Can i get same day car insurance in california – Can I get same-day car insurance in California? This is a question many Californians ask, especially when facing an unexpected need for coverage. While the possibility of obtaining insurance on the same day is appealing, several factors determine whether this is feasible. The availability of same-day insurance depends on the insurer, your driving history, credit score, and the type of coverage you seek. Understanding these factors is crucial for navigating the process of securing car insurance quickly and effectively.

Obtaining same-day car insurance in California is a real possibility, but it’s important to understand the factors involved. This article explores the concept of same-day insurance, the benefits and drawbacks, the types of policies available, and the steps required to obtain coverage quickly. We’ll also provide tips for finding a suitable insurance provider and discuss considerations after obtaining same-day insurance.

Understanding Same-Day Car Insurance in California

In California, same-day car insurance refers to the possibility of obtaining a car insurance policy and having it become effective on the same day you apply for it. This can be a convenient option for individuals who need immediate coverage, such as those who have recently purchased a vehicle or are facing a lapse in their existing insurance.

Benefits and Drawbacks of Same-Day Car Insurance

The availability of same-day car insurance in California can offer several benefits, including:

- Immediate Coverage: Obtaining coverage on the same day you apply can provide peace of mind, knowing that you are protected in case of an accident or other unforeseen events.

- Convenience: The process can be completed quickly and efficiently, saving you time and effort.

- Flexibility: Some insurers may offer flexible payment options, allowing you to choose a payment plan that suits your budget.

However, there are also some potential drawbacks to consider:

- Limited Options: You may have fewer insurance providers to choose from compared to traditional policies, which could limit your ability to find the best coverage at the most competitive price.

- Higher Premiums: Same-day policies may come with higher premiums compared to traditional policies. This is because insurers may need to charge more to cover the costs associated with expedited processing and potential higher risks.

- Limited Coverage: Some same-day policies may have limited coverage options, meaning you may not be able to get the same level of protection as a traditional policy.

Types of Car Insurance Policies Available for Same-Day Purchase, Can i get same day car insurance in california

In California, several types of car insurance policies can be purchased on the same day, including:

- Liability Coverage: This type of coverage is required by law in California and protects you from financial liability in case you cause an accident that results in damage to another person’s property or injuries to another person. It is the minimum coverage required for all drivers in the state.

- Collision Coverage: This coverage helps pay for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage: This coverage helps pay for repairs or replacement of your vehicle if it is damaged due to events other than an accident, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient insurance to cover your damages.

Factors Influencing Same-Day Car Insurance Availability

While the idea of securing car insurance on the same day might seem appealing, several factors determine whether this is feasible in California. These factors vary depending on the insurance provider and your individual circumstances. Understanding these factors can help you make informed decisions about your car insurance needs.

Insurance Provider Policies

Insurance providers have their own policies and procedures regarding same-day insurance issuance. Some insurers might offer same-day coverage if you meet specific requirements, while others might have a longer processing time.

- Online Application Process: Some insurers have streamlined online application processes that allow for quicker processing and potential same-day coverage.

- Agent Availability: If you’re working with an insurance agent, their availability can impact the time it takes to complete the process. Some agents might be able to finalize your policy on the same day, while others might need additional time.

- Underwriting Requirements: The complexity of your insurance application can also influence the processing time. Insurers might need to conduct additional verification or underwriting checks, which can extend the processing time beyond a single day.

Your Individual Circumstances

Your individual circumstances, such as your driving history, credit score, and the type of vehicle you own, can also impact the availability of same-day insurance.

- Driving History: A clean driving record with no accidents or violations might lead to faster processing times, potentially allowing for same-day coverage. Conversely, a history of accidents or traffic violations might require additional review, which could delay the process.

- Credit Score: Your credit score can be a factor in determining your insurance rates. A good credit score might indicate a lower risk to insurers, potentially leading to faster processing times. However, a poor credit score might require additional review, potentially delaying the process.

- Vehicle Type: The type of vehicle you own can also impact the processing time. Some vehicles might require additional inspections or verification, which could extend the processing time beyond a single day.

Steps to Obtain Same-Day Car Insurance

Securing same-day car insurance in California involves a straightforward process. You’ll need to contact an insurance company, provide essential information, and complete the necessary steps.

Contacting an Insurance Company

The first step is to reach out to an insurance company offering same-day coverage. This can be done through their website, phone, or in-person visit.

Providing Essential Information

You will need to provide the following information:

- Personal details: Full name, address, date of birth, driver’s license number, and Social Security number.

- Vehicle details: Make, model, year, VIN (Vehicle Identification Number), and current mileage.

- Driving history: Information about your driving record, including any accidents or violations.

- Insurance history: Details of your previous insurance policies, including coverage and premiums.

Obtaining a Quote

Based on the information you provide, the insurance company will generate a quote for your car insurance. This quote will Artikel the coverage options and premium amounts.

Choosing Coverage and Payment

Review the quote carefully and choose the coverage options that best suit your needs and budget. You will also need to decide on your preferred payment method, such as monthly installments or a lump sum.

Policy Issuance

Once you have chosen your coverage and payment method, the insurance company will issue your policy. In most cases, this will be done electronically, and you will receive a confirmation email or text message.

Receiving Your Policy Documents

You will receive your policy documents either electronically or via mail, depending on the insurance company’s procedures. These documents will contain the details of your coverage and policy terms.

Flowchart

The process of obtaining same-day car insurance can be illustrated by the following flowchart:

- Contact an insurance company.

- Provide essential information.

- Receive a quote.

- Choose coverage and payment method.

- Policy issuance.

- Receive policy documents.

Finding a Suitable Insurance Provider

Finding the right car insurance provider in California is crucial, especially if you need same-day coverage. Several reputable companies offer this service, but it’s important to compare their features, pricing, and customer service to find the best fit for your needs.

Reputable Insurance Providers in California

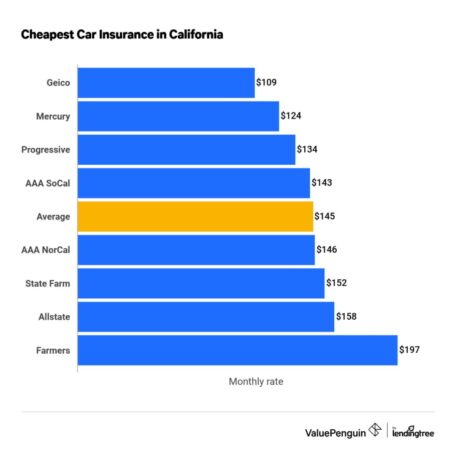

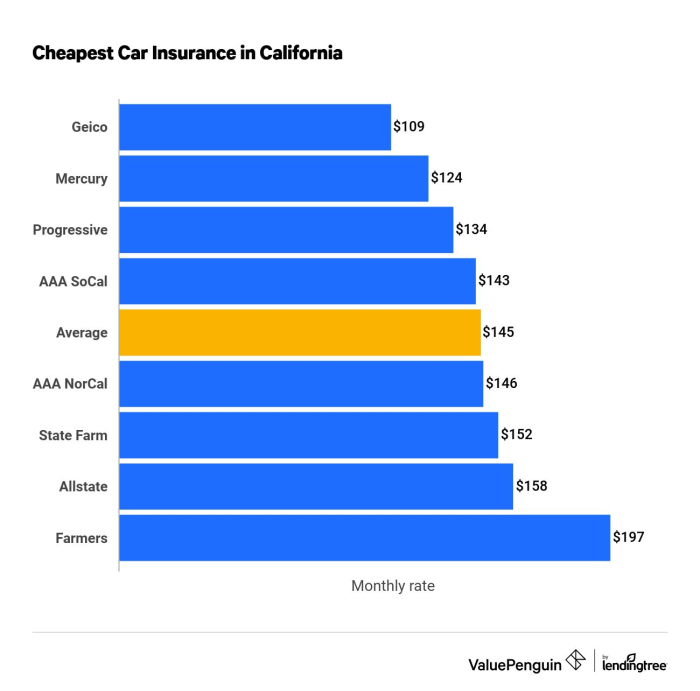

Several insurance providers in California offer same-day car insurance. Some of the most popular and reputable include:

- State Farm: State Farm is one of the largest insurance providers in the United States, known for its comprehensive coverage options and competitive pricing. They offer same-day coverage in California, subject to their eligibility requirements.

- Geico: Geico is another major insurance provider with a strong presence in California. They offer a wide range of coverage options, including same-day coverage. They are known for their competitive pricing and convenient online and mobile services.

- Progressive: Progressive is a well-known insurance provider that offers same-day coverage in California. They are known for their innovative features, such as their Name Your Price tool, which allows you to set your desired premium and see available coverage options.

- Farmers Insurance: Farmers Insurance is a regional insurance provider with a strong presence in California. They offer a variety of coverage options, including same-day coverage. They are known for their personalized service and local agents.

- Allstate: Allstate is a national insurance provider with a strong reputation in California. They offer same-day coverage and are known for their comprehensive coverage options and customer service.

Comparing Features, Pricing, and Customer Service

Once you have identified a few potential insurance providers, it’s essential to compare their features, pricing, and customer service. This will help you determine which provider best meets your specific needs.

- Coverage Options: Compare the types of coverage offered by each provider, including liability, collision, comprehensive, and uninsured motorist coverage. Make sure the provider offers the coverage you need and at a price you can afford.

- Pricing: Get quotes from multiple providers to compare their prices. Be sure to provide the same information to each provider, including your driving history, vehicle details, and desired coverage levels. This will allow you to compare apples to apples.

- Customer Service: Read online reviews and talk to friends and family to get an idea of the customer service provided by each provider. Look for companies with a history of responsive and helpful customer service.

Tips for Choosing the Most Suitable Insurance Provider

Here are some tips to help you choose the most suitable insurance provider for your needs:

- Consider your driving history: If you have a clean driving record, you may qualify for lower premiums. Conversely, if you have a history of accidents or violations, you may need to pay higher premiums. Be sure to compare quotes from different providers to see who offers the best rates for your driving history.

- Think about your vehicle: The type and value of your vehicle will also affect your insurance premium. If you drive a newer or more expensive vehicle, you will likely pay higher premiums. Consider the age, make, and model of your vehicle when comparing quotes.

- Evaluate your coverage needs: The amount of coverage you need will depend on your individual circumstances. If you have a significant amount of debt or assets, you may need more liability coverage. If you drive an older vehicle, you may not need collision or comprehensive coverage. Be sure to carefully evaluate your coverage needs before selecting a policy.

- Read the fine print: Before signing up for a policy, be sure to read the fine print carefully. Pay attention to the terms and conditions, including the deductible, coverage limits, and exclusions. This will help you understand exactly what you are covered for and what you are not covered for.

- Look for discounts: Many insurance providers offer discounts for various factors, such as good driving records, safe driving courses, and multiple policy discounts. Be sure to ask about available discounts to see if you can save money on your premiums.

Conclusive Thoughts

Securing same-day car insurance in California can be a convenient solution for those needing immediate coverage. While not always possible, understanding the factors influencing availability, the steps involved, and the considerations after obtaining coverage can help you navigate the process effectively. Remember to carefully review the policy details and understand the coverage provided to ensure your needs are met. By understanding the intricacies of same-day insurance, you can make informed decisions and protect yourself on the road.

Questions Often Asked: Can I Get Same Day Car Insurance In California

What are the benefits of same-day car insurance?

The primary benefit is immediate coverage, providing peace of mind in case of an accident or unexpected event. You can also avoid driving without insurance, which carries significant legal consequences.

What documents are required for same-day insurance?

Typically, you’ll need your driver’s license, vehicle registration, proof of address, and Social Security number. Some insurers may require additional documents depending on your situation.

What if I have a poor driving history?

A poor driving history can make it more difficult to obtain same-day insurance. Insurers may require a higher premium or deny coverage altogether. It’s advisable to be transparent about your driving record.

Can I change my insurance provider after obtaining same-day coverage?

You can usually switch providers after obtaining same-day insurance. However, you may need to fulfill a waiting period or pay a cancellation fee.

Is it possible to get same-day insurance online?

Many insurers offer online applications for car insurance, and some may provide same-day coverage if you meet their requirements. However, it’s essential to check the provider’s specific policies.