- Understanding Florida’s Car Insurance Market

- Finding Affordable Car Insurance Options

- Factors Influencing Car Insurance Costs: Best Cheap Car Insurance Florida

- Tips for Lowering Car Insurance Premiums

- Understanding Insurance Coverage

- Avoiding Common Mistakes

- Conclusive Thoughts

- Essential Questionnaire

Best cheap car insurance Florida is a hot topic for many residents, especially considering the state’s unique insurance landscape. Florida’s high population density, prevalence of uninsured drivers, and frequent weather events all contribute to higher car insurance premiums. Navigating this complex market can feel daunting, but finding affordable coverage is possible with the right knowledge and strategies.

This guide delves into the intricacies of Florida’s car insurance market, providing valuable insights and actionable tips for securing the best cheap car insurance in the state. We’ll explore the factors influencing insurance costs, discuss different coverage options, and share strategies for lowering your premiums. Whether you’re a new driver, seasoned veteran, or simply looking to save money on your insurance, this guide will equip you with the tools and information you need to make informed decisions.

Understanding Florida’s Car Insurance Market

Florida’s car insurance market is complex and unique, influenced by a combination of factors that drive premiums higher than in many other states. Understanding these factors is crucial for Florida drivers seeking affordable car insurance.

Florida’s Unique Factors Influencing Car Insurance Costs

Florida’s car insurance market is influenced by several factors that contribute to higher premiums.

- Weather Patterns: Florida’s susceptibility to hurricanes and other severe weather events significantly increases the risk of car accidents and damage, leading to higher insurance premiums.

- High Population Density: Florida’s large population and heavy traffic contribute to a higher frequency of accidents, which in turn drives up insurance costs.

- Prevalence of Uninsured Drivers: Florida has a high percentage of uninsured drivers, which increases the financial burden on insured drivers when involved in accidents with uninsured motorists.

Florida’s No-Fault Insurance System

Florida’s no-fault insurance system requires all drivers to carry Personal Injury Protection (PIP) coverage, which covers medical expenses and lost wages following an accident, regardless of fault. This system aims to reduce litigation and expedite claims processing. However, it can also contribute to higher premiums as drivers are required to carry PIP coverage, even if they prefer to opt out.

Key Regulations and Laws Governing Car Insurance in Florida

Florida has specific regulations and laws governing car insurance, including minimum liability coverage requirements.

- Minimum Liability Coverage Requirements: Florida law requires all drivers to carry a minimum amount of liability insurance, including $10,000 for bodily injury per person, $20,000 for bodily injury per accident, and $10,000 for property damage per accident. These minimum requirements may not be sufficient to cover all potential damages in a serious accident.

- Financial Responsibility Law: Florida’s Financial Responsibility Law requires drivers to provide proof of financial responsibility, such as car insurance, to demonstrate their ability to pay for damages caused by an accident. Failure to comply can result in fines and license suspension.

Finding Affordable Car Insurance Options

Navigating the world of car insurance in Florida can feel like a maze, especially when trying to find the most affordable option. However, with a strategic approach, you can significantly reduce your premiums and ensure you’re getting the best value for your money. This section delves into practical tips, reputable providers, and essential coverage considerations to help you find the right car insurance policy for your needs and budget.

Comparing Quotes from Multiple Insurers

The most crucial step in finding cheap car insurance is to compare quotes from multiple insurers. Each company uses its own pricing algorithms, considering factors like your driving history, vehicle type, and location. By obtaining quotes from several insurers, you can identify the best rates and potentially save hundreds of dollars annually.

Exploring Discounts

Most car insurance companies offer various discounts that can significantly reduce your premiums. These discounts can be based on factors like:

- Good driving record: Maintaining a clean driving record with no accidents or violations can qualify you for significant discounts.

- Safety features: Cars equipped with safety features like anti-theft devices, airbags, and anti-lock brakes often receive lower insurance rates.

- Bundling policies: Combining your car insurance with other policies like homeowners or renters insurance can result in substantial savings.

- Membership discounts: Organizations like AARP, AAA, and professional associations may offer discounts to their members.

- Student discounts: Good students with high GPAs may qualify for reduced premiums.

- Military discounts: Active military personnel and veterans often receive special discounts.

Negotiating Premiums

Don’t be afraid to negotiate your premiums. Once you’ve received quotes from multiple insurers, contact the companies with the most attractive offers and inquire about potential discounts or adjustments. Be prepared to discuss your driving history, safety features, and any other relevant factors that might qualify you for lower rates.

Reputable Car Insurance Providers in Florida

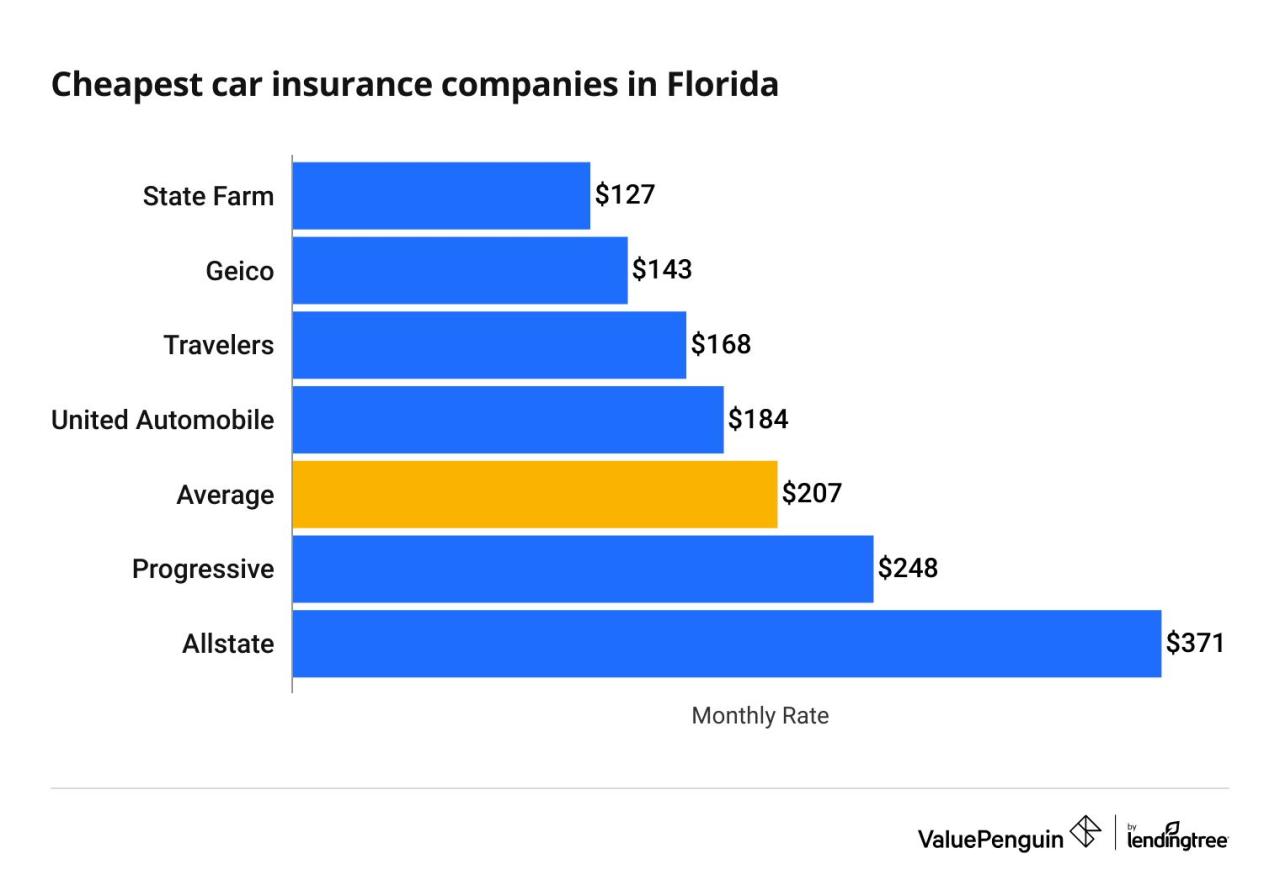

Several reputable car insurance providers are known for offering competitive rates in Florida. Here are a few to consider:

- State Farm: State Farm is a well-established insurer with a wide range of coverage options and discounts.

- Geico: Geico is known for its competitive rates and user-friendly online platform.

- Progressive: Progressive offers a variety of insurance products, including specialized coverage for unique vehicles like motorcycles and RVs.

- USAA: USAA is a highly-rated insurer that specializes in serving military members and their families.

- Allstate: Allstate offers a wide range of coverage options and discounts, including Drive Safe & Save, which rewards safe driving habits.

Understanding Different Types of Car Insurance Coverage

Understanding the different types of car insurance coverage is crucial to choosing the right policy for your needs and budget. Here’s a breakdown of the most common types of coverage:

- Liability Coverage: This coverage is legally required in Florida and protects you financially if you cause an accident that results in injuries or property damage to others.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who’s at fault.

- Comprehensive Coverage: This coverage protects your vehicle against damage from non-accident events, such as theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): This coverage pays for medical expenses and lost wages for you and your passengers, regardless of who’s at fault in an accident.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough coverage to cover your damages.

Factors Influencing Car Insurance Costs: Best Cheap Car Insurance Florida

Several factors influence car insurance premiums in Florida, making it crucial to understand these elements to find the most affordable coverage. Understanding how these factors impact your rates can help you make informed decisions about your car insurance policy and potentially save money.

Driving History

Your driving history is a significant factor in determining your car insurance premiums. Insurance companies assess your risk based on your past driving behavior, including accidents, traffic violations, and driving record.

- Accidents: A recent accident, even if you were not at fault, can significantly increase your premiums. Insurance companies view accidents as an indicator of higher risk.

- Traffic Violations: Speeding tickets, reckless driving, and other traffic violations can also increase your rates. Each violation adds to your risk profile, making you a less desirable customer for insurance companies.

- Driving Record: A clean driving record with no accidents or violations is a significant advantage when seeking car insurance. It demonstrates a lower risk to insurance companies, leading to potentially lower premiums.

Age

Age is another important factor that influences car insurance rates. Younger drivers, particularly those under 25, are generally considered higher risk due to their lack of experience and higher likelihood of accidents.

- Younger Drivers: Younger drivers often face higher premiums because they have less experience behind the wheel and are statistically more likely to be involved in accidents.

- Mature Drivers: Older drivers, particularly those over 65, may also see slightly higher rates due to potential health concerns or reduced reaction times. However, they often benefit from experience and safer driving habits.

Vehicle Type

The type of vehicle you drive plays a significant role in determining your car insurance premiums. Insurance companies assess the risk associated with different vehicles based on factors such as safety features, repair costs, and theft risk.

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and stability control, are often considered safer and may result in lower premiums.

- Repair Costs: Vehicles with higher repair costs, such as luxury cars or high-performance models, tend to have higher insurance premiums. This is because insurance companies need to cover the cost of repairs in case of an accident.

- Theft Risk: Vehicles that are more susceptible to theft, such as popular models or those with valuable components, may have higher insurance premiums. Insurance companies need to account for the potential cost of replacing a stolen vehicle.

Location

Your location, specifically the zip code where your vehicle is registered, can significantly impact your car insurance premiums. Insurance companies consider the frequency of accidents, crime rates, and other risk factors in different areas.

- High-Risk Areas: Areas with higher crime rates, traffic congestion, or a history of accidents may have higher insurance premiums. Insurance companies need to account for the increased risk of accidents or theft in these locations.

- Low-Risk Areas: Conversely, areas with lower crime rates, less traffic, and fewer accidents may have lower insurance premiums. Insurance companies may offer discounts for drivers residing in these areas due to lower risk.

Credit Score

In Florida, your credit score can impact your car insurance premiums. While it may seem unrelated, insurance companies use credit scores as an indicator of financial responsibility and risk.

A good credit score generally indicates responsible financial behavior, which can lead to lower insurance premiums. Conversely, a poor credit score may suggest a higher risk of financial instability, potentially resulting in higher rates.

Discounts, Best cheap car insurance florida

Several discounts can help you lower your car insurance premiums in Florida. Understanding these discounts and qualifying for them can save you money on your insurance policy.

| Discount Type | Description |

|---|---|

| Safe Driving Discount | Offered to drivers with a clean driving record, no accidents, and no traffic violations. |

| Good Student Discount | Available to students who maintain a certain GPA or academic standing. |

| Multi-Car Discount | Offered to policyholders who insure multiple vehicles with the same insurance company. |

| Anti-Theft Device Discount | Offered to drivers who install anti-theft devices, such as alarms or GPS tracking systems, in their vehicles. |

| Defensive Driving Course Discount | Available to drivers who complete a defensive driving course, demonstrating their commitment to safe driving practices. |

Tips for Lowering Car Insurance Premiums

In Florida’s competitive car insurance market, finding affordable coverage is essential. Fortunately, there are several strategies you can implement to reduce your premiums and save money. By understanding the factors influencing insurance costs and taking proactive steps, you can significantly lower your monthly payments.

Improving Driving Habits

Safe driving practices are crucial for lowering insurance premiums. Insurance companies reward drivers with a clean record and a history of responsible driving.

- Avoid Speeding: Exceeding the speed limit increases the risk of accidents, leading to higher insurance rates.

- Maintain a Safe Distance: Tailgating or following too closely can contribute to accidents, resulting in increased premiums.

- Avoid Distracted Driving: Using a cell phone, texting, or engaging in other distractions while driving can lead to accidents and higher insurance costs.

- Be Aware of Your Surroundings: Pay attention to your surroundings and anticipate potential hazards to avoid accidents.

Increasing Deductibles

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. By increasing your deductible, you can lower your monthly premiums.

- Higher Deductibles, Lower Premiums: A higher deductible means you’ll pay more in the event of an accident, but your monthly premiums will be lower.

- Consider Your Financial Situation: Before increasing your deductible, ensure you can afford to pay the higher amount in case of an accident.

- Balance Risk and Cost: Carefully weigh the potential savings against the risk of having to pay a higher deductible.

Bundling Insurance Policies

Bundling multiple insurance policies, such as car, home, or renters insurance, with the same insurer can often result in significant discounts.

- Discounts for Multiple Policies: Insurance companies often offer discounts for bundling multiple policies, as it demonstrates customer loyalty and reduces administrative costs.

- Compare Bundled Rates: Shop around and compare quotes from different insurers to find the best bundled rates.

- Review Your Coverage Needs: Ensure the bundled policies meet your specific needs and coverage requirements.

Participating in Driver Safety Courses

Enrolling in driver safety courses can demonstrate your commitment to safe driving and potentially lead to discounts on your insurance premiums.

- Proof of Safe Driving Practices: Driver safety courses provide training on defensive driving techniques and traffic laws, highlighting your commitment to safe driving.

- Discounts Offered by Insurers: Many insurance companies offer discounts for completing approved driver safety courses.

- Check Eligibility Requirements: Contact your insurance provider to inquire about eligibility requirements and available discounts for driver safety courses.

Maintaining a Good Driving Record

A clean driving record is essential for obtaining affordable car insurance rates. Traffic violations can significantly increase your premiums.

- Impact of Traffic Violations: Speeding tickets, reckless driving, and DUI convictions can lead to higher insurance premiums, sometimes for several years.

- Consequences of Accidents: Being involved in accidents, even if you are not at fault, can also increase your insurance rates.

- Defensive Driving Strategies: Practice defensive driving techniques to avoid accidents and maintain a clean driving record.

Understanding Insurance Coverage

Navigating the world of car insurance in Florida can be complex, but understanding the different types of coverage available is essential for making informed decisions. This section will delve into the various types of car insurance coverage offered in Florida, explaining their benefits and importance in protecting you and your vehicle.

Liability Coverage

Liability coverage is the most basic and often legally required type of car insurance in Florida. It protects you financially if you cause an accident that results in injuries or property damage to others. Liability coverage typically includes two main components:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages to individuals injured in an accident that you caused.

- Property Damage Liability: This coverage pays for repairs or replacement costs for damage to another person’s vehicle or property that you caused in an accident.

Florida’s minimum liability coverage requirements are 10/20/10, which means you must have at least $10,000 in bodily injury liability coverage per person, $20,000 in bodily injury liability coverage per accident, and $10,000 in property damage liability coverage. However, it’s crucial to consider that these minimums may not be sufficient to cover the costs of a serious accident.

Collision Coverage

Collision coverage protects you financially if your vehicle is damaged in an accident, regardless of who is at fault. This coverage pays for repairs or replacement costs for your vehicle, minus your deductible. If you have a loan or lease on your vehicle, your lender may require you to carry collision coverage.

Comprehensive Coverage

Comprehensive coverage provides financial protection for damage to your vehicle caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters. It also pays for repairs or replacement costs, minus your deductible. Like collision coverage, your lender may require you to carry comprehensive coverage.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage is essential in Florida, a state with a high number of uninsured drivers. This coverage protects you and your passengers if you are involved in an accident caused by an uninsured or underinsured driver.

- Uninsured Motorist Coverage: This coverage pays for your medical expenses, lost wages, and other damages if you are injured in an accident caused by a driver without insurance.

- Underinsured Motorist Coverage: This coverage supplements the liability coverage of the other driver if it’s not enough to cover your losses.

In Florida, you are automatically offered UM/UIM coverage, but you can choose to waive it. However, it’s highly recommended to keep this coverage, as it can provide critical financial protection in the event of an accident with an uninsured or underinsured driver.

Comparing Car Insurance Coverage

| Coverage Type | Benefits | Required in Florida? |

|---|---|---|

| Liability Coverage | Protects you financially if you cause an accident that results in injuries or property damage to others. | Yes (minimum requirements of 10/20/10) |

| Collision Coverage | Protects you financially if your vehicle is damaged in an accident, regardless of who is at fault. | No |

| Comprehensive Coverage | Provides financial protection for damage to your vehicle caused by events other than collisions. | No |

| Uninsured/Underinsured Motorist Coverage | Protects you and your passengers if you are involved in an accident caused by an uninsured or underinsured driver. | Offered automatically but can be waived. |

Avoiding Common Mistakes

In the quest for the most affordable car insurance in Florida, it’s easy to make mistakes that can cost you more in the long run. Understanding common pitfalls and how to avoid them is crucial to securing the best possible coverage at a price that fits your budget.

Choosing the Wrong Coverage

It’s tempting to opt for the cheapest car insurance policy available, but skimping on coverage can leave you financially vulnerable in the event of an accident. For example, choosing only the minimum required liability coverage might seem like a good way to save money, but it could leave you personally liable for significant expenses if you’re involved in a serious accident.

Failing to Shop Around

Many people assume that their current insurance provider offers the best rates, but this is often not the case. Insurance companies use different algorithms to calculate premiums, and what might be a good deal for one person might not be for another.

“Always shop around for car insurance quotes from multiple providers. Don’t just rely on your current insurer or the first quote you get.”

Not Taking Advantage of Available Discounts

Insurance companies offer a variety of discounts that can significantly reduce your premiums. These discounts might be based on factors like:

- Good driving record

- Safety features in your car

- Bundling multiple insurance policies

- Paying your premium in full

It’s important to ask your insurance provider about all the discounts you may qualify for and ensure you’re taking advantage of them.

Conclusive Thoughts

Finding the best cheap car insurance in Florida requires a proactive approach. By understanding the unique characteristics of the state’s insurance market, exploring different coverage options, and taking advantage of available discounts, you can secure affordable protection for your vehicle. Remember, comparison shopping, maintaining a good driving record, and choosing the right coverage are crucial steps towards achieving both affordability and peace of mind.

Essential Questionnaire

What are the minimum car insurance requirements in Florida?

Florida requires drivers to have a minimum of $10,000 in Personal Injury Protection (PIP), $10,000 in Property Damage Liability (PDL), and $10,000 in Bodily Injury Liability (BIL) per person and $20,000 per accident.

How does my credit score affect my car insurance rates in Florida?

Insurance companies in Florida can use your credit score to determine your car insurance rates. A higher credit score generally leads to lower premiums.

What are some common car insurance discounts available in Florida?

Common discounts include safe driving discounts, good student discounts, multi-car discounts, and bundling discounts.

What are some tips for lowering my car insurance premiums in Florida?

Consider increasing your deductible, maintaining a clean driving record, taking driver safety courses, and bundling your insurance policies.