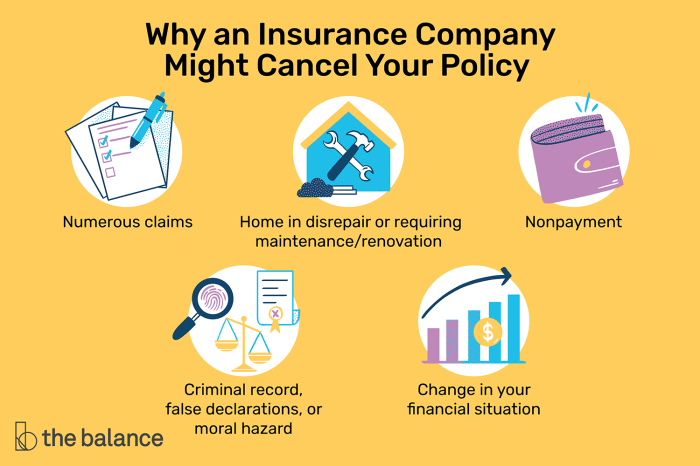

Can my insurance company cancel my policy? It’s a question that many people have wondered, and for good reason. Insurance policies are designed to protect you, but what happens when you break the rules? From unpaid premiums to driving violations, there are a number of reasons why your insurance company might decide to terminate your coverage. This guide will explore the ins and outs of policy cancellation, including your rights, potential consequences, and ways to avoid losing your coverage.

Understanding the reasons for policy cancellation is crucial for any policyholder. Whether you’re dealing with a car insurance policy, health insurance, or homeowners insurance, it’s important to be aware of the terms and conditions of your agreement. By knowing what could lead to cancellation, you can take steps to protect yourself and your coverage.

Consequences of Policy Cancellation

Getting your insurance policy canceled can be a major headache, and it’s not just about the inconvenience of finding new coverage. Cancellation can have serious financial implications that impact your wallet and your future insurance premiums. Let’s break down what happens when your policy gets the axe.

Financial Implications, Can my insurance company cancel my policy

Policy cancellation can lead to significant financial consequences. If you’re in the middle of a claim, cancellation means you’re left holding the bag for all costs, even if the claim is valid. Imagine getting into an accident, having your car totaled, and then finding out your insurance policy is gone – ouch! It’s also important to remember that insurance premiums are often based on your driving history and claims history. Cancellation can negatively impact your record, leading to higher premiums in the future. Think of it as a big “F” on your insurance report card.

Coverage and Future Premiums

Cancellation means you’re no longer protected by the insurance policy. This leaves you vulnerable to financial ruin if you experience an accident or other covered event. For example, if your auto insurance is canceled and you get into an accident, you’ll be responsible for all repair costs, medical bills, and potential legal fees. It’s like playing a game of financial roulette without a safety net. Additionally, insurance companies often keep track of your cancellation history. This means that even if you manage to get new coverage, you’ll likely face higher premiums due to your cancellation record. Think of it as a black mark on your insurance profile that follows you around.

Impact on Specific Insurance Types

Auto Insurance

Cancellation of your auto insurance can leave you with a mountain of bills if you get into an accident. Imagine your car is totaled, and you’re stuck with the repair costs and rental car expenses. It’s a nightmare scenario. Additionally, future insurance premiums can skyrocket due to your cancellation history. Think of it as a hefty price tag for your driving mistakes.

Health Insurance

Canceling your health insurance can have serious consequences, especially if you have a pre-existing condition. You may face difficulty finding new coverage or be forced to pay higher premiums. It’s like playing a game of medical Russian roulette with your health and finances. Imagine needing a medical procedure and being left with a massive bill because you’re no longer covered. Not a pretty picture.

Home Insurance

Cancellation of your home insurance can leave you exposed to financial ruin in case of a fire, theft, or natural disaster. Think of it as living in a house of cards with no safety net. Imagine your home being destroyed by a fire and having to rebuild it from scratch without any insurance coverage. The financial burden could be overwhelming. Plus, finding new home insurance after cancellation can be a challenge, and you might have to pay higher premiums due to your cancellation history.

Preventing Policy Cancellation

Your insurance policy is a safety net, but just like any safety net, it needs regular maintenance to ensure it’s there when you need it. Avoiding policy cancellation is key to keeping that protection in place.

Maintaining a Good Insurance Record

A clean insurance record is your best defense against policy cancellation. Think of it like a good credit score; it unlocks better rates and protects you from unexpected surprises. Here’s how to keep your insurance record in tip-top shape:

- Pay Your Premiums on Time: Late payments are a red flag for insurance companies. Set reminders, automate payments, or explore payment plans if you need help staying on track.

- Be Honest About Your Information: Providing accurate information about your vehicle, driving history, or property is crucial. Don’t try to hide things – it can come back to bite you later.

- Maintain a Safe Driving Record: Speeding tickets, accidents, and driving under the influence can significantly impact your insurance rates and even lead to policy cancellation.

- Keep Your Vehicle in Good Condition: Proper maintenance can prevent accidents and help you avoid policy cancellation related to vehicle safety.

- Avoid Fraudulent Claims: Making false claims is a serious offense that can result in policy cancellation and even legal repercussions.

Communicating with Your Insurance Company

Open communication is key to a healthy insurance relationship. Here’s how to keep the lines of communication open:

- Inform Them of Any Changes: Moving, changing vehicles, or adding drivers to your policy? Notify your insurance company promptly to ensure your coverage remains accurate.

- Ask Questions: Don’t be afraid to ask for clarification on your policy terms, coverage limits, or any other concerns. It’s better to ask than to assume.

- Respond to Requests: Insurance companies may occasionally need to verify information or update your policy. Respond promptly to their requests to avoid potential issues.

Concluding Remarks: Can My Insurance Company Cancel My Policy

Losing your insurance coverage can have serious consequences, so it’s essential to stay informed about your policy and your rights. By understanding the reasons for cancellation, your rights as a policyholder, and the potential consequences, you can make informed decisions about your insurance and protect yourself from unexpected surprises. Remember, communication is key. If you have any questions or concerns, reach out to your insurance company for clarification. Taking these steps can help you keep your coverage and safeguard your financial well-being.

Question & Answer Hub

Can my insurance company cancel my policy for a small mistake?

It depends. Minor errors like a typo on your application might be overlooked, but more serious mistakes could lead to cancellation. It’s always best to be accurate and honest with your insurance company.

What happens to my premiums if my policy is canceled?

You may not get a refund for any premiums you paid in advance, but you might be entitled to a prorated refund for the remaining time on your policy.

Can I get insurance after my policy has been canceled?

Yes, but you might have to pay higher premiums or have difficulty finding coverage. Your cancellation history will be considered by future insurance companies.