in accidents. Gender can also play a role, with some insurers charging higher premiums for young male drivers.

- Credit Score: In some states, insurers may use your credit score as a factor in determining your premium. A higher credit score can sometimes lead to lower premiums.

Types of Car Insurance Coverage

Car insurance policies typically include various types of coverage, each providing protection for specific situations. Understanding these coverage options allows you to choose the right combination to meet your needs and budget.

- Liability Coverage: This essential coverage protects you financially if you are at fault in an accident causing damage to another person’s property or injuries. It covers the other party’s medical expenses, lost wages, and property damage.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of fault. It covers damage caused by collisions with other vehicles, objects, or even hitting a pothole.

- Comprehensive Coverage: This coverage protects your vehicle from damages caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters. It can cover the cost of repairs or replacement of your vehicle.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who has no insurance or insufficient coverage. It can cover your medical expenses, lost wages, and property damage.

- Personal Injury Protection (PIP): This coverage, available in some states, covers your medical expenses and lost wages if you are injured in an accident, regardless of fault.

- Medical Payments Coverage (Med Pay): This coverage, also known as “medical expense coverage,” pays for your medical expenses, regardless of fault, if you are injured in an accident. It typically has a lower limit than PIP coverage.

Situations Where Different Coverage Might Be Necessary

The type of coverage you need depends on your individual circumstances. Here are some examples:

- New Car: If you have recently purchased a new car, you might consider purchasing comprehensive and collision coverage to protect your investment.

- Older Car: For an older car, you might choose to decline collision and comprehensive coverage, as the cost of repairs or replacement might be less than the cost of the premium.

- High-Risk Area: If you live in an area with a high rate of theft or vandalism, you might want to consider comprehensive coverage to protect your vehicle.

- Limited Budget: If you are on a tight budget, you might choose to purchase only the minimum liability coverage required by your state. However, this could leave you financially vulnerable in the event of a serious accident.

Factors to Consider When Choosing a Company

Choosing the right car insurance company is crucial to ensure you have adequate coverage and receive prompt and efficient service in case of an accident. It’s not just about finding the cheapest option; you need to consider several factors to make an informed decision.

Financial Stability and Claims Handling Experience

Financial stability and claims handling experience are crucial when selecting a car insurance company. These factors directly impact your ability to receive compensation when you need it most.

- Financial Strength: Look for companies with strong financial ratings from reputable agencies like A.M. Best, Standard & Poor’s, or Moody’s. These ratings reflect a company’s ability to pay claims, even in the event of major disasters or economic downturns. A financially stable company is less likely to go bankrupt, ensuring your claim won’t be jeopardized.

- Claims Handling Experience: Research the company’s reputation for handling claims efficiently and fairly. Look for reviews and testimonials from previous customers to gauge their experiences. A company with a good track record of settling claims promptly and amicably is more likely to provide a positive experience during a stressful time.

Customer Service Features

Customer service is another critical factor to consider when choosing a car insurance company. You want a company that provides convenient and responsive support when you need it.

- Online Portals: Many insurance companies offer online portals that allow you to manage your policy, pay bills, file claims, and access other important information. A user-friendly online portal can save you time and effort. Look for companies with portals that are easy to navigate and provide comprehensive features.

- Mobile Apps: Mobile apps provide even greater convenience and accessibility. Look for apps that allow you to perform the same functions as the online portal, such as policy management, claim filing, and roadside assistance. Some apps even offer features like telematics, which can track your driving behavior and potentially earn you discounts.

- 24/7 Support: A company that offers 24/7 customer support is invaluable, especially if you need to file a claim or get roadside assistance outside of regular business hours. Look for companies with multiple contact options, such as phone, email, and live chat, to ensure you can reach them when you need them.

Discounts and Promotions

Discounts and promotions can significantly reduce your overall insurance costs.

- Bundling Discounts: Many companies offer discounts for bundling your car insurance with other types of insurance, such as homeowners or renters insurance. This can save you a considerable amount of money.

- Safe Driver Discounts: Good driving records are often rewarded with discounts. If you have a clean driving history, you can expect to pay lower premiums.

- Vehicle Safety Features Discounts: Cars equipped with safety features like anti-theft devices, airbags, and anti-lock brakes can qualify for discounts.

- Loyalty Discounts: Some companies offer discounts to customers who have been with them for a certain period. This can be a significant incentive to stay with a company over the long term.

Top-Rated Car Insurance Companies

Choosing the right car insurance company can be a daunting task, as there are numerous options available. This section will provide insights into some of the top-rated companies, helping you make an informed decision.

Comparison of Top-Rated Companies

To compare top-rated car insurance companies, we can examine factors like customer satisfaction, financial strength, and coverage options. This table provides a concise overview:

| Company | Customer Satisfaction | Financial Strength | Coverage Options |

|—|—|—|—|

| USAA | Excellent | Very Strong | Comprehensive |

| Geico | Excellent | Strong | Comprehensive |

| State Farm | Excellent | Very Strong | Comprehensive |

| Progressive | Good | Strong | Comprehensive |

| Liberty Mutual | Good | Strong | Comprehensive |

Note: This table is a simplified representation and should be used as a starting point. Individual needs and preferences may vary, so it’s essential to conduct thorough research before making a decision.

Real-World Customer Experiences

Customer experiences with different insurance companies can provide valuable insights. Here are a few examples:

* USAA: A military veteran shared his positive experience with USAA, highlighting their excellent customer service and competitive rates. He praised their responsiveness and the ease of filing claims.

* Geico: A young professional mentioned her satisfaction with Geico’s online platform, which allowed her to manage her policy and make payments conveniently. She also appreciated their clear and concise communication.

* State Farm: A homeowner expressed her confidence in State Farm’s financial stability and the wide range of coverage options they offered. She felt secure knowing her property was well-protected.

* Progressive: A driver with a good driving record reported saving money with Progressive’s discounts and personalized rates. They were pleased with the company’s commitment to providing affordable coverage.

* Liberty Mutual: A family with a history of minor accidents found Liberty Mutual’s forgiveness program beneficial, as it helped them avoid rate increases due to minor incidents. They appreciated the company’s focus on customer loyalty.

Strengths and Weaknesses of Each Company

Each insurance company has its own strengths and weaknesses, and understanding these can help you determine the best fit for your specific needs:

* USAA:

* Strengths: Excellent customer service, competitive rates, strong financial stability, dedicated to serving military personnel and their families.

* Weaknesses: Only available to military members and their families.

* Geico:

* Strengths: Wide range of coverage options, competitive rates, user-friendly online platform, strong financial stability.

* Weaknesses: Limited customer service options, may not offer the best rates for drivers with poor credit scores.

* State Farm:

* Strengths: Excellent customer service, strong financial stability, wide range of coverage options, strong community presence.

* Weaknesses: Rates can be higher than some competitors, limited online tools.

* Progressive:

* Strengths: Personalized rates, discounts for good drivers, user-friendly online platform, strong financial stability.

* Weaknesses: Customer service can be inconsistent, rates can be higher for drivers with poor credit scores.

* Liberty Mutual:

* Strengths: Comprehensive coverage options, discounts for good drivers, forgiveness programs for minor accidents, strong financial stability.

* Weaknesses: Rates can be higher than some competitors, customer service can be inconsistent.

Getting the Best Value for Your Money

Finding the right car insurance policy is about more than just the lowest price. You need to ensure you’re getting adequate coverage at a rate that fits your budget. This section explores strategies to maximize your savings and secure the best value for your insurance investment.

Negotiating Insurance Premiums

Negotiating insurance premiums can be a rewarding endeavor. It’s important to understand that insurance companies are businesses, and like any business, they are open to negotiation. Here’s a breakdown of effective negotiation tactics:

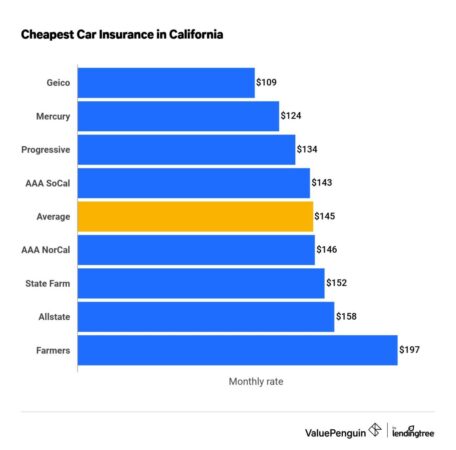

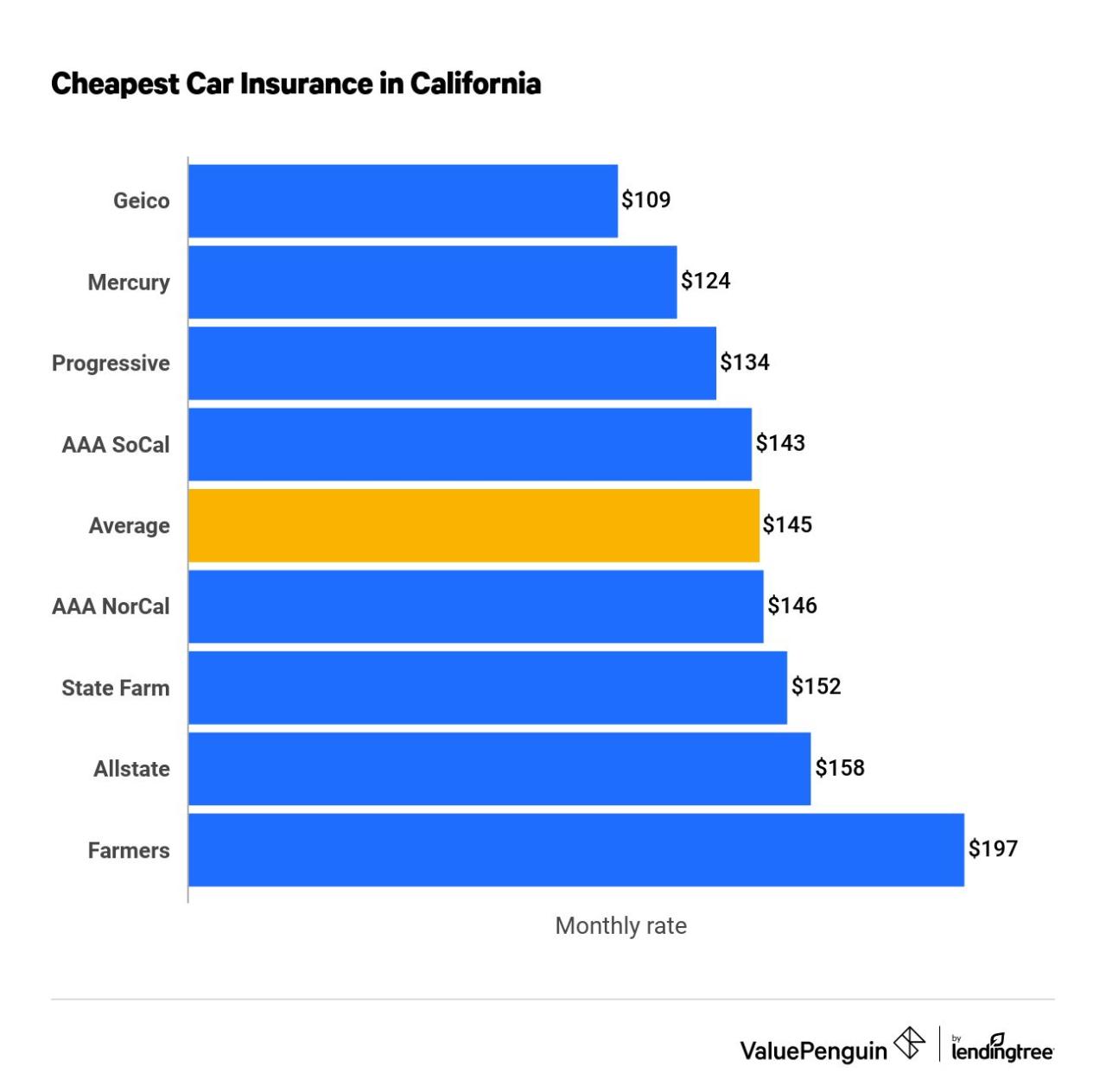

- Shop Around: Get quotes from multiple insurance companies to compare rates and coverage options. This gives you a clear understanding of the market and helps you identify the best deals.

- Bundle Insurance Policies: Combining your car insurance with other policies like homeowners, renters, or life insurance can often lead to significant discounts. This is a popular strategy offered by many insurers.

- Improve Your Driving Record: Maintaining a clean driving record with no accidents or violations is a crucial factor in securing lower premiums. If you have a good driving history, be sure to highlight it during your negotiations.

- Consider Higher Deductibles: Increasing your deductible (the amount you pay out of pocket before your insurance kicks in) can lower your premium. However, ensure the deductible amount is manageable for you in case of an accident.

- Explore Discounts: Most insurers offer a variety of discounts, such as good student discounts, safe driver discounts, or discounts for anti-theft devices. Research these discounts and see if you qualify.

- Negotiate Directly: Once you’ve received a quote, don’t hesitate to contact the insurer directly to discuss the rate. Explain your situation and inquire about potential discounts or adjustments.

Benefits of Bundling Insurance Policies

Bundling your car insurance with other types of insurance offers several advantages:

- Cost Savings: Combining policies typically leads to significant discounts, as insurance companies often offer lower rates for multiple policies. This can save you a considerable amount of money over time.

- Convenience: Having all your insurance policies with one company simplifies management. You only need to deal with one provider for all your insurance needs, making it easier to track policies, pay premiums, and file claims.

- Improved Customer Service: Insurance companies often prioritize their bundled customers, offering better customer service and support when you have multiple policies with them.

- Streamlined Claims Process: If you need to file a claim for any of your bundled policies, the process is usually smoother and more efficient. The insurer can easily coordinate between different policies, reducing hassle for you.

Resources and Tools for Comparing Quotes, Best car insurance companies

Several resources and tools are available to help you compare insurance quotes and find the best deals:

- Online Insurance Comparison Websites: Websites like Insurance.com, The Zebra, and Policygenius allow you to enter your information once and receive quotes from multiple insurers. This streamlines the comparison process and helps you find the best value.

- Insurance Brokers: Independent insurance brokers can help you navigate the insurance market and find the best policies based on your specific needs. They often have access to a wide range of insurers and can provide expert advice.

- Consumer Reports: Consumer Reports provides detailed reviews and ratings of car insurance companies, based on factors such as customer satisfaction, claims handling, and financial stability. This information can help you choose a reputable and reliable insurer.

Understanding Your Policy and Coverage: Best Car Insurance Companies

It’s crucial to carefully read and understand your car insurance policy. It’s your contract with the insurance company, outlining your coverage and responsibilities. This knowledge empowers you to make informed decisions and avoid surprises during a claim.

Common Exclusions and Limitations

Car insurance policies often have exclusions and limitations that specify situations where coverage is not provided. Understanding these provisions is vital to avoid disappointment when you need to file a claim.

- Wear and Tear: Most policies exclude coverage for damage caused by normal wear and tear, such as a flat tire due to aging.

- Acts of God: Coverage for damage caused by natural disasters like earthquakes or floods may be limited or excluded entirely.

- Driving While Intoxicated: Policies typically exclude coverage for accidents caused by driving under the influence of alcohol or drugs.

- Unlicensed Drivers: Coverage for accidents involving unlicensed drivers may be limited or excluded, depending on the policy.

- Certain Types of Vehicles: Some policies may exclude coverage for specific types of vehicles, such as motorcycles or commercial trucks, unless additional coverage is purchased.

Filing a Claim

Filing a claim with your insurance company involves a series of steps. Following these steps will help you navigate the process smoothly and ensure a timely resolution.

- Report the Accident: Immediately contact your insurance company to report the accident, providing all relevant details, including the date, time, location, and parties involved.

- Gather Information: Collect all necessary information, including the names, addresses, and insurance details of all parties involved, as well as any witnesses’ information.

- File a Claim: Submit a formal claim with your insurance company, providing all required documentation, such as police reports, medical bills, and repair estimates.

- Cooperate with the Insurance Company: Be cooperative with your insurance company’s investigation, providing any requested information and attending any scheduled appointments or meetings.

- Review the Settlement Offer: Carefully review the settlement offer provided by your insurance company and negotiate if necessary to ensure a fair resolution.

Concluding Remarks

Ultimately, choosing the best car insurance company is a personal decision. By understanding your needs, researching different companies, and comparing quotes, you can find the right coverage at a price that works for you. Remember, insurance is a crucial safety net in the event of an accident or unforeseen circumstances, so it’s essential to choose a provider you trust and feel confident with.

FAQs

How often should I review my car insurance policy?

It’s generally recommended to review your car insurance policy at least annually, or even more frequently if there are significant changes in your driving habits, vehicle, or financial situation.

What are the common discounts offered by car insurance companies?

Common discounts include good driver discounts, safe driver discounts, multi-car discounts, bundling discounts, and discounts for safety features like anti-theft devices or airbags.

What should I do if I’m involved in an accident?

If you’re involved in an accident, prioritize safety and call emergency services if needed. Then, contact your insurance company to report the accident and follow their instructions for filing a claim.