Can I change life insurance companies? Absolutely! You might be surprised to learn that switching life insurance companies can be a smart move, especially if your life circumstances have changed since you first purchased your policy. Maybe you got married, had kids, bought a house, or simply found a better deal elsewhere. The good news is that you have options and you’re not stuck with your current policy if it no longer fits your needs.

This guide will walk you through the process of evaluating your current policy, exploring new options, and making an informed decision about whether switching is right for you. We’ll cover the key factors to consider, the potential benefits and risks, and provide tips for choosing the right company to meet your evolving insurance needs.

Factors to Consider When Switching: Can I Change Life Insurance Companies

Switching life insurance companies can be a smart move if you’re looking for a better deal or need different coverage. But before you make the leap, it’s essential to weigh the pros and cons carefully.

You’ll need to consider the potential costs and benefits, any potential risks or challenges involved, and the process of switching, including the paperwork and timelines involved.

Potential Costs and Benefits

Switching life insurance companies can involve both costs and benefits. You might have to pay a new policy’s application fee, medical exam fees, or a higher premium if your health has changed. However, you could also save money on your premiums or get better coverage.

Potential Risks and Challenges

Switching life insurance companies can involve some risks. For example, you might not be approved for a new policy if you have health problems. Additionally, you might lose some of the benefits of your old policy, such as a guaranteed death benefit.

The Process of Switching

Switching life insurance companies typically involves a few steps:

- Contact a new life insurance company and get quotes.

- Apply for a new policy and complete any required paperwork.

- Get a medical exam if required.

- Once your application is approved, pay your first premium.

- Cancel your old policy.

The process can take a few weeks or months to complete, depending on the company and your individual circumstances.

Tips for Choosing the Right Company

Switching life insurance companies can be a big decision, so you want to make sure you choose the right one. There are a lot of factors to consider, like the company’s financial stability, customer service, and the types of policies they offer. But with a little research, you can find the perfect company for your needs.

Factors to Consider When Choosing a Life Insurance Company, Can i change life insurance companies

Here are some key factors to consider when choosing a new life insurance company.

- Financial Stability: Look for a company with a strong financial rating, like A or better from a reputable rating agency like A.M. Best or Standard & Poor’s. This means the company is financially sound and likely to be able to pay out claims in the future.

- Customer Service: A good life insurance company will have excellent customer service. Look for companies with high customer satisfaction ratings and a history of responding promptly to customer inquiries.

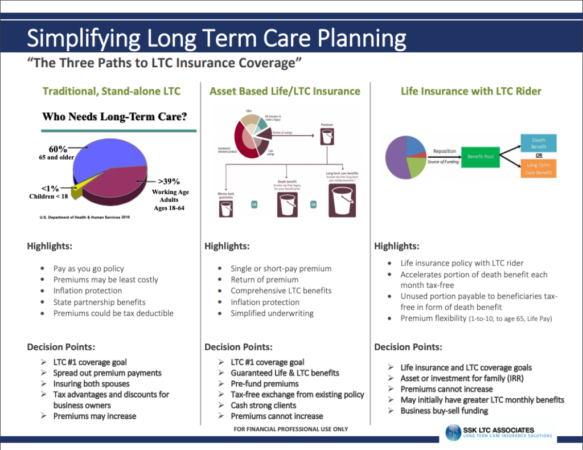

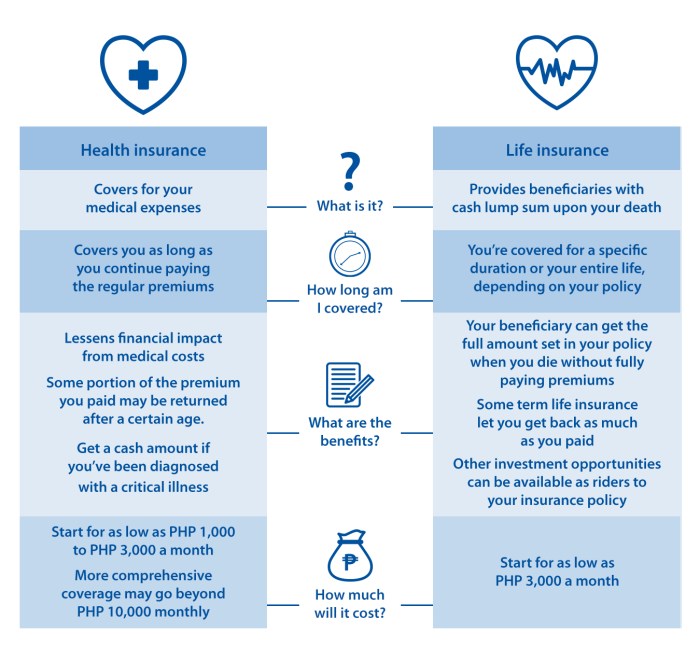

- Policy Options: Different companies offer different types of life insurance policies. Consider your needs and choose a company that offers the right type of policy for you. Some common types of life insurance include term life insurance, whole life insurance, and universal life insurance.

- Pricing: Life insurance premiums can vary widely between companies. Get quotes from several companies to compare prices and find the best deal.

- Reputation: Research the company’s reputation online and read customer reviews. Look for companies with a good track record of customer satisfaction and ethical business practices.

Conclusive Thoughts

Ultimately, deciding whether to switch life insurance companies is a personal choice based on your individual circumstances. By carefully weighing your options, understanding the potential costs and benefits, and choosing a reputable company, you can make a decision that provides peace of mind and financial security for you and your loved ones. Remember, life insurance is an important part of your financial plan, so it’s essential to review your coverage regularly and make adjustments as needed.

FAQ Explained

What if I have a pre-existing condition?

If you have a pre-existing condition, it’s important to be upfront with any potential new insurance company. They may require additional medical information or adjust your premiums accordingly.

How long does it take to switch life insurance companies?

The time it takes to switch can vary depending on the company and the type of policy you’re switching to. It can take anywhere from a few weeks to a few months. Be sure to ask about the timeline when you’re applying for a new policy.

What happens to my current policy if I switch?

You’ll typically need to cancel your existing policy once your new policy is in effect. Be sure to understand the cancellation process and any potential penalties or fees.