- Understanding Employer-Sponsored Health Insurance

- Eligibility for Employer-Sponsored Health Insurance

- Cost Considerations

- Open Enrollment and Plan Changes: Can My Company Pay For My Health Insurance

- Health Insurance Laws and Regulations

- Comparing Employer-Sponsored Plans to Individual Plans

- Final Review

- Quick FAQs

Can my company pay for my health insurance? This question pops up for a lot of folks when they’re thinking about their job perks, especially if you’re trying to juggle a budget or need serious coverage. It’s like figuring out the winning strategy in a game of life, where knowing the rules and your options can make all the difference. There’s a whole world of plans out there, from the classic HMOs to the more flexible PPOs, and even the trendy HSAs. Each one has its own perks and downsides, just like choosing the right power-up in a video game.

Knowing what’s available and how your company plays the insurance game can be a game-changer for your financial well-being. We’ll break down the ins and outs of employer-sponsored health insurance, so you can understand the rules, choose the right plan, and score big on your health care.

Understanding Employer-Sponsored Health Insurance

Many employers offer health insurance as a benefit to their employees. This can be a valuable perk, as it can help you save money on healthcare costs and provide you with peace of mind knowing that you have coverage in case of a medical emergency.

Types of Employer-Sponsored Health Insurance Plans

Employer-sponsored health insurance plans come in a variety of types, each with its own set of benefits and drawbacks. Here are some of the most common types of plans:

- Health Maintenance Organization (HMO): HMOs are known for their lower premiums and copayments. However, they typically have a limited network of providers, and you may need to get a referral from your primary care physician to see a specialist.

- Preferred Provider Organization (PPO): PPOs offer more flexibility than HMOs, as you can see any doctor or specialist you choose, in-network or out-of-network. However, PPOs usually have higher premiums and copayments than HMOs.

- Health Savings Account (HSA): HSAs are a tax-advantaged savings account that you can use to pay for healthcare expenses. They are typically offered with high-deductible health plans (HDHPs), which have lower premiums but higher deductibles.

Benefits of Employer-Sponsored Health Insurance

Employer-sponsored health insurance plans offer several benefits, including:

- Lower Premiums: You may be able to get a lower premium on your health insurance through your employer than you would if you purchased it on your own.

- Tax Advantages: Employer-sponsored health insurance premiums are typically paid with pre-tax dollars, which means you can save money on your taxes.

- Access to a Wide Range of Benefits: Employer-sponsored plans often offer a wide range of benefits, such as coverage for preventive care, prescription drugs, and mental health services.

Drawbacks of Employer-Sponsored Health Insurance

While employer-sponsored health insurance plans offer many benefits, they also have some drawbacks:

- Limited Choice: You may not have as much choice in your health insurance plan if you are getting it through your employer.

- Potential for Higher Deductibles: Some employer-sponsored plans have high deductibles, which means you may have to pay a significant amount of money out-of-pocket before your insurance coverage kicks in.

- Changes in Coverage: Your employer may change your health insurance plan or benefits at any time.

Common Health Insurance Benefits Offered by Employers

Many employers offer a variety of health insurance benefits to their employees, such as:

- Preventive Care: This includes coverage for routine checkups, screenings, and vaccinations.

- Prescription Drugs: Most employer-sponsored health insurance plans cover prescription drugs, though there may be a copayment or coinsurance.

- Mental Health Services: Coverage for mental health services, such as therapy and counseling.

- Dental and Vision Care: Some employers also offer dental and vision care as part of their health insurance package.

Eligibility for Employer-Sponsored Health Insurance

Knowing whether you’re eligible for employer-sponsored health insurance is a crucial step in navigating your benefits. Let’s break down the typical requirements and factors that determine your eligibility.

Full-Time vs. Part-Time Employment

The amount of time you work directly impacts your eligibility. Full-time employees are generally more likely to be offered health insurance by their employers. The Department of Labor defines full-time employment as working at least 30 hours per week.

- Full-Time Employees: Full-time employees usually meet the minimum hours requirement and are typically eligible for health insurance.

- Part-Time Employees: Part-time employees, working fewer than 30 hours per week, may not be eligible for employer-sponsored health insurance. However, some companies offer health insurance to part-time employees, especially if they meet specific requirements.

Waiting Periods

Even if you meet the eligibility requirements, you might have to wait a certain amount of time before your health insurance coverage begins. This waiting period is a common practice used by employers to manage costs and ensure new employees are committed to the company.

- Typical Waiting Periods: Waiting periods usually range from 30 to 90 days. Some companies may have shorter or longer waiting periods depending on their specific policies.

- Exceptions: Some companies may have exceptions to the waiting period, such as for employees who are transferring from another employer’s health plan or for certain types of coverage, like dental or vision.

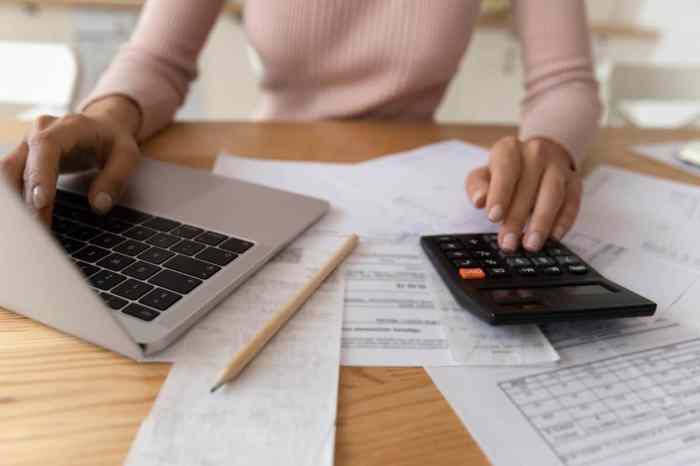

Cost Considerations

Employer-sponsored health insurance can be a valuable benefit, but it’s crucial to understand the associated costs before you jump on board. These costs can vary significantly depending on your employer’s plan and your personal circumstances.

Understanding the costs involved in employer-sponsored health insurance is essential for making informed decisions about your health care. You’ll want to weigh the benefits of the plan against the costs to determine if it’s the right fit for you. Let’s break down the different costs and how they might affect your wallet.

Premiums

Premiums are the monthly payments you make to maintain your health insurance coverage. These payments are typically deducted from your paycheck. The amount you pay for premiums can vary based on several factors, including your age, location, and the type of plan you choose.

- Employer Contributions: Many employers contribute a portion of the premium cost, which can significantly reduce your out-of-pocket expenses. This is a major perk of employer-sponsored plans, as it helps make health insurance more affordable.

- Employee Contributions: The remaining portion of the premium cost is typically paid by the employee. This amount can vary depending on the plan and your employer’s contribution.

Deductibles

A deductible is the amount you must pay out-of-pocket for health care services before your insurance plan begins to cover costs. Think of it as a “gatekeeper” for your benefits.

- Higher Deductibles: Plans with higher deductibles typically have lower monthly premiums. This can be a good option if you’re generally healthy and don’t anticipate needing frequent medical care.

- Lower Deductibles: Plans with lower deductibles usually have higher monthly premiums. This can be a better choice if you have pre-existing conditions or expect to need more medical care.

Copayments

Copayments are fixed amounts you pay for specific health care services, such as doctor’s visits or prescription drugs. They’re kind of like a “small fee” for accessing certain services.

- Copayment Amounts: Copayments can vary depending on the type of service and the insurance plan. For example, a copay for a doctor’s visit might be $20, while a copay for a specialist visit might be $40.

- Out-of-Pocket Maximums: Most plans have an out-of-pocket maximum, which is the total amount you’ll have to pay for covered health care services in a year. Once you reach this maximum, your insurance plan will cover 100% of the remaining costs.

Tax Advantages

Employer-sponsored health insurance plans offer significant tax advantages for both employers and employees.

- Employer Premiums: Employers can deduct the premiums they pay for employee health insurance as a business expense. This reduces their taxable income.

- Employee Premiums: Employees can deduct their portion of the premium cost from their taxable income. This can help lower your overall tax bill.

Open Enrollment and Plan Changes: Can My Company Pay For My Health Insurance

Open enrollment is the time of year when you can make changes to your health insurance plan. This is a crucial period to review your coverage and ensure it aligns with your current needs and budget.

The open enrollment period for employer-sponsored health insurance plans typically lasts for a few weeks each year, usually in the fall. During this time, you can:

Enroll in a Plan

If you are a new employee or have previously declined coverage, you can enroll in a health insurance plan during open enrollment.

Make Changes to an Existing Plan

You can switch between different health insurance plans offered by your employer during open enrollment. This includes changing your coverage level, adding or removing dependents, or selecting a different deductible or co-pay structure.

Restrictions and Limitations

While open enrollment allows for flexibility, there are certain restrictions and limitations to keep in mind:

- Changes outside open enrollment: Generally, you can only make changes to your health insurance plan during open enrollment, unless you experience a qualifying life event. Qualifying life events include marriage, divorce, birth or adoption of a child, loss of coverage, or moving to a new state.

- Waiting periods: If you enroll in a new plan or change plans during open enrollment, there may be a waiting period before your coverage becomes effective. This waiting period is usually 30 days, but it can vary depending on the plan.

- Pre-existing conditions: If you have a pre-existing condition, your employer’s health insurance plan cannot deny coverage or charge you higher premiums based on that condition. This is due to the Affordable Care Act, which prohibits health insurance companies from discriminating against individuals with pre-existing conditions.

Health Insurance Laws and Regulations

Navigating the world of employer-sponsored health insurance can be a bit like navigating a jungle. You’ve got to know the rules to stay safe, avoid getting lost, and make sure you’re getting what you deserve. So, let’s dive into the legal landscape of health insurance, because understanding these laws can make a big difference in your coverage and your wallet.

Federal Laws and Regulations

The federal government plays a big role in setting the rules for employer-sponsored health insurance. Think of it as the main boss of the insurance jungle. Here are some key laws you need to know:

- The Affordable Care Act (ACA): This law, often called Obamacare, is like the big game-changer. It brought about major changes in health insurance, including requiring most Americans to have health insurance and making it easier for people with pre-existing conditions to get coverage. The ACA also established marketplaces where individuals can buy health insurance and expanded Medicaid eligibility.

- The Employee Retirement Income Security Act (ERISA): This law is like the health insurance cop on the beat. It sets rules for employer-sponsored health plans and requires them to provide certain information to employees, like plan documents and summaries. ERISA also regulates how these plans are managed and what happens if there’s a dispute over benefits.

- The Health Insurance Portability and Accountability Act (HIPAA): HIPAA is like the privacy protector in the insurance jungle. It sets rules for protecting your health information, including your medical records and insurance claims. It’s designed to prevent your personal information from being shared without your consent.

State-Specific Laws and Regulations

While the federal government sets the basic rules, each state has its own set of laws and regulations that can affect employer-sponsored health insurance. It’s like each state having its own set of local laws for the insurance jungle.

- State Mandated Benefits: Some states require employers to cover specific health services, like mental health care or infertility treatment. This is like a state-level requirement for certain benefits in the insurance jungle.

- Small Employer Health Insurance Programs: Some states have programs to help small businesses provide health insurance to their employees. It’s like a state-level helping hand for small businesses in the insurance jungle.

- Consumer Protection Laws: Many states have laws to protect consumers from unfair or deceptive practices by health insurance companies. Think of these laws as consumer rights in the insurance jungle.

Consequences of Non-Compliance

Not following the rules of the insurance jungle can have serious consequences. Think of it as getting a ticket for speeding in the jungle.

- Penalties: Employers that don’t comply with federal laws, like the ACA, could face penalties. This could be like getting a fine for not following the rules in the insurance jungle.

- Lawsuits: Employees can sue their employers if they believe their health plan is not being managed properly or if they’re denied coverage. This is like taking legal action for unfair treatment in the insurance jungle.

- Reputational Damage: Non-compliance can damage an employer’s reputation and make it harder to attract and retain employees. It’s like getting a bad reputation in the insurance jungle.

Comparing Employer-Sponsored Plans to Individual Plans

Choosing the right health insurance plan can feel like navigating a maze, especially when you’re deciding between employer-sponsored plans and individual plans. Both have their pros and cons, and the best choice for you depends on your individual needs and circumstances.

Advantages and Disadvantages

Understanding the advantages and disadvantages of each type of plan can help you make an informed decision.

Employer-Sponsored Plans

- Lower Premiums: Employer-sponsored plans often have lower premiums than individual plans because employers negotiate group rates with insurance companies. Think of it as a bulk discount for a whole team!

- Tax Advantages: Premiums paid through an employer-sponsored plan are typically pre-tax, which means you save money on taxes. It’s like getting a bonus before you even see the money!

- Employer Contributions: Some employers contribute to the cost of health insurance, which can significantly reduce your out-of-pocket expenses. It’s like getting a little extra help from your boss to stay healthy.

- Wider Network: Employer-sponsored plans often have wider networks of doctors and hospitals than individual plans. This means you’re more likely to find a provider in your area that accepts your insurance.

- Limited Choice: You may not have as many plan options with an employer-sponsored plan as you would with an individual plan. It’s like having a limited menu at a restaurant, but you can still find something tasty.

- Dependence on Employer: Your health insurance coverage is tied to your employment. If you lose your job, you may lose your health insurance. It’s like having a great roommate, but they might move out unexpectedly.

- Open Enrollment Period: You can only make changes to your plan during the open enrollment period, which is usually once a year. So, you need to think carefully about your needs and choose the right plan for the whole year.

Individual Plans

- More Choice: You have a wider range of plan options with individual plans, allowing you to customize your coverage to meet your specific needs. It’s like having a buffet with all your favorite dishes!

- Flexibility: You can change your plan at any time, even if you’re not in an open enrollment period. This is great if your health needs change or if you find a better plan.

- Portability: You can take your individual health insurance plan with you if you change jobs or move. It’s like having a travel buddy that’s always there for you.

- Higher Premiums: Individual plans generally have higher premiums than employer-sponsored plans. This is because you’re not getting the group rate discount.

- Tax Deductions: While you can deduct premiums for individual plans on your taxes, the process can be more complicated than with employer-sponsored plans.

- Limited Network: Individual plans may have smaller networks of doctors and hospitals than employer-sponsored plans. It’s like having a smaller circle of friends, but they’re all super supportive.

Factors to Consider

Several factors can influence your decision to choose an employer-sponsored plan or an individual plan.

- Your Health Needs: If you have pre-existing conditions or expect high medical expenses, an employer-sponsored plan might be a better option due to the lower premiums and potentially wider network.

- Your Budget: If you’re on a tight budget, an employer-sponsored plan might be more affordable, especially if your employer contributes to the cost.

- Your Job Security: If you’re in a stable job, an employer-sponsored plan might be a good choice. But if you’re in a job with high turnover, an individual plan might offer more flexibility.

- Your Location: The availability of plans and networks can vary depending on your location. It’s like choosing a restaurant based on what’s in your neighborhood.

- Your Age: Younger, healthier individuals may find individual plans more affordable, while older individuals with higher healthcare needs may benefit from the lower premiums and wider networks of employer-sponsored plans.

Key Differences, Can my company pay for my health insurance

Here’s a table summarizing the key differences between employer-sponsored and individual plans:

| Feature | Employer-Sponsored Plans | Individual Plans |

|---|---|---|

| Premiums | Generally lower | Generally higher |

| Tax Advantages | Premiums are pre-tax | Deductible on taxes |

| Employer Contributions | Some employers contribute | No employer contributions |

| Network Size | Often wider | May be smaller |

| Choice | Limited options | Wide range of options |

| Flexibility | Limited to open enrollment | Can change plans at any time |

| Portability | Tied to employment | Portable |

Final Review

So, can your company pay for your health insurance? The answer is a resounding maybe! It’s all about understanding the different options, figuring out what fits your needs and budget, and playing the health insurance game smart. Remember, you’re not alone in this quest for coverage. There are resources out there to help you navigate the world of employer-sponsored health insurance and find the perfect plan for your personal health journey.

Quick FAQs

What if I’m part-time? Can I still get health insurance through my employer?

It depends on your company’s policies and whether you meet their eligibility requirements for part-time employees. Some companies offer health insurance to part-time workers, while others don’t. It’s best to check with your HR department to find out the specifics.

Are there any downsides to employer-sponsored health insurance?

While employer-sponsored plans offer several benefits, they can also have some downsides. You might be limited in your choice of doctors or hospitals, and you could face higher costs if you switch jobs or lose your employment.

What if I’m not happy with my current plan? Can I switch?

You can typically make changes to your health insurance plan during the annual open enrollment period. Some companies may allow you to switch plans outside of open enrollment if you experience a qualifying life event, like getting married or having a baby.

Can I use my employer-sponsored health insurance if I move out of state?

It depends on the specific plan and your employer’s policies. Some plans have limited coverage outside of a certain geographic area. It’s important to review your plan details and check with your HR department before making any major moves.