Can insurance companies cancel your policy sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. You’ve paid your premiums, you’ve been a good driver (or homeowner, or whatever your policy covers), and you think you’re good to go. But what if your insurance company decides to drop you? It’s not as uncommon as you might think, and it can be a major headache. This guide will break down everything you need to know about policy cancellation, from the reasons why it might happen to your rights and options if it does.

Imagine this: you’re cruising down the highway, blasting your favorite tunes, and suddenly, BAM! You get a notice in the mail that your insurance policy has been canceled. Not cool, right? This isn’t just a theoretical scenario; it happens to people all the time. From failing to pay your premiums to getting into too many accidents, there are a variety of reasons why your insurance company might decide to pull the plug. But don’t worry, this isn’t the end of the road. Understanding the reasons behind cancellation, your rights, and the steps you can take to prevent it can empower you to stay on top of your insurance game.

Understanding Policy Cancellation

It’s a bummer, but sometimes insurance companies have to cancel policies. While it’s not a common occurrence, it’s important to understand why it might happen and what your rights are if it does.

Reasons for Policy Cancellation

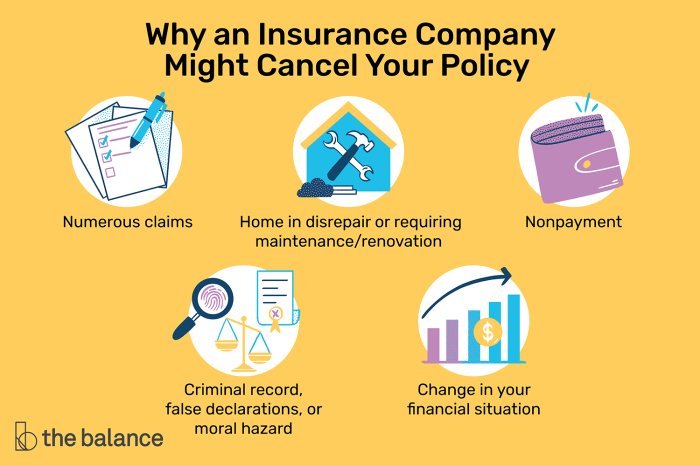

Insurance companies have specific reasons for canceling a policy. They might cancel a policy if the insured:

- Fails to Pay Premiums: This is the most common reason for policy cancellation. If you don’t pay your premiums on time, the insurance company might cancel your policy. This is like missing your rent payment, eventually, they have to take action.

- Provides Incorrect Information: If you lie on your application, the insurance company could cancel your policy. This is like applying for a job and lying about your experience, you’re not going to get the job. The same goes for insurance, they need accurate information to properly assess risk.

- Engages in Risky Behavior: If you engage in risky behavior that increases the risk of a claim, your insurance company might cancel your policy. For example, if you’re a driver and get into a lot of accidents, or if you’re a homeowner and let your property fall into disrepair, the insurance company might cancel your policy. Think of it as a party where you’re not following the rules, you’re likely to be asked to leave.

- Breaches Policy Terms: Every insurance policy has specific terms and conditions that you agree to when you sign up. If you violate these terms, the insurance company could cancel your policy. This is like breaking the rules of a game, you’re going to be penalized. For example, if your car insurance policy states you need to notify the insurance company if you make any modifications to your car, and you don’t, the insurance company could cancel your policy.

Examples of Policy Violations

Some common examples of policy violations that could lead to cancellation include:

- Driving without a license: This is a serious violation of your car insurance policy. If you’re caught driving without a license, your insurance company could cancel your policy.

- Driving under the influence of alcohol or drugs: This is another serious violation that could lead to policy cancellation. Think of it as driving a car without a seatbelt, you’re putting yourself and others at risk.

- Failing to disclose a prior accident: If you’ve been in an accident before and don’t disclose it when applying for insurance, the insurance company could cancel your policy.

- Using your car for commercial purposes without informing your insurer: If your car insurance policy is for personal use and you use your car for commercial purposes, the insurance company could cancel your policy. Think of it like using your personal credit card for business expenses, it’s not allowed.

Legal Framework and Rights of the Insured

The legal framework surrounding policy cancellation varies by state. Generally, insurance companies must follow specific procedures before canceling a policy. This usually involves providing the insured with written notice of the cancellation and an opportunity to appeal the decision. Think of it as a fair trial where you have a chance to present your side of the story. It’s important to read the fine print of your insurance policy and understand your rights as an insured. If you believe your policy has been wrongfully canceled, you may be able to take legal action. It’s always best to consult with an attorney if you have any questions about your rights.

Cancellation Procedures

So, you’re thinking about canceling your insurance policy? It’s important to understand the process and your rights before taking the plunge.

Let’s break down the typical steps involved in canceling your policy, and the things you need to be aware of.

Notice Period

Insurance companies usually require a certain amount of time before they’ll actually cancel your policy. This is known as the “notice period.” Think of it as a “cooling-off” period, giving you a chance to reconsider or make adjustments.

The notice period can vary depending on the type of insurance and the state you live in. Here are some general examples:

* Auto Insurance: Most states require a 30-day notice period.

* Homeowners Insurance: This usually requires a 30-day notice period, but check your policy for specific details.

* Life Insurance: Life insurance policies often have a grace period, which is a short period of time after your premium payment is due, during which you can still pay your premium and keep your policy active.

Pro-Tip: Check your insurance policy for the exact notice period. It’s usually Artikeld in the “Cancellation” section.

Cancellation Request

To cancel your insurance policy, you’ll need to contact your insurance company and make a formal request. You can usually do this by:

* Phone: Call your insurance company and speak with a customer service representative.

* Mail: Send a written request via certified mail, so you have proof of delivery.

* Email: Some insurance companies accept cancellation requests via email.

Cancellation Confirmation

Once you’ve submitted your request, your insurance company should send you a written confirmation. This confirmation will usually include:

* The effective date of your cancellation.

* The amount of any refund you’re entitled to.

* Any other important information related to your cancellation.

Cancellation Disputes

If you disagree with the cancellation decision or believe it’s unfair, you have options. Here are some things you can do:

* Contact your insurance company: Explain your concerns and try to resolve the issue.

* File a complaint: You can file a complaint with your state’s insurance department or the state attorney general’s office.

* Seek legal advice: If you feel your rights have been violated, consider consulting with an attorney.

Consequences of Cancellation

So, your insurance policy got the axe. Not cool, right? It’s like getting dumped by your best friend… except this friend was protecting your stuff. But fear not, we’re gonna break down the potential fallout from this insurance breakup.

Financial Implications of Cancellation, Can insurance companies cancel your policy

Having your insurance policy canceled can hit your wallet harder than a rogue bowling ball. First off, you’re left without coverage, meaning you’re on the hook for any accidents or damages that happen. Think of it like this: you’re now playing “insurance roulette,” and you might not like the odds. Plus, you’ll likely have to pay a cancellation fee, which is like a breakup tax. And let’s not forget the biggest hit: if you need to file a claim after cancellation, you’re outta luck. It’s like showing up at a party without an RSVP – you’re not on the guest list.

Difficulty Obtaining New Insurance

Getting a new insurance policy after cancellation is like trying to get a date after a bad breakup – it can be tough. Insurance companies view cancellation as a red flag, kinda like a bad credit score for your insurance history. They might see you as a higher risk, leading to higher premiums or even a refusal to insure you altogether. It’s like being stuck in the friend zone of insurance, never getting to the good stuff.

Impact on Future Premiums

Cancellation can also leave a mark on your insurance record, affecting future premiums. Think of it as a “bad boy” tattoo that screams, “I’m a risk!” Insurance companies might view you as a higher risk, leading to higher premiums. It’s like having to pay extra for the same thing just because you’re “that guy” with the bad insurance history.

Preventing Policy Cancellation

You don’t want to be left high and dry without insurance, so knowing how to avoid cancellation is key. It’s all about keeping your insurance company happy and your policy in good standing.

Importance of Communication

Clear and timely communication with your insurance company is crucial to preventing policy cancellation. It’s like keeping your best friend in the loop. You want to be sure they know what’s going on, right? The same goes for your insurance company.

- Notify them of any changes. Did you move? Get a new car? Change your address? Tell your insurance company ASAP. They need to know these details to keep your policy accurate.

- Stay on top of payments. Late payments can be a big no-no. Set reminders and make sure your payments are made on time. You can even set up automatic payments to avoid any missed deadlines.

- Ask questions. If you’re unsure about something, don’t hesitate to ask your insurance company. They’re there to help you understand your policy and answer any questions you may have.

Maintaining Good Standing

Think of your insurance policy as a relationship. You want to keep it healthy and strong, right? Here’s a checklist of things you can do to keep your policy in good standing:

- Pay your premiums on time. This is a biggie. Late payments can lead to cancellation. Set up automatic payments to avoid any surprises.

- Update your contact information. If you move or change your phone number, let your insurance company know. They need to be able to reach you.

- Report any changes to your vehicle. If you get a new car, modify your current one, or have any accidents, let your insurance company know.

- Review your policy regularly. Make sure your coverage is still right for you. You may need to adjust your policy as your needs change.

- Be honest with your insurance company. Don’t try to hide information. Being upfront and truthful is the best way to maintain a good relationship with your insurance company.

Specific Policy Types: Can Insurance Companies Cancel Your Policy

It’s important to understand that cancellation policies can vary significantly depending on the type of insurance you have. Each type of insurance has its own set of rules and regulations, and you need to be aware of these before you sign up for a policy.

This section will provide a detailed comparison of cancellation policies for different types of insurance, including auto, home, and health insurance. We’ll examine the specific clauses and conditions that govern cancellation in each policy type and highlight the differences in cancellation procedures, notice periods, and consequences.

Cancellation Procedures and Consequences for Different Insurance Types

This table provides a comparison of cancellation procedures, notice periods, and consequences for different types of insurance.

| Insurance Type | Cancellation Procedures | Notice Period | Consequences of Cancellation |

|---|---|---|---|

| Auto Insurance |

|

|

|

| Home Insurance |

|

|

|

| Health Insurance |

|

|

|

Cancellation Clauses and Conditions

Each type of insurance has specific clauses and conditions that govern cancellation. These clauses may vary depending on the insurer and the state in which you live.

Here are some common cancellation clauses and conditions:

- Non-Payment of Premiums: If you fail to pay your premiums on time, your insurer can cancel your policy. This is usually a standard clause in all insurance policies.

- Material Misrepresentation: If you provided inaccurate information on your application, your insurer can cancel your policy. For example, if you lied about your driving history or the condition of your property.

- Breach of Contract: If you violate the terms of your policy, your insurer can cancel your policy. This could include things like driving without insurance, failing to maintain your property, or making fraudulent claims.

- Change in Risk: Your insurer may cancel your policy if there is a significant change in the risk associated with your coverage. For example, if you move to a high-risk area or make significant changes to your property.

- Cancellation for Convenience: Some insurers may allow you to cancel your policy for convenience, but you may not receive a refund of your premium. This is usually a standard clause in all insurance policies.

Dispute Resolution

Feeling like your insurance company canceled your policy unfairly? You’re not alone. It’s a common experience, and there are steps you can take to fight back.

When an insurance company cancels your policy, it’s important to understand your rights and options. You may be able to appeal the decision or file a complaint with a regulatory body.

Options for Policyholders

Policyholders who believe their policy was wrongfully canceled have several options available to them. These options include:

- Appeal the cancellation decision: Many insurance companies have internal appeal processes. This often involves writing a letter explaining why you believe the cancellation was unfair and providing supporting documentation. If you are unsuccessful in appealing the decision, you may have other options.

- Negotiate with the insurance company: If you are willing to compromise, you may be able to negotiate a different outcome with the insurance company. This could involve agreeing to pay a higher premium or making changes to your policy.

- File a complaint with the insurance commissioner: Each state has an insurance commissioner who is responsible for regulating the insurance industry. You can file a complaint with the commissioner if you believe your insurance company has violated state law. The commissioner will investigate your complaint and may take action against the insurance company if they find that it has violated the law.

- File a lawsuit: In some cases, you may be able to file a lawsuit against the insurance company if you believe that it has acted wrongfully. This is a more complex and expensive option, but it may be necessary if you are unable to resolve the issue through other means.

Filing a Complaint with the Insurance Commissioner

Filing a complaint with the insurance commissioner is a straightforward process. You can typically file a complaint online, by phone, or by mail. You will need to provide the commissioner with your contact information, the name of the insurance company, and a detailed description of your complaint.

You should also provide any supporting documentation, such as copies of your insurance policy, cancellation notice, and any correspondence with the insurance company.

Successful Outcomes in Disputed Policy Cancellations

There have been numerous successful outcomes in cases of disputed policy cancellations.

For example, a recent case in California involved a homeowner whose insurance policy was canceled after his home was damaged in a fire. The insurance company claimed that the homeowner had failed to maintain his property, but the homeowner argued that the damage was caused by a faulty electrical system. The insurance commissioner investigated the complaint and found that the insurance company had wrongfully canceled the policy. The insurance company was ordered to reinstate the policy and pay the homeowner’s damages.

These successful outcomes demonstrate that policyholders have rights and can fight back against unfair insurance practices.

Final Review

So, there you have it! Insurance companies can cancel your policy, but it’s not the end of the world. By understanding the reasons for cancellation, your rights, and the steps you can take to prevent it, you can navigate this tricky situation with confidence. Remember, staying informed and proactive is key to keeping your insurance coverage in good standing and avoiding unexpected surprises. Now go out there, be a responsible policyholder, and keep those premiums rolling in!

FAQ Overview

What are some common reasons why insurance companies cancel policies?

Insurance companies can cancel policies for a variety of reasons, including non-payment of premiums, fraudulent claims, exceeding the number of allowed claims, failing to meet policy requirements, and engaging in risky behavior.

What are my options if my insurance policy is canceled?

If your policy is canceled, you have a few options. You can try to appeal the decision with your insurance company, find a new insurance provider, or explore alternative insurance options, such as high-risk insurance.

What happens if I have an accident after my policy is canceled?

If you have an accident after your policy is canceled, you will be responsible for all costs associated with the accident, including repairs, medical bills, and legal fees. You may also face legal consequences for driving without insurance.