Can I get gap insurance through my insurance company? You betcha! It’s a question a lot of folks are asking, especially those who’ve got a sweet ride and a loan to match. Think of gap insurance as a safety net, protecting you from the financial bummer of owing more on your car than it’s worth after an accident. It covers the gap between what your regular insurance pays out and what you still owe on your loan.

Getting gap insurance through your existing insurer can be a real time-saver and often means a smoother process. Your insurance agent can explain the ins and outs, help you choose the right coverage, and even compare prices with other options. But before you jump in, it’s good to know what factors can affect the cost, like your car’s age, your loan amount, and your driving history.

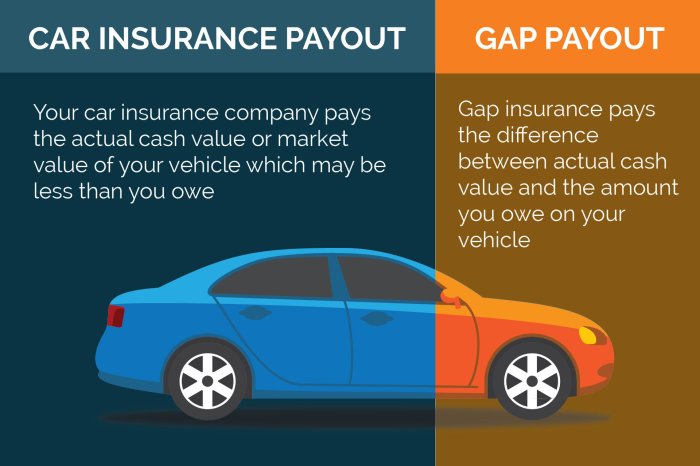

How Gap Insurance Works

Gap insurance is like a safety net for your car loan. It covers the difference between what you owe on your car loan and what your insurance company pays out after an accident or theft. This can be a lifesaver if your car is totaled, and you’re left with a big gap in your pocket.

How Gap Insurance Payments Are Calculated

Gap insurance payments are calculated based on the difference between the actual cash value (ACV) of your car and the outstanding balance on your loan.

The actual cash value is determined by your insurance company and reflects the current market value of your car, taking into account factors like age, mileage, and condition.

The outstanding balance is the amount you still owe on your car loan.

Gap insurance will cover the difference between the ACV and the outstanding balance, up to the amount of your gap insurance policy.

Scenarios Where Gap Insurance Would Be Used

Here are some examples of situations where gap insurance would be useful:

- You financed a brand new car, but it was totaled in an accident a few months later. The ACV of the car has already depreciated significantly, but you’re still on the hook for a large portion of the loan. Gap insurance would cover the difference.

- Your car is stolen and never recovered. Again, your insurance company will only pay the ACV of your car, which is likely less than what you owe. Gap insurance can help bridge the gap.

Getting Gap Insurance through Your Insurance Company: Can I Get Gap Insurance Through My Insurance Company

You might be thinking, “Why should I get gap insurance through my car insurance company?” It’s a good question, and the answer might surprise you. There are a few perks to getting your gap insurance from the same company that handles your car insurance.

Advantages of Getting Gap Insurance from Your Existing Insurer

It’s a good idea to explore getting your gap insurance from your existing car insurance company. There are a few advantages to doing this.

- Convenience: One of the biggest advantages is convenience. You can get a quote and buy gap insurance right from your car insurance company, all in one place. You don’t have to go through the hassle of contacting another company, comparing quotes, and filling out paperwork.

- Bundled Discounts: Many car insurance companies offer discounts if you bundle your gap insurance with your car insurance policy. This can save you money in the long run.

- Trust: You’re already familiar with your car insurance company and you trust them to handle your car insurance. It’s likely that you’ll also trust them to handle your gap insurance.

Requesting a Gap Insurance Quote from Your Insurance Company

Requesting a gap insurance quote from your existing car insurance company is pretty straightforward. You can do it online, over the phone, or in person.

- Online: Most car insurance companies have a website where you can request a gap insurance quote. You’ll need to provide some basic information about your car, like the year, make, and model.

- Phone: You can also call your car insurance company and ask for a gap insurance quote. A customer service representative will ask you some questions about your car and your insurance needs.

- In Person: If you prefer, you can visit your car insurance company’s office in person to get a gap insurance quote. You’ll need to bring your car’s registration and insurance information.

Comparing the Cost of Gap Insurance from Different Insurance Providers

It’s a good idea to compare gap insurance quotes from different insurance providers, even if you plan to get your gap insurance from your existing car insurance company. This will help you make sure that you’re getting the best deal.

- Online Comparison Tools: There are a number of online comparison tools that can help you compare gap insurance quotes from different insurance providers. These tools are free to use and can save you time and money.

- Contact Multiple Companies: You can also contact multiple insurance companies directly and ask for gap insurance quotes. Be sure to tell each company about your car and your insurance needs.

- Consider the Fine Print: When comparing gap insurance quotes, be sure to read the fine print carefully. Pay attention to things like the deductible, the coverage period, and the exclusions.

Factors Affecting Gap Insurance Availability and Cost

Gap insurance, like most insurance products, isn’t a one-size-fits-all deal. Several factors can impact whether you qualify for gap insurance and how much it will cost. Let’s dive into the factors that influence the availability and cost of this valuable protection.

Vehicle Age

The age of your vehicle is a significant factor in determining your eligibility for gap insurance and the premium you’ll pay. Generally, gap insurance is more readily available and affordable for newer vehicles. As your car ages, its value depreciates faster, potentially increasing the gap between your loan balance and the actual market value. Insurance companies may be less likely to offer gap insurance on older vehicles, or the premiums may be higher due to the increased risk of a significant gap.

Loan Amount

The amount of your car loan plays a crucial role in determining the cost of gap insurance. A larger loan amount means a greater potential gap between the loan balance and the vehicle’s actual value in the event of a total loss. Therefore, higher loan amounts usually translate to higher gap insurance premiums.

Insurance History

Your driving history, including accidents and traffic violations, can also influence the cost of gap insurance. A clean driving record generally results in lower premiums, while a history of accidents or violations may lead to higher premiums. Insurance companies consider your driving history as a measure of your risk as a driver, and they adjust premiums accordingly.

Comparison Table, Can i get gap insurance through my insurance company

Here’s a simplified table showcasing how these factors can impact the cost of gap insurance:

| Factor | Impact on Gap Insurance Availability and Cost |

|—|—|

| Newer Vehicle | More readily available, lower premiums |

| Older Vehicle | Less readily available, higher premiums |

| Larger Loan Amount | Higher premiums |

| Smaller Loan Amount | Lower premiums |

| Clean Driving Record | Lower premiums |

| Poor Driving Record | Higher premiums |

Alternatives to Gap Insurance

Gap insurance isn’t the only way to protect yourself from financial loss if your car is totaled. Here are a few other options you might want to consider.

Extended Warranties

Extended warranties, also known as service contracts, can provide coverage for repairs beyond the manufacturer’s warranty. They can help protect you from unexpected repair costs, which can be especially helpful if your car is older or has high mileage. However, extended warranties are not a replacement for gap insurance. They typically cover repairs, not the difference between the loan amount and the actual cash value of your vehicle.

Loan Protection Plans

Loan protection plans are designed to help you make your car payments if you become disabled or lose your job. They can also pay off your loan if you die. However, loan protection plans typically don’t cover the difference between the loan amount and the actual cash value of your vehicle. They are also often more expensive than gap insurance.

Other Options

In addition to extended warranties and loan protection plans, you may be able to get some protection from financial loss if your car is totaled through other means. For example, some credit unions and banks offer loan programs that include gap insurance as part of the financing package. You may also be able to get gap insurance through your employer or other organizations.

Decision-Making

Deciding whether or not to get gap insurance is a personal choice that depends on your individual financial situation and risk tolerance. It’s like deciding whether to wear a seatbelt – you might not need it, but it’s there to protect you in case of a major mishap.

Factors to Consider When Deciding Whether to Purchase Gap Insurance

Before you decide whether to get gap insurance, take a moment to consider these key factors:

- Your Vehicle’s Loan or Lease: If you have a car loan or lease, gap insurance can be especially helpful. This is because you’re likely to owe more on your car than its actual market value, especially during the early years of your loan. In a total loss scenario, your insurance company will only pay out the actual cash value of your vehicle, leaving you with a significant financial gap. Gap insurance bridges this gap, covering the difference between what you owe and what your insurance company pays.

- Your Vehicle’s Age and Value: Gap insurance is generally more beneficial for newer vehicles with higher loan balances. As your car ages and depreciates, the gap between your loan amount and the actual cash value of your vehicle shrinks. Think of it like a brand new phone – it loses a lot of value the second you walk out of the store, but a phone you’ve had for a few years doesn’t lose as much value anymore.

- Your Financial Situation: Consider your overall financial health. Do you have a good emergency fund? Can you afford to pay off the remaining loan balance if your car is totaled? If the answer is no, gap insurance can provide peace of mind and protect you from a potential financial burden.

- Your Driving Habits: If you’re a safe driver with a clean record, you might feel less inclined to need gap insurance. But remember, accidents can happen to anyone, and even the safest drivers can find themselves in unexpected situations.

Financial Risks and Benefits of Having Gap Insurance

It’s like buying an insurance policy for your insurance policy! Here’s the breakdown:

- Financial Risks Without Gap Insurance: If you don’t have gap insurance and your car is totaled, you could be left with a significant amount of debt. This could happen if your loan balance is higher than the actual cash value of your vehicle. Imagine this: You owe $25,000 on your car, but it’s only worth $15,000. You’d be on the hook for the remaining $10,000. Ouch!

- Financial Benefits of Having Gap Insurance: Gap insurance can help you avoid this financial burden. If your car is totaled, gap insurance will pay the difference between the actual cash value of your vehicle and your loan balance. This means you can walk away from the accident without owing any money on the car. It’s like a safety net that protects you from financial disaster.

Decision-Making Flowchart

| Start | Do you have a car loan or lease? | |

| Yes | ||

| No | Gap insurance may not be necessary. | |

| Is your vehicle relatively new? | ||

| Yes | ||

| No | Gap insurance may not be as necessary. | |

| Is your loan balance significantly higher than the actual cash value of your vehicle? | ||

| Yes | ||

| No | Gap insurance may not be as necessary. | |

| Do you have a good emergency fund? | ||

| Yes | You may not need gap insurance. | |

| No | ||

| Are you comfortable with the risk of being financially responsible for the remaining loan balance if your car is totaled? | ||

| Yes | You may not need gap insurance. | |

| No | Consider purchasing gap insurance. | |

| End |

Final Review

So, should you get gap insurance? It’s a decision that depends on your individual situation, your financial comfort level, and how much you’re willing to gamble on your car’s future. If you’re driving a new or nearly new car with a hefty loan, gap insurance might be worth considering. But if you’re cruising in a classic with a smaller loan, you might be able to skip it. Either way, do your research, chat with your insurance agent, and make the call that’s right for you.

FAQs

What if my insurance company doesn’t offer gap insurance?

No worries! You can often find gap insurance through other providers, like banks or credit unions. Just make sure to compare prices and coverage before you commit.

Is gap insurance worth it for used cars?

It depends! If you bought a used car with a loan and it’s still worth less than what you owe, gap insurance could be a good idea. But if you’re driving a well-loved car with a smaller loan, you might not need it.

How long does gap insurance last?

Usually, gap insurance lasts for the duration of your car loan. Once your loan is paid off, you won’t need it anymore.