Best Florida car insurance is essential for navigating the Sunshine State’s unique driving landscape. Florida’s no-fault insurance system, hurricane risks, and specific regulations all impact the cost of car insurance. This guide delves into the factors influencing premiums, helps you find the best provider, and guides you through the claims process.

Understanding the complexities of Florida’s car insurance market can feel overwhelming. From navigating the no-fault system to accounting for hurricane risks, it’s crucial to make informed decisions to secure the best coverage at a fair price. We’ll break down the key factors influencing your rates, provide insights on finding the right provider, and equip you with the knowledge to navigate the claims process smoothly.

Understanding Florida Car Insurance

Navigating the world of car insurance in Florida can be a complex journey. The Sunshine State presents a unique landscape of factors that influence insurance costs, making it essential to understand the nuances of the market. This guide will delve into the key aspects of Florida car insurance, shedding light on its complexities and helping you make informed decisions.

Florida’s No-Fault Insurance System

Florida operates under a no-fault insurance system, which means that drivers are primarily responsible for covering their own medical expenses and lost wages following an accident, regardless of who is at fault. This system aims to streamline the claims process and reduce litigation.

- Under this system, each driver is required to carry Personal Injury Protection (PIP) coverage, which pays for medical expenses and lost wages up to a certain limit, typically $10,000.

- Florida also mandates Property Damage Liability (PDL) coverage, which protects you financially if you cause damage to another person’s property.

- While PIP covers your own medical expenses, you can sue the at-fault driver for additional damages, such as pain and suffering, if your injuries meet specific criteria, such as “serious injury” as defined by Florida law.

Florida’s Hurricane Risk and Insurance Premiums

Florida is highly susceptible to hurricanes, a significant factor influencing car insurance premiums. Insurance companies consider the risk of hurricanes and other natural disasters when setting rates.

- Coastal areas, known for their proximity to the Atlantic Ocean, generally face higher premiums due to the increased risk of hurricane damage.

- Insurance companies often utilize sophisticated models and historical data to assess hurricane risk, factoring in factors such as wind speed, storm surge, and the frequency of past storms.

- To mitigate the impact of hurricane risk, insurance companies offer various options, including hurricane deductibles and coverage for windstorm damage.

The Role of the Florida Department of Financial Services

The Florida Department of Financial Services (DFS) plays a crucial role in regulating the state’s car insurance market. Its primary responsibilities include:

- Ensuring that insurance companies operate fairly and transparently.

- Monitoring insurance rates to prevent excessive increases.

- Investigating complaints against insurance companies.

- Providing consumer education resources on car insurance.

Key Factors to Consider: Best Florida Car Insurance

Car insurance premiums in Florida are influenced by a variety of factors. These factors are assessed by insurance companies to determine the risk associated with insuring a particular driver. Understanding these factors can help you make informed decisions about your coverage and potentially lower your premiums.

Driving History

Your driving history plays a crucial role in determining your car insurance rates. Insurance companies carefully analyze your driving record, looking for any instances of accidents, traffic violations, or DUI convictions.

- A clean driving record with no accidents or violations generally translates to lower premiums.

- Conversely, a history of accidents, especially those deemed at-fault, can significantly increase your premiums.

- Traffic violations like speeding tickets, running red lights, or reckless driving can also lead to higher rates.

- DUI convictions have the most severe impact on premiums, often resulting in significantly higher rates or even denial of coverage.

Age

Age is another significant factor in car insurance pricing. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents.

- Insurance companies typically charge higher premiums for young drivers due to their higher risk profile.

- As drivers gain experience and reach their mid-20s, their premiums generally decrease.

- Older drivers, particularly those over 65, may also face higher premiums due to factors like age-related health conditions or reduced reaction times.

Credit Score

In Florida, insurance companies can use your credit score as a factor in determining your car insurance premiums. This practice, known as “credit-based insurance scoring,” is legal in the state.

- A higher credit score is generally associated with lower premiums.

- Insurance companies believe that individuals with good credit are more financially responsible and less likely to file claims.

- It’s important to note that this practice is controversial, and some argue that it unfairly penalizes individuals with lower credit scores who may not have a poor driving history.

Coverage Options

The type and amount of coverage you choose will also significantly affect your car insurance premiums.

- Higher coverage limits, such as comprehensive and collision coverage, generally result in higher premiums.

- However, they offer greater financial protection in case of an accident or damage to your vehicle.

- You can often save money by choosing lower coverage limits or opting for higher deductibles, but this comes with the risk of paying more out-of-pocket in case of a claim.

Coverage Types and Benefits

| Coverage Type | Benefits |

|---|---|

| Liability Coverage | Protects you financially if you cause an accident that injures another person or damages their property. |

| Collision Coverage | Covers damage to your vehicle if you’re involved in an accident, regardless of who is at fault. |

| Comprehensive Coverage | Protects your vehicle against damage from non-collision events such as theft, vandalism, or natural disasters. |

| Personal Injury Protection (PIP) | Covers medical expenses for you and your passengers, regardless of fault, in case of an accident. |

| Uninsured/Underinsured Motorist Coverage | Provides financial protection if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. |

Finding the Best Car Insurance Provider

Finding the most suitable car insurance provider in Florida requires careful consideration and comparison of various options. It’s crucial to navigate through the diverse landscape of insurance companies and policies to secure the best coverage at a competitive price.

Comparing Car Insurance Quotes

To effectively compare car insurance quotes, it’s essential to gather quotes from multiple providers. This allows you to analyze different coverage options, premiums, and policy features side-by-side. Here’s a step-by-step guide for comparing quotes:

- Gather your information: Before requesting quotes, prepare essential information such as your driving history, vehicle details, and desired coverage levels. This ensures accurate quote generation.

- Utilize online quote tools: Many insurance companies offer online quote tools that allow you to quickly receive estimates based on your input. These tools are convenient and can help you narrow down your options.

- Contact multiple providers: Don’t rely solely on online tools. Reach out to several insurance companies directly to discuss your specific needs and get personalized quotes.

- Compare quotes side-by-side: Once you have multiple quotes, carefully compare the coverage, deductibles, premiums, and any additional features offered. Look for clear and concise policy language.

- Consider discounts: Many insurance companies offer discounts for safe driving, good credit, multiple policies, or being a member of certain organizations. Inquire about available discounts to potentially lower your premium.

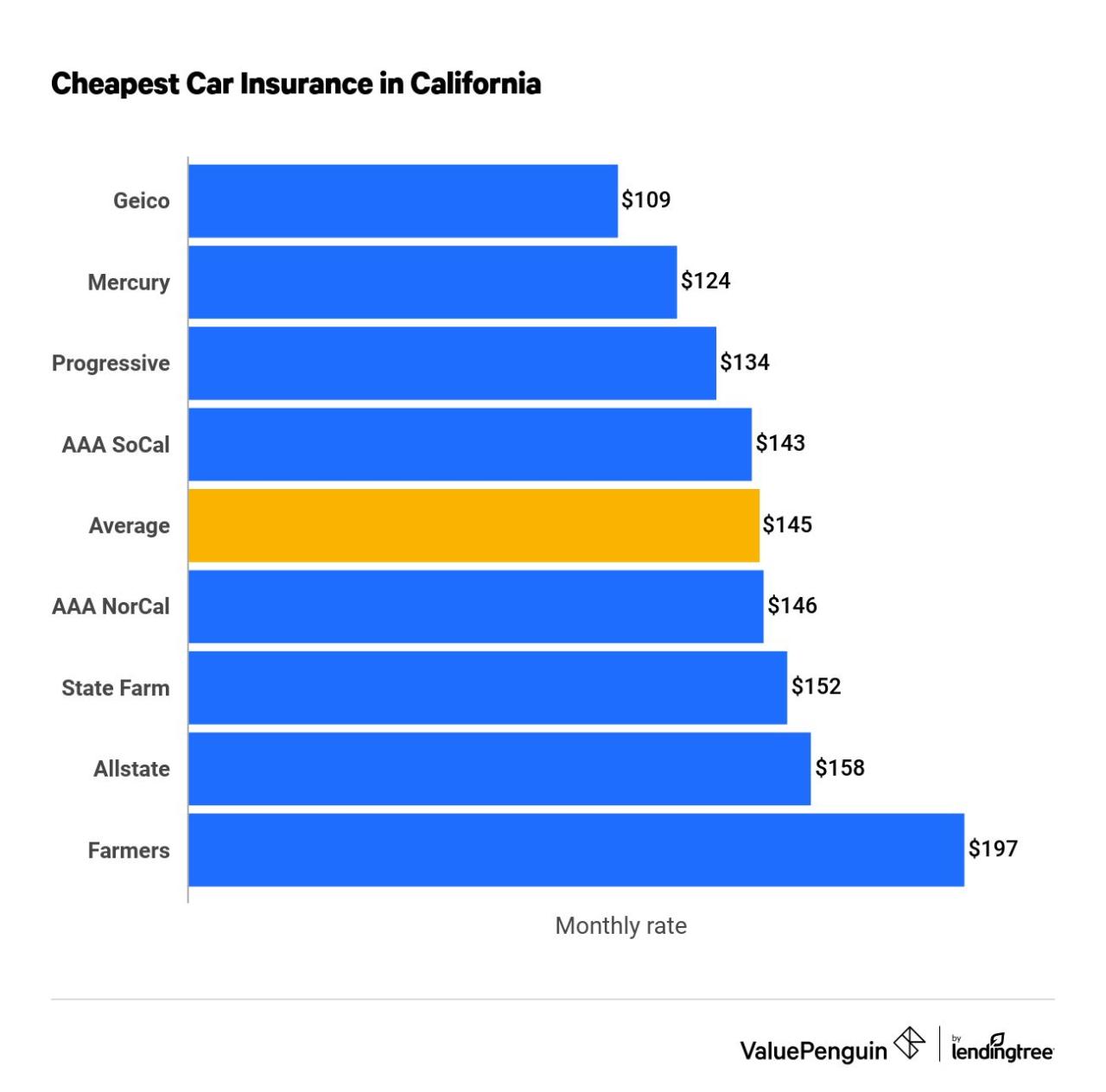

Reputable Car Insurance Companies in Florida, Best florida car insurance

Several reputable car insurance companies operate in Florida, each offering unique coverage options and pricing structures. It’s important to research and select a company that aligns with your specific needs and budget. Here’s a list of well-regarded companies in Florida:

- State Farm: Known for its widespread availability and diverse coverage options, State Farm is a popular choice for many Floridians.

- GEICO: GEICO is renowned for its competitive pricing and strong customer service, making it a competitive contender in the Florida market.

- Progressive: Progressive offers a wide range of coverage options and is known for its innovative features, such as its “Name Your Price” tool.

- Allstate: Allstate provides comprehensive coverage options and a strong reputation for customer satisfaction, making it a reliable choice.

- USAA: While USAA primarily serves military personnel and their families, it’s a highly regarded provider known for its excellent customer service and competitive rates.

Leveraging Online Tools and Resources

The internet offers a wealth of resources for finding the best car insurance deals. These tools can help you compare quotes, research companies, and gain insights into coverage options.

- Insurance comparison websites: Websites like Policygenius, Insurance.com, and The Zebra allow you to compare quotes from multiple insurers simultaneously. This can save you time and effort in your search.

- Insurance company websites: Directly visiting insurance company websites provides access to detailed information about their policies, coverage options, and online quote tools.

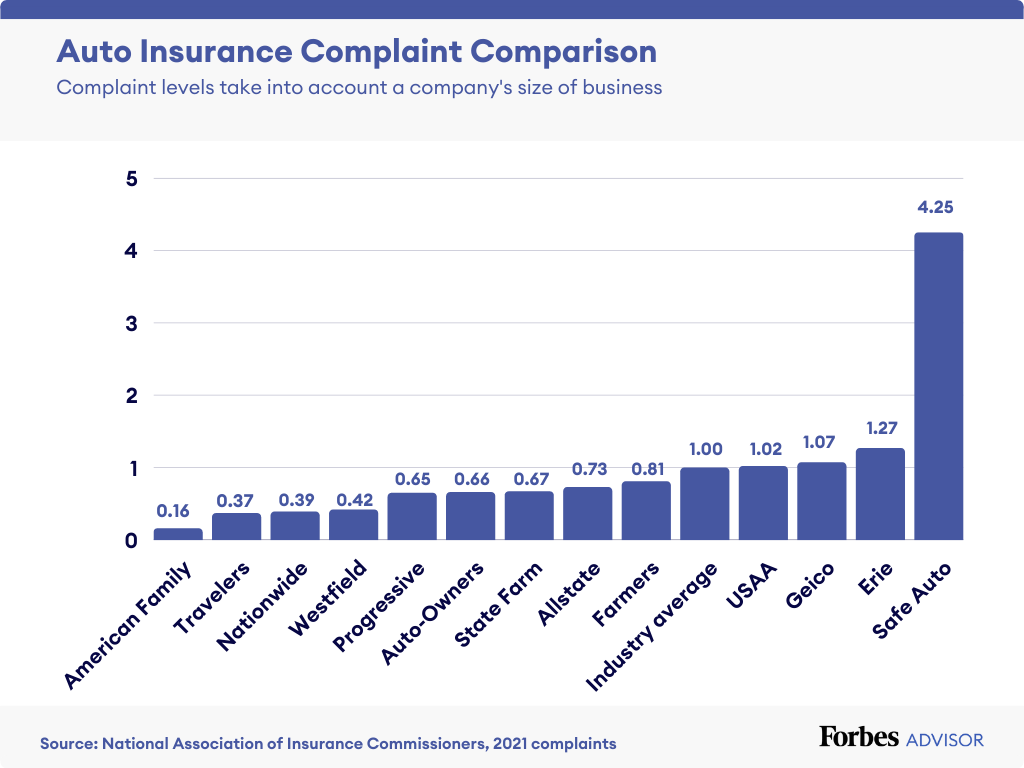

- Consumer reviews and ratings: Websites like J.D. Power and Consumer Reports provide independent reviews and ratings of insurance companies based on customer satisfaction and financial stability. These resources can offer valuable insights into the performance of different providers.

Reading Reviews and Testimonials

Before making a final decision, it’s highly recommended to read reviews and testimonials from other customers who have experience with the insurance company you’re considering. These insights can provide valuable information about the company’s customer service, claims handling process, and overall satisfaction.

- Online review platforms: Websites like Yelp, Google Reviews, and Trustpilot host user-generated reviews that can shed light on a company’s reputation and customer experiences.

- Insurance industry websites: Insurance industry websites often feature customer reviews and ratings, providing a more specialized perspective on company performance.

- Social media: Social media platforms can offer insights into customer experiences, with many people sharing their feedback and reviews on insurance companies.

Navigating Florida’s Insurance Landscape

Navigating Florida’s insurance landscape can be complex, but understanding the available resources and processes can help you make informed decisions. This section will delve into key aspects of Florida’s insurance system, from discounts to claim procedures.

Common Insurance Discounts Available in Florida

Many car insurance companies offer discounts in Florida to help policyholders save money. These discounts are often based on various factors, such as your driving history, vehicle safety features, and even your profession.

- Good Driver Discount: This discount is awarded to drivers with a clean driving record, typically with no accidents or traffic violations within a specified period.

- Safe Driver Discount: Similar to the good driver discount, this recognizes drivers who have not been involved in accidents or received traffic violations.

- Multi-Car Discount: Insurance companies often offer a discount if you insure multiple vehicles under the same policy.

- Multi-Policy Discount: This discount applies when you bundle your car insurance with other types of insurance, such as homeowners or renters insurance.

- Defensive Driving Course Discount: Completing a defensive driving course can demonstrate your commitment to safe driving and earn you a discount.

- Anti-theft Device Discount: Installing anti-theft devices in your vehicle, such as alarms or tracking systems, can make your car less appealing to thieves and qualify you for a discount.

- Good Student Discount: Some insurance companies offer discounts to students who maintain a good academic record.

- Loyalty Discount: This discount is often given to customers who have been with the same insurance company for a long period.

Filing a Car Insurance Claim in Florida

Filing a car insurance claim in Florida involves a series of steps to ensure your claim is processed smoothly.

- Report the Accident: Immediately after an accident, contact your insurance company to report the incident. This is usually done by phone or online.

- Gather Information: Collect essential details about the accident, including the names and contact information of all parties involved, the location of the accident, and any witnesses present. Take pictures of the damage to your vehicle and the accident scene.

- File a Claim: After reporting the accident, you will need to file a formal claim with your insurance company. This can usually be done online, through a mobile app, or by contacting your agent.

- Provide Required Documentation: Your insurance company will request specific documentation to process your claim, such as your driver’s license, vehicle registration, and police report (if applicable).

- Cooperate with Your Insurance Company: Be prepared to answer questions and provide any necessary information to your insurance company.

- Review the Claim: Carefully review the claim details and ensure all information is accurate. If you have any questions, don’t hesitate to contact your insurance company.

Seeking Legal Representation in Case of an Accident

In some cases, you may need legal representation following a car accident.

- If the Other Driver is Uninsured or Underinsured: If the other driver does not have adequate insurance coverage, you may need legal assistance to recover damages.

- If You Are Injured: If you sustain serious injuries in an accident, legal representation can help you navigate the complexities of personal injury claims.

- If the Accident is Complex: Accidents involving multiple vehicles or significant property damage can require legal expertise to ensure your rights are protected.

Tips for Ensuring Smooth and Efficient Insurance Claim Handling

Taking proactive steps can help ensure a smooth and efficient claim handling process.

- Understand Your Policy: Carefully read your insurance policy to understand your coverage limits, deductibles, and any exclusions.

- Keep Accurate Records: Maintain a record of all your insurance documents, including your policy, claim forms, and correspondence with your insurance company.

- Be Prompt and Cooperative: Respond promptly to your insurance company’s requests for information and cooperate fully throughout the claim process.

- Document Everything: Keep a detailed record of all communication with your insurance company, including dates, times, and the content of conversations.

- Consider Legal Advice: If you are unsure about any aspect of your claim or if the process is becoming difficult, consult with an attorney.

Concluding Remarks

Securing the best Florida car insurance involves careful research, comparing quotes, and understanding the intricacies of the state’s insurance landscape. By considering the factors discussed, comparing providers, and utilizing available resources, you can find the most suitable coverage for your needs and budget. Remember, choosing the right insurance is crucial for financial protection in case of an accident, ensuring peace of mind on the road.

Essential Questionnaire

What are the minimum insurance requirements in Florida?

Florida requires drivers to have Personal Injury Protection (PIP) coverage of $10,000 and Property Damage Liability (PDL) coverage of $10,000.

How can I get a discount on my car insurance?

Many insurers offer discounts for good driving records, safety features, bundling policies, and being a member of certain organizations.

What should I do if I get into an accident in Florida?

After an accident, it’s crucial to stay calm, exchange information with the other driver, and contact your insurance company to report the incident.