- Understanding Long-Term Care Insurance in Florida

- Key Considerations for Choosing Long-Term Care Insurance

- Top Long-Term Care Insurance Providers in Florida

- Financial Planning and Long-Term Care Insurance

- Government Resources and Programs

- Alternatives to Long-Term Care Insurance

- Legal and Ethical Considerations: Best Long Term Care Insurance In Florida

- Conclusion

- Questions Often Asked

Best long term care insurance in florida – Navigating the world of long-term care insurance in Florida can feel like a maze, especially when you’re looking for the best coverage to safeguard your future. The right policy can provide peace of mind, knowing that you’ll have financial support if you need assistance with daily living activities. But with so many providers and plans available, choosing the right one can be overwhelming.

This guide aims to illuminate the path, providing essential information on long-term care insurance in Florida, from understanding the basics to selecting the best provider for your individual needs. We’ll delve into key considerations, top providers, and financial planning strategies to help you make informed decisions about your long-term care future.

Understanding Long-Term Care Insurance in Florida

Long-term care insurance in Florida is a valuable tool for individuals seeking financial protection against the rising costs of long-term care services. It provides a safety net, helping to ensure that individuals have access to the care they need without depleting their savings.

Benefits of Long-Term Care Insurance in Florida

Long-term care insurance offers numerous benefits for Florida residents. It provides financial security, allowing individuals to focus on their health and well-being without worrying about the financial burden of long-term care.

- Financial Protection: Long-term care insurance helps pay for a wide range of services, including nursing home care, assisted living, home health care, and adult day care. This financial protection alleviates the stress of managing these costs and ensures that individuals have access to quality care without depleting their savings.

- Preservation of Assets: By covering long-term care expenses, long-term care insurance helps preserve assets, such as savings, investments, and real estate. This ensures that individuals have financial resources available for their loved ones or other important needs.

- Choice and Control: Long-term care insurance gives individuals more control over their care decisions. Policyholders can choose the type of care they receive, the location of their care, and the providers they trust.

- Peace of Mind: Knowing that long-term care expenses are covered provides peace of mind for both individuals and their families. It reduces the stress and anxiety associated with planning for future care needs.

Types of Long-Term Care Services Covered, Best long term care insurance in florida

Long-term care insurance policies in Florida typically cover a wide range of services, providing flexibility and options for individuals with varying care needs.

- Nursing Home Care: This covers skilled nursing care in a nursing home facility, including medical care, rehabilitation, and personal care services.

- Assisted Living: This provides support with activities of daily living, such as bathing, dressing, and eating, in a residential setting.

- Home Health Care: This includes skilled nursing care, therapy, and personal care services provided in the individual’s home.

- Adult Day Care: This offers social and recreational activities, as well as assistance with personal care, in a supervised setting during the day.

- Respite Care: This provides temporary care for individuals with long-term care needs, allowing family caregivers to take a break.

Eligibility Requirements and Application Process

To be eligible for long-term care insurance in Florida, individuals typically need to meet certain criteria, including age, health, and financial status.

- Age: Most insurers have age limits for eligibility, typically ranging from 18 to 80 years old.

- Health: Applicants undergo a medical underwriting process to assess their health status and determine the premium rate. This may involve a medical exam, a review of medical records, and a health questionnaire.

- Financial Status: Insurers may consider factors such as income, assets, and debt to assess the applicant’s ability to pay premiums.

The application process for long-term care insurance in Florida involves several steps:

- Contact an Insurance Agent: Start by contacting a licensed insurance agent specializing in long-term care insurance. They can provide personalized advice and guidance throughout the process.

- Request a Quote: Provide the agent with information about your age, health, and desired coverage. The agent will then obtain quotes from different insurers.

- Review Policy Options: Carefully review the policy options, including coverage, benefits, premiums, and exclusions. Ask questions and clarify any uncertainties.

- Complete the Application: Once you’ve chosen a policy, complete the application form, providing accurate and complete information.

- Underwriting and Approval: The insurer will review your application and conduct medical underwriting if necessary. If approved, you’ll receive a policy.

Key Considerations for Choosing Long-Term Care Insurance

Choosing the right long-term care insurance policy is crucial to ensure adequate financial protection for your future needs. Carefully evaluating various factors will help you make an informed decision.

Coverage Amounts

The coverage amount determines the maximum daily benefit you can receive for long-term care services. It is essential to choose a coverage amount that aligns with your estimated long-term care costs. Consider factors like your current lifestyle, potential future care needs, and local average costs for long-term care facilities.

Benefit Periods

The benefit period defines the maximum duration for which your policy will cover long-term care expenses. It is typically expressed in years or days. Selecting a benefit period that meets your projected care needs is vital. For instance, if you anticipate needing care for several years, a longer benefit period would be more suitable.

Daily Benefits

The daily benefit represents the amount your insurance policy will pay for each day of long-term care services. The daily benefit should be sufficient to cover the costs of your chosen care option, which can vary based on the level of care required and the location of the facility.

Deductibles

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles generally lead to lower premiums. However, it’s crucial to ensure the deductible amount is manageable for you, considering your financial situation.

Copayments

Copayments are fixed amounts you pay for each day of long-term care services after your deductible has been met. Copayments can help manage overall policy costs but also increase your out-of-pocket expenses.

Elimination Periods

The elimination period is the waiting period before your benefits start. It is usually measured in days. A longer elimination period can lower your premium but requires you to self-fund your care for a more extended period.

Top Long-Term Care Insurance Providers in Florida

Choosing the right long-term care insurance provider is crucial in Florida, as the state has a significant aging population with increasing needs for long-term care services. Several reputable providers offer competitive policies tailored to Floridian residents’ specific needs and budgets.

Top-Rated Long-Term Care Insurance Providers in Florida

To help you navigate the options, we’ve compiled a table showcasing some of the top-rated long-term care insurance providers in Florida, along with key policy features and pricing information.

| Provider | Policy Features | Pricing |

|—|—|—|

| Genworth |

- Comprehensive coverage options

- Flexible benefit periods

- Inflation protection

| Varies based on age, health, and coverage level |

| John Hancock |

- Competitive premiums

- Wide range of benefit options

- Strong financial stability

| Varies based on age, health, and coverage level |

| Mutual of Omaha |

- Affordable premiums

- Easy-to-understand policies

- Excellent customer service

| Varies based on age, health, and coverage level |

| New York Life |

- Financial strength and stability

- Personalized policy options

- Extensive network of providers

| Varies based on age, health, and coverage level |

| UnitedHealthcare |

- Strong reputation in health insurance

- Competitive pricing

- Comprehensive coverage options

| Varies based on age, health, and coverage level |

Resources for Comparing Long-Term Care Insurance Quotes

Once you’ve identified a few providers that align with your needs, it’s essential to compare quotes to ensure you’re getting the best value for your money. Several resources can assist you in this process:

- Long-Term Care Insurance Comparison Websites: Websites like LTCInsurance.com and LTCQuotes.com allow you to compare quotes from multiple providers simultaneously.

- Independent Insurance Agents: Working with an independent insurance agent can provide personalized advice and help you navigate the complex world of long-term care insurance.

- State Insurance Departments: Contacting the Florida Department of Financial Services can provide information on licensed long-term care insurance providers and consumer protection resources.

Remember that obtaining multiple quotes and carefully reviewing each policy’s terms and conditions is crucial to making an informed decision.

Financial Planning and Long-Term Care Insurance

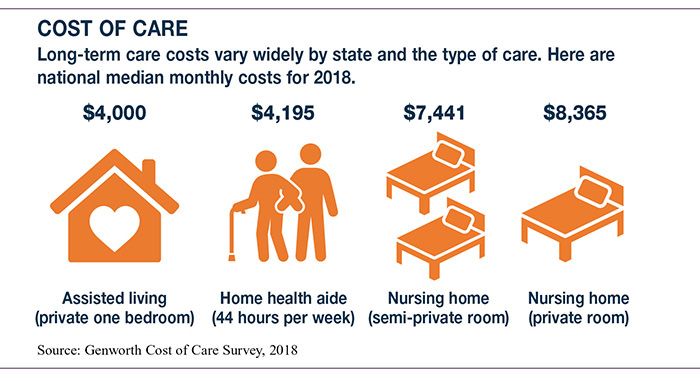

Planning for long-term care expenses is an essential part of overall financial planning, particularly as individuals age. The cost of long-term care services, such as assisted living, nursing homes, or in-home care, can be substantial and can quickly deplete personal savings. Long-term care insurance can play a vital role in mitigating the financial burden associated with these expenses.

Understanding the Financial Impact of Long-Term Care

The cost of long-term care can vary significantly depending on the type of care needed, the location, and the duration of care. According to the Genworth Cost of Care Survey, the national median annual cost of a private room in a nursing home in 2023 is $110,000. In Florida, the median annual cost of a private room in a nursing home is $118,000. These costs can quickly add up, especially if care is needed for several years.

How Long-Term Care Insurance Can Help

Long-term care insurance policies are designed to provide financial protection against the high costs of long-term care. These policies can help cover a wide range of services, including:

- Nursing home care

- Assisted living

- Home health care

- Adult day care

- Respite care

Long-term care insurance policies typically have a daily or monthly benefit limit, and they may also have a maximum lifetime benefit. The policyholder pays premiums for the coverage, and the insurance company will pay benefits when the policyholder needs long-term care.

Potential Tax Benefits

Long-term care insurance premiums may be tax-deductible in certain situations. For example, if you are self-employed or have a health savings account (HSA), you may be able to deduct premiums as a medical expense. It’s important to consult with a tax advisor to determine if you qualify for any tax benefits.

Government Resources and Programs

Navigating the complex world of long-term care in Florida can be overwhelming. Fortunately, various government resources and programs exist to assist individuals and families in securing the care they need. This section explores some key government resources and programs that can provide financial assistance, support services, and guidance for long-term care in Florida.

Medicaid Benefits

Medicaid, a joint federal and state program, provides health coverage for low-income individuals and families. In Florida, Medicaid offers long-term care benefits through the “Medicaid Long-Term Care Program.”

- Eligibility for Medicaid long-term care is based on income and asset levels. For example, in 2023, a single individual with a monthly income below $2,382 and assets under $2,000 may qualify for Medicaid long-term care.

- Medicaid covers a wide range of long-term care services, including nursing home care, assisted living, adult day care, and home health services.

- However, Medicaid long-term care benefits have specific requirements, such as a “spend-down” period, where individuals may need to use their assets to meet certain financial thresholds before becoming eligible.

Medicare Benefits

Medicare, a federal health insurance program for individuals aged 65 and older and those with certain disabilities, offers limited long-term care coverage.

- Medicare Part A (Hospital Insurance) covers short-term stays in skilled nursing facilities (SNFs) following a hospital admission. The coverage is limited to 100 days, with a daily co-payment required after the first 20 days.

- Medicare Part B (Medical Insurance) covers some home health services, but only if they are medically necessary and ordered by a doctor.

- Medicare does not cover custodial care, which includes personal care, assistance with activities of daily living, or supervision.

Florida Department of Elder Affairs

The Florida Department of Elder Affairs (DOEA) plays a vital role in supporting long-term care needs for seniors and individuals with disabilities.

- DOEA provides information and referral services, helping individuals connect with long-term care providers and resources.

- DOEA administers various programs, such as the “Florida Senior Legal Services Program,” which offers free legal assistance to seniors facing legal issues related to long-term care.

- DOEA also operates the “Florida Elder Helpline,” a toll-free number (1-800-96-ELDER) that provides information and support to seniors and their families.

Alternatives to Long-Term Care Insurance

While long-term care insurance provides financial protection against the high costs of long-term care, it’s not the only option available. Several alternatives can help you plan for these expenses, each with its own advantages and disadvantages.

This section explores alternative options for financing long-term care expenses, such as reverse mortgages and life insurance policies. We will also discuss the advantages and disadvantages of self-funding long-term care through savings or investments, as well as the role of family support networks in providing long-term care.

Reverse Mortgages

Reverse mortgages can provide seniors with access to their home equity, offering a source of funds to cover long-term care expenses. This type of mortgage allows homeowners aged 62 and older to borrow against the equity in their homes without making monthly mortgage payments. The loan is repaid when the homeowner sells the property, moves out, or passes away.

Reverse mortgages can be a valuable resource for seniors who need to pay for long-term care but have limited income or savings. However, it’s crucial to understand the potential drawbacks before making a decision.

- Advantages:

- Provides access to home equity without monthly payments.

- Can supplement retirement income or help cover long-term care costs.

- No requirement to make monthly payments, allowing seniors to retain their homeownership.

- Disadvantages:

- Can lead to a higher debt burden, especially if the home value declines.

- May reduce the inheritance for heirs.

- Can result in the loss of the home if the borrower defaults on the loan.

It’s essential to carefully consider the terms of a reverse mortgage, including the interest rate, fees, and potential impact on your estate before proceeding. Consult with a financial advisor to determine if a reverse mortgage is the right choice for your situation.

Life Insurance Policies

Some life insurance policies offer long-term care benefits as a rider or a separate policy. These policies can provide financial support for long-term care expenses while also offering death benefits to your beneficiaries.

- Advantages:

- Combines life insurance coverage with long-term care benefits.

- Can provide a lump sum payment or ongoing income for long-term care needs.

- Offers flexibility in choosing the level of coverage and benefit period.

- Disadvantages:

- May have higher premiums than traditional life insurance policies.

- The long-term care benefits may be limited in scope or duration.

- The death benefit may be reduced if long-term care benefits are used.

When considering life insurance with long-term care benefits, carefully review the policy terms, including the coverage limitations, benefit period, and any potential impact on the death benefit.

Self-Funding Long-Term Care

Self-funding involves saving or investing enough money to cover potential long-term care expenses. This approach can provide flexibility and control over your care, but it requires careful planning and disciplined savings.

- Advantages:

- Provides flexibility in choosing care options and providers.

- Avoids the potential for premium increases or policy cancellations.

- Offers control over how funds are used for long-term care.

- Disadvantages:

- Requires significant savings and disciplined financial planning.

- The risk of outliving your savings or investments.

- May require adjustments to your retirement plans or lifestyle.

To effectively self-fund long-term care, consider creating a comprehensive financial plan that includes a detailed estimate of potential expenses, a savings strategy, and a plan for managing potential risks.

Family Support Networks

Family support networks can play a significant role in providing long-term care, offering emotional and practical assistance. Family members can provide caregiving, support with daily tasks, and companionship.

- Advantages:

- Provides a familiar and loving environment for care.

- Offers emotional support and companionship.

- Can reduce the need for professional caregiving services.

- Disadvantages:

- Can be physically and emotionally demanding for family caregivers.

- May require adjustments to work schedules or personal lives.

- Can create stress and strain on family relationships.

It’s important to carefully consider the impact of family caregiving on everyone involved. Open communication and realistic expectations are crucial for ensuring a positive and sustainable caregiving experience.

Legal and Ethical Considerations: Best Long Term Care Insurance In Florida

Long-term care planning involves not only financial considerations but also navigating crucial legal and ethical aspects. Understanding these aspects is essential for making informed decisions that protect your rights and ensure your wishes are honored.

Power of Attorney and Advance Directives

Power of attorney and advance directives are legal documents that empower you to appoint someone to make decisions on your behalf if you become unable to do so yourself. These documents play a vital role in ensuring your healthcare wishes are respected and your financial affairs are managed according to your instructions.

- Power of Attorney: This document grants someone the authority to act on your behalf in financial matters, such as managing your bank accounts, paying bills, and making investments. There are two types of power of attorney:

- Durable Power of Attorney: This type remains in effect even if you become incapacitated.

- Springing Power of Attorney: This type takes effect only if you become incapacitated, as determined by a medical professional.

- Advance Directives: These documents specify your wishes regarding medical treatment in the event you become unable to make decisions yourself. They can include:

- Living Will: This document Artikels your preferences for life-sustaining treatments, such as artificial respiration or feeding tubes.

- Healthcare Power of Attorney (also known as a Durable Power of Attorney for Healthcare): This document designates someone you trust to make healthcare decisions on your behalf if you are unable to do so.

Resources for Navigating Legal Aspects

Navigating the legal aspects of long-term care planning can be complex. Several resources can help you understand your rights and options.

- Florida Bar Lawyer Referral Service: This service can connect you with attorneys specializing in elder law and estate planning.

- Florida Department of Elder Affairs: This department provides information and resources on elder care, including legal issues.

- Area Agencies on Aging (AAAs): These organizations offer support and guidance to older adults and their families, including legal assistance.

Conclusion

As you navigate the complexities of long-term care insurance in Florida, remember that seeking professional advice is crucial. Consult with a qualified insurance agent or financial advisor to tailor a plan that aligns with your specific circumstances and financial goals. By understanding the options, comparing providers, and planning ahead, you can gain control of your future and ensure peace of mind for yourself and your loved ones.

Questions Often Asked

How much does long-term care insurance cost in Florida?

The cost of long-term care insurance in Florida varies greatly depending on factors like your age, health, coverage level, and the insurer you choose. It’s recommended to get quotes from multiple providers to compare prices and find the best value for your needs.

What are the benefits of having long-term care insurance?

Long-term care insurance provides financial protection against the potentially high costs of long-term care services, allowing you to maintain your independence and quality of life. It also helps alleviate the financial burden on your family and loved ones.

Can I get long-term care insurance if I have a pre-existing condition?

Yes, you may still be eligible for long-term care insurance even if you have a pre-existing condition. However, the cost of your policy may be higher, and you may have to undergo a medical underwriting process.