Best car insurance in Illinois? Finding the right coverage for your needs in the Land of Lincoln can be a bit of a wild ride. With so many different companies and plans out there, it’s easy to get lost in the details. But don’t worry, we’re here to help you navigate the insurance maze and find the perfect policy for your driving situation. We’ll break down everything you need to know about Illinois car insurance requirements, top providers, and tips for saving money.

From understanding your minimum liability coverage to exploring unique discounts and features, we’ll make sure you’re equipped to make the best decision for your wallet and peace of mind. Whether you’re a seasoned driver or just starting out, we’ll guide you through the process and help you avoid any unexpected bumps in the road.

Understanding Illinois Car Insurance Requirements: Best Car Insurance In Illinois

Navigating the world of car insurance in Illinois can feel like driving through a Chicago snowstorm – confusing and a little scary. But don’t worry, we’re here to help you understand the rules of the road when it comes to car insurance in the Land of Lincoln.

Illinois requires all drivers to have a minimum amount of liability insurance to cover potential damages caused to others in an accident. Think of it like a safety net for your fellow drivers, and trust us, you want that net!

Minimum Liability Insurance Requirements in Illinois

Illinois mandates that all drivers carry a minimum amount of liability insurance, which covers damages to others in an accident. This coverage is divided into two parts:

- Bodily Injury Liability: This covers medical expenses, lost wages, and pain and suffering for injuries caused to others in an accident. The minimum requirement is $25,000 per person and $50,000 per accident.

- Property Damage Liability: This covers damages to another person’s vehicle or property in an accident. The minimum requirement is $20,000.

Understanding Different Types of Car Insurance Coverage

While minimum liability coverage is required, you can also opt for additional coverage to protect yourself and your vehicle. Here’s a breakdown of the most common types:

- Collision Coverage: This covers damage to your vehicle in an accident, regardless of who is at fault. If you’re financing your car, your lender might require collision coverage.

- Comprehensive Coverage: This covers damage to your vehicle caused by non-accident events, like theft, vandalism, or natural disasters. It’s a good idea to consider comprehensive coverage if you have a newer or more expensive vehicle.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with a driver who doesn’t have enough insurance or no insurance at all. This is a good idea, especially if you drive in areas with a high number of uninsured drivers.

- Personal Injury Protection (PIP): This coverage helps pay for your medical expenses, lost wages, and other expenses related to injuries you sustain in an accident, regardless of who is at fault. It’s optional in Illinois, but it can be a valuable addition to your policy.

Factors Influencing Car Insurance Premiums in Illinois

Your car insurance premium, or the amount you pay for your policy, is determined by a number of factors, including:

- Driving Record: A clean driving record with no accidents or violations will generally result in lower premiums. On the other hand, a history of accidents, speeding tickets, or DUI convictions will likely increase your premiums.

- Age and Gender: Younger and less experienced drivers often pay higher premiums, as they are statistically more likely to be involved in accidents. Gender can also play a role in premium calculations, with men generally paying more than women.

- Vehicle Type and Value: Sports cars and luxury vehicles tend to be more expensive to insure due to their higher repair costs and potential for greater damage in an accident. Older vehicles, on the other hand, may have lower premiums due to their lower value.

- Location: Where you live can affect your car insurance premiums. Areas with higher rates of car theft, accidents, or vandalism will generally have higher premiums. For example, you might pay more for insurance in Chicago than in a rural area of Illinois.

- Credit Score: Your credit score can also influence your car insurance premium. While this practice is not universal, some insurance companies believe that individuals with good credit are less likely to file claims, which can result in lower premiums.

- Coverage Levels: The type and amount of coverage you choose will also affect your premium. Higher coverage limits generally mean higher premiums.

- Deductible: Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible generally means a lower premium, while a lower deductible means a higher premium.

Top Car Insurance Providers in Illinois

Choosing the right car insurance provider in Illinois can feel like navigating a maze of options. But don’t worry, we’re here to help you find the perfect fit! Illinois is a state with a diverse population, and as a result, has a wide range of car insurance companies offering a variety of coverage options and pricing. We’ve taken the guesswork out of the equation and compiled a list of the top 5 providers in Illinois based on customer satisfaction, coverage options, and pricing.

Top Car Insurance Providers in Illinois

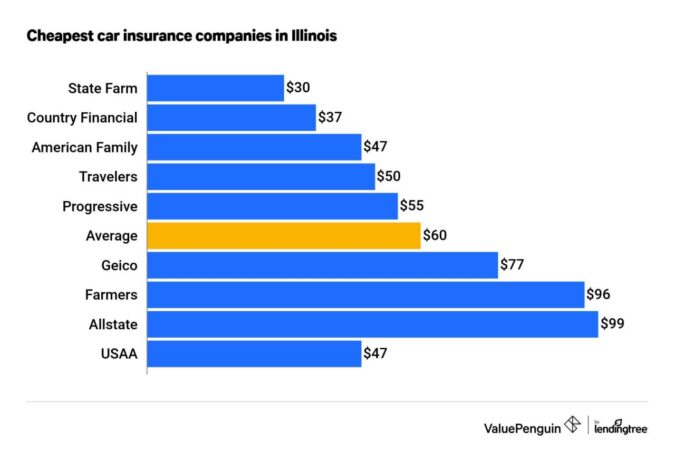

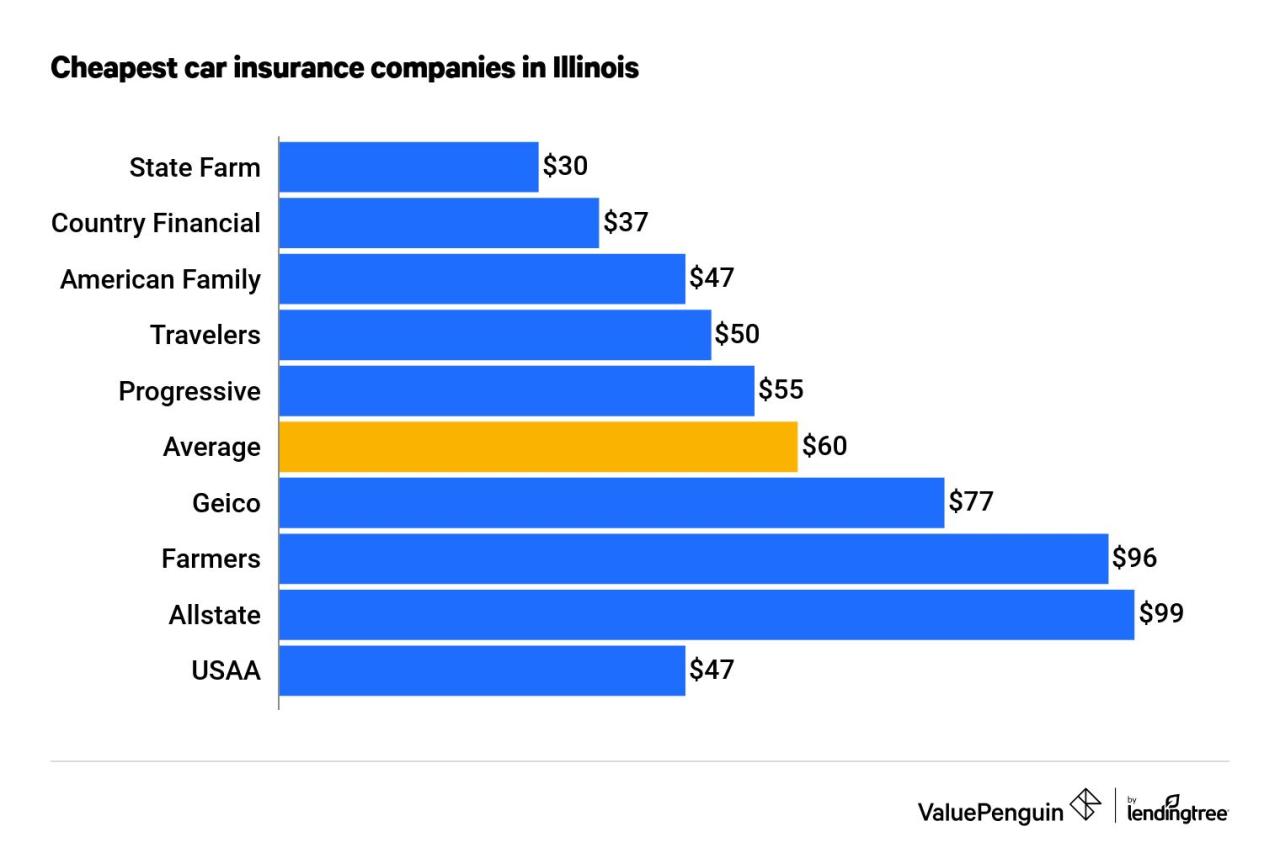

Finding the best car insurance for you requires considering several factors, including price, coverage, and customer service. Here are the top 5 car insurance providers in Illinois, based on data from J.D. Power and other reputable sources:

| Insurance Company Name | Average Premium | Customer Satisfaction Rating | Key Coverage Options |

|---|---|---|---|

| State Farm | $1,300 | 4.5/5 | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Personal Injury Protection, Medical Payments Coverage |

| GEICO | $1,200 | 4.2/5 | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Personal Injury Protection, Medical Payments Coverage |

| Allstate | $1,400 | 4.0/5 | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Personal Injury Protection, Medical Payments Coverage |

| Progressive | $1,350 | 3.8/5 | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Personal Injury Protection, Medical Payments Coverage |

| Farmers Insurance | $1,450 | 3.5/5 | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Personal Injury Protection, Medical Payments Coverage |

Factors to Consider When Choosing Car Insurance

Finding the best car insurance in Illinois is like finding the perfect pair of jeans: it’s all about finding the right fit for your needs and budget. But with so many different insurance providers and policies available, it can be tough to know where to start.

To make the process easier, consider these important factors:

Comparing Quotes

Comparing quotes from multiple insurers is crucial to finding the best deal. This is like shopping around for the best price on a new TV: you wouldn’t buy the first one you see, would you? The same applies to car insurance. By getting quotes from several companies, you can compare coverage options and prices to ensure you’re getting the best value for your money.

Factors Influencing Premiums

Several factors can influence your car insurance premiums, so it’s important to understand how these factors affect your bottom line.

- Driving History: Your driving history is like your resume for car insurance. A clean record with no accidents or traffic violations will generally lead to lower premiums. But if you’ve got a history of fender benders or speeding tickets, you can expect to pay more.

- Vehicle Type: The type of car you drive is a big factor in your insurance premiums. Think of it this way: a flashy sports car is like a celebrity – it’s going to attract more attention and potentially cost more to insure. A more practical sedan, on the other hand, is like a regular person – less attention, less cost.

- Location: Where you live can also affect your car insurance rates. If you live in a bustling city with a lot of traffic, you’re more likely to get into an accident, so your premiums will be higher. If you live in a rural area with fewer cars on the road, your premiums will likely be lower.

Credit Score

You might be thinking, “What does my credit score have to do with my car insurance?” In Illinois, insurers can use your credit score to determine your premiums. It’s like a secret code that reveals your financial responsibility. A good credit score suggests you’re financially responsible, which means you’re less likely to file a claim, so you’ll get lower premiums. But if your credit score is lower, you might face higher premiums.

Tips for Saving Money on Car Insurance

You’ve got your Illinois car insurance, but you want to make sure you’re getting the best deal. Here are some tips for saving money on your car insurance premiums:

Maintain a Good Driving Record, Best car insurance in illinois

Maintaining a good driving record is essential for keeping your car insurance premiums low. A clean driving record demonstrates that you’re a responsible driver, and insurance companies reward this behavior with lower rates. Avoid traffic violations like speeding tickets, reckless driving, and driving under the influence, as these will significantly increase your premiums.

Bundle Insurance Policies

Bundling your car insurance with other insurance policies, like homeowners or renters insurance, can lead to significant savings. Insurance companies often offer discounts for bundling multiple policies, as it reduces their risk and administrative costs.

Explore Discounts

Many insurance companies offer discounts to policyholders who meet specific criteria. Here are some common discounts you might be eligible for:

- Good Student Discount: This discount is available to students who maintain a certain GPA or academic standing.

- Safe Driver Discount: This discount is often given to drivers who have a clean driving record and haven’t been involved in any accidents.

- Anti-theft Device Discount: If you have anti-theft devices installed in your car, you may be eligible for a discount. These devices help deter theft, which reduces the risk for insurance companies.

- Multi-car Discount: If you insure multiple vehicles with the same company, you may qualify for a multi-car discount.

- Loyalty Discount: Some insurance companies offer discounts to long-term customers who have maintained their policies for a certain period.

Increase Your Deductible

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Increasing your deductible can lower your premiums, as you’re essentially taking on more financial responsibility. However, it’s important to consider your financial situation and ensure you can afford to pay a higher deductible if you need to file a claim.

Review Your Insurance Policies Regularly

Your insurance needs can change over time, so it’s important to review your policies regularly. You may be able to lower your premiums by making adjustments to your coverage, such as removing unnecessary add-ons or increasing your deductible. It’s also a good idea to compare quotes from different insurance companies to ensure you’re getting the best rate.

Understanding Claims and Coverage

You’ve got your Illinois car insurance policy, but what happens when you need to use it? Understanding how to file a claim and the different types of coverage you have is crucial to navigating the process smoothly.

Filing a Claim in Illinois

Filing a car insurance claim in Illinois is typically a straightforward process. Here’s what you can expect:

1. Contact your insurance company: After an accident, the first step is to contact your insurance company as soon as possible. You can typically do this by phone, online, or through their mobile app.

2. Provide information: You’ll need to provide details about the accident, including the date, time, location, and any injuries or damages.

3. File a claim: Your insurance company will guide you through the claim filing process, which may involve completing a form or providing additional documentation.

4. Investigation: The insurance company will investigate the accident to determine fault and assess the extent of the damages.

5. Payment: Once the investigation is complete, your insurance company will process your claim and pay for covered expenses, such as repairs, medical bills, or lost wages.

Types of Coverage and Their Applications

Car insurance policies in Illinois typically include several types of coverage, each designed to protect you in different situations:

- Liability coverage: This is the most common type of car insurance and is required by law in Illinois. It covers damages to other people’s property and injuries to others if you are at fault in an accident.

- Collision coverage: This coverage pays for repairs to your vehicle if it is damaged in an accident, regardless of fault.

- Comprehensive coverage: This coverage protects your vehicle against damages from events other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/underinsured motorist coverage: This coverage protects you if you are injured in an accident caused by a driver who does not have insurance or has insufficient insurance.

- Medical payments coverage: This coverage pays for medical expenses for you and your passengers, regardless of who is at fault in an accident.

Common Car Insurance Claims

Here are some examples of common car insurance claims and how they are typically handled:

- Accident involving another vehicle: If you are at fault, your liability coverage will pay for the other driver’s damages and injuries. If you are not at fault, the other driver’s liability coverage should cover your damages.

- Hit-and-run accident: If you are hit by an uninsured driver, your uninsured motorist coverage will pay for your damages and injuries.

- Vehicle theft: Your comprehensive coverage will pay for the replacement or repair of your stolen vehicle.

- Damage from a natural disaster: Your comprehensive coverage will pay for repairs or replacement of your vehicle if it is damaged by a natural disaster, such as a hailstorm or flood.

Conclusion

So, buckle up and get ready to hit the road with confidence! By understanding your needs, comparing quotes, and taking advantage of available discounts, you can find the best car insurance in Illinois and keep your finances safe while cruising down the highway. Remember, knowledge is power, and when it comes to car insurance, it can save you a whole lot of dough. Now, go forth and conquer the world of car insurance, one policy at a time!

Quick FAQs

What is the minimum car insurance coverage required in Illinois?

Illinois requires all drivers to have minimum liability coverage, including $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $20,000 for property damage.

How does my credit score affect my car insurance premiums in Illinois?

Illinois allows insurance companies to consider your credit score when determining your premiums. A good credit score can lead to lower rates, while a poor credit score may result in higher premiums.

What are some common car insurance claims in Illinois?

Common claims include accidents, theft, vandalism, and weather-related damage. Your coverage will determine how your claim is handled and what benefits you’re eligible for.