- Understanding Florida’s Unique Insurance Landscape

- Key Considerations for Choosing Car Insurance

- Comparing Top Car Insurance Providers in Florida

- Navigating Florida-Specific Coverage Options: Best Car Insurance For Florida

- Tips for Saving Money on Car Insurance in Florida

- Ending Remarks

- User Queries

Best car insurance for Florida? It’s a question many Floridians ask, given the state’s unique insurance landscape. Florida’s high car insurance rates, hurricane risk, and no-fault insurance system create a complex environment for finding the right coverage. Navigating this landscape can be challenging, but understanding the key considerations and comparing top providers can help you find the best policy for your needs.

This guide will delve into the factors that make Florida’s car insurance market distinct, discuss essential considerations for choosing insurance, and provide a comprehensive comparison of top providers. We’ll also explore Florida-specific coverage options and offer practical tips for saving money on your premiums.

Understanding Florida’s Unique Insurance Landscape

Florida’s car insurance market is distinct from other states due to several factors, including its high rates, vulnerability to hurricanes, and unique coverage requirements. Understanding these characteristics is crucial for Florida drivers seeking the best car insurance policy.

Florida’s High Car Insurance Rates

Florida has consistently ranked among the states with the highest average car insurance premiums. Several factors contribute to this, including:

- High frequency of accidents and claims: Florida has a higher than average number of car accidents, leading to more insurance claims and increased costs for insurers.

- High cost of auto repairs: The state’s warm climate and high humidity can accelerate vehicle wear and tear, leading to more frequent repairs and higher repair costs.

- High cost of healthcare: Florida has a large population of seniors and a high concentration of hospitals, leading to higher healthcare costs that impact insurance premiums.

- High legal costs: Florida has a litigious environment, with many lawsuits filed related to car accidents, increasing insurance costs to cover legal expenses.

Florida’s No-Fault Insurance System

Florida operates under a no-fault insurance system, meaning that drivers are primarily responsible for covering their own injuries and damages, regardless of fault, up to a certain limit. This system is designed to reduce lawsuits and streamline the claims process. However, it also impacts car insurance policies in several ways:

- Personal Injury Protection (PIP): All Florida drivers are required to carry PIP coverage, which covers medical expenses, lost wages, and other expenses related to injuries sustained in an accident, regardless of fault.

- Limited Tort Threshold: Drivers have the option to choose between two types of coverage: “limited tort” and “full tort.” Limited tort restricts the ability to sue for pain and suffering unless certain conditions are met, while full tort allows for unlimited lawsuits. This option impacts the cost of premiums, with limited tort typically being more affordable.

- No-Fault Threshold: Florida’s no-fault system has a “threshold” that determines when drivers can sue for pain and suffering. This threshold is typically based on the severity of the injuries. If the injuries are below the threshold, drivers are limited to recovering medical expenses and lost wages.

Key Regulatory Bodies and Laws

Several regulatory bodies and laws govern car insurance in Florida, including:

- Florida Office of Insurance Regulation (OIR): The OIR is the primary regulatory body responsible for overseeing the insurance industry in Florida. It sets rules and regulations for car insurance companies and investigates complaints against them.

- Florida Department of Highway Safety and Motor Vehicles (DHSMV): The DHSMV is responsible for issuing driver licenses and vehicle registrations, and it plays a role in enforcing car insurance requirements.

- Florida Statute 627: This statute Artikels the legal framework for car insurance in Florida, including the requirements for coverage, the no-fault system, and the process for resolving disputes.

Key Considerations for Choosing Car Insurance

Choosing the right car insurance in Florida is crucial for protecting yourself financially in the event of an accident. It’s essential to consider a range of factors to ensure you have adequate coverage at a price that fits your budget.

Understanding Coverage Types

It’s essential to understand the different types of car insurance coverage available in Florida and their benefits and limitations.

- Liability Coverage: This is the most basic type of car insurance and is required by law in Florida. It covers damages to other people’s property and injuries caused by you in an accident. This coverage does not cover your own vehicle.

- Personal Injury Protection (PIP): This coverage pays for medical expenses and lost wages for you and your passengers, regardless of who caused the accident. It is also mandatory in Florida.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. It is optional and often has a deductible.

- Comprehensive Coverage: This coverage protects your vehicle against damage from non-collision events such as theft, vandalism, natural disasters, or falling objects. It is optional and often has a deductible.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are involved in an accident with a driver who does not have adequate insurance or is uninsured. It is optional but highly recommended.

Evaluating Deductibles

A deductible is the amount you pay out of pocket before your insurance coverage kicks in.

- Higher Deductibles: Choosing a higher deductible can lower your monthly premiums, but you’ll have to pay more out of pocket if you need to file a claim.

- Lower Deductibles: Choosing a lower deductible means you’ll pay less out of pocket if you need to file a claim, but your monthly premiums will be higher.

Exploring Discounts

Insurance companies offer various discounts to help you save money on your premiums.

- Safe Driving Discounts: These discounts are offered to drivers with clean driving records and no accidents or violations.

- Good Student Discounts: These discounts are available to students who maintain a certain GPA.

- Multi-Car Discounts: These discounts are offered when you insure multiple vehicles with the same company.

- Bundling Discounts: These discounts are offered when you bundle your car insurance with other types of insurance, such as homeowners or renters insurance.

- Anti-theft Device Discounts: These discounts are offered if your vehicle has anti-theft devices installed.

Understanding Your Driving History and Risk Factors

Your driving history and risk factors play a significant role in determining your car insurance premiums.

- Accidents and Violations: Having a history of accidents or traffic violations will likely increase your premiums.

- Age and Experience: Younger and less experienced drivers are generally considered higher risk and may face higher premiums.

- Vehicle Type and Value: The type and value of your vehicle can also influence your premiums. More expensive or high-performance vehicles are often associated with higher premiums.

- Location: Your location can impact your premiums. Areas with higher rates of accidents or theft may have higher premiums.

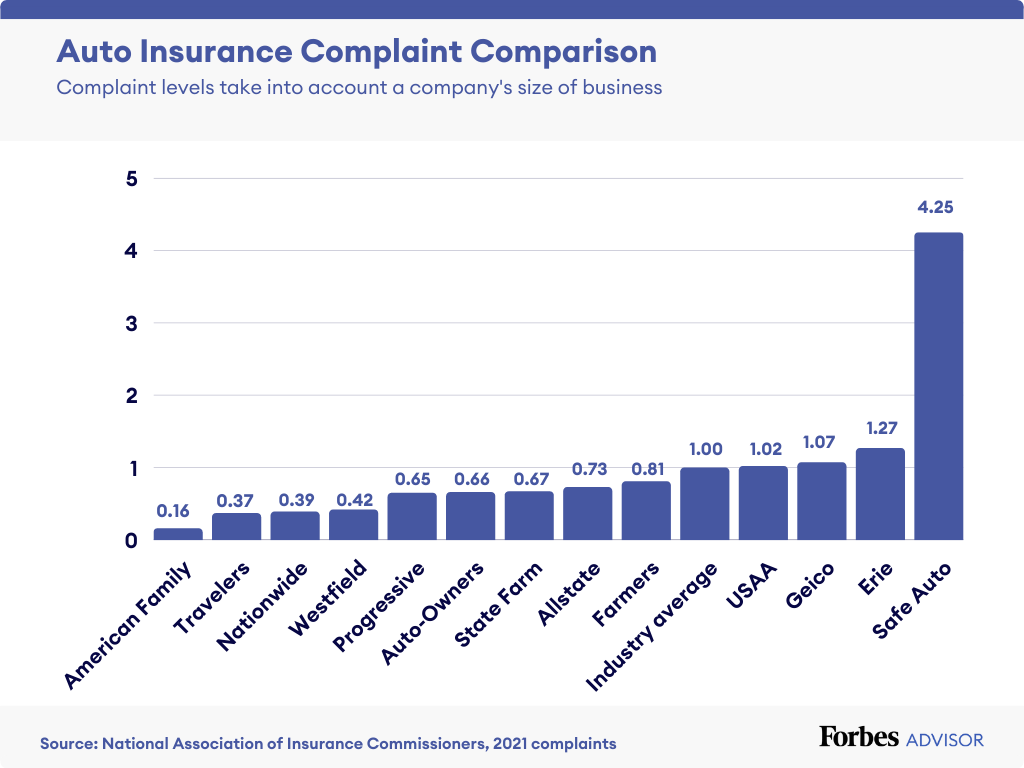

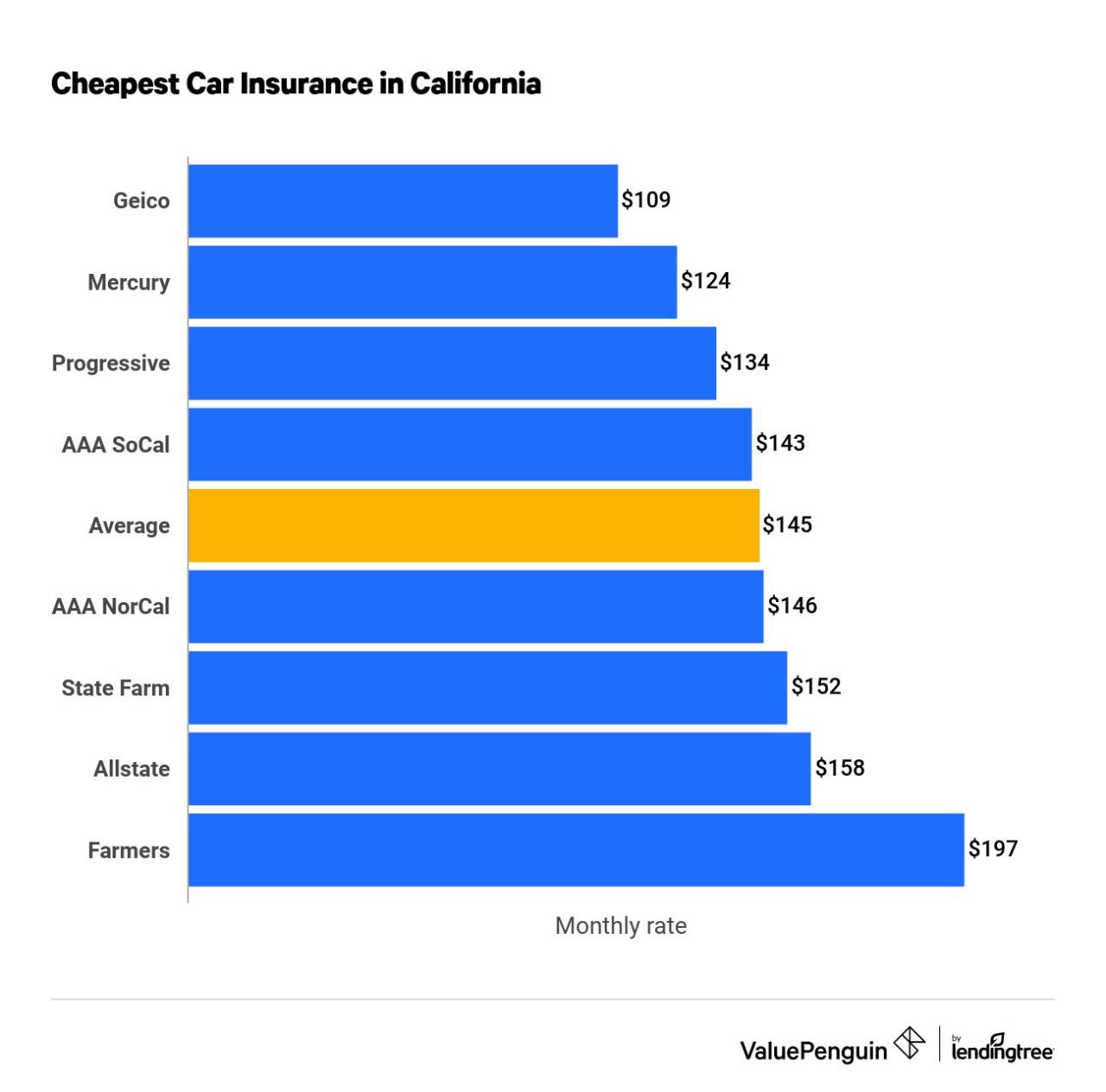

Comparing Top Car Insurance Providers in Florida

Finding the best car insurance in Florida requires careful consideration of various factors, including price, coverage, and customer service. While the best option for you will depend on your individual needs and circumstances, understanding the strengths and weaknesses of different insurers can help you make an informed decision.

Top Car Insurance Providers in Florida

| Insurer | Average Annual Premium | Customer Satisfaction | Coverage Options |

|---|---|---|---|

| State Farm | $1,500 – $2,000 | High | Comprehensive, collision, liability, personal injury protection (PIP), uninsured/underinsured motorist (UM/UIM) |

| Geico | $1,400 – $1,900 | High | Comprehensive, collision, liability, PIP, UM/UIM, rental car reimbursement |

| Progressive | $1,300 – $1,800 | Moderate | Comprehensive, collision, liability, PIP, UM/UIM, roadside assistance |

| Allstate | $1,600 – $2,100 | Moderate | Comprehensive, collision, liability, PIP, UM/UIM, accident forgiveness |

| USAA | $1,200 – $1,700 | High | Comprehensive, collision, liability, PIP, UM/UIM, military discounts |

Strengths and Weaknesses of Top Insurers

| Insurer | Strengths | Weaknesses |

|---|---|---|

| State Farm | Wide network of agents, strong customer service, comprehensive coverage options | Potentially higher premiums compared to some competitors |

| Geico | Competitive rates, convenient online and mobile services, strong financial stability | Limited availability of agents, fewer discounts compared to some competitors |

| Progressive | Innovative features like Snapshot program, customizable coverage options, strong online presence | Potentially lower customer satisfaction ratings, less personalized service |

| Allstate | Strong brand recognition, diverse coverage options, comprehensive customer support | Potentially higher premiums, limited availability of discounts |

| USAA | Highly rated customer service, competitive rates for military members, specialized discounts | Only available to military members and their families |

Comparing Quotes from Multiple Insurers

It is crucial to compare quotes from multiple insurers before making a decision. Each insurer uses different algorithms to calculate rates, and your individual circumstances can significantly impact your premium. Online quote comparison tools can help you streamline this process, but it is recommended to contact insurers directly to discuss your specific needs and get personalized quotes.

Navigating Florida-Specific Coverage Options: Best Car Insurance For Florida

Florida’s car insurance landscape presents unique challenges and opportunities. While you’ll find standard coverage options like liability and collision, the state mandates specific coverage types that are crucial to understanding and securing the right policy for your needs.

Personal Injury Protection (PIP)

Florida law requires all drivers to carry Personal Injury Protection (PIP) coverage. This coverage pays for medical expenses, lost wages, and other related costs incurred by the policyholder, regardless of who caused the accident. PIP benefits are capped at $10,000 per person, and it’s crucial to understand how PIP coverage works to ensure you have adequate protection.

PIP coverage is a “no-fault” system, meaning that your insurance company will pay for your medical expenses, regardless of who caused the accident. However, PIP benefits are limited, and you may need to pursue additional compensation through a lawsuit if your injuries exceed the PIP coverage limit.

Uninsured/Underinsured Motorist (UM/UIM) Coverage, Best car insurance for florida

Florida also mandates that all drivers carry Uninsured/Underinsured Motorist (UM/UIM) coverage. This coverage protects you in the event you’re involved in an accident with a driver who either doesn’t have insurance or has insufficient coverage to cover your damages.

In Florida, UM/UIM coverage must be equal to or greater than your bodily injury liability limits. This means that if your liability coverage is $100,000 per person and $300,000 per accident, your UM/UIM coverage must be at least $100,000 per person and $300,000 per accident.

Optional Coverages

While PIP and UM/UIM are required in Florida, other optional coverages can provide additional peace of mind and protection. Some common optional coverages include:

- Rental Car Reimbursement: This coverage pays for a rental car while your vehicle is being repaired after an accident. This can be a valuable benefit if you rely on your car for work or daily errands.

- Roadside Assistance: This coverage provides assistance in case of a flat tire, dead battery, or other roadside emergencies. This can save you time and money in the event of a breakdown.

- Comprehensive and Collision Coverage: While not required, comprehensive and collision coverage can help protect you from financial loss in the event of damage to your vehicle due to non-collision events (like theft or vandalism) or accidents.

Tips for Saving Money on Car Insurance in Florida

Florida’s car insurance market is known for its competitiveness, which translates into opportunities for drivers to secure affordable coverage. By understanding the key factors that influence insurance premiums and implementing effective strategies, you can significantly reduce your monthly costs.

Safe Driving Practices

Safe driving habits are paramount in securing lower insurance premiums. Insurance companies reward drivers with a clean record by offering discounted rates.

- Maintaining a clean driving record is crucial. Avoid traffic violations like speeding tickets, reckless driving, or DUI charges, as these can significantly increase your premiums.

- Defensive driving courses can equip you with valuable skills and knowledge to navigate the roads safely, which can lead to lower insurance costs.

- By adhering to traffic laws and driving responsibly, you minimize the risk of accidents, thus making yourself a more desirable policyholder for insurers.

Bundling Policies

Bundling your car insurance with other policies, such as homeowners or renters insurance, can often lead to significant savings.

- Insurance companies often offer discounts to policyholders who bundle multiple insurance products, recognizing the loyalty and reduced administrative costs associated with a consolidated customer base.

- Bundling your car insurance with other policies can lead to a more streamlined and convenient insurance experience, as you’ll have a single point of contact for all your insurance needs.

Utilizing Discounts

Insurance companies offer a variety of discounts to their policyholders. By taking advantage of these discounts, you can significantly reduce your premiums.

- Good student discounts are often available to students with high GPAs, demonstrating their responsible nature and lower risk profile.

- Discounts for safety features, such as anti-theft devices, airbags, and anti-lock brakes, reflect the reduced risk associated with vehicles equipped with these safety features.

- Loyalty discounts are offered to policyholders who have maintained their coverage with the same insurer for a certain period, rewarding their continued business and trust.

Vehicle Choice

The type of vehicle you drive plays a significant role in determining your insurance premiums.

- Luxury cars and high-performance vehicles are generally more expensive to insure due to their higher repair costs and greater risk of theft.

- Older vehicles, while potentially less expensive to purchase, may have higher insurance premiums due to their increased risk of mechanical failure and lack of modern safety features.

- Selecting a vehicle with a proven safety record, such as those with high safety ratings from organizations like the IIHS (Insurance Institute for Highway Safety) and NHTSA (National Highway Traffic Safety Administration), can help you secure lower insurance premiums.

Location

The location where you reside can significantly impact your car insurance premiums.

- Urban areas with high traffic density and higher rates of accidents tend to have higher insurance premiums compared to rural areas.

- Areas with a high prevalence of theft or vandalism can also result in higher insurance premiums.

- By choosing a location with a lower risk profile, you can potentially lower your insurance costs.

Negotiating Rates

Don’t hesitate to negotiate your car insurance rates with insurance companies.

- Shop around and compare quotes from multiple insurance providers to ensure you’re getting the best possible rate.

- Highlight your positive driving record and any relevant discounts you qualify for during your negotiations.

- Be prepared to explain your specific needs and requirements to ensure you’re getting the right coverage at a competitive price.

Ending Remarks

Choosing the best car insurance for Florida requires careful consideration of your individual needs and circumstances. By understanding the state’s unique insurance landscape, comparing quotes from multiple insurers, and utilizing available discounts, you can find a policy that provides adequate coverage at a reasonable price. Remember, your car insurance should provide peace of mind knowing you’re protected in case of an accident, and you can save money by making informed choices.

User Queries

What are the main reasons for high car insurance rates in Florida?

Florida’s high car insurance rates are attributed to several factors, including a high number of uninsured drivers, a large number of accidents, and the state’s no-fault insurance system, which requires all drivers to carry personal injury protection (PIP) coverage.

What is the minimum car insurance coverage required in Florida?

Florida requires all drivers to carry a minimum of $10,000 in personal injury protection (PIP), $10,000 in property damage liability, and $10,000 in bodily injury liability per person and $20,000 per accident. However, it’s generally recommended to carry higher limits for better protection.

How can I get a discount on my car insurance in Florida?

There are several ways to get a discount on your car insurance in Florida, including safe driving practices, bundling policies, maintaining good credit, taking a defensive driving course, and choosing a vehicle with safety features.