Can you have two life insurance policies with different companies? Absolutely! In fact, having multiple life insurance policies can be a smart move for many people. Whether you’re a young professional starting out, a growing family, or someone with a complex financial situation, having multiple policies can provide the coverage you need, offer flexibility, and potentially even save you money.

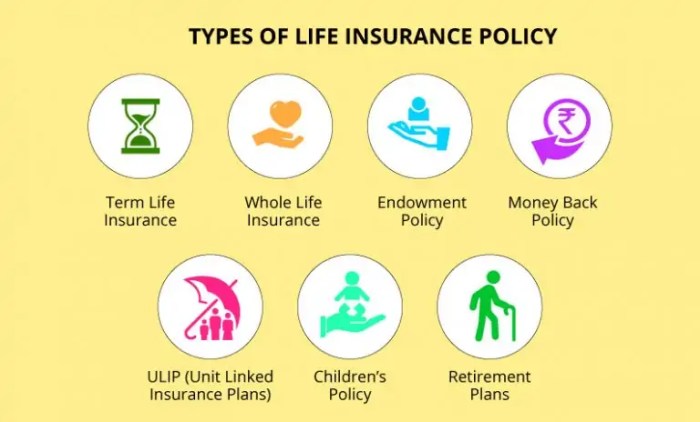

Life insurance is a vital part of financial planning, but the right type and amount of coverage can vary depending on your individual circumstances. From term life to whole life, universal life, and more, understanding the different types of policies and their features is crucial to making informed decisions. Let’s dive into the world of life insurance and explore the benefits and considerations of having multiple policies.

Understanding Multiple Life Insurance Policies

You might be thinking, “Wait, multiple life insurance policies? That sounds complicated!” And you’re not wrong. But hear me out. Sometimes, having more than one life insurance policy can be a good thing, especially if you’re a bit of a risk-taker or have some unique needs.

Think of it like having different types of insurance for your car. You might have collision coverage for accidents and comprehensive coverage for other stuff like theft or hail damage. Life insurance is similar – you can have different policies to cover different aspects of your life.

Situations Where Multiple Policies Are Beneficial, Can you have two life insurance policies with different companies

Here’s where having multiple life insurance policies can come in handy:

- You have a high-risk job. Let’s say you’re a stuntman, a firefighter, or a construction worker. These jobs can be dangerous, and insurance companies might charge you higher premiums. Getting a separate policy from a company that specializes in high-risk professions could be a good idea. This way, you can get the coverage you need without breaking the bank.

- You’re a business owner. As a business owner, you might need a larger death benefit to cover business debts, estate taxes, or to provide for your family’s financial security. A separate life insurance policy specifically for your business can help you manage these risks.

- You have a large mortgage or other debts. Life insurance can help your family pay off these debts if something happens to you. Having multiple policies can ensure that your loved ones have enough coverage to cover all of your financial obligations.

Advantages of Multiple Policies

- Increased coverage. This is a no-brainer. Having multiple policies means you have a higher total death benefit, giving your loved ones more financial protection. Think of it like having a bigger safety net.

- Greater flexibility. Different life insurance companies offer different types of policies with varying features and premiums. Having multiple policies gives you more options to choose from, allowing you to tailor your coverage to your specific needs.

- Potential for lower premiums. You might be able to get lower premiums by spreading your coverage across multiple companies. Insurance companies compete with each other, so they might offer better rates to attract new customers.

Disadvantages of Multiple Policies

- Complexity. Managing multiple policies can be a bit of a headache. You’ll need to keep track of your policy details, premiums, and beneficiary information for each policy.

- Higher administrative costs. You’ll be paying premiums for multiple policies, which can add up over time. Make sure the benefits outweigh the costs before you decide to go this route.

Types of Life Insurance Policies: Can You Have Two Life Insurance Policies With Different Companies

Life insurance policies come in different flavors, each with its own unique set of features, benefits, and costs. Understanding these differences is crucial for making an informed decision about which policy best suits your individual needs.

Term Life Insurance

Term life insurance is like a temporary safety net, providing coverage for a specific period, typically 10, 20, or 30 years. It’s the most affordable option, making it a popular choice for young families or individuals with a short-term financial obligation.

Term life insurance is like a temporary safety net, providing coverage for a specific period.

Term Life Insurance Features

- Simple and straightforward: Term life insurance policies are easy to understand, with premiums remaining fixed for the duration of the policy.

- Affordable: Term life insurance premiums are generally lower than other types of life insurance.

- Coverage for a specific period: You are only covered for the term of the policy, after which you can renew or purchase a new policy.

- No cash value: Term life insurance policies do not accumulate cash value.

Whole Life Insurance

Whole life insurance is like a long-term investment, offering permanent coverage for your entire life, as long as you pay your premiums. It combines death benefit coverage with a cash value component that grows over time.

Whole life insurance is like a long-term investment, offering permanent coverage for your entire life.

Whole Life Insurance Features

- Permanent coverage: Whole life insurance provides lifetime coverage, as long as you pay your premiums.

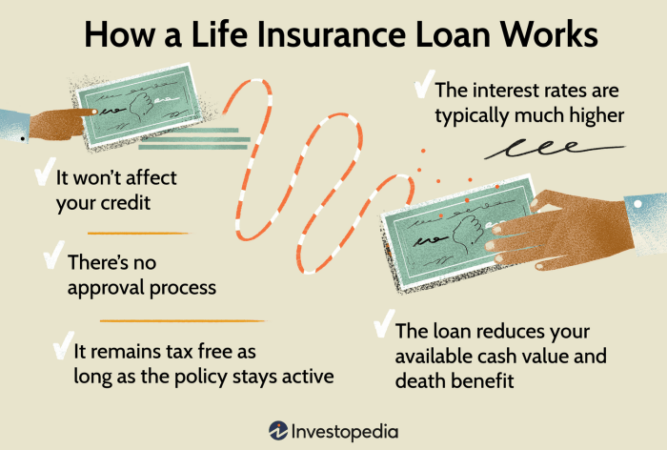

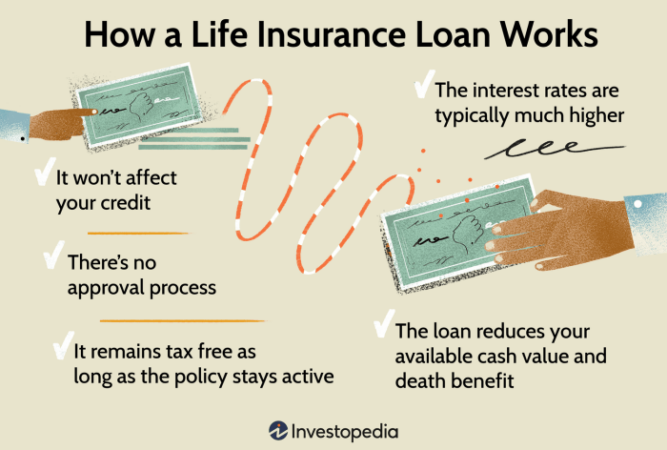

- Cash value accumulation: A portion of your premium goes towards building cash value, which can be borrowed against or withdrawn.

- Higher premiums: Whole life insurance premiums are typically higher than term life insurance premiums.

- Guaranteed interest rates: Whole life insurance policies typically offer a guaranteed interest rate on the cash value component.

Universal Life Insurance

Universal life insurance offers a flexible approach to life insurance, combining permanent coverage with the ability to adjust your death benefit and premiums. It’s a good option for individuals who want more control over their policy.

Universal life insurance offers a flexible approach to life insurance, combining permanent coverage with the ability to adjust your death benefit and premiums.

Universal Life Insurance Features

- Flexible premiums: You can adjust your premiums based on your financial situation.

- Adjustable death benefit: You can increase or decrease your death benefit as needed.

- Cash value accumulation: Universal life insurance policies build cash value, which can be borrowed against or withdrawn.

- Potential for higher returns: Universal life insurance policies may offer higher returns on the cash value component than whole life insurance policies.

Variable Life Insurance

Variable life insurance is a type of permanent life insurance that allows you to invest your premium payments in a variety of sub-accounts, similar to a mutual fund. This gives you the potential for higher returns, but also exposes you to market risk.

Variable life insurance is a type of permanent life insurance that allows you to invest your premium payments in a variety of sub-accounts, similar to a mutual fund.

Variable Life Insurance Features

- Investment options: You can choose from a variety of sub-accounts to invest your premiums, including stocks, bonds, and mutual funds.

- Potential for higher returns: The value of your cash value can fluctuate based on the performance of your investments.

- Market risk: Your investment choices can affect the value of your cash value and the amount of your death benefit.

- Higher premiums: Variable life insurance premiums are typically higher than term life insurance premiums.

Which Type of Life Insurance Policy Is Right for You?

The best type of life insurance policy for you depends on your individual needs and financial situation. Consider factors such as your age, health, income, and financial goals.

- Term life insurance is a good option for individuals who need temporary coverage, such as young families or individuals with a short-term financial obligation.

- Whole life insurance is a good option for individuals who want permanent coverage and a guaranteed interest rate on their cash value.

- Universal life insurance is a good option for individuals who want flexibility in their premiums and death benefit.

- Variable life insurance is a good option for individuals who are willing to take on market risk in exchange for the potential for higher returns.

Multiple Life Insurance Policies

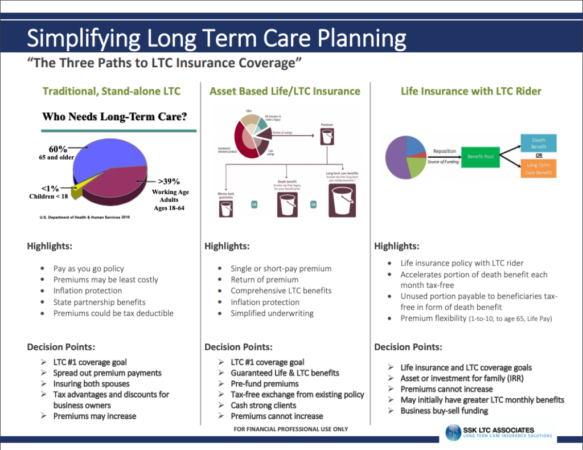

Having multiple life insurance policies with different companies can be a good strategy for certain situations. For example, if you need more coverage than one policy can provide, or if you want to have different types of coverage for different purposes.

Having multiple life insurance policies with different companies can be a good strategy for certain situations.

Potential Challenges and Solutions

Having multiple life insurance policies can be a smart move, but it also comes with its own set of potential challenges. Like juggling multiple streaming services, you need to make sure you’re not paying for more than you need or missing out on crucial coverage.

Let’s dive into some common hurdles and how to navigate them like a pro.

Potential Challenges of Managing Multiple Policies

It’s easy to get lost in the paperwork and forget about your policies, especially if they’re with different companies. This can lead to missed payments, lapses in coverage, and even duplicate policies, which can be a waste of money.

Here’s a breakdown of potential issues:

- Keeping Track of Payment Dates: Remembering multiple payment dates and amounts can be a real headache. It’s easy to miss a deadline, which can lead to late fees and even policy cancellation.

- Policy Overlap: You might have overlapping coverage from different policies, which can lead to unnecessary expenses.

- Confusing Policy Details: With multiple policies, it can be hard to keep track of your beneficiaries, coverage amounts, and other essential details.

- Administrative Burden: Managing multiple policies can be time-consuming, especially when it comes to updates, changes, or claims.

Conclusive Thoughts

In a nutshell, having multiple life insurance policies can offer a range of benefits, from increased coverage to diversification of your financial portfolio. It’s important to consider your individual needs and goals, research different policy options, and make informed decisions to ensure you have the right level of protection for yourself and your loved ones. Remember, life insurance is a long-term commitment, so it’s essential to review and update your policies regularly to keep them aligned with your changing circumstances. By taking a proactive approach to life insurance, you can create a solid financial foundation for the future.

Q&A

How many life insurance policies can I have?

There’s no limit on how many life insurance policies you can have. You can have as many as you need to meet your financial goals and provide adequate coverage for your beneficiaries.

Can I have two policies with the same company?

Yes, you can have multiple policies with the same insurance company. However, it’s important to understand the terms and conditions of each policy to avoid any potential overlaps or conflicts.

What are the advantages of having multiple policies?

Having multiple policies can offer increased coverage, flexibility in choosing policy types, and potential cost savings through bundling or discounts.

What are the disadvantages of having multiple policies?

Potential disadvantages include managing multiple premiums, the complexity of coordinating policies, and the risk of over-insuring.