Can I use my car insurance in another state? This is a common question for anyone who plans to drive beyond their home state. The answer, however, isn’t always simple. While your insurance may provide some coverage in other states, it’s essential to understand the limitations and specific requirements of each state you’re traveling through.

Your car insurance policy is a contract that Artikels the coverage you have in case of an accident or other incident. This coverage can vary depending on the state you purchased the policy in and the specific terms and conditions. For instance, your policy may have geographic limitations that restrict your coverage to certain areas. It’s important to review your policy carefully to understand these limitations before driving out of state.

Understanding Your Car Insurance Policy

Your car insurance policy is a contract between you and your insurance company. It Artikels the coverage you have in case of an accident or other covered event. It’s essential to understand the terms and conditions of your policy, especially regarding driving in other states.

Geographic Limitations

Most car insurance policies have geographic limitations. This means that the coverage you have may not be valid in all states. Your policy will specify the states where your coverage applies. If you drive in a state where your coverage is not valid, you could be driving without insurance, which can lead to serious consequences.

Terms and Conditions Related to Driving in Other States, Can i use my car insurance in another state

- Coverage: While some policies offer limited coverage in other states, most policies only provide full coverage within the state you reside. For example, if you have a policy in California and drive to Nevada, you might have limited coverage in Nevada.

- No-Fault Coverage: Some states have no-fault insurance laws. These laws require drivers to file claims with their own insurance company, regardless of who caused the accident. If you’re driving in a no-fault state and your policy doesn’t cover no-fault insurance, you might be responsible for paying for your own medical expenses, even if the other driver was at fault.

- Financial Responsibility Laws: All states have financial responsibility laws that require drivers to carry a minimum amount of liability insurance. These laws ensure that drivers have enough insurance to cover damages and injuries they cause to others. If you’re driving in a state with higher financial responsibility requirements than your home state, you may be driving without enough insurance. This could lead to serious legal consequences.

Consequences of Driving in Another State Without Proper Coverage

- Denial of Claims: If you have an accident in another state and your policy doesn’t cover you in that state, your insurance company may deny your claim. This means you could be responsible for paying for all the damages and injuries yourself.

- Legal Penalties: Driving without insurance is illegal in all states. You could face fines, license suspension, or even jail time if you’re caught driving without proper insurance in another state.

- Financial Responsibility: If you cause an accident in another state without proper insurance, you could be held personally responsible for all damages and injuries. This could mean paying out of pocket for medical bills, car repairs, and other expenses.

State-Specific Insurance Requirements

Each state in the United States has its own set of minimum car insurance requirements that drivers must adhere to. These requirements are designed to ensure that drivers have adequate financial protection in case of an accident.

State-Specific Insurance Requirements

It’s crucial to understand the specific requirements of the state you’re driving in, as failing to meet these minimums can result in hefty fines and penalties.

| State | Liability Coverage | Property Damage Coverage | Uninsured Motorist Coverage |

|---|---|---|---|

| Alabama | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| Alaska | $50,000 per person/$100,000 per accident | $25,000 | $50,000 per person/$100,000 per accident |

| Arizona | $25,000 per person/$50,000 per accident | $15,000 | $25,000 per person/$50,000 per accident |

| Arkansas | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| California | $15,000 per person/$30,000 per accident | $5,000 | $15,000 per person/$30,000 per accident |

| Colorado | $25,000 per person/$50,000 per accident | $15,000 | $25,000 per person/$50,000 per accident |

| Connecticut | $20,000 per person/$40,000 per accident | $10,000 | $20,000 per person/$40,000 per accident |

| Delaware | $30,000 per person/$60,000 per accident | $10,000 | $30,000 per person/$60,000 per accident |

| Florida | $10,000 per person/$20,000 per accident | $10,000 | $10,000 per person/$20,000 per accident |

| Georgia | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| Hawaii | $20,000 per person/$40,000 per accident | $10,000 | $20,000 per person/$40,000 per accident |

| Idaho | $25,000 per person/$50,000 per accident | $15,000 | $25,000 per person/$50,000 per accident |

| Illinois | $20,000 per person/$40,000 per accident | $15,000 | $20,000 per person/$40,000 per accident |

| Indiana | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| Iowa | $20,000 per person/$40,000 per accident | $10,000 | $20,000 per person/$40,000 per accident |

| Kansas | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| Kentucky | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| Louisiana | $15,000 per person/$30,000 per accident | $10,000 | $15,000 per person/$30,000 per accident |

| Maine | $50,000 per person/$100,000 per accident | $25,000 | $50,000 per person/$100,000 per accident |

| Maryland | $30,000 per person/$60,000 per accident | $15,000 | $30,000 per person/$60,000 per accident |

| Massachusetts | $20,000 per person/$40,000 per accident | $5,000 | $20,000 per person/$40,000 per accident |

| Michigan | $20,000 per person/$40,000 per accident | $10,000 | $20,000 per person/$40,000 per accident |

| Minnesota | $30,000 per person/$60,000 per accident | $10,000 | $30,000 per person/$60,000 per accident |

| Mississippi | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| Missouri | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| Montana | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| Nebraska | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| Nevada | $25,000 per person/$50,000 per accident | $15,000 | $25,000 per person/$50,000 per accident |

| New Hampshire | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| New Jersey | $15,000 per person/$30,000 per accident | $5,000 | $15,000 per person/$30,000 per accident |

| New Mexico | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| New York | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| North Carolina | $30,000 per person/$60,000 per accident | $25,000 | $30,000 per person/$60,000 per accident |

| North Dakota | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| Ohio | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| Oklahoma | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| Oregon | $25,000 per person/$50,000 per accident | $20,000 | $25,000 per person/$50,000 per accident |

| Pennsylvania | $15,000 per person/$30,000 per accident | $5,000 | $15,000 per person/$30,000 per accident |

| Rhode Island | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| South Carolina | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| South Dakota | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| Tennessee | $25,000 per person/$50,000 per accident | $15,000 | $25,000 per person/$50,000 per accident |

| Texas | $30,000 per person/$60,000 per accident | $25,000 | $30,000 per person/$60,000 per accident |

| Utah | $25,000 per person/$65,000 per accident | $15,000 | $25,000 per person/$65,000 per accident |

| Vermont | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| Virginia | $25,000 per person/$50,000 per accident | $20,000 | $25,000 per person/$50,000 per accident |

| Washington | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| West Virginia | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| Wisconsin | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| Wyoming | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

It’s important to note that these are just the minimum requirements. You may want to consider purchasing additional coverage, such as collision and comprehensive coverage, to protect yourself financially in the event of an accident.

Options for Out-of-State Coverage

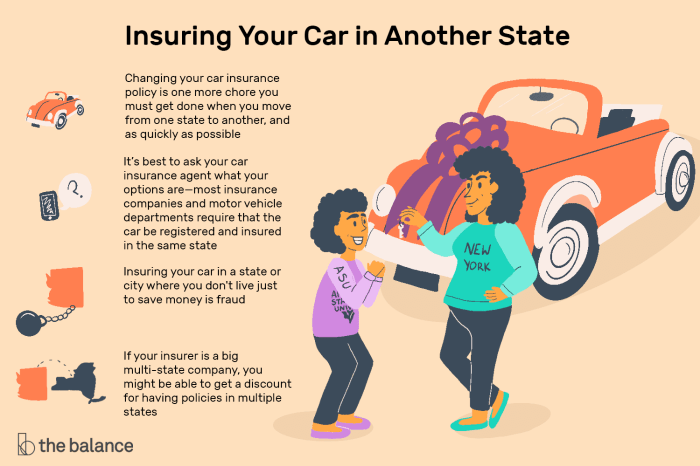

If you’re planning a trip outside of your home state, you might be wondering whether your current car insurance policy will cover you. The answer is not always straightforward and depends on various factors, including your state’s laws, the length of your trip, and your insurance provider’s policies. Here are some options for out-of-state coverage you can consider:

Non-Resident Insurance

Non-resident insurance is a type of coverage specifically designed for drivers who live in one state but frequently drive in another. It provides liability coverage, which is essential for protecting you financially in case you cause an accident. This type of insurance is often a good option for individuals who regularly commute across state lines or have a second home in another state.

Temporary Insurance for Specific Trips

If you’re only going on a short trip out of state, purchasing temporary insurance might be a more cost-effective option. This type of insurance provides coverage for a limited period, such as a few days or weeks. Temporary insurance can be purchased online or through a local insurance broker.

Obtaining an Out-of-State Insurance Policy

In some cases, you might need to obtain a full out-of-state insurance policy if you’re planning to live or work in another state for an extended period. This can be done through a local insurance broker in the state where you’ll be residing. You’ll need to provide your driver’s license, proof of residency, and other relevant information to apply for a policy.

Driving in Mexico or Canada

Planning a road trip to Mexico or Canada? It’s essential to understand the specific insurance requirements and driving regulations of each country. While your US car insurance might offer some coverage, it’s crucial to ensure you have the necessary protection for a safe and worry-free journey.

Driving in Mexico

Driving in Mexico can be an exciting adventure, but it’s important to be aware of the unique regulations and potential challenges. Here’s a guide to help you navigate the roads safely:

Insurance Requirements

Mexico requires all drivers to have valid liability insurance. Your US car insurance policy might offer limited liability coverage in Mexico, but it’s highly recommended to purchase additional insurance from a Mexican insurance company. This supplemental insurance, known as “Mexican insurance,” provides broader coverage and meets the legal requirements.

- Liability Coverage: This covers damage or injuries you cause to others in an accident.

- Collision Coverage: Protects your vehicle in case of an accident, even if you are at fault.

- Comprehensive Coverage: Provides coverage for damage to your vehicle caused by events like theft, vandalism, or natural disasters.

Traffic Laws and Road Conditions

Mexico’s traffic laws and road conditions can differ significantly from the US. Here are some key differences to be aware of:

- Speed Limits: Speed limits are generally lower in Mexico, and enforcement can be stricter.

- Driving Etiquette: Mexican drivers tend to be more aggressive and less predictable. Be prepared for sudden lane changes and close calls.

- Road Quality: Road conditions can vary widely, with some highways being well-maintained while others are poorly paved or have potholes.

Tips for Driving in Mexico

- Obtain Mexican Insurance: Purchase a policy from a reputable Mexican insurance company before crossing the border.

- Carry Your Driving Documents: Keep your driver’s license, car registration, and insurance documents readily available.

- Be Aware of Your Surroundings: Pay close attention to other drivers, pedestrians, and road conditions.

- Drive Defensively: Maintain a safe following distance and anticipate potential hazards.

- Avoid Driving at Night: Night driving can be more dangerous due to poor lighting and increased risk of accidents.

- Stay Informed: Research local traffic laws and regulations before your trip.

Driving in Canada

Driving in Canada is generally considered safe and straightforward, but it’s still essential to understand the country’s insurance requirements and traffic laws.

Insurance Requirements

Canada requires all drivers to have valid liability insurance. Your US car insurance policy might offer some coverage in Canada, but it’s essential to check with your insurer to confirm the extent of coverage.

- Liability Coverage: This covers damage or injuries you cause to others in an accident.

- Collision Coverage: Protects your vehicle in case of an accident, even if you are at fault.

- Comprehensive Coverage: Provides coverage for damage to your vehicle caused by events like theft, vandalism, or natural disasters.

Traffic Laws and Road Conditions

Canadian traffic laws are similar to those in the US, but there are some key differences to be aware of:

- Speed Limits: Speed limits are generally lower in Canada than in the US.

- Seat Belt Laws: All passengers must wear seat belts in Canada.

- Drinking and Driving: Canada has a strict zero-tolerance policy for drunk driving.

- Road Conditions: Canada experiences harsh winter conditions, including snow, ice, and freezing rain. Be prepared for challenging driving conditions during winter months.

Tips for Driving in Canada

- Check Your Insurance Coverage: Confirm with your US insurer the extent of coverage you have in Canada.

- Obtain a Canadian Driving Permit: If you plan to drive in Canada for an extended period, consider obtaining a Canadian driving permit.

- Be Aware of Winter Conditions: If driving during winter months, be prepared for snow, ice, and freezing rain. Equip your vehicle with winter tires and drive cautiously.

- Familiarize Yourself with Canadian Traffic Laws: Research local traffic laws and regulations before your trip.

Insurance Claims and Coverage

Filing an insurance claim while driving in another state is generally the same process as filing one in your home state. You’ll need to contact your insurance company, provide details about the accident or incident, and follow their instructions for submitting a claim. However, there are some important differences to keep in mind.

Coverage Differences Based on State

The coverage you have under your car insurance policy may vary depending on the state where the accident occurs. For example, some states have mandatory coverage requirements that are different from your home state. If you’re involved in an accident in a state with higher minimum coverage requirements, your insurance policy may not provide enough coverage to meet those requirements. This could mean you’re responsible for paying the difference out of pocket.

Tips for Safe Out-of-State Driving: Can I Use My Car Insurance In Another State

Hitting the road for a trip to another state can be an exciting adventure. However, it’s important to prioritize safety and be prepared for any potential challenges you might encounter. This section provides practical tips and essential information to help you drive safely and confidently while traveling out of state.

Essential Documents and Information

Carrying the right documents and information while driving out of state is crucial for a smooth and hassle-free journey. This section details essential documents and information you should have readily available.

- Driver’s License: Ensure your driver’s license is valid and up-to-date. Some states have stricter requirements, so check the specific regulations of your destination.

- Vehicle Registration: Carry proof of vehicle registration, including the registration certificate and license plates. It’s essential to have this documentation readily available in case of traffic stops or accidents.

- Insurance Information: Keep your insurance card readily accessible. It should include policy details, coverage limits, and contact information for your insurance company.

- Emergency Contact Information: Have a list of emergency contacts with their phone numbers, including family members, friends, and your insurance company.

- Route Map or GPS: Familiarize yourself with the route and potential road conditions. A physical map or a GPS device can be helpful, especially in areas with limited cell service.

- Vehicle Maintenance Records: Carry a record of recent vehicle maintenance, including oil changes, tire rotations, and any repairs. This information can be helpful in case of unexpected issues.

Preparing Your Vehicle for a Long Road Trip

A well-maintained vehicle is essential for a safe and enjoyable road trip. This section highlights key safety inspections and maintenance tasks to prepare your vehicle for a long journey.

- Pre-Trip Inspection: Conduct a thorough pre-trip inspection to ensure your vehicle is in optimal condition. Check the tire pressure, fluids (oil, coolant, brake fluid), lights, windshield wipers, and brakes.

- Tire Condition: Inspect your tires for wear and tear, including tread depth and any damage. Replace worn or damaged tires before embarking on a long trip.

- Fluid Levels: Check and top off all fluid levels, including engine oil, coolant, brake fluid, and windshield washer fluid. Low fluid levels can lead to overheating or other mechanical issues.

- Lights and Windshield Wipers: Ensure all lights, including headlights, taillights, brake lights, and turn signals, are functioning properly. Replace worn or damaged windshield wipers for optimal visibility.

- Brakes: Check your brake pads and rotors for wear and tear. If you notice any issues, have them inspected and repaired by a qualified mechanic.

- Spare Tire and Tools: Make sure your spare tire is in good condition and properly inflated. Pack a jack, lug wrench, and other essential tools in case of a flat tire.

- Emergency Kit: Assemble an emergency kit that includes a flashlight, jumper cables, a first-aid kit, non-perishable food, water, a blanket, and any necessary medications.

Epilogue

Driving in another state can be a fun and exciting experience, but it’s crucial to be prepared. By understanding your insurance coverage, state-specific requirements, and potential risks, you can ensure a safe and enjoyable journey. Always review your policy, check the regulations of the state you’re traveling to, and consider purchasing additional coverage if needed. Remember, being informed is the best way to protect yourself and your loved ones while on the road.

Helpful Answers

What if I have an accident in another state?

If you have an accident in another state, your insurance company will still handle the claim, but the coverage and process might differ from your home state. It’s important to contact your insurance company immediately to report the accident and follow their instructions.

How do I know if my insurance is valid in another state?

The best way to know is to review your insurance policy carefully. Look for any mention of geographic limitations or coverage in other states. You can also contact your insurance company directly to ask about your coverage in specific states.

What if I’m driving in a state with higher insurance requirements than my home state?

If you’re driving in a state with higher insurance requirements than your home state, you may be required to purchase additional coverage to meet the minimum requirements. This can be done through your existing insurance company or by purchasing temporary insurance in the state you’re visiting.