Can I register and insure a car in another state? This question arises for many individuals, whether they’re relocating, traveling frequently, or simply seeking better insurance rates. Navigating the intricacies of vehicle registration and insurance across state lines can be confusing, but understanding the requirements and processes involved is crucial.

This guide delves into the essential aspects of registering and insuring a car in a different state, covering residency requirements, vehicle registration procedures, insurance regulations, driver’s license exchange, and considerations for non-residents. We’ll also address potential legal implications and practical challenges you might encounter.

State Residency Requirements

To register and insure a car in a specific state, you need to demonstrate that you are a resident. This is a standard practice across the United States, as states use registration fees and insurance premiums to fund their transportation infrastructure and safety programs.

Residency Requirements

Each state has its own set of residency requirements. While the specific requirements may vary, they typically include a combination of factors such as physical presence, intent to reside, and documentation.

Common Residency Requirements

States commonly use a combination of factors to determine residency, including:

- Physical Presence: This refers to the amount of time you’ve physically lived in the state. Some states might require you to have resided in the state for a certain period, like 30 days, 60 days, or even six months, before you can register your car.

- Intent to Reside: This refers to your plans and intentions for living in the state. You’ll likely need to provide documentation that demonstrates your intention to make the state your permanent or primary residence. This can include things like voter registration, a driver’s license, or a lease agreement.

- Documentation: States often require specific documents to prove residency. These can include:

- Driver’s license: A driver’s license issued by the state you’re registering your car in.

- Voter registration card: A voter registration card showing your registration in the state.

- Utility bills: Recent utility bills (gas, electric, water, etc.) with your name and address in the state.

- Lease agreement: A lease agreement for your residence in the state.

- Mortgage statement: A mortgage statement for your home in the state.

- Bank statements: Recent bank statements with your address in the state.

- Tax returns: Recent tax returns filed with the state.

- Insurance policy: Your current insurance policy with your address in the state.

Examples of Residency Requirements

Here are some examples of residency requirements in different states:

- California: To register a vehicle in California, you must be a resident and provide proof of residency, such as a California driver’s license, voter registration card, or utility bill.

- Texas: In Texas, you must have lived in the state for at least 30 days before you can register a vehicle. You’ll also need to provide proof of residency, such as a Texas driver’s license, voter registration card, or utility bill.

- New York: New York requires residents to register their vehicles within 30 days of establishing residency. You’ll need to provide proof of residency, such as a New York driver’s license, voter registration card, or utility bill.

Driver’s License Requirements

Obtaining a driver’s license in a new state is essential for driving legally and registering your vehicle. You may need to exchange your existing out-of-state license for a new one, depending on the specific regulations of your new state. This process typically involves providing proof of residency, passing a vision test, and possibly a driving test.

Exchanging an Out-of-State License

If you are moving to a new state, you may be able to exchange your existing driver’s license for a new one. This is usually a simpler process than getting a brand new license. To exchange your license, you will typically need to:

- Provide proof of residency in the new state, such as a utility bill or lease agreement.

- Provide your current driver’s license.

- Pay a fee.

- Pass a vision test.

In some cases, you may also need to provide proof of insurance and pass a written test.

Driving Tests and Examinations

If you are not eligible to exchange your out-of-state license, you will need to obtain a new driver’s license from the new state. This process typically involves:

- Applying for a driver’s license at a state-approved location.

- Providing proof of residency.

- Passing a written test to demonstrate your knowledge of traffic laws and regulations.

- Passing a vision test.

- Passing a driving test to demonstrate your ability to operate a vehicle safely.

The specific requirements for driving tests may vary depending on the state. For example, some states may require a road test, while others may only require a skills test in a parking lot.

Considerations for Non-Residents

Registering and insuring a vehicle as a non-resident can be different from the process for residents. Non-residents may face limitations or restrictions depending on the state and their individual circumstances.

Registration Process for Non-Residents

Non-residents generally need to register their vehicles in the state where they reside. However, some states allow non-residents to register their vehicles for a limited time, often for work or temporary residency purposes.

- Temporary Registration: Many states offer temporary registration options for non-residents, typically for a specific period, like 30 days or 90 days. These registrations are usually required for people visiting the state for a short duration, like tourists or those relocating for work.

- Work-Related Registration: Some states have specific provisions for non-residents who work in the state and need to register their vehicles for work-related purposes. This often involves providing proof of employment and residency in another state.

- Military Personnel: States may have special provisions for military personnel stationed in the state. These provisions often exempt them from registering their vehicles in the state if they have a valid military driver’s license and registration from another state.

Insurance Requirements for Non-Residents

Non-residents are generally required to have insurance on their vehicles that meets the minimum liability requirements of the state where they are driving.

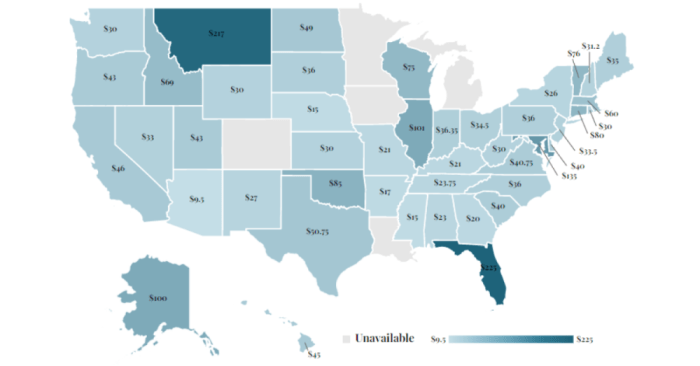

- Minimum Liability Coverage: Non-residents must carry at least the minimum liability insurance required by the state, which typically covers bodily injury and property damage caused by an accident. The minimum coverage limits may vary from state to state.

- Proof of Insurance: Non-residents may be required to provide proof of insurance when they are stopped by law enforcement. This can include an insurance card or electronic proof of insurance.

- Out-of-State Insurance: Non-residents can usually maintain their insurance coverage from their home state. However, they should ensure that their insurance policy covers them in the state where they are driving.

Comparison of Resident vs. Non-Resident Registration and Insurance

The process of registering and insuring a vehicle as a non-resident can differ from the process for residents in several ways.

- Registration: Residents typically register their vehicles in the state where they reside and receive permanent registration plates. Non-residents may be eligible for temporary registrations, work-related registrations, or other special provisions.

- Insurance: Both residents and non-residents are required to carry insurance on their vehicles, but the requirements and options may vary. Non-residents often need to ensure their insurance policy covers them in the state where they are driving.

- Limitations: Non-residents may face limitations on the types of vehicles they can register, the duration of their registration, or the types of insurance policies they can obtain.

Legal and Practical Implications

Registering and insuring your car in another state without meeting residency requirements can have serious legal and practical consequences. Failure to comply with these regulations can lead to fines, legal penalties, and even the suspension of your driving privileges. It is crucial to understand the potential risks involved and to ensure that you are following the proper procedures for registering and insuring your vehicle.

Legal Consequences of Driving Without Proper Registration or Insurance

Driving a vehicle without proper registration or insurance is illegal in all states. The penalties for these offenses vary by state but can include:

- Fines

- Suspension of driving privileges

- Impoundment of the vehicle

- Jail time (in some cases)

In addition to these penalties, driving without proper registration or insurance can also lead to:

- Difficulty obtaining a driver’s license in the future

- Increased insurance premiums

- Difficulties obtaining a loan or financing for a vehicle

Impact on Insurance Rates and Coverage

If you register and insure your car in a state where you are not a resident, your insurance rates may be higher than if you were insured in your home state. This is because insurance companies may consider you to be a higher risk due to your non-resident status.

Insurance companies may also limit your coverage in a state where you are not a resident. For example, you may not be covered for certain types of accidents or claims.

Potential Challenges and Complications, Can i register and insure a car in another state

There are several potential challenges and complications that may arise when registering and insuring your car in another state. For example, you may have difficulty:

- Obtaining a driver’s license in the new state

- Finding an insurance company that will insure you

- Getting your car inspected in the new state

- Paying your car registration fees

You may also have difficulty getting your car title transferred to the new state. This can be especially challenging if you are not a resident of the state.

Closure: Can I Register And Insure A Car In Another State

Ultimately, registering and insuring a car in another state involves a multifaceted process with various legal and practical implications. By understanding the specific requirements of each state, carefully following the procedures, and ensuring you meet all necessary documentation, you can navigate this process smoothly. Remember, seeking guidance from the relevant state motor vehicle department and insurance providers is always recommended to ensure compliance and avoid potential complications.

User Queries

Can I register my car in a new state if I’m only there temporarily?

Generally, you need to establish residency in a state to register a vehicle there. Temporary stays may not qualify.

What if I’m a student living in a different state?

States often have specific rules for students. You may need to provide proof of enrollment and residency at the school.

Do I need to get a new driver’s license if I move to another state?

Most states require you to obtain a driver’s license within a certain timeframe after establishing residency.

What happens if I get into an accident while driving a car registered in another state?

Your insurance coverage and the laws of the state where the accident occurred will apply.