Business Health Insurance Cost Overview

Business health insurance costs refer to the financial expenses incurred by businesses to provide health insurance coverage for their employees. These costs have a significant impact on a business’s overall financial health and competitiveness in the job market.

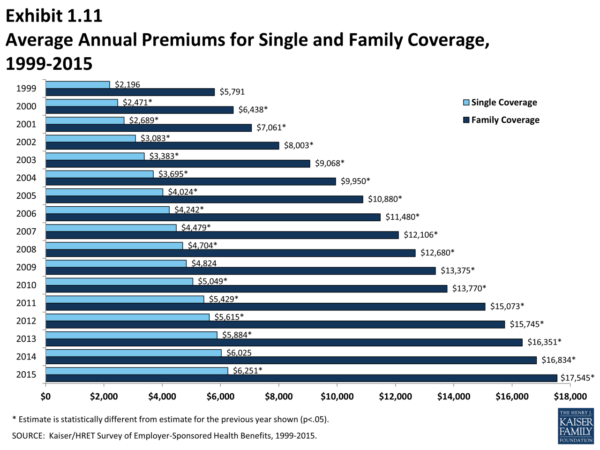

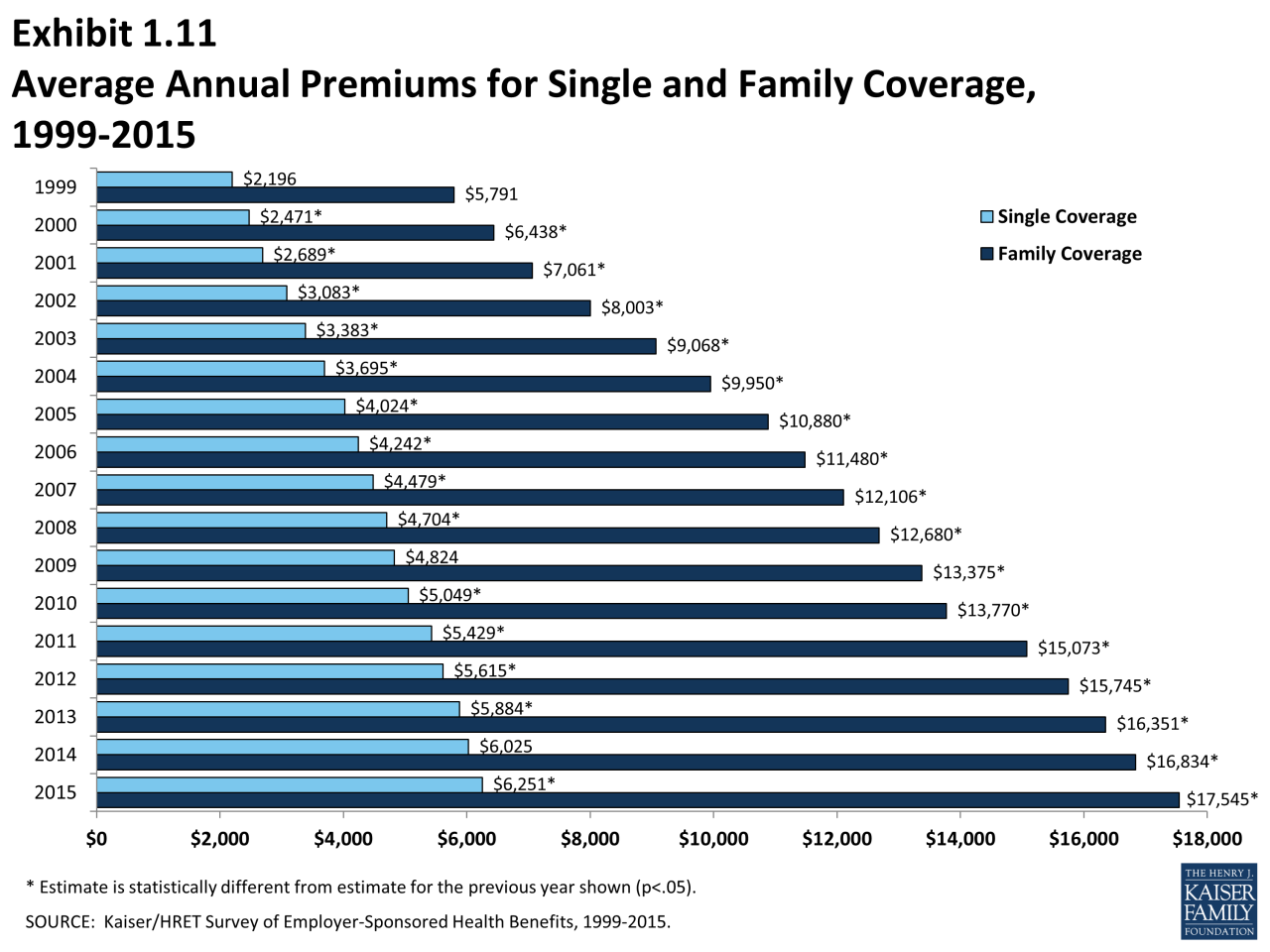

According to a study by the Kaiser Family Foundation, the average annual premium for employer-sponsored health insurance in the United States was $22,221 in 2023, an increase of 5% from the previous year. This translates to an average monthly cost of $1,852 per employee.

Factors Influencing Business Health Insurance Costs

Numerous factors contribute to the variations in business health insurance costs. These include:

- Size of the business: Larger businesses typically have lower per-employee health insurance costs due to their ability to spread the risk across a broader pool of employees.

- Industry: The type of industry a business operates in can also impact health insurance costs. Industries with higher-risk occupations, such as construction or manufacturing, tend to have higher health insurance premiums.

- Geographic location: Health insurance costs can vary significantly depending on the geographic location of the business. Factors such as the cost of living, availability of healthcare providers, and state regulations can all affect premiums.

- Employee demographics: The age, health status, and family size of employees can also influence health insurance costs. Businesses with a higher proportion of older or sicker employees may face higher premiums.

- Plan design: The type of health insurance plan offered by the business, such as a PPO or HMO, can also affect costs. Plans with lower deductibles and more comprehensive coverage typically have higher premiums.

Cost Control Strategies

Controlling health insurance costs is crucial for businesses to maintain financial stability and provide affordable benefits to employees. Effective cost control strategies include proactive planning, leveraging technology, and optimizing plan design.

Wellness Programs

Wellness programs promote employee health and well-being, reducing healthcare costs in the long run. These programs may include health screenings, fitness challenges, and smoking cessation initiatives.

High-Deductible Health Plans (HDHPs)

HDHPs have lower premiums but higher deductibles. They encourage employees to be more mindful of healthcare expenses, leading to potential savings.

Reference-Based Pricing

Reference-based pricing compares the cost of medical services to a set benchmark, ensuring fair pricing and reducing overcharging by providers.

Generic Drug Encouragement

Generic drugs offer the same benefits as brand-name drugs at a lower cost. Encouraging employees to use generic drugs can significantly reduce pharmacy expenses.

Telemedicine

Telemedicine allows employees to access healthcare services remotely, reducing the need for costly in-person visits and improving convenience.

Employee Engagement and Wellness

Employee engagement and wellness programs play a crucial role in reducing health insurance costs by improving employee health and reducing healthcare utilization. These programs focus on promoting healthy behaviors, providing access to preventive care, and creating a supportive work environment.

Successful employee engagement initiatives include:

– Health screenings and wellness assessments

– Health education programs

– Fitness challenges and incentives

– Stress management programs

– Employee assistance programs

These programs can improve employee health by:

– Identifying and addressing health risks early on

– Encouraging healthy lifestyle choices

– Reducing stress and improving mental well-being

By improving employee health, these programs can reduce healthcare utilization and associated costs, such as:

– Doctor’s visits

– Hospitalizations

– Prescription drug costs

– Absenteeism

Case Study

A study conducted by the Centers for Disease Control and Prevention (CDC) found that a comprehensive worksite wellness program reduced healthcare costs by 25% over a three-year period. The program included health screenings, health education, and fitness challenges.

Negotiating with Insurance Carriers

Negotiating with insurance carriers can be a daunting task for businesses. However, by following some key tips and strategies, you can increase your chances of securing a favorable contract that meets the needs of your company and employees.

One of the most important factors to consider when negotiating a health insurance contract is the size of your group. The larger your group, the more leverage you will have in negotiations. This is because insurance carriers are more likely to offer discounts and concessions to larger groups in order to secure their business.

Another important factor to consider is the health of your employees. If your employees are generally healthy, you will be able to negotiate lower premiums. However, if your employees have a history of health problems, you may need to pay higher premiums.

It is also important to understand the different types of health insurance plans that are available. There are a variety of plans to choose from, each with its own set of benefits and costs. You will need to carefully consider the needs of your employees and your budget when choosing a plan.

Once you have considered these factors, you can begin negotiating with insurance carriers. It is important to be prepared and to know what you want before you start negotiations. You should also be willing to walk away from the table if you cannot reach an agreement that is satisfactory to you.

Tips for Negotiating with Insurance Carriers

- Be prepared and know what you want.

- Consider the size of your group and the health of your employees.

- Understand the different types of health insurance plans that are available.

- Be willing to walk away from the table if you cannot reach an agreement that is satisfactory to you.

Legal and Regulatory Considerations

Business health insurance is subject to various legal and regulatory requirements. Understanding these obligations is crucial for businesses to comply and avoid potential penalties or legal liabilities.

The Affordable Care Act

The Affordable Care Act (ACA), also known as Obamacare, has significantly impacted business health insurance. Key provisions include:

- Employer Mandate: Businesses with 50 or more full-time employees must offer affordable health insurance or pay penalties.

- Individual Mandate: Individuals are required to have health insurance or pay a tax penalty.

- Premium Subsidies: Tax credits are available to low- and moderate-income individuals to help cover health insurance premiums.

Compliance and Guidance

To ensure compliance with legal and regulatory requirements, businesses should:

- Consult with legal counsel to understand their specific obligations.

- Review and update employee health insurance plans regularly to meet ACA requirements.

- Document compliance efforts, including communication with employees and record-keeping.