Can I pay my car insurance deductible in payments? It’s a question many drivers ask after an accident, especially if they’re facing a hefty deductible. While paying your deductible in full is usually the standard, many insurance companies offer payment options, making it easier to manage this unexpected expense.

This guide explores the different ways to pay your car insurance deductible, including common payment methods, financing options, and factors that can influence your choices. We’ll also discuss the consequences of not paying your deductible and provide helpful tips for managing these costs effectively.

Understanding Car Insurance Deductibles: Can I Pay My Car Insurance Deductible In Payments

A car insurance deductible is the amount of money you agree to pay out of pocket before your insurance company covers the remaining costs of a covered claim. Think of it as your “share” of the repair or replacement costs. It’s a crucial aspect of your car insurance policy and understanding how it works is essential.

Deductibles in Action

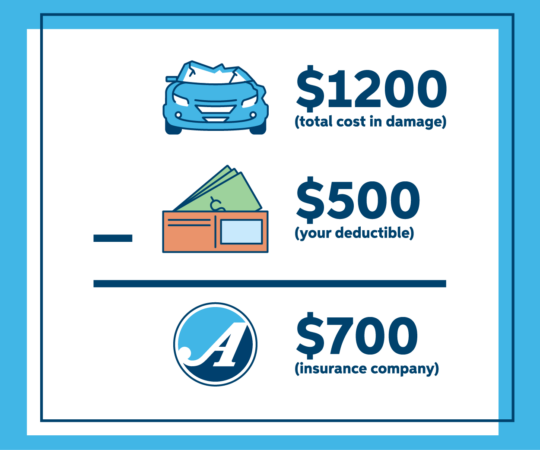

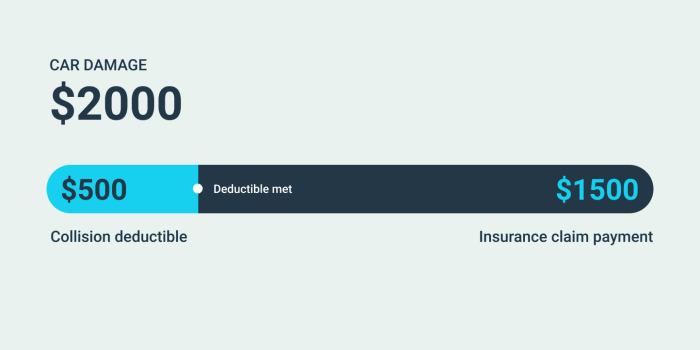

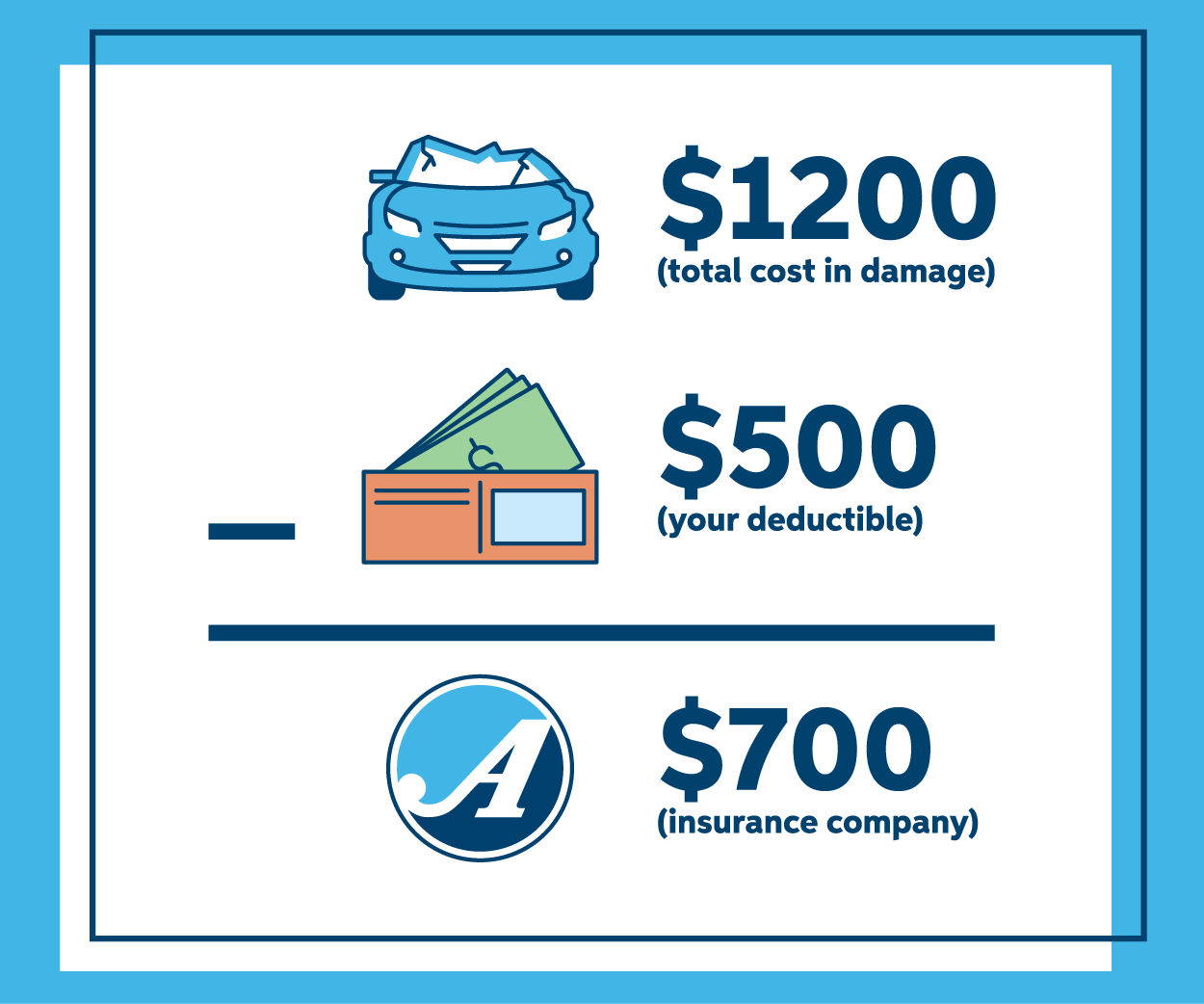

Deductibles come into play when you file a claim for a covered event, such as an accident, theft, or vandalism. Here are some examples:

- You’re involved in an accident, and your car needs repairs totaling $2,000. If your deductible is $500, you pay $500, and your insurance company covers the remaining $1,500.

- Your car is stolen, and you have a comprehensive coverage deductible of $1,000. If the replacement value of your car is $15,000, you pay $1,000, and your insurance company covers the remaining $14,000.

Deductible Amount and Insurance Premium

The amount of your deductible directly impacts your insurance premium. A higher deductible generally means a lower premium, and vice versa.

A higher deductible signifies that you’re willing to take on more financial risk in case of a claim, which allows your insurance company to offer you a lower premium.

For instance, if you opt for a $1,000 deductible instead of a $500 deductible, your monthly premium might be lower by a few dollars. However, if you file a claim, you’ll have to pay a higher amount out of pocket.

Ultimately, choosing the right deductible amount involves weighing the potential savings on your premium against the potential cost of a higher deductible. It’s a personal decision that depends on your financial situation and risk tolerance.

Payment Options for Deductibles

After an accident or incident, you’ll need to pay your deductible before your insurance company covers the rest of the costs. Insurance companies offer various payment methods to accommodate different preferences and financial situations. Understanding these options allows you to choose the best fit for your needs.

Common Payment Methods

Insurance companies typically accept various payment methods for deductibles. Here are some common options:

- Cash: Paying in cash is a straightforward option, providing immediate payment and avoiding any interest charges. However, carrying large amounts of cash can be inconvenient and risky.

- Check: Checks are a traditional payment method, allowing you to pay your deductible directly from your bank account. However, checks can take time to process, potentially delaying your claim settlement.

- Debit Card: Debit cards offer a convenient and secure way to pay your deductible directly from your checking account. They provide real-time transaction confirmation and are widely accepted.

- Credit Card: Using a credit card can provide flexibility and reward points, but be mindful of interest charges if you don’t pay the balance in full. It’s crucial to compare credit card interest rates and payment terms before using this option.

- Money Order: Money orders offer a secure payment method, especially when dealing with large sums. They can be purchased at various locations, including banks, post offices, and retail stores. However, they may involve a fee and require time to process.

Financing Options

If you can’t afford to pay your deductible upfront, some insurance companies offer financing options.

- Payment Plans: Some insurance companies allow you to set up a payment plan for your deductible, spreading the cost over several months. This can be helpful if you need time to gather funds. However, these plans may come with interest charges.

- Loans: You can consider personal loans from banks or credit unions to cover your deductible. This option provides a fixed interest rate and a set repayment schedule. However, ensure you can afford the monthly payments before taking out a loan.

Setting Up a Payment Plan

If you need to set up a payment plan for your deductible, contact your insurance company directly.

- Eligibility: Not all insurance companies offer payment plans, and eligibility criteria may vary.

- Terms and Conditions: Understand the payment plan’s terms and conditions, including interest rates, repayment period, and any associated fees.

- Documentation: You may need to provide documentation, such as proof of income, to support your payment plan request.

Factors Affecting Deductible Payment Options

The ability to pay your car insurance deductible in installments depends on various factors, including your insurance policy, state regulations, and the specific requirements of your insurance company. Understanding these factors is crucial to determining your payment options.

Insurance Policy Terms and Conditions

Your car insurance policy Artikels the terms and conditions regarding deductible payments, including whether or not installment payments are allowed.

“The policy may specify that deductibles must be paid in full at the time of the claim or offer a limited number of payment options, such as a specific timeframe or maximum number of installments.”

For example, some policies might allow you to pay your deductible in two or three installments over a certain period, while others may require full payment upfront. Carefully review your policy to understand your payment options.

State Regulations

State regulations play a significant role in shaping deductible payment options. Some states have specific laws governing how insurance companies can handle deductible payments, including whether they must offer installment plans.

“State laws may mandate that insurance companies provide a minimum number of payment options or a maximum timeframe for paying the deductible.”

For instance, some states may require insurers to offer installment plans for deductibles exceeding a certain threshold. It is essential to check your state’s regulations to understand your rights and options.

Insurance Company Requirements

Insurance companies have their own specific policies and procedures regarding deductible payments. Some companies may offer flexible payment plans, while others may have stricter requirements.

“Companies may have different criteria for approving installment plans, such as credit score, payment history, or claim frequency.”

For example, an insurance company might require you to have a good credit score or a history of timely payments to qualify for an installment plan. It is important to contact your insurance company directly to inquire about their specific payment options and requirements.

Consequences of Not Paying Deductible

Failing to pay your car insurance deductible can have serious consequences, potentially impacting your future insurance coverage and premiums. It’s essential to understand the potential repercussions and make timely payments to avoid these complications.

Impact on Future Insurance Coverage

Not paying your deductible can directly impact your future insurance coverage. Insurance companies often consider non-payment a breach of the insurance contract, leading to various actions.

- Cancellation of Coverage: The most severe consequence is the cancellation of your insurance policy. This means you will be left without coverage, leaving you financially vulnerable in case of another accident.

- Refusal to Renew: Even if your policy isn’t immediately canceled, the insurance company might refuse to renew it when it expires. This forces you to search for a new insurer, potentially facing higher premiums due to your past non-payment history.

- Limited Coverage: In some cases, instead of canceling your policy, the insurance company might limit your coverage. This could mean reduced coverage limits or exclusions for specific types of accidents or claims.

Impact on Future Premiums, Can i pay my car insurance deductible in payments

Non-payment of your deductible can significantly impact your future premiums. Insurance companies consider non-payment a sign of high risk, leading to increased premiums.

- Higher Premiums: Non-payment can result in significantly higher premiums when you renew your policy. This increase can be substantial, making your insurance more expensive.

- Difficulty Finding Coverage: Your non-payment history can make it challenging to find another insurance company willing to cover you. Some insurers may refuse to provide coverage due to your past non-payment.

- Limited Options: Even if you find an insurer willing to cover you, your non-payment history might limit your options. You may be restricted to specific policies with higher premiums and limited coverage.

Actions Taken by Insurance Companies

Insurance companies have various actions they can take in case of non-payment of your deductible.

- Late Payment Fees: Most insurance companies charge late payment fees for overdue deductibles. These fees can add up quickly, increasing your overall costs.

- Collection Efforts: If you fail to pay your deductible, the insurance company may initiate collection efforts. This can involve sending you reminders, contacting you by phone, or even involving debt collection agencies.

- Legal Action: In extreme cases, insurance companies may take legal action to recover the unpaid deductible. This can involve filing a lawsuit against you, which can further damage your credit score and financial standing.

Tips for Managing Deductibles

Car insurance deductibles are a crucial part of your policy. They represent the amount you pay out-of-pocket before your insurance coverage kicks in. Understanding how to manage deductibles can help you save money and minimize financial strain in the event of an accident.

Budgeting and Saving for Deductibles

Planning ahead for potential deductible payments is essential. Here are some tips to help you budget and save:

- Set Up a Dedicated Savings Account: Create a separate savings account specifically for car insurance deductibles. This helps you visualize the amount you’re saving and prevents you from using the funds for other purposes.

- Automate Savings: Set up automatic transfers from your checking account to your deductible savings account on a regular basis. This ensures consistent savings and reduces the risk of forgetting to save.

- Consider Increasing Your Deductible: A higher deductible typically translates to lower monthly premiums. However, make sure you can comfortably afford the higher deductible in case of an accident.

Negotiating Deductible Payment Terms

While deductibles are typically paid upfront, there might be opportunities to negotiate payment terms with your insurance company.

- Discuss Payment Plans: Contact your insurance company to inquire about payment plans or options for splitting the deductible into installments. Some insurers may offer this flexibility, especially if you have a good payment history.

- Explore Deductible Waivers: Certain insurance policies offer deductible waivers for specific events, such as accidents caused by uninsured motorists. Check your policy details to see if you qualify for such waivers.

Steps to Pay Your Deductible

Here’s a breakdown of the steps involved in paying your deductible:

| Step | Action |

|---|---|

| 1 | File a claim with your insurance company. |

| 2 | Provide all necessary documentation, including details of the accident and any relevant receipts. |

| 3 | Your insurance company will assess the claim and determine the amount of the deductible. |

| 4 | You’ll receive a bill for the deductible amount. |

| 5 | Pay the deductible using your preferred method, such as online, by phone, or by mail. |

End of Discussion

Paying your car insurance deductible can be a stressful experience, but understanding your options and planning ahead can ease the burden. By exploring different payment methods, considering your financial situation, and communicating with your insurance company, you can find a solution that works best for you. Remember, being proactive and informed can help you navigate this process smoothly and minimize any potential financial strain.

FAQ

Can I negotiate my deductible payment?

While negotiating your deductible amount is usually not an option, you might be able to negotiate the payment terms. This could involve setting up a payment plan or exploring alternative payment methods. It’s best to contact your insurance company directly to discuss your options.

What happens if I can’t afford to pay my deductible?

If you’re facing financial hardship, it’s important to contact your insurance company as soon as possible. They may be able to offer a payment plan or work with you to find a solution. However, failing to pay your deductible could lead to delays in repairs, potential penalties, or even the cancellation of your insurance policy.

Can I use my health insurance to cover my car insurance deductible?

Health insurance typically doesn’t cover car insurance deductibles. These are separate types of insurance with distinct coverage areas.