Can I transfer my life insurance to another company? You bet! Switching your life insurance can be a smart move, like changing your jersey number to a new team if you’re getting a better deal. But before you go jumping ship, there are a few things you gotta know about the process.

Life insurance is like a safety net for your loved ones, so making sure you’ve got the right coverage and the best price is crucial. Whether you’re looking for a better deal, more coverage, or simply a change of pace, understanding the ins and outs of transferring your policy can help you make the right call.

Financial Considerations

Switching your life insurance policy to a new company can be a big decision. It’s important to consider the financial implications, including potential costs, fees, and tax implications. Here’s a breakdown of the key factors to keep in mind.

Costs and Fees

It’s important to understand the costs and fees associated with transferring your life insurance policy. These can include:

- Surrender Charges: Some life insurance policies have surrender charges that are assessed if you cancel the policy before a certain period. These charges can be substantial, especially in the early years of the policy. For example, if you have a 10-year surrender charge period and you cancel your policy after 5 years, you may have to pay a significant penalty.

- Application Fees: The new insurance company may charge an application fee to process your application. This fee can vary depending on the insurer and the type of policy.

- Policy Fees: Many life insurance policies have annual or monthly fees. These fees can add up over time, so it’s important to consider them when comparing policies.

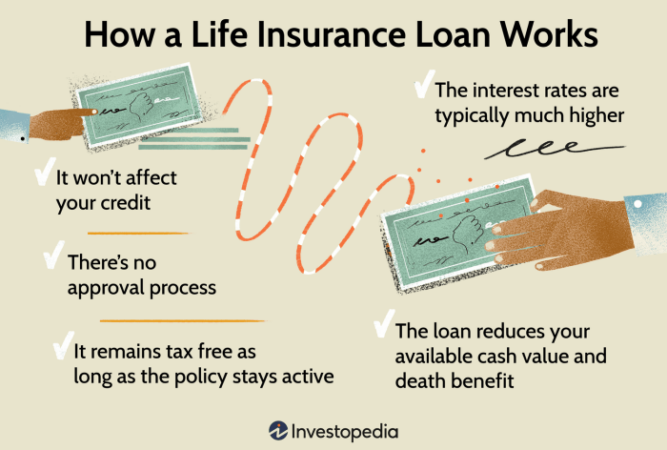

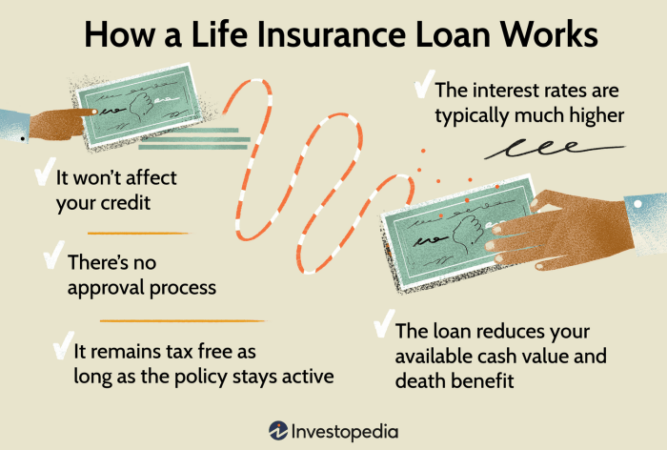

Tax Implications

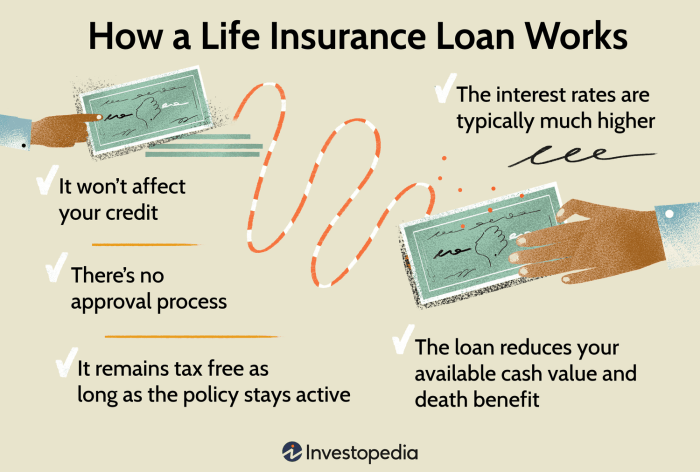

There are also tax implications to consider when transferring a life insurance policy. For example, if you cash out your existing policy, you may have to pay taxes on the earnings. However, if you transfer the policy to a new company without cashing it out, you may not have to pay taxes.

Financial Advantages and Disadvantages

There are several scenarios where transferring a life insurance policy might be financially advantageous or disadvantageous. Here are a few examples:

- Lower Premiums: If you can find a policy with lower premiums, transferring your policy could save you money in the long run. However, be sure to compare the coverage and features of the new policy to ensure that it meets your needs.

- Improved Coverage: If you need more coverage or different types of coverage, transferring your policy might be a good option. However, you may have to pay a higher premium for the increased coverage.

- Better Investment Options: Some life insurance policies offer investment options. If you’re unhappy with the investment options in your current policy, transferring to a policy with better options might be a good idea.

- Financial Hardship: If you’re facing financial hardship and need to access the cash value of your policy, transferring to a new company might be a good option. However, be aware of the surrender charges and tax implications.

Key Financial Considerations for Transferring a Life Insurance Policy

| Financial Consideration | Description |

|---|---|

| Surrender Charges | Fees charged for canceling a policy before a specific period. |

| Application Fees | Fees charged by the new insurance company to process your application. |

| Policy Fees | Annual or monthly fees charged for maintaining the policy. |

| Tax Implications | Potential taxes on earnings if you cash out your existing policy. |

| Lower Premiums | Potential cost savings if you find a policy with lower premiums. |

| Improved Coverage | Potential to get more coverage or different types of coverage. |

| Better Investment Options | Potential to get better investment options with a new policy. |

| Financial Hardship | Potential to access cash value in case of financial hardship. |

Considerations for Policyholders

Before deciding to transfer your life insurance policy, it’s crucial to take a step back and carefully assess your current situation and needs. This involves a thorough evaluation of your policy, your financial goals, and the potential benefits and drawbacks of transferring. Think of it like choosing a new phone plan – you want to make sure you’re getting the best deal and features for your money.

Factors to Consider

It’s important to weigh the pros and cons of transferring your life insurance policy. This includes analyzing your current policy’s features, premiums, and benefits, as well as considering your future needs and goals.

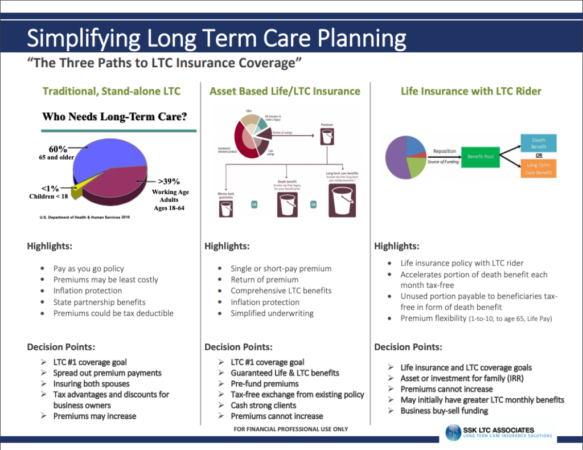

- Current Policy Features: Evaluate your current policy’s coverage amount, premium structure, death benefit, and any additional features like riders or cash value accumulation.

- Premium Costs: Compare your current premium to the projected premiums of the new policy. Consider factors like your age, health, and the type of coverage you need.

- Death Benefit: Determine if the death benefit offered by the new policy aligns with your family’s needs and financial goals.

- Cash Value Accumulation: If your current policy has a cash value component, analyze the potential for growth and compare it to the cash value accumulation offered by the new policy.

- Financial Goals: Consider your long-term financial goals, such as retirement planning or estate planning, and how a policy transfer might impact them.

- Health Status: Your health status can significantly influence the premiums and coverage options available to you. If your health has changed since purchasing your current policy, you might be able to secure a better rate with a new insurer.

- Policy Surrender Charges: Be aware of any surrender charges associated with canceling your current policy. These charges can be substantial, especially if you’re still early in your policy term.

Initiating and Completing the Transfer, Can i transfer my life insurance to another company

The process of transferring a life insurance policy involves several steps, from contacting the new insurer to completing the necessary paperwork.

- Contact the New Insurer: Start by contacting the new insurance company you’re interested in and expressing your desire to transfer your policy. They will provide you with information about their policies and the transfer process.

- Complete an Application: The new insurer will require you to complete an application that includes personal and financial information, health history, and details about your existing policy.

- Medical Examination: Depending on the new policy and your age, you may need to undergo a medical examination. This ensures the insurer has accurate health information to assess your risk.

- Policy Approval: Once the new insurer reviews your application and medical information, they will decide whether to approve your transfer request. The approval process can take several weeks.

- Policy Issuance: Upon approval, the new insurer will issue your new life insurance policy. The old policy will be canceled, and any remaining cash value will be transferred to the new policy.

Finding a Reputable Insurance Company

Choosing the right insurance company is crucial for ensuring your policy is secure and provides the coverage you need.

- Financial Stability: Look for a company with a strong financial rating, such as an A+ or better from reputable rating agencies like AM Best or Standard & Poor’s. This indicates the company is financially sound and has a history of meeting its obligations.

- Customer Service: Research the company’s customer service reputation. Look for reviews and ratings from independent sources like the Better Business Bureau or J.D. Power. A good customer service record is essential for resolving any issues or questions you may have.

- Policy Options: Compare the policy options offered by different insurers. Consider factors like coverage amounts, premium structures, riders, and cash value accumulation options.

- Transparency: Choose a company that is transparent in its pricing, policy terms, and claims process. Avoid companies that use complex jargon or hide important information in the fine print.

Final Wrap-Up: Can I Transfer My Life Insurance To Another Company

Switching your life insurance can be a bit like changing your tune, but it’s not always a smooth transition. Make sure you do your homework and weigh the pros and cons before you make a move. You want to make sure you’re getting the best bang for your buck and ensuring your loved ones are protected. If you’re unsure, talking to a financial advisor can be a great way to get some expert advice and make sure you’re making the right decision for your situation.

FAQ Insights

What are the main reasons people transfer their life insurance?

People transfer their life insurance for a variety of reasons, like getting a better rate, needing more coverage, or simply wanting to change companies.

Can I transfer my life insurance policy without my current insurer’s approval?

Nope! You’ll need to get the green light from your current insurer before you can transfer your policy. They might have some requirements or conditions that you need to meet.

What are the potential costs involved in transferring my life insurance policy?

There could be fees associated with transferring your policy, like application fees or administrative charges. You should ask your current and new insurer about any potential costs before you make the switch.