- Understanding Florida’s Unique Insurance Landscape

- Key Considerations for Choosing Car Insurance in Florida

- Exploring Popular Car Insurance Providers in Florida: Best Car Insurance In Florida

- Navigating Car Insurance Claims in Florida

- Understanding Florida’s Unique Insurance Laws and Regulations

- Addressing Common Car Insurance Concerns in Florida

- Final Thoughts

- Questions and Answers

Finding the best car insurance in Florida can be a daunting task, given the state’s unique insurance landscape. Florida’s high population density, frequent lawsuits, and hurricane risks all contribute to a more complex insurance market than in other states. Navigating the complexities of Florida’s “no-fault” system and understanding the importance of Personal Injury Protection (PIP) coverage are essential for securing the right insurance policy.

This guide will delve into the key considerations for choosing car insurance in Florida, exploring popular insurance providers, and providing strategies for saving money on your premiums. We’ll also discuss the intricacies of filing claims and navigating Florida’s unique insurance laws and regulations. By the end, you’ll have a comprehensive understanding of the Florida car insurance market and be equipped to make informed decisions for your specific needs.

Understanding Florida’s Unique Insurance Landscape

Florida’s car insurance market is distinct from other states due to several factors, including its susceptibility to natural disasters, high population density, and a litigious environment. These factors contribute to a complex and often expensive insurance landscape for Florida drivers.

Florida’s Unique Risk Profile

Florida’s location on the Atlantic coast makes it particularly vulnerable to hurricanes, which can cause significant damage to vehicles and property. The state also experiences frequent thunderstorms, hailstorms, and other severe weather events that can lead to insurance claims. This elevated risk of natural disasters drives up insurance premiums for Florida drivers.

High Population Density and Traffic Congestion

Florida is one of the most populous states in the US, with a high concentration of vehicles on the road. This dense population leads to increased traffic congestion, which in turn raises the likelihood of accidents and insurance claims.

Litigious Environment

Florida is known for its high number of lawsuits, particularly in the area of personal injury. This litigious environment can increase insurance costs as insurers face a greater risk of being sued and paying out large settlements.

Role of the Florida Department of Financial Services

The Florida Department of Financial Services (DFS) plays a critical role in regulating the insurance industry in the state. The DFS is responsible for licensing and overseeing insurance companies, ensuring their financial stability, and protecting consumers from unfair or deceptive practices. The DFS also sets minimum insurance requirements for Florida drivers, including coverage limits for bodily injury liability, property damage liability, and personal injury protection (PIP).

History of Car Insurance in Florida

The history of car insurance in Florida is marked by several significant changes and events that have shaped the current market.

- 1940s: The Florida Legislature introduced the first mandatory insurance requirements for drivers, including coverage for bodily injury liability and property damage liability.

- 1970s: Florida introduced a no-fault insurance system, requiring drivers to carry personal injury protection (PIP) coverage to cover their own medical expenses in the event of an accident, regardless of fault.

- 1990s: The Florida Legislature passed several reforms aimed at reducing insurance costs, including caps on medical expenses covered by PIP and limits on attorney fees in accident cases.

- 2000s: The state experienced a series of hurricanes, including Andrew in 1992 and Katrina in 2005, which caused billions of dollars in damages and led to a spike in insurance premiums.

- 2010s: The Florida Legislature passed further reforms aimed at stabilizing the insurance market and addressing the high cost of premiums, including the creation of the Florida Hurricane Catastrophe Fund, which provides reinsurance coverage to insurers in the event of a major hurricane.

Key Considerations for Choosing Car Insurance in Florida

Choosing the right car insurance in Florida involves more than just finding the cheapest option. It requires a comprehensive understanding of your needs, the state’s unique insurance landscape, and the various coverage options available. This guide will walk you through key considerations to help you make an informed decision.

Coverage Types

It’s essential to understand the different types of car insurance coverage available in Florida and how they relate to your specific needs. Here’s a breakdown:

- Liability Coverage: This is the most basic type of car insurance, legally required in Florida. It covers damages and injuries you cause to others in an accident, including property damage and medical expenses.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in a collision with another vehicle or object, regardless of fault. It’s often optional but highly recommended, especially if you have a financed or leased vehicle.

- Comprehensive Coverage: This coverage protects your vehicle against damages caused by non-collision events like theft, vandalism, fire, or natural disasters. Like collision coverage, it’s optional but can be valuable depending on your vehicle’s value and your risk tolerance.

- Personal Injury Protection (PIP): This coverage is mandatory in Florida and covers your own medical expenses, lost wages, and other related costs following an accident, regardless of fault. PIP benefits are capped at $10,000, and you can choose a lower limit, but it’s generally recommended to keep the full amount.

Deductibles

Deductibles are the amounts you pay out-of-pocket before your insurance coverage kicks in. Choosing the right deductible can impact your premiums significantly.

- Higher Deductible: A higher deductible means you pay more out-of-pocket in the event of a claim but generally results in lower premiums.

- Lower Deductible: A lower deductible means you pay less out-of-pocket but typically leads to higher premiums.

It’s crucial to consider your financial situation and risk tolerance when deciding on a deductible. If you can comfortably afford a higher deductible, you can potentially save on premiums. However, if you’re concerned about unexpected expenses, a lower deductible might provide more peace of mind.

Premiums

Premiums are the monthly or annual payments you make for your car insurance. Several factors influence your premium, including:

- Driving History: Your driving record, including accidents, tickets, and violations, significantly affects your premium. A clean driving history usually translates to lower premiums.

- Vehicle Type: The make, model, and year of your vehicle impact your premium. Higher-value vehicles and those with a history of theft or accidents often have higher premiums.

- Age and Gender: Your age and gender can influence your premium, with younger drivers typically paying more due to higher risk.

- Location: Where you live can affect your premium, as rates are influenced by factors like traffic density, crime rates, and weather conditions.

- Coverage Limits: The amount of coverage you choose, such as the liability limits and PIP coverage, directly impacts your premium. Higher coverage limits generally mean higher premiums.

- Discounts: Several discounts are available to reduce your premium, such as good driver discounts, safe driving courses, multi-car discounts, and bundling insurance policies.

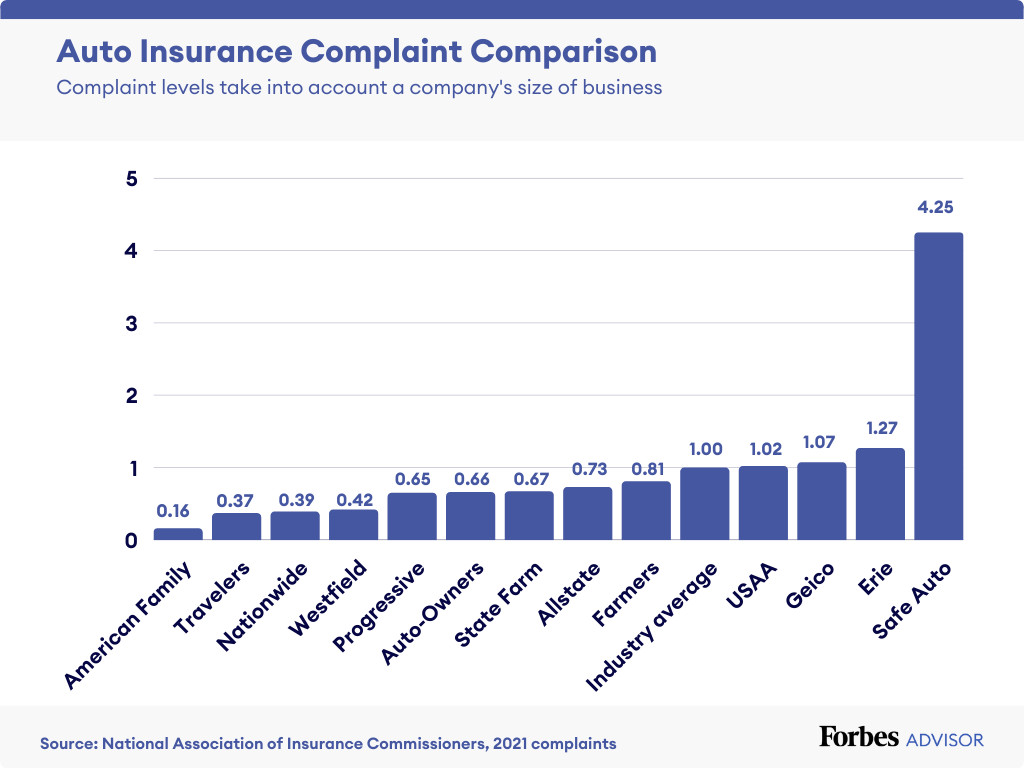

Customer Service

Customer service is crucial when choosing car insurance. You want an insurer that is responsive, helpful, and easy to work with, especially during a claim. Consider factors like:

- Availability: Look for an insurer with accessible customer service channels, such as phone, email, and online chat.

- Responsiveness: Ensure the insurer responds promptly to your inquiries and concerns.

- Claim Process: Research the insurer’s claim process and how smoothly it operates.

- Reputation: Check online reviews and ratings to gauge the insurer’s overall customer satisfaction.

Understanding Florida’s “No-Fault” System

Florida operates under a “no-fault” insurance system. This means that after an accident, your own PIP coverage will cover your medical expenses, regardless of who was at fault. You can then pursue a claim against the at-fault driver for additional damages, such as lost wages or pain and suffering. However, there are limits on these “fault” claims.

- PIP Coverage: As mentioned earlier, PIP coverage is mandatory in Florida and covers your medical expenses, lost wages, and other related costs up to $10,000. You can choose a lower limit, but it’s generally recommended to keep the full amount.

- “Threshold” for Fault Claims: In Florida, you can only pursue a “fault” claim against the other driver if your injuries meet a specific “threshold,” typically defined as “serious injury” or “permanent injury.” This threshold can be challenging to meet, and you should consult with an attorney to understand its implications.

- “No-Fault” System: This system aims to expedite the claims process and reduce litigation. However, it can be complex and requires careful consideration of your coverage options and the potential implications of “fault” claims.

Exploring Popular Car Insurance Providers in Florida: Best Car Insurance In Florida

Florida’s diverse insurance market offers a wide range of providers, each with its unique strengths and offerings. Understanding the key features, coverage options, and customer experiences of these providers is crucial for making an informed decision.

Major Car Insurance Companies in Florida

This table provides a snapshot of some of the major car insurance companies operating in Florida, highlighting their key features, coverage options, and customer reviews.

| Company | Key Features | Coverage Options | Customer Reviews |

|---|---|---|---|

| State Farm | Wide range of discounts, strong financial stability, extensive agent network | Comprehensive, collision, liability, personal injury protection (PIP), uninsured/underinsured motorist (UM/UIM) | Generally positive reviews, praised for customer service and claims handling |

| Geico | Known for competitive pricing, convenient online and mobile services | Comprehensive, collision, liability, PIP, UM/UIM, rental car coverage | Mixed reviews, some praise for affordability, others criticize customer service |

| Progressive | Offers a variety of coverage options, including unique programs like “Name Your Price” | Comprehensive, collision, liability, PIP, UM/UIM, roadside assistance | Mixed reviews, some appreciate the customization options, others find the claims process challenging |

| Allstate | Strong financial stability, offers a range of discounts and coverage options | Comprehensive, collision, liability, PIP, UM/UIM, accident forgiveness | Mixed reviews, some praise for customer service, others find the pricing less competitive |

| USAA | Exclusive to military members and their families, known for excellent customer service and claims handling | Comprehensive, collision, liability, PIP, UM/UIM, roadside assistance | Highly positive reviews, consistently ranked among the best for customer satisfaction |

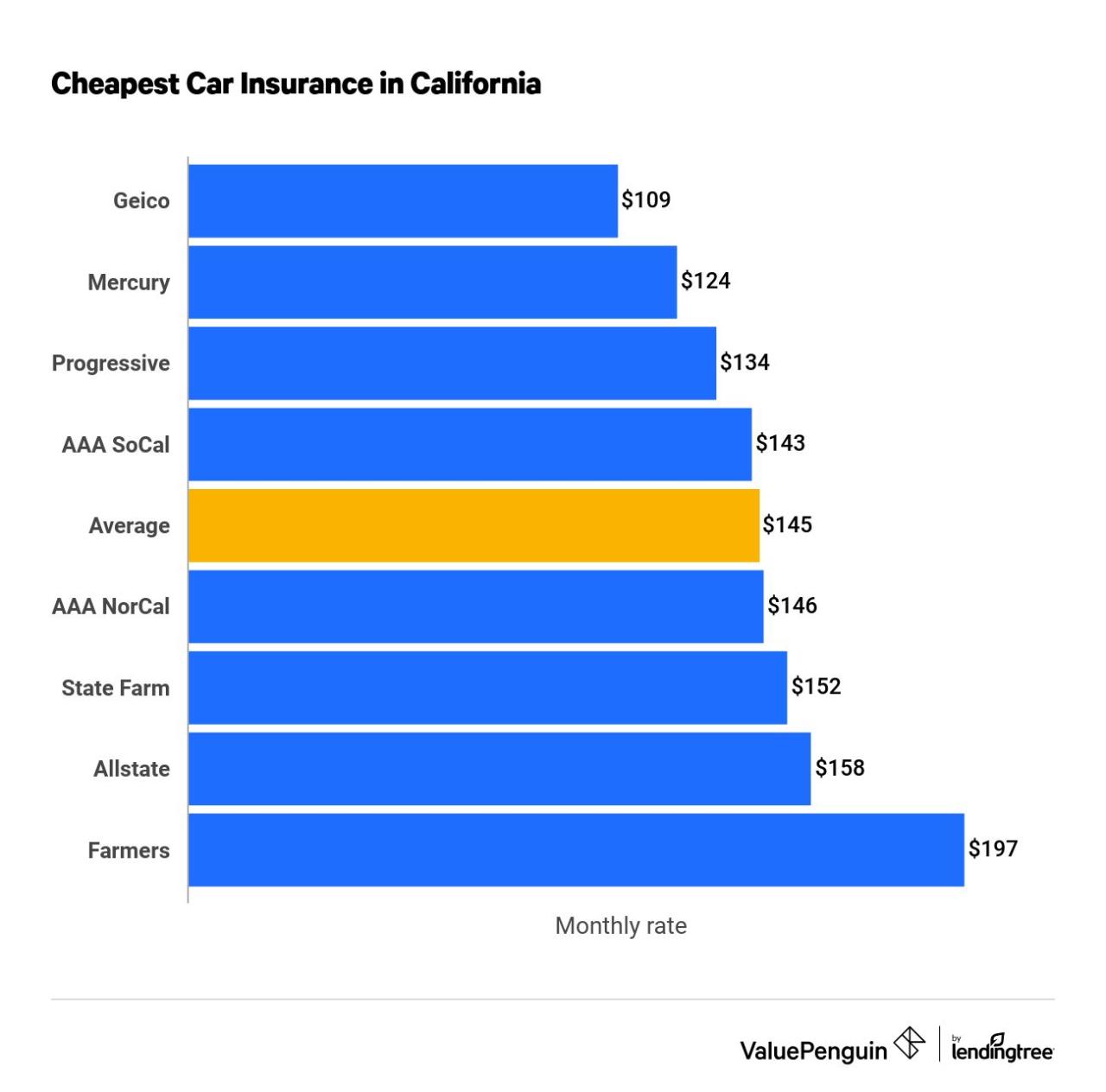

Average Premiums Charged by Insurance Companies, Best car insurance in florida

This table compares the average premiums charged by different insurance companies for various car profiles, considering factors like age, driving history, and vehicle type.

| Company | Age | Driving History | Vehicle Type | Average Premium |

|---|---|---|---|---|

| State Farm | 30 | Clean | Sedan | $1,500 |

| Geico | 30 | Clean | Sedan | $1,400 |

| Progressive | 30 | Clean | Sedan | $1,600 |

| Allstate | 30 | Clean | Sedan | $1,700 |

| USAA | 30 | Clean | Sedan | $1,300 |

Strengths and Weaknesses of Insurance Providers

This table highlights the strengths and weaknesses of each insurance provider, focusing on aspects like customer service, claims processing, and financial stability.

| Company | Strengths | Weaknesses |

|---|---|---|

| State Farm | Strong financial stability, extensive agent network, wide range of discounts | Pricing can be higher than competitors |

| Geico | Competitive pricing, convenient online and mobile services | Customer service can be inconsistent, claims processing can be slow |

| Progressive | Offers a variety of coverage options, unique programs like “Name Your Price” | Claims process can be challenging, customer service can be difficult to reach |

| Allstate | Strong financial stability, offers a range of discounts and coverage options | Pricing can be less competitive, customer service can be inconsistent |

| USAA | Excellent customer service and claims handling, strong financial stability | Only available to military members and their families |

Navigating Car Insurance Claims in Florida

Filing a car insurance claim in Florida can be a complex process, especially for first-time claimants. Understanding the steps involved and the different types of claims is crucial for a smooth and successful outcome. This section will provide a comprehensive guide to help you navigate the claims process effectively.

Steps to Take After an Accident

After a car accident, immediate action is crucial to protect yourself and your claim. Here’s a step-by-step guide:

- Ensure Safety: Prioritize the safety of yourself and others involved. If necessary, call emergency services (911).

- Exchange Information: Gather contact information from all parties involved, including their insurance details, driver’s license numbers, and vehicle registration information.

- Document the Accident: Take photographs of the damage to all vehicles involved, the accident scene, and any injuries sustained.

- Report the Accident: Contact your insurance company to report the accident as soon as possible. Provide them with all the information you gathered.

- Seek Medical Attention: Even if you feel fine, seek medical attention immediately. Any injuries, even minor ones, should be documented.

- Avoid Making Admissions of Fault: Do not admit fault or apologize for the accident, as this could be used against you in the claims process.

Documentation Requirements for Car Insurance Claims

To ensure a smooth claims process, you need to provide your insurance company with the necessary documentation. This typically includes:

- Police Report: If the accident involved property damage exceeding $500 or resulted in injuries, a police report is mandatory.

- Medical Records: If you sustained injuries, provide your insurance company with medical records from the treating physician.

- Repair Estimates: Obtain estimates from qualified repair shops for the damage to your vehicle.

- Photographs: The photographs you took at the accident scene will be valuable evidence for your claim.

- Witness Statements: If there were witnesses to the accident, obtain their contact information and statements.

Understanding Different Types of Car Insurance Claims

Florida law requires drivers to carry certain types of car insurance, and understanding these types is essential when filing a claim. Here’s a breakdown:

- Collision Coverage: This coverage pays for damage to your vehicle caused by an accident, regardless of fault.

- Comprehensive Coverage: This coverage protects your vehicle against damage caused by events other than collisions, such as theft, vandalism, or natural disasters.

- Liability Coverage: This coverage protects you financially if you are at fault for an accident that causes injury or damage to another person or property.

- Personal Injury Protection (PIP): This coverage, also known as “no-fault” insurance, covers your medical expenses and lost wages following an accident, regardless of who was at fault.

Potential Challenges and Disputes in the Claims Process

While the claims process should be straightforward, there can be challenges and disputes that arise. These may include:

- Disagreements Over Fault: Determining fault in an accident can be complex, especially if there are multiple parties involved.

- Insurance Company Delays: Insurance companies may delay the claims process for various reasons, such as requesting additional documentation or investigating the accident.

- Denial of Coverage: Insurance companies may deny coverage based on policy exclusions or other factors.

- Disputes Over Settlement Amount: The insurance company may offer a settlement amount that you consider insufficient to cover your losses.

Strategies for Resolving Disputes

If you encounter challenges or disputes in the claims process, here are some strategies for resolving them effectively:

- Keep Detailed Records: Document all communication with your insurance company, including dates, times, and the content of conversations.

- Be Persistent: Follow up regularly with your insurance company and advocate for your rights.

- Seek Legal Advice: If you are unable to resolve a dispute with your insurance company, consider consulting with a qualified attorney specializing in insurance law.

Understanding Florida’s Unique Insurance Laws and Regulations

Florida’s car insurance landscape is distinct due to its “no-fault” system and unique regulations. This system aims to simplify accident claims and expedite compensation for medical expenses, but it also presents specific considerations for drivers.

Florida’s “No-Fault” Insurance Law

Florida’s “no-fault” insurance law, also known as the “Personal Injury Protection (PIP) Law,” significantly impacts how car insurance claims are handled. This law requires all drivers to carry PIP coverage, which provides medical benefits to the insured individual regardless of fault in an accident.

This means that after an accident, your own insurance company will cover your medical expenses, regardless of who caused the accident. However, there are limits on the amount of PIP coverage you can receive.

Personal Injury Protection (PIP) Coverage

PIP coverage in Florida is mandatory for all drivers and covers medical expenses related to accidents. It acts as a first-party benefit, meaning your own insurance company will pay for your medical bills, regardless of fault.

Here are the key aspects of PIP coverage in Florida:

- Coverage Limits: The minimum PIP coverage required in Florida is $10,000 per person. However, you can choose higher limits for more extensive coverage.

- Benefits Covered: PIP coverage typically covers medical expenses, including doctor’s visits, hospital stays, and rehabilitation costs. However, there are some limitations on what types of treatments are covered.

- 80/20 Rule: Florida has an 80/20 rule for PIP coverage, meaning your insurance company will pay 80% of your medical bills, and you are responsible for the remaining 20% (up to the coverage limit). However, this rule does not apply to emergency services.

- Deductibles: Some PIP policies may have deductibles, meaning you are responsible for paying a certain amount out-of-pocket before your insurance coverage kicks in.

Florida’s Financial Responsibility Laws

Florida’s financial responsibility laws establish minimum liability insurance requirements for all drivers. These laws aim to ensure that drivers have adequate coverage to compensate others for damages caused by an accident.

- Minimum Liability Coverage: Florida law requires drivers to carry a minimum of $10,000 in Personal Injury Protection (PIP) coverage, $10,000 in Property Damage Liability (PDL) coverage, and $10,000 in Bodily Injury Liability (BIL) coverage per person, with a total limit of $20,000 per accident.

- Financial Responsibility Certificate: Drivers must provide proof of insurance to the Department of Motor Vehicles (DMV) to maintain a valid driver’s license and vehicle registration. This proof is typically in the form of a financial responsibility certificate.

- Penalties for Non-Compliance: Failure to comply with Florida’s financial responsibility laws can result in fines, license suspension, and even vehicle impoundment.

Addressing Common Car Insurance Concerns in Florida

Navigating the intricacies of car insurance in Florida can be challenging, especially for those unfamiliar with the state’s unique laws and regulations. Understanding common concerns and potential pitfalls can help drivers make informed decisions and avoid costly mistakes.

The Risks of Driving Uninsured or Underinsured in Florida

Driving without adequate car insurance in Florida carries significant risks, both legal and financial. Florida is a “no-fault” state, meaning that drivers are primarily responsible for covering their own injuries and damages following an accident, regardless of fault. However, this does not absolve drivers from liability for the injuries or damages they cause to others.

- Legal Consequences: Driving uninsured or underinsured in Florida is illegal and can result in severe penalties, including:

- Fines: Drivers caught driving without insurance can face fines of up to $1,000 for a first offense, and even higher penalties for subsequent offenses.

- License Suspension: The Florida Department of Motor Vehicles (DMV) can suspend the driver’s license of those who fail to maintain the required minimum car insurance coverage.

- Vehicle Impoundment: In some cases, the vehicle itself may be impounded until the driver provides proof of insurance.

- Criminal Charges: Driving without insurance may also lead to criminal charges, especially in cases involving accidents with injuries or fatalities.

- Financial Implications: The financial consequences of driving uninsured or underinsured can be devastating, particularly in the event of an accident.

- Medical Expenses: Without insurance, drivers are responsible for covering their own medical bills, which can be substantial, especially in serious accidents.

- Property Damage: If the driver is at fault for an accident, they will be responsible for repairing or replacing any damaged property, including their own vehicle and any other vehicles involved.

- Legal Fees: If the driver is sued by the other party involved in the accident, they will be responsible for covering legal fees and court costs.

Understanding Florida’s “Fault” System

While Florida is a “no-fault” state for personal injury protection (PIP), it remains a “fault” state for liability coverage. This means that the driver at fault for an accident is generally responsible for covering the damages and injuries of the other party.

- Liability Coverage: Liability coverage in Florida is designed to protect drivers from financial losses resulting from their negligence in causing an accident. It covers the following:

- Bodily Injury Liability: Pays for the medical expenses, lost wages, and pain and suffering of the other party involved in the accident.

- Property Damage Liability: Pays for repairs or replacement of the other party’s vehicle or other property damaged in the accident.

- Determining Fault: Determining fault in an accident can be complex, and it often involves investigations by law enforcement and insurance companies. The following factors are typically considered:

- Police Reports: The police report filed at the scene of the accident provides a detailed account of the incident, including witness statements and the officer’s assessment of fault.

- Witness Statements: Statements from witnesses to the accident can provide valuable insights into the events leading up to the accident.

- Evidence: Physical evidence such as skid marks, damage to vehicles, and road conditions can help determine the cause of the accident.

Navigating Car Insurance Claims in Florida

Filing a car insurance claim in Florida can be a complex process, requiring careful attention to detail and communication.

- Documentation: Thorough documentation is essential for a successful claim.

- Police Report: Obtain a copy of the police report filed at the scene of the accident.

- Medical Records: If you have sustained injuries, gather all medical records related to the accident.

- Vehicle Repair Estimates: Obtain estimates for repairs to your vehicle from reputable repair shops.

- Photographs: Take photographs of the accident scene, vehicle damage, and any injuries sustained.

- Communication: Clear and timely communication with your insurance company is crucial.

- Notify Your Insurance Company: Report the accident to your insurance company as soon as possible.

- Follow Instructions: Carefully follow your insurance company’s instructions regarding filing a claim and providing documentation.

- Keep Records: Maintain a detailed record of all communications with your insurance company, including dates, times, and the content of conversations.

- Negotiation: Be prepared to negotiate with your insurance company regarding the settlement of your claim.

- Understand Your Coverage: Review your insurance policy carefully to understand your coverage limits and benefits.

- Seek Legal Advice: If you are dissatisfied with your insurance company’s settlement offer, consider consulting with an attorney who specializes in car insurance claims.

Final Thoughts

Choosing the best car insurance in Florida involves a careful consideration of your individual needs and financial situation. By understanding the nuances of the state’s insurance market, researching different providers, and implementing smart strategies for saving money, you can secure a policy that offers the right coverage at a competitive price. Remember to compare quotes, read reviews, and prioritize customer service when making your final decision. Armed with the right knowledge and a proactive approach, you can find the best car insurance in Florida and drive with peace of mind.

Questions and Answers

What are the minimum car insurance requirements in Florida?

Florida requires all drivers to carry at least $10,000 in Personal Injury Protection (PIP) coverage, $10,000 in Property Damage Liability (PDL), and $10,000 in Bodily Injury Liability (BIL) per person, and $20,000 per accident.

What is the “no-fault” system in Florida?

Florida operates under a “no-fault” system, where drivers are required to file claims with their own insurance company, regardless of who is at fault in an accident. This system aims to simplify the claims process and reduce lawsuits.

How can I save money on my car insurance in Florida?

You can save money on car insurance in Florida by bundling policies, maintaining a good driving record, taking advantage of discounts, opting for higher deductibles, and reducing coverage levels.