Can i transfer life insurance policy to another company – Can I transfer my life insurance policy to another company? This is a question many people ask, especially if they’re unhappy with their current policy or have found a better deal elsewhere. The good news is that it’s possible to transfer your policy, but it’s not always a simple process. There are several factors to consider, including the type of policy you have, your health status, and the age of the policy.

This guide will explore the ins and outs of transferring life insurance policies, including the steps involved, the potential benefits and drawbacks, and some alternative options to consider. We’ll also discuss the importance of seeking professional guidance to ensure you make the best decision for your individual circumstances.

Potential Benefits and Drawbacks of Policy Transfers

Switching your life insurance policy from one company to another might seem like a daunting task, but it could be a smart move if it helps you get a better deal. Before diving in, let’s explore the potential benefits and drawbacks of policy transfers.

Potential Benefits of Policy Transfers

Transferring your life insurance policy can potentially offer several advantages.

- Lower Premiums: You might be able to find a new insurer offering lower premiums for similar coverage. This could be due to a change in your health status, age, or the insurer’s pricing strategy.

- Better Coverage Options: The new insurer might offer more comprehensive coverage, additional riders, or features that better suit your current needs. For example, if you’ve recently started a family, you might need to increase your coverage amount or add a rider for critical illness coverage.

- Improved Financial Stability: If your current insurer is facing financial difficulties, transferring your policy to a financially stronger company could provide greater peace of mind.

- Enhanced Customer Service: Sometimes, a change in insurers can lead to a better customer experience. If you’ve been dissatisfied with your current insurer’s service, transferring your policy could be a way to find a company that provides better support and communication.

Drawbacks of Policy Transfers

While policy transfers can be beneficial, it’s crucial to consider the potential downsides.

- Potential for Higher Premiums: In some cases, you might end up paying higher premiums with the new insurer, especially if your health has deteriorated or you’re older.

- Loss of Policy Features: The new insurer might not offer the same coverage features as your current policy, such as riders or specific benefits.

- Potential for Reduced Cash Value: If you have a whole life insurance policy with cash value, transferring it to a new insurer might result in a lower cash value. This is because the new insurer may not offer the same cash value accumulation rate as your current policy.

- Administrative Hassle: Transferring a life insurance policy can be a complex and time-consuming process. It might involve paperwork, medical examinations, and waiting periods before the new policy takes effect.

- Potential for Policy Lapse: There’s a risk of your policy lapsing during the transfer process, especially if there are delays or complications. This could leave your beneficiaries without coverage.

Financial Implications of Policy Transfers

Transferring your life insurance policy can have significant financial implications.

- Transfer Fees: Some insurers might charge fees for transferring your policy.

- Medical Examinations: You might need to undergo a medical examination as part of the transfer process. The cost of this examination will be borne by you.

- Potential for Higher Premiums: As mentioned earlier, you might end up paying higher premiums with the new insurer.

- Loss of Cash Value: If you have a whole life insurance policy with cash value, you might lose some of this value during the transfer.

Alternatives to Policy Transfers

Sometimes, transferring your life insurance policy to another company might not be the best move. Before you make a decision, consider exploring other options for modifying or adjusting your existing policy. There are strategies for maximizing the benefits of your current policy without the hassle of transferring it.

Policy Modifications

Making adjustments to your existing life insurance policy can be a viable alternative to transferring it. This involves making changes to the policy’s terms, such as increasing the death benefit, changing the beneficiary, or adding riders. These modifications can tailor the policy to your current needs without the complexities of transferring it.

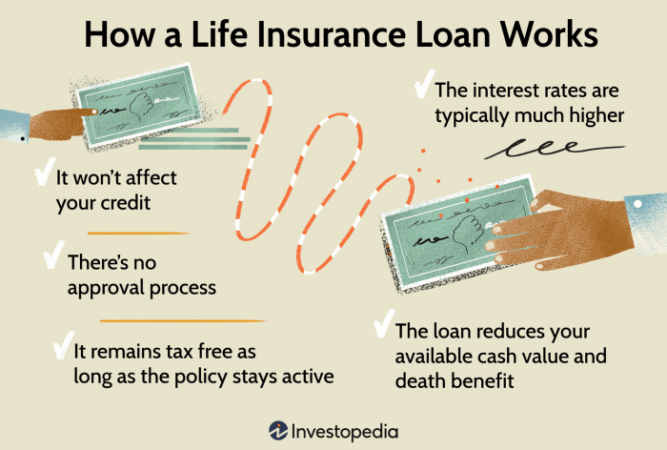

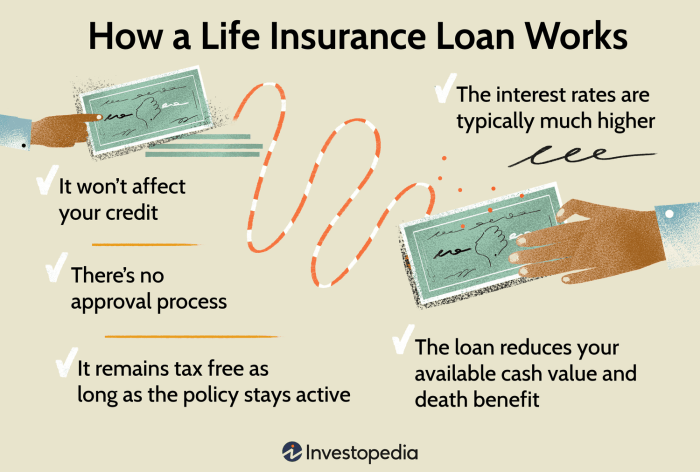

Policy Loans

Taking out a loan against your life insurance policy can be a good option if you need cash quickly. This allows you to borrow against the policy’s cash value, which you can then use for various purposes. However, it’s important to remember that interest accrues on these loans, which can increase the overall cost of the policy.

Policy loans can be a valuable resource for short-term financial needs, but it’s crucial to understand the potential impact on the policy’s cash value and death benefit.

Increasing Premiums

Increasing your premium payments can increase the death benefit or cash value of your policy. This is a way to enhance the coverage you receive without switching policies. This option can be beneficial if you’ve experienced an increase in your income or need more coverage due to changing life circumstances.

Adding Riders, Can i transfer life insurance policy to another company

Adding riders to your existing policy can provide additional coverage or benefits. These riders can address specific needs, such as long-term care, disability, or accidental death. This way, you can customize your policy to meet your evolving requirements without the need for a transfer.

Final Review

Transferring a life insurance policy can be a complex process, but it can also be a valuable way to secure better coverage or save money. By understanding the factors involved, carefully weighing the pros and cons, and seeking professional advice, you can make an informed decision that meets your specific needs. Remember, life insurance is a critical part of financial planning, and it’s important to have the right coverage in place to protect your loved ones.

FAQ Compilation: Can I Transfer Life Insurance Policy To Another Company

Can I transfer a life insurance policy without the consent of the insured?

Generally, you can’t transfer a life insurance policy without the consent of the insured. The policyholder has the right to decide if they want to transfer their policy, and they may need to provide their signature and other documentation.

What happens if I transfer my life insurance policy and then my health deteriorates?

If your health deteriorates after transferring your life insurance policy, the new insurer may require you to undergo a medical exam or may even decline to issue you a new policy. It’s important to be aware of your health status and how it could affect the transfer process.

How much does it cost to transfer a life insurance policy?

The cost of transferring a life insurance policy can vary depending on the insurer and the specific policy. There may be fees associated with the transfer process, and you may also need to pay new premiums based on your age and health status.