Can you get car insurance with a permit in NJ? The answer is yes, but there are some things you need to know. In New Jersey, drivers with permits are subject to specific rules and restrictions, including insurance requirements. Understanding these regulations is crucial for young drivers who are just starting their journey behind the wheel. This guide will explore the ins and outs of car insurance for permit holders in New Jersey, providing essential information about the necessary coverage, the impact on premiums, and the factors that influence your insurance costs.

While you may not be able to drive independently yet, having car insurance is vital for protecting yourself and others on the road. This is especially important for permit holders, as they are still learning and gaining experience. In New Jersey, you are required to have insurance even if you are only driving with a licensed adult present. The good news is that there are several insurance options available to permit holders, and you can find a plan that fits your needs and budget.

Driving with a Permit in New Jersey: Can You Get Car Insurance With A Permit In Nj

In New Jersey, a learner’s permit allows individuals to practice driving under the supervision of a licensed driver. This supervised driving experience is crucial for gaining the necessary skills and experience before obtaining a driver’s license.

Supervised Driving Requirements

The supervised driving period in New Jersey is designed to provide learners with a comprehensive understanding of driving rules, road safety, and practical driving skills. This period requires a minimum number of hours of driving experience under the supervision of a licensed driver.

- Minimum Driving Hours: The New Jersey Motor Vehicle Commission (MVC) requires a minimum of 60 hours of supervised driving, including at least 10 hours of night driving.

- Types of Driving Experiences: These 60 hours must include a variety of driving experiences, such as driving in different weather conditions, driving on highways, and practicing various driving maneuvers.

During the supervised driving period, the learner driver must have a licensed driver, who is at least 21 years old, in the front passenger seat. This licensed driver must have a valid New Jersey driver’s license and be in good standing with the MVC. The learner driver is also required to have their learner’s permit with them at all times while driving.

Legal Consequences of Driving Without a Licensed Driver

Driving with a permit without a licensed driver present in New Jersey is illegal and can result in serious consequences.

- Traffic Tickets: Drivers who violate this law will receive a traffic ticket, which can result in fines and points on their driving record.

- Vehicle Impoundment: The vehicle being driven may be impounded.

- License Suspension: Repeat violations can lead to the suspension of the learner’s permit.

Insurance Requirements for Permit Holders

In New Jersey, having a driver’s permit means you’re on your way to getting your driver’s license. However, it also means you’ll need to have insurance coverage in place before you can legally drive. This section will cover the insurance requirements for permit holders in New Jersey.

Insurance Coverage Requirements

New Jersey law mandates that all drivers, including permit holders, must have the following minimum insurance coverage:

* Liability Coverage: This coverage protects you financially if you cause an accident that injures someone or damages their property. The minimum requirements are:

* Bodily Injury Liability: $15,000 per person/$30,000 per accident.

* Property Damage Liability: $5,000 per accident.

* Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages. The minimum requirement is $15,000 per person/$30,000 per accident.

Permit Holders and Parent’s Insurance

While permit holders are required to have insurance, they are not required to have their own separate insurance policy. Instead, they can be added to their parent’s or guardian’s existing insurance policy. This means that the permit holder will be covered under the same policy as their parent or guardian, and will be subject to the same coverage limits and deductibles.

Impact on Insurance Premiums

Adding a permit holder to an existing insurance policy will typically increase the premium. This is because insurance companies assess risk based on factors such as age, driving experience, and driving record. Permit holders are considered higher risk due to their lack of driving experience, which can lead to an increase in the overall cost of insurance.

The extent of the premium increase will vary depending on several factors, including:

* The driver’s age: Younger drivers are generally considered higher risk than older drivers.

* The driving record: A clean driving record will typically result in lower premiums compared to a record with violations or accidents.

* The vehicle: The type and value of the vehicle can also affect the premium.

* The insurance company: Different insurance companies have different pricing structures.

It’s important to note that insurance companies may also offer discounts for safe driving habits, such as taking a driver’s education course or having a good academic record.

Obtaining Car Insurance with a Permit

In New Jersey, obtaining car insurance with a permit is a straightforward process, but it’s important to understand the requirements and options available. You can get insurance for your car even if you are a permit holder, and you can choose a plan that suits your budget and coverage needs.

Requirements for Obtaining Car Insurance with a Permit

To obtain car insurance with a permit, you’ll need to provide the following information and documents:

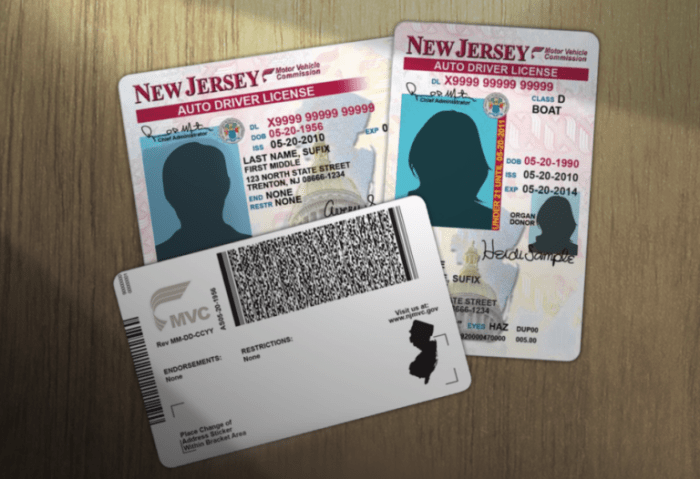

- Your driver’s permit

- Your Social Security number

- Your driver’s license history, if you have one

- Information about the vehicle you will be driving, including the year, make, and model

- Your contact information, including your name, address, and phone number

You may also be asked to provide proof of residency, such as a utility bill or a lease agreement.

Insurance Options for Permit Holders

When applying for car insurance with a permit, you’ll have several options available:

- Liability insurance: This is the minimum amount of coverage required by law in New Jersey. It covers damages to other people’s property and injuries caused by an accident that you are at fault for.

- Collision coverage: This coverage pays for repairs to your car if you are involved in an accident, regardless of who is at fault. This is optional but can be helpful if you are driving a newer car.

- Comprehensive coverage: This coverage protects your car from damage caused by events other than accidents, such as theft, vandalism, or natural disasters. This is also optional but can be beneficial if you are driving a valuable car.

The cost of car insurance for permit holders can vary depending on factors such as your age, driving experience, the type of car you are driving, and your driving history. You can compare quotes from different insurance companies to find the best rates.

Factors Affecting Insurance Premiums

Insurance premiums for permit holders in New Jersey are influenced by various factors, just like those for licensed drivers. These factors help insurance companies assess the risk associated with each driver and determine the cost of coverage.

Age

The age of the permit holder is a significant factor in determining insurance premiums. Younger drivers, especially teenagers, are statistically more likely to be involved in accidents due to lack of experience and judgment. Therefore, insurance companies often charge higher premiums for younger permit holders.

Driving History

Even though permit holders are not yet licensed drivers, their driving history can still influence their insurance premiums. Any previous driving violations or accidents, even those that occurred while driving with a licensed driver, may be reflected in the premium. For example, if a permit holder was involved in an accident while driving with a parent or guardian, the insurance company may consider this incident when calculating the premium.

Vehicle Type

The type of vehicle driven by a permit holder also plays a role in insurance premiums. Some vehicles are considered riskier than others, such as high-performance cars or those with a history of frequent accidents. Insurance companies may charge higher premiums for these types of vehicles, as they are statistically more likely to be involved in accidents.

Comparison with Licensed Drivers

In general, insurance premiums for permit holders are higher than those for licensed drivers. This is because permit holders are considered higher risk due to their limited driving experience. However, it is important to note that individual premiums can vary significantly based on the factors discussed above.

Impact of Driving Violations and Accidents

Driving violations or accidents can significantly impact insurance premiums for permit holders. Even minor violations, such as speeding tickets, can lead to increased premiums. Accidents, regardless of fault, can also result in a substantial increase in premiums.

Insurance Coverage Options for Permit Holders

In New Jersey, permit holders have access to various insurance coverage options, each offering different levels of protection and financial responsibility. Understanding the benefits and drawbacks of each coverage option is crucial for permit holders to make informed decisions about their insurance needs.

Liability Coverage

Liability coverage is mandatory in New Jersey and protects you financially if you cause an accident that results in damage to another person’s property or injuries to another person. This coverage pays for the other driver’s medical expenses, lost wages, and property damage.

Liability coverage is essential for all drivers, including permit holders, as it can help you avoid significant financial burdens in case of an accident.

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and pain and suffering for the other driver and passengers if you are at fault in an accident.

- Property Damage Liability: This coverage pays for repairs or replacement of the other driver’s vehicle or property if you are at fault in an accident.

Collision Coverage

Collision coverage protects you against damage to your own vehicle if you are involved in an accident, regardless of fault. This coverage pays for repairs or replacement of your vehicle, minus your deductible.

Collision coverage is optional for permit holders in New Jersey, but it can be beneficial if you are driving a newer or more expensive vehicle.

- Deductible: The amount you pay out of pocket before your insurance company covers the remaining costs of repairs or replacement.

Comprehensive Coverage, Can you get car insurance with a permit in nj

Comprehensive coverage protects you against damage to your own vehicle caused by events other than accidents, such as theft, vandalism, fire, or natural disasters. This coverage also pays for repairs or replacement of your vehicle, minus your deductible.

Comprehensive coverage is optional for permit holders in New Jersey, but it can be beneficial if you are driving a newer or more expensive vehicle.

- Deductible: The amount you pay out of pocket before your insurance company covers the remaining costs of repairs or replacement.

Closing Summary

Navigating the world of car insurance as a permit holder in New Jersey can seem daunting, but it doesn’t have to be. By understanding the regulations, your insurance options, and the factors that influence your premiums, you can make informed decisions and ensure you have the right coverage. Remember, driving with a permit requires responsibility, and having the appropriate insurance is a crucial step in your journey towards becoming a safe and confident driver.

FAQ Explained

How much does car insurance cost for permit holders in NJ?

The cost of car insurance for permit holders in NJ can vary depending on factors like age, driving history, and the type of vehicle. It’s generally cheaper than for licensed drivers, but it’s important to compare quotes from different insurers.

Can I drive someone else’s car with a permit in NJ?

Yes, you can drive someone else’s car with a permit in NJ, but only if you have their permission and a licensed driver over 21 is present in the passenger seat.

What happens if I get into an accident with a permit in NJ?

If you get into an accident with a permit in NJ, you will be held responsible for any damages or injuries. Your insurance will cover the costs, but your premiums may increase.