Can insurance company cancel your policy – Can insurance companies cancel your policy? It’s a question that pops up in the back of your mind when you’re dealing with those pesky premiums, right? Well, the answer is a little more complex than a simple yes or no. While insurance companies have the right to cancel your policy, they can’t just do it on a whim. There are specific reasons why they might pull the plug on your coverage, and knowing what they are can help you avoid getting caught off guard.

From breaking the rules of your policy to simply forgetting to pay your bills, there are a bunch of reasons why your insurance company might give you the boot. We’re diving deep into the world of insurance cancellation, covering everything from the common reasons why your policy might get the axe to your rights as a policyholder. We’ll also spill the tea on how to avoid cancellation and what to do if it happens to you. So, buckle up, because this ride is about to get real!

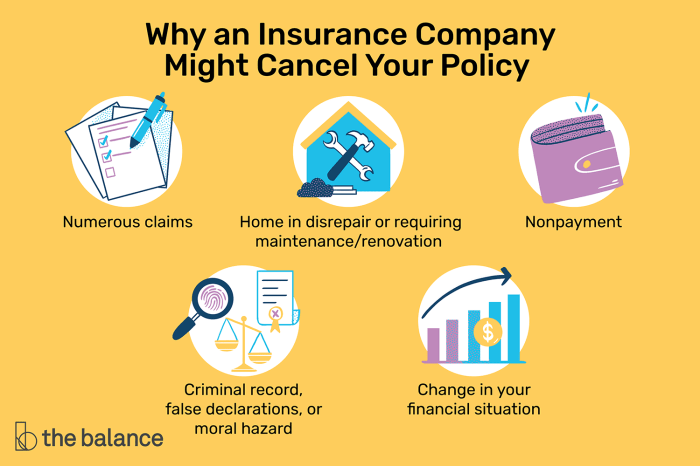

Reasons for Policy Cancellation

Insurance companies can cancel your policy for a variety of reasons, and understanding these reasons can help you avoid a situation where you need coverage and don’t have it. It’s crucial to be aware of the terms and conditions of your policy and adhere to them.

Policy Violations

Insurance companies have specific terms and conditions that policyholders must adhere to. If these conditions are violated, the insurer has the right to cancel your policy. These violations can range from minor infractions to serious offenses.

- Driving record: If you accumulate too many traffic violations, such as speeding tickets or accidents, your insurance company may cancel your policy. It’s important to maintain a clean driving record to avoid potential cancellation.

- Failure to disclose information: When applying for insurance, you’re required to provide accurate information about your driving history, vehicle usage, and other relevant details. Failing to disclose important information, even unintentionally, can lead to policy cancellation.

- Modifying your vehicle: Making significant changes to your vehicle without informing your insurer can void your policy. This includes modifications that affect the vehicle’s safety or performance, such as adding a turbocharger or changing the suspension.

Non-Payment of Premiums

Paying your insurance premiums on time is essential to maintaining your coverage. If you fail to make payments, your policy can be canceled. Insurance companies have a grace period for late payments, but if you consistently miss payments, your policy may be terminated.

“Insurance companies typically send you a notice of cancellation before actually canceling your policy. It’s crucial to respond to these notices and address the issue promptly.”

Fraudulent Activities

Engaging in fraudulent activities related to your insurance policy can lead to immediate cancellation. This includes filing false claims, intentionally causing damage to your vehicle, or providing false information to obtain a lower premium. Insurance companies take fraud seriously and have strict measures in place to detect and investigate such activities.

Notice and Cancellation Process

So, you’ve gotten a cancellation notice from your insurance company. Don’t freak out! This isn’t the end of the world, but it’s definitely a situation you want to handle with care. Let’s break down what you need to know about the legal requirements, timelines, and your options.

Legal Requirements for Notice

Insurance companies aren’t allowed to just cancel your policy on a whim. They have to follow specific legal requirements, which are usually laid out in your state’s insurance laws. The general rule of thumb is that they need to give you fair warning before canceling your policy. This means they need to send you a formal notice in writing, explaining why they’re canceling your policy and when the cancellation will take effect.

Cancellation Notice Timeframes

The amount of time you get to prepare for a policy cancellation varies depending on the type of insurance and your state’s laws. However, most states require insurance companies to give you at least 30 days’ notice before canceling your policy. This gives you time to find a new policy or make other arrangements.

Steps for Policyholders Upon Receiving a Cancellation Notice

Alright, so you’ve received that dreaded cancellation notice. Don’t panic! Here’s what you need to do:

- Read the notice carefully: Understand why your policy is being canceled and when the cancellation will take effect.

- Check your policy: Review your policy to make sure you understand your rights and obligations.

- Contact your insurance company: Ask questions about the cancellation and see if there’s anything you can do to keep your policy in force.

- Consider your options: If you can’t keep your current policy, start looking for a new one. You might need to shop around to find the best rates and coverage.

Cancellation Process Comparison

Let’s take a look at how the cancellation process can vary depending on the type of insurance:

| Type of Insurance | Cancellation Notice Timeframe | Other Considerations |

|---|---|---|

| Auto Insurance | Typically 30 days | Cancellation may be due to non-payment of premiums, driving violations, or changes in your driving record. |

| Homeowners Insurance | Typically 30 days | Cancellation may be due to non-payment of premiums, changes in the property, or claims history. |

| Health Insurance | May vary depending on the plan | Cancellation may be due to non-payment of premiums, changes in your eligibility, or changes in the plan’s coverage. |

Rights of Policyholders

Don’t get your knickers in a twist if your insurance company decides to cancel your policy! You’ve got rights, and knowing them is your superpower. This section breaks down your rights and the options you have when faced with cancellation.

Appealing the Cancellation Decision

You’re not just a number, and your insurance company can’t just toss you aside. If you think the cancellation is unfair, you have the right to appeal their decision. This means you can challenge their reasoning and present your side of the story.

Consumer Protection Laws

Your state has your back! Many states have laws specifically designed to protect policyholders from unfair cancellation practices. These laws might cover things like:

- Notice requirements: How much notice the insurance company must give you before canceling your policy.

- Grounds for cancellation: The reasons the company can legally cancel your policy.

- Right to a hearing: The opportunity to have a formal hearing to present your case.

Role of State Insurance Regulators

State insurance regulators are like the referees of the insurance world. They make sure insurance companies play fair and follow the rules. If you think your insurance company has violated your rights, you can file a complaint with your state’s insurance regulator. They can investigate the situation and try to resolve the dispute.

Impact of Cancellation

Getting your insurance policy canceled can feel like a punch to the gut, especially when you’re counting on it for protection. It’s not just about losing coverage; it can have serious consequences for your finances, your future, and even your ability to get back on your feet.

Challenges of Obtaining New Coverage

Policy cancellation can make getting new insurance coverage a real uphill battle. Insurers view cancellations as red flags, suggesting you might be a higher risk. This can lead to higher premiums, limited coverage options, or even outright refusal of coverage. Imagine trying to find a new apartment after being evicted. It’s a similar situation – your past actions have consequences.

Impact on Individuals and Businesses, Can insurance company cancel your policy

Cancellation can hit individuals and businesses hard in different ways. For example, a canceled car insurance policy could leave you financially exposed if you’re involved in an accident. For businesses, cancellation of liability insurance could mean facing lawsuits without protection, putting their entire operation at risk.

Financial Implications of Policy Cancellation

Cancellation can have serious financial consequences. You could be left footing the bill for unexpected expenses, like medical bills after a car accident, or repairs after a fire. You might also face penalties or fees for canceling your policy, and it could affect your credit score. Think of it like a credit card – if you miss payments, your credit score takes a hit, making it harder to get future loans.

Preventing Cancellation

You’ve got your insurance policy, but you want to make sure it stays in good standing. No one wants to be left high and dry without coverage! Here’s how you can avoid having your policy cancelled:

Understanding Policy Terms and Conditions

It’s crucial to understand the terms and conditions of your insurance policy, like reading the fine print of your favorite movie streaming service. It’s a bit of a chore, but it’s essential for knowing the rules of the game. You need to be aware of things like:

- Premium payment deadlines: When your premium is due, you want to be on top of it. Late payments can be a major reason for cancellation.

- Coverage limits: Knowing your policy’s coverage limits helps you understand what’s covered and what’s not. This prevents you from being surprised if a claim is denied.

- Exclusions: Every policy has exclusions – things that aren’t covered. Knowing these exclusions keeps you from making a claim that’s not covered.

Maintaining Accurate Contact Information

You wouldn’t want to miss an important message from your insurance company, right? Keeping your contact information updated with them is crucial. Imagine you’re changing addresses or phone numbers, and your insurance company can’t reach you. You might miss important updates or notifications.

Importance of Timely Premium Payments

Paying your premiums on time is like paying your rent – it’s a big deal! Late payments can be a red flag for insurance companies. Here’s why:

- Late fees: You might end up with late fees, which can add up quickly.

- Policy cancellation: If you consistently make late payments, your policy could be cancelled. This means you’d be left without coverage, which is a huge risk.

- Future coverage: A history of late payments could make it harder to get insurance in the future. It’s like having a bad credit score for insurance companies.

Ending Remarks

Getting your insurance canceled can be a real bummer, but knowing the reasons behind it can help you avoid it in the first place. Remember, being aware of your rights and responsibilities as a policyholder is key. From understanding the terms and conditions to staying on top of your payments, taking proactive steps can save you a whole lot of headaches down the line. So, keep your insurance game strong, and let’s make sure you’re covered, no matter what!

General Inquiries: Can Insurance Company Cancel Your Policy

What happens if my insurance company cancels my policy?

If your insurance company cancels your policy, you’ll be left without coverage. This means you’ll be responsible for any costs related to accidents or incidents that happen after the cancellation date. You’ll also have a harder time getting new insurance coverage, as your cancellation history will be reflected in your insurance records.

Can I appeal the cancellation of my insurance policy?

Yes, you can appeal the cancellation of your insurance policy. You’ll need to contact your insurance company and explain why you believe the cancellation was unjustified. You can also contact your state’s insurance regulator to file a complaint.

What if I’m having trouble paying my insurance premiums?

If you’re having trouble paying your insurance premiums, it’s important to contact your insurance company as soon as possible. They may be able to work with you to set up a payment plan or offer other options to help you stay covered.

Can I get my insurance canceled for a minor violation?

It depends on the violation and your insurance company’s policies. Minor violations, like a late payment, might not result in immediate cancellation. However, repeated violations or serious offenses could lead to cancellation.