Can you get gap insurance from your insurance company – So, you’re thinking about gap insurance, but you’re wondering if you can get it from your current insurance company. It’s a smart move to think about protecting yourself, especially if you’re still paying off a car loan. Gap insurance can be a lifesaver if your car gets totaled, but it can be confusing to navigate. Let’s break it down and see if your insurance company is the right place to get it.

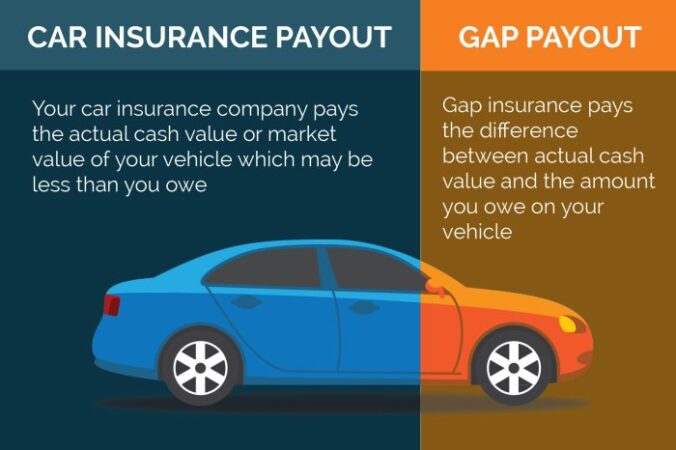

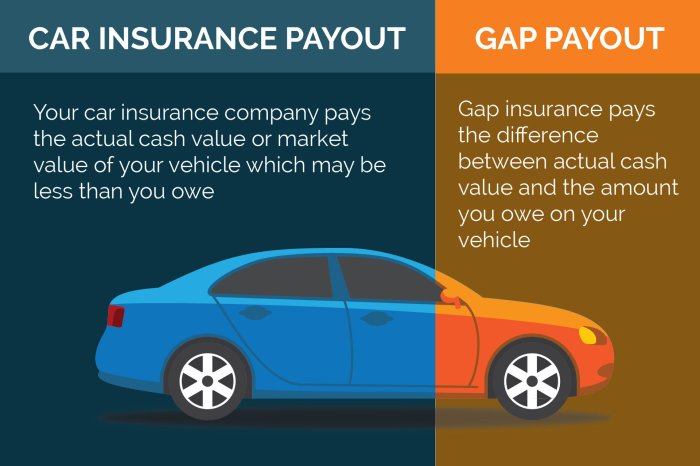

Gap insurance is basically a safety net for your wallet. Imagine this: you’re driving your sweet ride, and bam! You get into an accident, and your car is a total write-off. Now, your insurance company pays out the actual cash value of your car, but that might be less than what you still owe on your loan. That’s where gap insurance steps in and covers the difference, saving you from a hefty financial blow. It’s like having a backup plan for when things go south.

Considerations When Purchasing Gap Insurance

Gap insurance can be a valuable tool for car owners, but it’s essential to carefully consider your individual needs and circumstances before deciding if it’s right for you. Understanding the factors that influence the need for gap insurance, its cost, and the specific terms of coverage will help you make an informed decision.

Cost of Gap Insurance

The cost of gap insurance varies depending on factors such as the make and model of your car, your location, and the insurance company you choose. Generally, gap insurance costs between $300 and $1,000 per year, but it can be less expensive if you bundle it with other insurance policies.

- It’s important to weigh the cost of gap insurance against the potential benefits. If you’re financing a new car, the gap insurance premium could be less than the potential cost of being upside down on your loan.

- For example, if you finance a $30,000 car and it’s totaled in an accident after a few years, your insurance company might only pay out $20,000, leaving you responsible for the remaining $10,000. Gap insurance would cover this difference.

Terms and Conditions of Gap Insurance Policies

It’s crucial to carefully review the terms and conditions of any gap insurance policy before purchasing it. Pay close attention to the following:

- Coverage limits: Most gap insurance policies have coverage limits, meaning they will only pay a certain amount of the difference between your loan balance and the actual cash value of your vehicle.

- Exclusions: Gap insurance policies typically exclude certain situations, such as damage caused by wear and tear or if you’re at fault for an accident.

- Deductibles: Some gap insurance policies have deductibles, meaning you’ll have to pay a certain amount out of pocket before the policy kicks in.

- Cancellation policy: Understand the cancellation policy of the gap insurance policy, including any refund options if you cancel early.

Factors to Consider When Determining If Gap Insurance Is Necessary

Before purchasing gap insurance, it’s essential to consider several factors:

- Loan-to-value ratio: The higher your loan-to-value ratio, the more likely you are to be upside down on your loan if your car is totaled.

- Age of your car: The older your car, the faster its value depreciates. If you’re financing a used car, you may be more likely to be upside down on your loan.

- Driving history: If you have a poor driving history, you may be more likely to be involved in an accident.

- Your financial situation: Consider your overall financial situation and whether you can afford the cost of gap insurance.

Alternatives to Gap Insurance

Gap insurance isn’t the only way to protect yourself from being upside down on your car loan. If you’re not sure gap insurance is right for you, there are other financial products you can consider. Let’s dive into a few alternatives that might be a better fit for your situation.

Comparing Alternatives

Here’s a quick breakdown of gap insurance and a few alternatives to help you decide what’s best for you:

| Feature | Gap Insurance | Extended Warranty | Loan Protection Plan |

|---|---|---|---|

| Coverage | Covers the difference between what you owe on your loan and what your insurance pays out in an accident or total loss | Covers repairs or replacement of covered parts for a specific period of time or mileage | Pays off your loan in case of death, disability, or job loss |

| Cost | Usually a one-time fee, sometimes rolled into your loan | Can be purchased separately or bundled with your loan | Usually a monthly fee added to your loan payment |

| Benefits | Protects you from financial loss if your car is totaled and you owe more than it’s worth | Provides peace of mind by covering expensive repairs and potential replacement costs | Provides financial protection for your loan in case of unexpected life events |

| Drawbacks | Can be expensive, especially for newer vehicles | May not cover all repairs or replacement costs | May have limitations on coverage and may not cover all situations |

Extended Warranties

Extended warranties, also known as service contracts, can provide coverage for repairs beyond the manufacturer’s warranty. These plans can be especially helpful for vehicles that are prone to expensive repairs or have a history of reliability issues. For example, if you’re buying a used car, an extended warranty might give you peace of mind, knowing you’re protected against unexpected repair costs.

However, extended warranties have their downsides. They can be expensive, and they may not cover all repairs. It’s important to read the fine print carefully before purchasing an extended warranty to make sure you understand what’s covered and what’s not.

Loan Protection Plans, Can you get gap insurance from your insurance company

Loan protection plans are designed to protect you from financial hardship in the event of unexpected life events, such as death, disability, or job loss. If you’re concerned about being able to make your loan payments if something unexpected happens, a loan protection plan can provide peace of mind.

However, it’s important to note that loan protection plans are not a substitute for comprehensive insurance coverage. They only cover specific situations, and they may have limitations on the amount of coverage they provide. It’s important to read the terms and conditions of any loan protection plan carefully before purchasing it.

Choosing the Right Solution

The best financial product for you depends on your individual circumstances and risk tolerance. Here are some factors to consider:

- Your budget: Consider the cost of each option and how it fits into your overall financial plan.

- Your vehicle: The age, make, and model of your vehicle can influence the need for gap insurance or an extended warranty.

- Your financial situation: If you’re concerned about being able to make your loan payments in the event of a job loss or disability, a loan protection plan might be a good option.

It’s always a good idea to talk to a financial advisor or insurance broker to discuss your options and get personalized advice.

Closure: Can You Get Gap Insurance From Your Insurance Company

So, can you get gap insurance from your insurance company? The answer is, it depends. Some companies offer it, some don’t. It’s all about doing your research and comparing options. But hey, if your current insurance company is your go-to, check out their offerings. They might have a sweet deal, and you can get all your insurance needs in one place. It’s like a one-stop shop for peace of mind. And remember, when it comes to your car, you want to be covered from every angle. Gap insurance might be the extra protection you need to keep your finances rolling.

Answers to Common Questions

Is gap insurance mandatory?

Nope, gap insurance is not mandatory. It’s a choice you make based on your individual financial situation and risk tolerance.

How much does gap insurance cost?

The cost of gap insurance varies depending on factors like your car’s value, loan amount, and your insurance company. It’s best to get quotes from different providers to compare prices.

What are the common exclusions in gap insurance policies?

Common exclusions in gap insurance policies can include things like wear and tear, pre-existing damage, and certain types of accidents (e.g., accidents caused by driving under the influence).