Buy FFIE stock? That’s the question on everyone’s lips, especially those who are in the know about the electric vehicle market. FFIE, short for Faraday Future, is a company that’s been making waves with its plans for futuristic electric vehicles. They’re aiming for the big leagues, taking on Tesla and other established players in the EV game. But is FFIE stock a winning ticket, or is it just another flash in the pan?

The company has a history of ups and downs, and their financial performance has been a roller coaster ride. But they’re also attracting attention for their bold vision and innovative designs. So, is FFIE a risky bet that could pay off big, or is it a risky bet that could leave you holding the bag? Let’s dive into the details and see if FFIE stock is worth your hard-earned cash.

Investment Considerations for FFIE Stock

Investing in FFIE stock presents a unique opportunity to capitalize on the burgeoning electric vehicle (EV) market. However, like any investment, it’s crucial to thoroughly evaluate the company’s prospects, risks, and valuation before making a decision.

Key Factors to Consider, Buy ffie stock

Investors should carefully consider the following factors when evaluating FFIE as an investment:

- FFIE’s Business Model: FFIE’s primary business involves developing and manufacturing electric vehicles, focusing on commercial trucks and buses. This segment is experiencing rapid growth as businesses and governments prioritize sustainable transportation solutions.

- Technology and Innovation: FFIE’s technological capabilities, including its battery technology and vehicle design, will play a crucial role in its success. Investors should assess the company’s research and development efforts and its ability to compete with established EV manufacturers.

- Market Competition: The EV market is becoming increasingly competitive, with established players like Tesla and newer entrants vying for market share. FFIE’s ability to differentiate itself and gain market traction will be crucial.

- Financial Performance: Investors should analyze FFIE’s financial statements, including revenue, profitability, and cash flow. A strong financial track record is essential for long-term sustainability.

- Management Team: The quality of FFIE’s management team, their experience in the automotive industry, and their ability to execute the company’s strategic plan are critical factors to consider.

Potential Risks and Rewards

Investing in FFIE stock involves both potential risks and rewards.

- Competition: The intense competition in the EV market could hinder FFIE’s growth and profitability. Established players with deep pockets and extensive resources pose a significant challenge.

- Technological Advancement: Rapid advancements in EV technology could render FFIE’s products obsolete, requiring significant investments in research and development to stay competitive.

- Regulatory Environment: Government regulations and incentives can significantly impact the EV industry. Changes in policies could affect FFIE’s business operations and financial performance.

- Financial Performance: FFIE is a relatively young company with limited revenue and profitability. Investors should be prepared for potential volatility in the stock price.

- Valuation: FFIE’s valuation is currently high compared to its peers and industry benchmarks. This reflects the market’s optimism about the company’s future prospects, but it also creates a higher risk of a significant price correction if expectations are not met.

Valuation Analysis

FFIE’s valuation is a key consideration for investors. The company’s current market capitalization is significantly higher than its revenue and earnings, reflecting investor enthusiasm for its growth potential. However, it’s crucial to compare FFIE’s valuation to its peers and industry benchmarks.

FFIE’s current price-to-sales (P/S) ratio is higher than many established EV manufacturers, indicating a premium valuation. This reflects the market’s expectations for rapid growth and market share gains. However, it also raises concerns about potential overvaluation.

Investors should also consider FFIE’s future earnings potential and its ability to generate cash flow. A detailed analysis of FFIE’s financial statements and projections can provide insights into its valuation and its long-term growth prospects.

FFIE’s Future Prospects: Buy Ffie Stock

FFIE’s future prospects hinge on its ability to execute its ambitious growth strategy, navigate the evolving electric vehicle landscape, and overcome significant challenges. The company’s success will be determined by its ability to capitalize on the growing demand for electric vehicles while managing its financial resources effectively.

Growth Potential and Expansion Plans

FFIE’s growth potential is fueled by its plans for expansion and new product development. The company aims to expand its manufacturing capacity and geographic reach to meet the growing demand for electric vehicles. FFIE is also developing a range of new products, including electric trucks, buses, and SUVs, to cater to diverse market segments.

- FFIE is actively pursuing strategic partnerships and acquisitions to enhance its technological capabilities and market reach.

- The company is investing heavily in research and development to create innovative and competitive electric vehicle technologies.

- FFIE is expanding its global presence by establishing manufacturing facilities and distribution networks in key markets.

Key Challenges and Opportunities

FFIE faces several challenges in the coming years, including intense competition, regulatory hurdles, and the need for substantial capital investment. However, the company also has significant opportunities to capitalize on the growing demand for electric vehicles and the increasing adoption of sustainable transportation solutions.

- FFIE needs to overcome challenges related to battery supply chain disruptions, rising raw material costs, and the need to secure financing for its ambitious growth plans.

- The company must navigate a complex regulatory environment that is constantly evolving, with varying standards and incentives across different regions.

- FFIE needs to differentiate itself from competitors by offering innovative products, competitive pricing, and exceptional customer service.

- The company can leverage the growing demand for electric vehicles, especially in the commercial and industrial sectors, to secure market share and expand its customer base.

- FFIE has the opportunity to capitalize on government incentives and subsidies for electric vehicle adoption, which can provide a significant boost to its sales and profitability.

- The company can leverage its expertise in electric vehicle technology to develop new products and services that cater to the evolving needs of consumers and businesses.

Long-Term Outlook and Stock Appreciation Potential

FFIE’s long-term outlook is positive, driven by the growing demand for electric vehicles and the company’s commitment to innovation and expansion. However, the company’s stock price is subject to volatility and depends on its ability to execute its strategic plans and overcome the challenges it faces.

- FFIE’s stock price is likely to be influenced by factors such as its financial performance, product launches, regulatory developments, and the overall market sentiment towards electric vehicles.

- Investors should carefully consider the risks and opportunities associated with investing in FFIE stock, including the company’s financial position, its dependence on external funding, and the competitive landscape in the electric vehicle market.

Last Point

FFIE stock is a wild card, but it’s a wild card with potential. It’s a company with a lot of ambition, and if they can deliver on their promises, the rewards could be huge. But there’s also a lot of risk involved, and investors need to be aware of the challenges ahead. If you’re looking for a high-risk, high-reward investment, FFIE stock might be worth considering. But if you’re looking for a safe and steady investment, there are probably better options out there. Ultimately, the decision of whether or not to buy FFIE stock is up to you. Do your research, weigh the risks and rewards, and make a decision that’s right for your investment goals.

Questions Often Asked

Is FFIE stock a good investment for beginners?

FFIE stock is considered a high-risk investment, so it’s not recommended for beginners. It’s best to start with investments that have less risk and more stability before venturing into more volatile stocks.

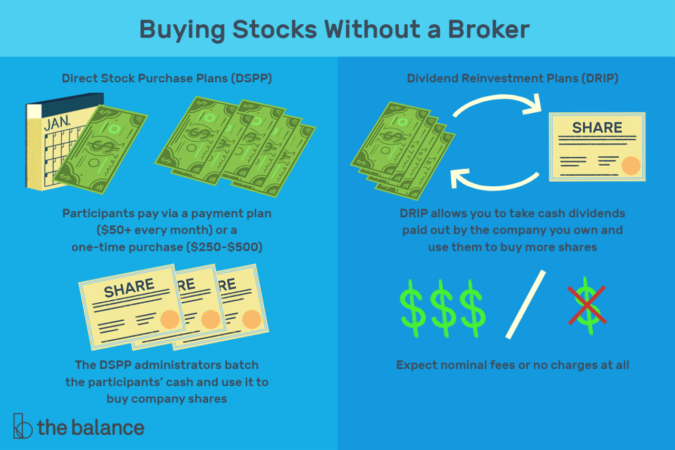

How much money do I need to invest in FFIE stock?

You can invest as little or as much as you want, but it’s important to only invest what you can afford to lose. It’s also important to diversify your investments across different assets to mitigate risk.

What are the risks of investing in FFIE stock?

There are several risks associated with investing in FFIE stock, including volatility, the company’s financial performance, and the overall market conditions. It’s important to understand these risks before making an investment.