Can an insurance company drop you for no reason? It’s a question that might make you sweat, especially if you’re already dealing with the stress of finding the right coverage. The good news is that while insurance companies have the right to cancel your policy, there are some serious rules they need to follow. Think of it like this: your insurance policy is a contract, and just like any contract, both sides have obligations. So, what are those obligations, and how can you protect yourself?

We’ll dive into the world of insurance contracts, exploring what’s fair game and what’s a total no-no. We’ll cover the situations where a company can legitimately cancel your policy, as well as the unfair practices you need to watch out for. We’ll also give you the lowdown on your rights as a policyholder and how to fight back if you feel like you’ve been dealt a bad hand.

Understanding Insurance Contracts

Insurance contracts are legally binding agreements between an insurance company and an insured individual or entity. These contracts Artikel the terms and conditions of the insurance policy, including the coverage provided, the premium amount, and the obligations of both parties.

Insurance Contract Clauses Addressing Termination, Can an insurance company drop you for no reason

Insurance contracts often contain clauses that address termination, outlining the circumstances under which either party can end the agreement. Some common clauses include:

- Non-Payment of Premiums: If the insured fails to pay premiums on time, the insurance company may terminate the policy.

- Material Misrepresentation: If the insured provides false or misleading information during the application process, the insurance company may have grounds to terminate the policy.

- Violation of Policy Terms: If the insured violates any of the terms and conditions of the policy, such as engaging in risky behavior or failing to maintain certain safety standards, the insurance company may terminate the policy.

- Fraudulent Claims: If the insured files a fraudulent claim, the insurance company can terminate the policy and potentially pursue legal action.

Legal Framework Governing Insurance Contracts

Insurance contracts are subject to a comprehensive legal framework that ensures their enforceability and protects the rights of both parties. These laws vary by jurisdiction, but generally include:

- Contract Law: Insurance contracts are governed by general principles of contract law, which address issues such as offer, acceptance, consideration, and enforceability.

- Insurance Law: Specific insurance laws regulate the insurance industry, including requirements for licensing, policy disclosures, and claim handling procedures.

- State Regulations: Each state has its own regulations governing insurance contracts, which may address specific issues such as coverage requirements, premium rates, and consumer protection.

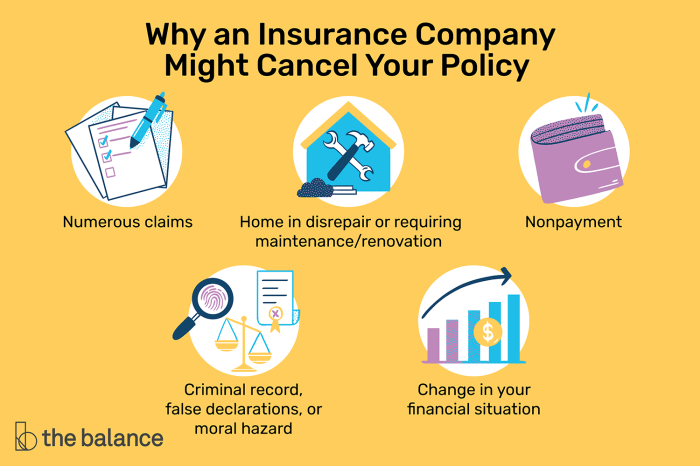

Legitimate Reasons for Cancellation

Insurance companies, just like any other business, have the right to end their contracts with you. While they can’t just drop you for no reason, there are specific situations where they can legally cancel your policy.

It’s important to understand these reasons and how they apply to your specific policy, as a canceled policy could leave you without the protection you need.

Policy Violations

Policy violations are the most common reason for insurance cancellation. These are situations where you, as the policyholder, fail to meet the terms and conditions of your agreement with the insurance company.

Here are some examples of policy violations that could lead to cancellation:

- Non-payment of Premiums: This is the most frequent reason for cancellation. Insurance companies rely on premium payments to cover their costs and pay claims. If you fail to make your payments on time, they may cancel your policy.

- Fraudulent Claims: If you attempt to defraud the insurance company by making false claims, they will likely cancel your policy and possibly pursue legal action.

- Misrepresentation: Providing false or misleading information when applying for insurance, such as your driving history or health status, can be grounds for cancellation.

- Breach of Contract: Failing to adhere to the terms of your policy, such as making changes to your property without notifying the insurer, could lead to cancellation.

Cancellation Process

The process for canceling an insurance policy varies depending on the insurer and the type of policy. However, there are some general steps involved:

- Notice Period: Most insurance companies have a grace period for missed payments or other violations. You’ll usually receive a notice from the insurer explaining the reason for cancellation and the time you have to correct the situation.

- Appeal Options: If you disagree with the cancellation, you may have the right to appeal the decision. You’ll need to contact the insurer and provide evidence supporting your appeal.

- Cancellation Effective Date: Once the cancellation process is complete, your policy will be terminated on a specific date. You’ll be notified of this date in advance.

Consumer Rights and Recourse

Okay, so your insurance company wants to drop you like a bad habit? Not cool, man. You have rights, and you can fight back. Don’t just roll over and let them take your coverage. Here’s the lowdown on what you can do.

Policyholder Rights

It’s important to remember that insurance companies can’t just kick you to the curb without a reason. They need to follow the rules, and you have the right to know why they’re trying to cancel your policy.

You have the right to:

- Get a clear explanation of why they’re canceling. Don’t let them just say “we’re canceling your policy” without giving you a reason. They need to be specific. This is where you can get your lawyer involved.

- Review your policy and make sure they’re following the terms. Is the cancellation allowed under your contract? Read the fine print.

- Challenge the cancellation. You have the right to appeal their decision. You can do this by writing a letter or contacting the insurance company directly.

- File a complaint with your state’s insurance department. If you think the insurance company is acting unfairly, you can file a complaint. They’ll investigate the situation and help you resolve the issue.

Steps to Challenge Unfair Cancellation

So, your insurance company’s giving you the runaround, and you’re ready to fight back? Here’s what you can do:

- Gather your documentation. This includes your policy, any communication from the insurance company, and any evidence that supports your case.

- Contact the insurance company. Call them up or write a letter. Explain your position and ask for a review of their decision. Be polite but firm.

- File an appeal. Most insurance companies have an internal appeals process. Follow their procedures carefully.

- Seek help from a consumer protection agency. Organizations like the Better Business Bureau or your state’s consumer protection agency can offer guidance and support.

- Consider legal action. If all else fails, you may need to consult with a lawyer. They can help you understand your rights and options.

Legal Remedies

Okay, so you’ve tried everything, and the insurance company still wants to drop you? You might need to get legal. Here’s the deal:

- Negotiation: You can try to negotiate with the insurance company. They may be willing to work with you if you can provide them with a good reason why they should keep you as a customer.

- Legal Action: If negotiation fails, you can file a lawsuit against the insurance company. This can be expensive and time-consuming, but it may be your only option if the insurance company is acting unfairly.

Preventing Cancellation

You know how it is, you’re paying your premiums on time, you’re driving like a saint, and suddenly, BAM! Your insurance company drops you like a bad habit. It’s not always fair, but it’s a reality. So how can you keep those insurance ninjas from canceling your policy? It’s all about playing the game right.

Understanding Your Policy

Let’s be real, insurance policies are about as exciting as watching paint dry. But, trust me, you gotta get your nose in that paperwork. Think of it like studying for your insurance “final exam.” Knowing what’s in your policy is the key to avoiding cancellation.

- Read the fine print: We know, we know, it’s a lot of words. But seriously, read through those terms and conditions. Pay attention to things like coverage limits, exclusions, and what they consider a “breach” of the contract.

- Ask questions: Don’t be shy! If you’re confused about anything, call your insurance company and ask. They’re supposed to help you understand, so don’t be afraid to pick their brains.

- Keep your policy up-to-date: Life changes, and so should your insurance. If you move, get a new car, or add a driver to your policy, make sure to update your insurance company.

Communicating with Your Insurance Company

Communication is key in any relationship, even with your insurance company. You gotta keep them in the loop.

- Be proactive: Don’t wait for them to call you about a problem. If you have any changes, claims, or even just questions, reach out to them.

- Be honest: Don’t try to hide anything from your insurance company. If you’re in an accident, tell them the truth, even if it’s embarrassing. Being honest builds trust and can help you avoid cancellation.

- Keep good records: Document everything. Keep copies of your policy, payment receipts, and any communication you have with your insurance company. This will help you if you ever need to dispute a claim or cancellation.

Maintaining a Good Driving Record

Let’s face it, if you’re racking up tickets and accidents, you’re going to look like a risky driver in the eyes of your insurance company.

- Drive safely: This one’s a no-brainer. Follow the rules of the road, be cautious, and avoid distractions.

- Take defensive driving courses: These courses can help you learn how to be a better driver and can even earn you a discount on your insurance.

- Maintain your car: Make sure your car is in good working order. Get regular maintenance, fix any problems promptly, and keep up with your car insurance.

Paying Your Premiums on Time

It might seem obvious, but missing payments is a surefire way to get your insurance canceled.

- Set reminders: Use your phone, calendar, or whatever works for you to set reminders for your insurance payments.

- Set up automatic payments: This is the easiest way to make sure your payments are always on time.

- Communicate with your insurance company: If you’re having trouble making a payment, contact your insurance company. They may be able to work with you.

Closing Notes

The bottom line is that understanding your insurance policy is key. Know your rights, and don’t be afraid to speak up if you feel like you’re being treated unfairly. Remember, you’re not alone, and there are resources available to help you navigate this sometimes confusing world of insurance. Stay informed, stay empowered, and don’t let those insurance companies pull the wool over your eyes!

FAQ Summary: Can An Insurance Company Drop You For No Reason

What are some common reasons for insurance cancellation?

Insurance companies can cancel your policy for things like failing to pay your premiums, making false statements on your application, or engaging in risky behavior that increases your risk.

Can I be dropped for a small mistake on my application?

It depends. Small errors might be overlooked, but if it’s something that significantly affects your risk profile, the company may have grounds to cancel.

What should I do if my insurance company tries to cancel my policy unfairly?

Contact your state’s insurance department or a consumer protection agency. They can help you understand your rights and file a complaint.