- Understanding Florida’s Car Insurance Landscape: Best Cheap Car Insurance In Florida

- Key Factors to Consider When Choosing Cheap Car Insurance

- Exploring Affordable Car Insurance Options in Florida

-

Saving Money on Car Insurance in Florida

- Understanding Discounts and Bundling Options

- Exploring Telematics Programs

- Maintaining a Good Driving Record

- Choosing the Right Coverage and Deductible

- Comparing Quotes from Multiple Insurers

- Benefits and Drawbacks of Online Comparison Websites

- Benefits and Drawbacks of Independent Insurance Agents

- Filing a Car Insurance Claim

- Wrap-Up

- FAQs

Finding the best cheap car insurance in Florida can be a daunting task, given the state’s unique insurance landscape. Florida is known for its high population density, hurricane risk, and a significant number of uninsured drivers, all of which contribute to higher insurance premiums. Navigating the complexities of Florida’s “no-fault” insurance system adds another layer of challenge. However, with careful planning and research, you can secure affordable car insurance that provides adequate coverage without breaking the bank.

Understanding the factors that influence car insurance costs in Florida is crucial. Your driving history, vehicle type, age, and location all play a significant role in determining your premiums. Additionally, exploring discounts, such as good driver discounts, safe driver courses, and multi-car discounts, can significantly impact your overall insurance costs. Comparing quotes from multiple insurance providers is essential to ensure you’re getting the best possible rates.

Understanding Florida’s Car Insurance Landscape: Best Cheap Car Insurance In Florida

Florida’s car insurance market is unique and complex, shaped by several factors that influence premiums and coverage options. This guide explores the key aspects of Florida’s car insurance landscape to help you make informed decisions about your coverage.

Factors Influencing Car Insurance Costs in Florida

Florida’s car insurance rates are higher than the national average, primarily due to several factors:

- High Population Density: Florida’s dense population leads to increased traffic congestion and the likelihood of accidents, which drive up insurance costs.

- Hurricane Risk: Florida is highly susceptible to hurricanes, which can cause significant damage to vehicles. Insurance companies factor in this risk by charging higher premiums.

- High Rate of Uninsured Drivers: Florida has a large number of uninsured drivers, increasing the financial burden on insured drivers when accidents occur. This is due to the state’s “no-fault” system, which allows drivers to file claims with their own insurance companies regardless of fault.

- Fraudulent Claims: Florida has a history of insurance fraud, which can inflate premiums for all drivers. This is particularly true for personal injury protection (PIP) claims, where fraudulent claims are more common.

Types of Car Insurance Coverage in Florida

Florida law requires drivers to carry specific types of car insurance coverage, including:

- Liability Coverage: This coverage protects you financially if you cause an accident that results in injuries or property damage to others. It includes bodily injury liability and property damage liability.

- Personal Injury Protection (PIP): This coverage pays for your medical expenses and lost wages after an accident, regardless of who is at fault. It’s mandatory in Florida, with a minimum coverage requirement of $10,000.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. It’s optional but highly recommended.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, or natural disasters. It’s optional but recommended, especially if you have a newer or more expensive vehicle.

Florida’s “No-Fault” Insurance System, Best cheap car insurance in florida

Florida operates under a “no-fault” insurance system, meaning that drivers file claims with their own insurance companies after an accident, regardless of who is at fault. This system aims to expedite the claims process and reduce lawsuits. However, it also contributes to the high cost of insurance in Florida.

“Florida’s no-fault system is a double-edged sword. While it aims to streamline the claims process, it also encourages more claims and increases the overall cost of insurance.”

- Benefits of No-Fault:

- Faster Claims Processing: Drivers can file claims with their own insurers, eliminating the need to determine fault immediately.

- Reduced Lawsuits: The system encourages drivers to seek compensation from their own insurers, reducing the number of lawsuits.

- Drawbacks of No-Fault:

- Higher Premiums: The system encourages more claims, leading to higher premiums for all drivers.

- Increased Fraud: The ease of filing claims under no-fault has led to an increase in fraudulent claims, particularly for PIP coverage.

- Limited Compensation: No-fault coverage limits the amount of compensation you can receive for injuries, even if the other driver was at fault.

Key Factors to Consider When Choosing Cheap Car Insurance

Finding affordable car insurance in Florida is crucial for most drivers. Numerous factors can influence your insurance rates, and understanding these factors can help you find the best possible deal.

Factors Influencing Your Car Insurance Rates

Several factors play a significant role in determining your car insurance premiums. Understanding these factors can help you make informed decisions and potentially lower your costs.

- Driving History: Your driving record is one of the most critical factors affecting your insurance rates. A clean driving record with no accidents or traffic violations will generally result in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions can significantly increase your rates.

- Vehicle Type: The type of car you drive also plays a significant role in your insurance costs. Sports cars, luxury vehicles, and high-performance models are generally considered riskier to insure and often have higher premiums. Older, less expensive cars may have lower premiums, but you might consider factoring in potential repair costs if the vehicle is older.

- Age: Your age can also influence your insurance rates. Younger drivers, especially those under 25, are often considered higher risks due to their lack of experience. As you age and gain more experience, your premiums may decrease.

- Location: The location where you live can significantly impact your insurance rates. Areas with higher crime rates or more frequent accidents may have higher premiums. Additionally, the cost of living and repair costs in your region can also affect your insurance rates.

Discounts and Their Impact

Several discounts can help you lower your car insurance premiums. Taking advantage of these discounts can significantly impact your overall costs.

- Good Driver Discounts: Maintaining a clean driving record can qualify you for good driver discounts. These discounts can significantly reduce your premiums, reflecting your responsible driving habits.

- Safe Driver Courses: Completing a defensive driving course can also earn you a discount. These courses teach you safe driving practices and can help reduce your risk of accidents, potentially leading to lower insurance rates.

- Multi-Car Discounts: If you insure multiple vehicles with the same insurance company, you may qualify for a multi-car discount. This discount is often offered as an incentive for bundling your policies, leading to lower premiums for all your vehicles.

Comparing Quotes from Multiple Providers

Once you understand the factors that influence your insurance rates, it’s essential to compare quotes from multiple insurance providers. This comparison allows you to find the best possible rates and coverage options for your needs.

- Online Comparison Tools: Many online comparison tools allow you to enter your information and receive quotes from multiple insurance providers simultaneously. This process can save you time and effort, making it easier to find the best deal.

- Direct Contact: You can also contact insurance providers directly to obtain quotes. This approach allows you to ask questions and get personalized recommendations.

Exploring Affordable Car Insurance Options in Florida

Finding the right car insurance policy in Florida can be a challenge, especially when you’re on a tight budget. With so many insurance providers and policy options, it can be difficult to navigate the landscape and find the most affordable option that meets your needs. This section will guide you through understanding the various types of car insurance policies available, comparing top providers, and providing tips on negotiating lower premiums.

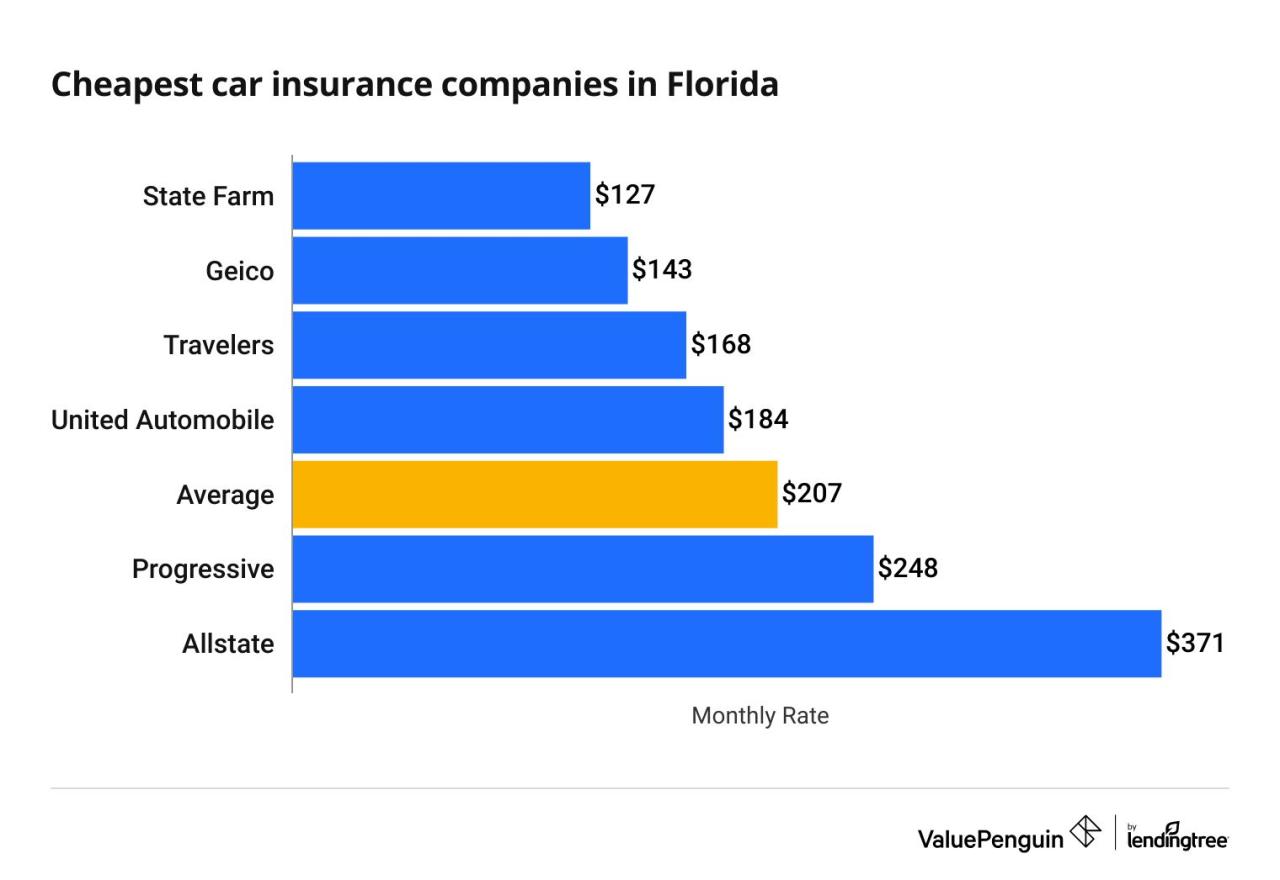

Comparing Top Affordable Car Insurance Providers

To help you find the best fit, here’s a comparison of the top 5 most affordable car insurance providers in Florida based on average rates, key features, and customer satisfaction ratings:

| Provider | Average Annual Rate | Key Features | Customer Satisfaction Rating |

|---|---|---|---|

| State Farm | $1,500 | Wide coverage options, discounts for bundling, strong customer service | 4.5/5 |

| Geico | $1,450 | Competitive rates, easy online quote process, 24/7 customer service | 4/5 |

| Progressive | $1,400 | Customizable policies, usage-based discounts, innovative features like Snapshot | 4/5 |

| USAA | $1,350 | Exclusive rates for military members and their families, excellent customer service | 4.7/5 |

| Florida Peninsula Insurance | $1,300 | Specialized coverage for Florida drivers, competitive rates, strong financial stability | 4.2/5 |

These rates are estimates and can vary based on individual factors like driving history, age, vehicle type, and location.

Understanding Different Types of Car Insurance Policies

Car insurance policies in Florida are categorized based on the level of coverage they provide. Understanding these categories will help you choose the most suitable option for your needs and budget:

- Minimum Coverage (Liability Only): This is the most basic level of coverage required by law in Florida. It covers damages to other people’s property and injuries to others in case of an accident you cause. It does not cover your own vehicle or injuries. This is the cheapest option but offers the least protection.

- Full Coverage: This comprehensive coverage includes liability, collision, and comprehensive coverage. Collision coverage covers damages to your vehicle in case of an accident, while comprehensive coverage covers damages from theft, vandalism, natural disasters, and other non-collision incidents. This is the most expensive option but provides the most protection.

- Customized Options: Many insurance providers offer customizable policies that allow you to choose specific coverages based on your needs and budget. This can include add-ons like rental car reimbursement, uninsured/underinsured motorist coverage, and personal injury protection (PIP).

Negotiating Lower Insurance Premiums

There are several strategies you can employ to lower your car insurance premiums in Florida:

- Bundle Your Policies: Combining your car insurance with other policies like home or renters insurance can earn you significant discounts. This is a common practice among many insurance providers.

- Increase Your Deductible: Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Increasing your deductible can lower your premium, but it means you’ll have to pay more in case of an accident. Carefully consider your financial situation before increasing your deductible.

- Explore Alternative Coverage Options: Consider exploring alternative coverage options like usage-based insurance, which uses telematics devices to track your driving habits and offer discounts for safe driving. You can also inquire about discounts for good driving records, safety features in your car, and membership in certain organizations.

- Shop Around and Compare Quotes: It’s always a good idea to compare quotes from multiple insurance providers before making a decision. This allows you to find the most competitive rates and the best coverage options for your specific needs.

Saving Money on Car Insurance in Florida

Finding affordable car insurance in Florida is crucial, especially given the state’s high rates. Luckily, various strategies can help you significantly reduce your premiums. By implementing these tips, you can potentially save hundreds of dollars annually on your car insurance.

Understanding Discounts and Bundling Options

Insurance companies offer various discounts to reduce your premiums. These discounts can be based on factors like your driving history, vehicle safety features, and even your occupation. It’s important to explore all available discounts and ensure you’re taking advantage of them. Bundling your car insurance with other policies, such as homeowners or renters insurance, can also lead to substantial savings.

Exploring Telematics Programs

Telematics programs use devices or smartphone apps to track your driving habits, such as speed, braking, and mileage. By demonstrating safe driving behavior, you can earn discounts on your insurance premiums. These programs provide real-time feedback on your driving and can help you improve your overall driving habits.

Maintaining a Good Driving Record

One of the most significant factors influencing your car insurance premiums is your driving history. Maintaining a clean driving record is essential for keeping your rates low. Avoid traffic violations, accidents, and other incidents that could increase your premiums.

Choosing the Right Coverage and Deductible

Selecting the right car insurance coverage and deductible can significantly impact your premiums. Higher deductibles typically result in lower premiums. However, it’s crucial to choose a deductible you can afford in case of an accident. Carefully consider your financial situation and risk tolerance when making this decision.

Comparing Quotes from Multiple Insurers

Getting quotes from multiple insurance companies is essential for finding the best rates. Online insurance comparison websites and independent insurance agents can help you quickly compare quotes from various insurers.

Benefits and Drawbacks of Online Comparison Websites

Online comparison websites offer a convenient and efficient way to compare quotes from multiple insurers. They typically provide a user-friendly interface and allow you to customize your search based on your specific needs. However, these websites may not always offer all available insurance options or provide personalized advice.

Benefits and Drawbacks of Independent Insurance Agents

Independent insurance agents work with multiple insurance companies, providing you with a broader range of options. They can offer personalized advice and help you understand the different coverage options available. However, they may not always have access to the same discounts as direct insurers.

Filing a Car Insurance Claim

Filing a car insurance claim can be a stressful process. However, understanding the process and following these steps can help ensure a smooth and efficient experience.

- Contact your insurance company as soon as possible after the accident.

- Provide all necessary information, such as the date, time, and location of the accident, as well as details about the other parties involved.

- File a police report if required by your state’s laws.

- Gather evidence, such as photographs, witness statements, and medical records.

- Follow your insurance company’s instructions and deadlines for filing the claim.

Wrap-Up

Finding the best cheap car insurance in Florida involves a combination of understanding the state’s unique insurance landscape, considering key factors that influence your premiums, and actively seeking out affordable options. By carefully evaluating your needs, comparing quotes, and exploring available discounts, you can secure car insurance that provides adequate coverage without exceeding your budget. Remember, taking the time to research and compare options is crucial for securing the best possible rates and ensuring you’re protected on the road.

FAQs

What are the minimum car insurance requirements in Florida?

Florida requires drivers to carry a minimum of $10,000 in Personal Injury Protection (PIP) coverage, $10,000 in Property Damage Liability (PDL) coverage, and $10,000 in Bodily Injury Liability (BIL) coverage per person and $20,000 per accident.

What are some tips for lowering my car insurance premiums in Florida?

Consider increasing your deductible, bundling your car insurance with other policies like homeowners or renters insurance, taking a defensive driving course, and maintaining a good driving record.

How do I file a car insurance claim in Florida?

Contact your insurance provider as soon as possible after an accident. They will guide you through the claim process, which may involve providing details of the accident, submitting documentation, and possibly having your vehicle inspected.