- Understanding Florida’s Car Insurance Landscape

- Key Factors Affecting Car Insurance Rates

- Comparing Car Insurance Quotes

- Finding Affordable Car Insurance Options: Best Rates For Car Insurance In Florida

- Understanding Coverage Options

- Choosing the Right Insurance Provider

- Concluding Remarks

- FAQ Explained

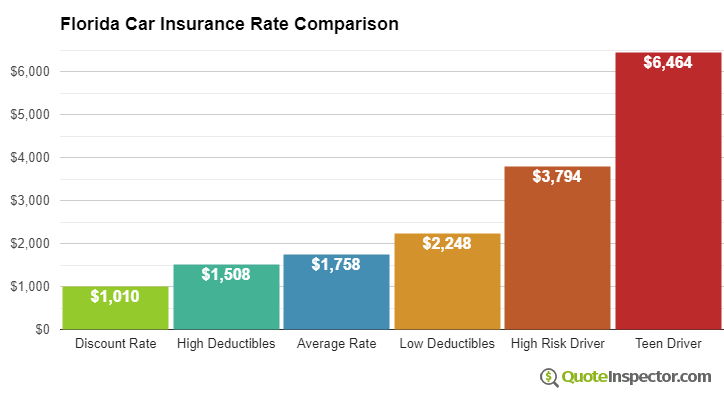

Best rates for car insurance in Florida are a top priority for drivers, especially given the state’s unique factors that influence premiums. From Florida’s no-fault insurance system to its high population density and hurricane risk, navigating the car insurance landscape can feel overwhelming. This guide aims to demystify the process, helping you find the most affordable and comprehensive coverage to protect yourself and your vehicle.

Understanding how car insurance rates are determined in Florida is crucial. Key factors include your driving history, age, credit score, vehicle type, coverage levels, and even your location. By understanding these factors, you can take steps to improve your rates and ensure you’re getting the best possible value for your money.

Understanding Florida’s Car Insurance Landscape

Florida’s car insurance market is unique, shaped by a complex interplay of factors that significantly influence rates. This complexity makes finding the best car insurance rates in Florida a challenging task, requiring a deep understanding of the market dynamics.

Florida’s No-Fault Insurance System

Florida’s no-fault insurance system, known as Personal Injury Protection (PIP), requires drivers to carry a minimum of $10,000 in PIP coverage. This coverage pays for medical expenses and lost wages regardless of fault in an accident. While this system aims to reduce litigation and streamline claims, it also contributes to higher insurance premiums. The no-fault system leads to higher utilization of medical services, as individuals are encouraged to seek treatment even for minor injuries. Additionally, the system’s structure can create opportunities for fraud, further increasing costs.

Florida’s High Population Density and Hurricane Risk

Florida’s high population density and susceptibility to hurricanes are significant factors contributing to higher car insurance rates. With a large number of vehicles on the road, the likelihood of accidents increases. Moreover, hurricanes pose a considerable risk to vehicles, leading to extensive damage and increased insurance claims. Insurance companies factor in these risks when calculating premiums, resulting in higher rates for Florida drivers.

Key Factors Affecting Car Insurance Rates

Car insurance companies use a variety of factors to determine your rates. These factors are designed to assess your risk as a driver, and they can significantly impact the cost of your insurance.

Driving History

Your driving history is one of the most important factors affecting your car insurance rates. A clean driving record with no accidents or traffic violations will result in lower premiums. However, if you have a history of accidents, speeding tickets, or DUI convictions, your rates will likely be higher.

“A single accident can increase your insurance premiums by 20-30%, and multiple accidents can lead to even higher increases.”

Age

Your age is also a significant factor in determining your insurance rates. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. This higher risk translates into higher insurance premiums. As you age, your rates generally decrease as you gain experience and become a less risky driver.

Credit Score

While it might seem counterintuitive, your credit score can impact your car insurance rates in many states, including Florida. Insurance companies use credit scores as a proxy for financial responsibility, believing that those with good credit are more likely to be responsible drivers. A higher credit score generally translates to lower insurance premiums.

Vehicle Type

The type of vehicle you drive also plays a role in your insurance rates. Expensive cars, luxury vehicles, and sports cars are generally more expensive to repair or replace, leading to higher insurance premiums. Conversely, less expensive and smaller vehicles often have lower insurance rates.

Coverage Levels

The amount of coverage you choose will directly impact your insurance premiums. Higher coverage limits, such as higher liability limits or comprehensive and collision coverage, will result in higher premiums. Choosing a lower deductible can also increase your rates, as you’ll be paying less out-of-pocket in case of an accident.

Location

Your location can significantly impact your car insurance rates. Areas with higher crime rates, traffic congestion, and a higher number of accidents tend to have higher insurance premiums. Insurance companies consider factors such as the number of claims filed in a specific area to determine rates.

Comparing Car Insurance Quotes

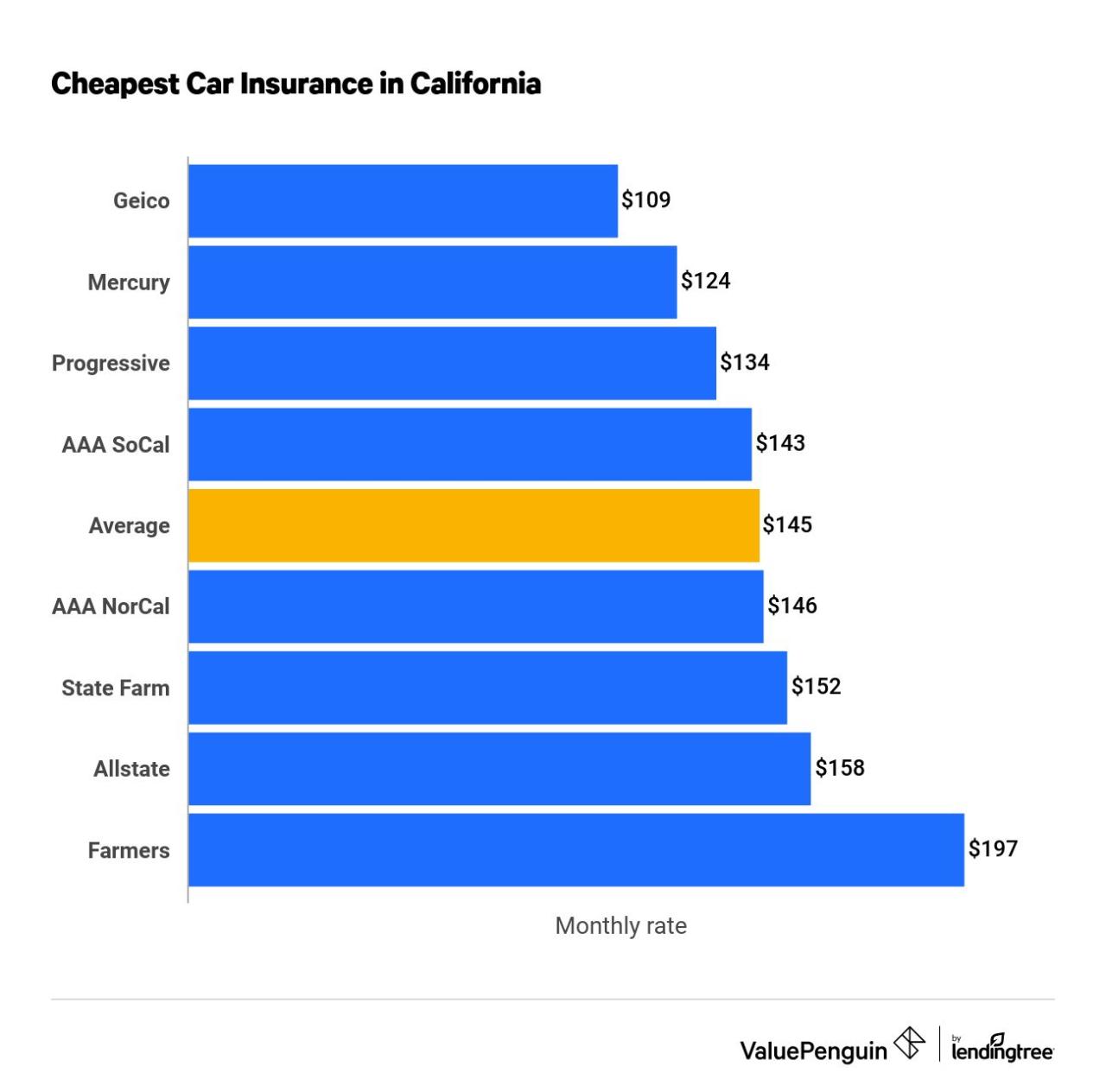

In Florida, obtaining the best car insurance rates involves comparing quotes from multiple insurance companies. This approach allows you to find the most competitive rates and coverage options that suit your needs and budget.

Importance of Comparing Quotes

Comparing quotes from different insurance providers is crucial for several reasons:

- Finding the Lowest Rates: Different insurance companies utilize various pricing models, resulting in significant rate variations. Comparing quotes ensures you don’t overpay for coverage.

- Discovering Better Coverage Options: Companies offer diverse coverage packages and add-ons. Comparing quotes helps identify the best coverage options that meet your specific needs and risk profile.

- Negotiating Rates: Armed with quotes from multiple companies, you can leverage this information to negotiate better rates with your existing insurer or even switch providers.

Effective Quote Comparison Strategies, Best rates for car insurance in florida

Navigating the quote comparison process effectively requires a strategic approach:

- Utilize Online Comparison Tools: Online platforms like insurance comparison websites simplify the process by providing quotes from multiple insurers simultaneously. These tools often allow you to customize your coverage preferences and receive personalized quotes.

- Contact Insurance Companies Directly: Reach out to insurance companies directly to request quotes. This allows for more detailed discussions about coverage options and personalized recommendations.

- Provide Accurate Information: Be precise when providing information about your vehicle, driving history, and other relevant details. Inaccurate information can lead to inaccurate quotes and potentially higher rates.

- Compare Apples to Apples: Ensure you compare quotes with similar coverage levels. Avoid comparing quotes with varying deductibles or coverage limits, as this can lead to misleading results.

- Review Policy Details Carefully: Once you receive quotes, carefully review the policy details, including coverage limits, deductibles, and exclusions. This ensures you understand the terms and conditions before making a decision.

Finding Affordable Car Insurance Options: Best Rates For Car Insurance In Florida

Finding the best car insurance rates in Florida isn’t just about comparing prices; it’s about understanding how to lower your premiums. By implementing smart strategies and taking advantage of available discounts, you can significantly reduce your insurance costs.

Strategies for Reducing Car Insurance Premiums

Here are some effective strategies to help you save money on your car insurance in Florida:

- Maintain a Good Driving Record: Your driving history is a major factor in determining your insurance rates. Avoid traffic violations, accidents, and DUI charges, as these can significantly increase your premiums.

- Choose a Safe Vehicle: Opting for vehicles with high safety ratings and anti-theft features can lead to lower insurance premiums. Insurance companies often offer discounts for vehicles with advanced safety technologies.

- Increase Your Deductible: Raising your deductible means you’ll pay more out of pocket in case of an accident, but it can significantly reduce your monthly premiums. This strategy is particularly beneficial if you have a good driving record and can afford to pay a higher deductible in the event of an accident.

- Bundle Your Policies: Bundling your car insurance with other policies, such as homeowners or renters insurance, can often result in substantial discounts.

- Shop Around for Quotes: Compare quotes from multiple insurance companies to find the best rates. Use online comparison tools or contact insurance agents directly.

- Ask About Discounts: Many insurance companies offer discounts for various factors, including good student status, safe driver courses, and membership in certain organizations.

- Consider Paying Annually: Paying your car insurance premium annually rather than monthly can often result in a lower overall cost.

- Maintain a Good Credit Score: In Florida, insurance companies can use your credit score as a factor in determining your rates. A good credit score can lead to lower premiums.

Common Car Insurance Discounts in Florida

Understanding the various discounts available can help you significantly reduce your insurance costs. Here’s a table outlining common discounts and their eligibility criteria:

| Discount Type | Eligibility Criteria |

|---|---|

| Good Student Discount | Maintaining a certain GPA or academic standing. |

| Safe Driver Discount | Having a clean driving record with no accidents or violations. |

| Multi-Car Discount | Insuring multiple vehicles with the same company. |

| Multi-Policy Discount | Bundling car insurance with other policies, such as homeowners or renters insurance. |

| Anti-theft Device Discount | Having an anti-theft device installed in your vehicle. |

| Defensive Driving Course Discount | Completing a defensive driving course. |

| Senior Citizen Discount | Being a certain age or older. |

| Military Discount | Active or retired military personnel. |

Comparing Car Insurance Options

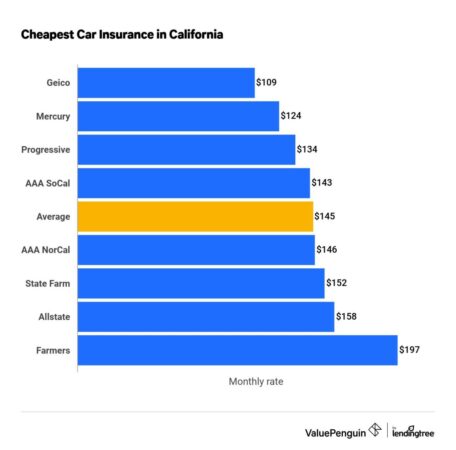

To find the most cost-effective car insurance option, it’s essential to compare different insurance providers and their offerings. Here’s a table comparing different insurance options based on their cost-effectiveness:

| Insurance Provider | Average Annual Premium (Estimated) | Key Features | Cost-Effectiveness |

|---|---|---|---|

| State Farm | $1,500 – $2,000 | Wide coverage options, strong customer service, discounts for bundling policies. | Generally affordable, particularly for those who bundle multiple policies. |

| Geico | $1,400 – $1,900 | Competitive rates, online quoting and management, discounts for good drivers and military personnel. | Competitive rates, especially for those with a good driving record. |

| Progressive | $1,300 – $1,800 | Name-your-price tool, customizable coverage options, discounts for safe drivers and good students. | Offers a variety of discounts and flexible coverage options. |

| Allstate | $1,600 – $2,100 | Comprehensive coverage options, 24/7 customer service, discounts for safe driving and good students. | Provides a wide range of coverage options and excellent customer service. |

Understanding Coverage Options

In Florida, understanding the various car insurance coverage options is crucial for making informed decisions and ensuring you have the right protection. Each coverage type plays a specific role in safeguarding you financially in the event of an accident or other covered incident.

Essential Coverage Options

Florida law mandates that all drivers carry a minimum level of car insurance coverage. This includes:

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related costs for you and your passengers, regardless of fault. PIP is limited to $10,000 per person, and you can choose to have lower coverage, but it’s generally recommended to have the full amount.

- Property Damage Liability (PDL): This coverage protects you against financial responsibility for damage you cause to another person’s property, such as their vehicle or belongings. The minimum required PDL coverage in Florida is $10,000.

Optional Coverage

While essential coverage is legally required, additional optional coverage can provide greater financial protection and peace of mind:

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if you’re involved in an accident, regardless of fault. Collision coverage is typically recommended for newer vehicles or those with significant loan balances.

- Comprehensive Coverage: This coverage protects your vehicle against damage caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. Comprehensive coverage is generally recommended for newer or more expensive vehicles.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you’re injured in an accident caused by a driver who doesn’t have insurance or has insufficient coverage. It can help cover medical expenses, lost wages, and other related costs. UM/UIM coverage is optional in Florida but is highly recommended.

- Medical Payments Coverage (Med Pay): This coverage supplements PIP by providing additional medical expense coverage for you and your passengers, regardless of fault. Med Pay can be helpful if your PIP coverage is insufficient or if you have a health insurance plan with a high deductible.

- Rental Reimbursement: This coverage helps pay for a rental car while your vehicle is being repaired after an accident. It can be particularly useful if you rely on your vehicle for work or daily errands.

- Roadside Assistance: This coverage provides assistance in case of breakdowns, flat tires, or other roadside emergencies. It can include services like towing, jump starts, and tire changes.

Choosing the Right Insurance Provider

Selecting the right car insurance provider is crucial in Florida, where rates can vary significantly. This involves more than just finding the cheapest option. It’s about finding a company that offers the best value for your needs, considering factors like coverage, customer service, financial stability, and claims handling.

Comparing Florida Car Insurance Companies

A comprehensive comparison of different car insurance companies in Florida helps you make an informed decision. Here’s a breakdown of some key factors to consider:

Key Considerations for Choosing a Car Insurance Provider

- Financial Strength: Choose a company with a strong financial rating, indicating its ability to pay claims in the long term. You can check ratings from organizations like A.M. Best and Standard & Poor’s.

- Customer Service: Look for companies known for their responsive and helpful customer service. Check online reviews and customer testimonials for insights into their reputation.

- Claims Handling: A smooth and efficient claims process is crucial. Research companies with a track record of fair and timely claim settlements.

- Discounts: Explore available discounts, such as good driver, safe vehicle, multi-car, and bundling discounts, to potentially lower your premium.

- Coverage Options: Compare the coverage options offered by different companies, ensuring they meet your specific needs. Consider factors like liability limits, comprehensive and collision coverage, and uninsured motorist coverage.

- Technology and Innovation: Evaluate companies that utilize technology to streamline the insurance process, such as online quoting, mobile apps, and digital claim filing.

Concluding Remarks

Finding the best car insurance rates in Florida requires careful research and comparison. By understanding the factors that influence premiums, comparing quotes from multiple insurers, and exploring available discounts, you can secure affordable coverage that meets your needs. Remember to regularly review your policy and make adjustments as your circumstances change to ensure you’re always getting the best value for your insurance dollar.

FAQ Explained

What is Florida’s no-fault insurance system and how does it affect my rates?

Florida has a no-fault insurance system, meaning drivers are required to have Personal Injury Protection (PIP) coverage. This coverage pays for medical expenses and lost wages regardless of fault in an accident. However, it can impact rates as PIP coverage is mandatory and often comes with specific coverage limits.

How can I lower my car insurance premiums in Florida?

There are several ways to lower your premiums, such as maintaining a good driving record, bundling insurance policies, taking defensive driving courses, and installing safety features in your car. You can also explore discounts for good students, seniors, and homeowners.

What types of car insurance coverage are required in Florida?

Florida requires drivers to have PIP, Personal Injury Protection, and Property Damage Liability coverage. These cover medical expenses and damage to other vehicles in an accident.

What are some tips for filing a car insurance claim in Florida?

It’s important to report the accident to your insurer promptly and provide accurate details. Keep a record of all communication and documentation related to the claim. Be prepared to provide information about the accident, your vehicle, and any injuries.