Can you insure a car you don’t own in Florida? This question often arises when individuals find themselves needing to drive a vehicle that isn’t registered in their name. Whether you’re renting a car for a vacation, borrowing a friend’s vehicle, or driving a company car for work, understanding Florida’s insurance laws is crucial. This guide delves into the specific requirements and options for insuring a car you don’t own in the Sunshine State.

Florida’s Department of Motor Vehicles (FLHSMV) mandates that all drivers have proper insurance coverage. This includes situations where you’re driving a car that you don’t own. The type of insurance you need will depend on the specific scenario, such as renting, borrowing, or driving a company vehicle. We’ll explore the different types of insurance policies available, the factors affecting insurance rates, and how to find the right coverage for your needs.

Florida Insurance Laws: Can You Insure A Car You Don’t Own In Florida

In Florida, driving a car without proper insurance is against the law and carries significant consequences. To ensure compliance, the state has specific requirements for car insurance, enforced by the Florida Department of Motor Vehicles (FLHSMV).

Florida’s Minimum Insurance Requirements

Florida requires all drivers to have a minimum amount of car insurance coverage. This is known as “financial responsibility.” The minimum coverage levels are as follows:

- Personal Injury Protection (PIP): $10,000 per person, covering medical expenses and lost wages for injuries sustained in an accident, regardless of fault.

- Property Damage Liability (PDL): $10,000 per accident, covering damage to another person’s property caused by the insured driver.

Florida Department of Motor Vehicles (FLHSMV) Regulations

The FLHSMV is responsible for enforcing Florida’s insurance laws. They require drivers to provide proof of insurance upon request by law enforcement officers.

Legal Implications of Driving Without Insurance in Florida

Driving a car without the required insurance in Florida is considered a serious offense. The consequences include:

- Fines: Drivers can face fines of up to $500 for driving without insurance.

- License Suspension: If a driver is caught driving without insurance multiple times, their driver’s license may be suspended.

- Vehicle Impoundment: The vehicle may be impounded until proof of insurance is provided.

- Jail Time: In some cases, driving without insurance can result in jail time.

“It is crucial to have the required car insurance in Florida to avoid legal consequences and protect yourself financially in case of an accident.”

Types of Insurance Policies

In Florida, you have various options when it comes to car insurance policies. Understanding the different types of coverage and their features is crucial to making an informed decision that best suits your needs and budget.

Liability Coverage

Liability insurance is a mandatory requirement in Florida. It protects you financially if you cause an accident that results in injuries or property damage to others. Liability coverage is divided into two parts:

* Bodily Injury Liability: This covers medical expenses, lost wages, and other damages related to injuries caused to others in an accident.

* Property Damage Liability: This covers repairs or replacement costs for damage to other people’s vehicles or property.

The minimum liability coverage required in Florida is:

* $10,000 for bodily injury per person

* $20,000 for bodily injury per accident

* $10,000 for property damage per accident

It’s important to note that these minimum limits might not be sufficient to cover all potential damages in a serious accident.

Collision Coverage

Collision coverage pays for repairs or replacement costs to your vehicle if it’s involved in an accident, regardless of who’s at fault. This coverage is optional, but it’s highly recommended if you have a loan or lease on your vehicle.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damage from events other than accidents, such as theft, vandalism, fire, hail, or natural disasters. This coverage is also optional, but it can be beneficial if your vehicle is new or has a high value.

Uninsured/Underinsured Motorist Coverage, Can you insure a car you don’t own in florida

This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages. It can also protect you if you’re hit by a hit-and-run driver.

Personal Injury Protection (PIP)

PIP coverage, also known as “no-fault” insurance, covers your medical expenses and lost wages, regardless of who’s at fault in an accident. It’s mandatory in Florida.

Benefits and Drawbacks of Different Policy Types

- Liability Coverage:

- Benefit: Protects you from financial ruin if you cause an accident.

- Drawback: Only covers damages to others, not your own vehicle.

- Collision Coverage:

- Benefit: Pays for repairs or replacement of your vehicle after an accident.

- Drawback: Can be expensive, especially for newer or high-value vehicles.

- Comprehensive Coverage:

- Benefit: Protects your vehicle from damage caused by non-accident events.

- Drawback: Can be costly, especially if you live in an area prone to natural disasters.

- Uninsured/Underinsured Motorist Coverage:

- Benefit: Protects you from financial loss when dealing with uninsured or underinsured drivers.

- Drawback: May not cover all damages, especially if the other driver has no insurance.

- Personal Injury Protection (PIP):

- Benefit: Covers your medical expenses and lost wages after an accident, regardless of fault.

- Drawback: May have limits on coverage and may not cover all medical expenses.

Insuring a Car You Don’t Own

In Florida, it’s important to understand the nuances of insuring a car you don’t own. There are specific scenarios where you might need to secure insurance coverage, and knowing the available options can help you make informed decisions.

Scenarios Requiring Insurance

You might need to insure a car you don’t own in several situations, each with its own set of requirements and considerations.

- Renting a Car: When renting a car, you are typically required to have insurance coverage. The rental company will usually offer their own insurance options, but you can also choose to use your personal auto insurance policy or a third-party provider. It’s essential to compare the coverage options and choose the one that best suits your needs and budget.

- Borrowing a Car: If you borrow a car from a friend or family member, you may need to secure insurance coverage. The level of coverage required will depend on the specific circumstances and the lender’s insurance policy. It’s crucial to discuss the insurance requirements with the car owner before driving the vehicle.

- Driving a Company Car: If you drive a company car as part of your job, your employer will likely provide insurance coverage. However, you might still need to secure additional insurance, such as personal liability coverage, to protect yourself in case of an accident. It’s important to review your company’s insurance policy and understand your responsibilities.

Insurance Requirements for Non-Owners

In Florida, if you don’t own a car but drive one regularly, you’ll need to secure non-owner’s insurance. This type of coverage protects you financially in case of an accident while driving a vehicle you don’t own.

Non-owner’s insurance in Florida provides liability coverage, which is mandatory. This means you must have this type of insurance to legally operate a vehicle on public roads.

Obtaining Non-Owner’s Insurance

To obtain non-owner’s insurance in Florida, follow these steps:

- Contact an insurance agent or broker. Discuss your driving history, the types of vehicles you’ll be driving, and your budget to determine the best coverage options.

- Provide the necessary documentation. This includes your driver’s license, proof of residency, and any relevant information about the vehicles you’ll be driving. You may also need to provide information about any prior accidents or violations.

- Pay your premium. Non-owner’s insurance premiums are typically based on your driving history, age, and the type of coverage you choose.

Documentation Required for Non-Owner’s Insurance

The following documentation is typically required when applying for non-owner’s insurance in Florida:

- Driver’s license: A valid Florida driver’s license is essential to prove your legal right to operate a vehicle.

- Proof of residency: This can include a utility bill, lease agreement, or bank statement with your name and address.

- Vehicle information: If you know the make, model, and year of the vehicle you’ll be driving, provide this information. This helps the insurance company assess your risk and determine your premium.

- Driving history: The insurance company will likely request your driving record to evaluate your risk. They’ll check for any accidents, violations, or suspensions. You can usually obtain a copy of your driving record from the Florida Department of Motor Vehicles.

- Prior insurance information: If you’ve had insurance in the past, provide details about your previous policies. This can help the insurance company assess your risk and determine your premium.

Factors Affecting Insurance Rates

Just like with regular car insurance, several factors influence the cost of non-owner car insurance in Florida. These factors are used to assess your risk as a driver, and they can significantly impact your premium.

Driving History

Your driving history is a major factor in determining your non-owner car insurance rates. Insurance companies use your driving record to evaluate your risk as a driver.

- Accidents: A history of accidents, especially those where you were at fault, will increase your premiums. The more accidents you have, the higher your rates are likely to be.

- Traffic Violations: Traffic violations, such as speeding tickets, DUI convictions, and reckless driving citations, also increase your insurance rates. The severity of the violation impacts the premium increase.

- Driving Record Length: A longer driving record with no accidents or violations can help you get lower rates. New drivers with less experience may have higher premiums.

Age

Your age is another important factor in determining your insurance rates.

- Young Drivers: Young drivers, especially those under 25, are statistically more likely to be involved in accidents. Insurance companies often charge higher premiums for young drivers.

- Older Drivers: Older drivers, especially those over 65, may also face higher premiums due to potential health concerns and slower reaction times.

- Mature Drivers: Drivers in their mid-30s to mid-50s often enjoy the lowest insurance rates, as they have a good balance of experience and fewer risks.

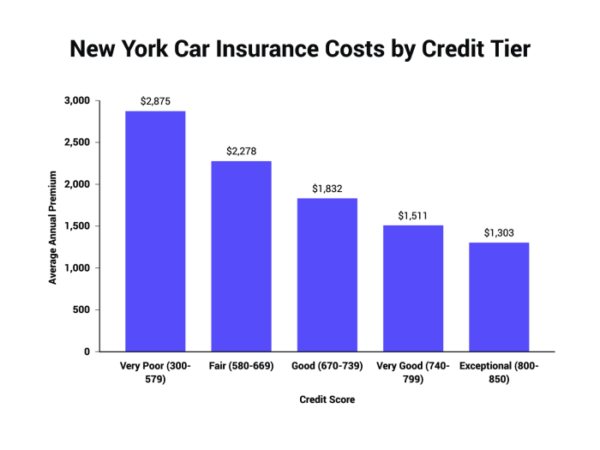

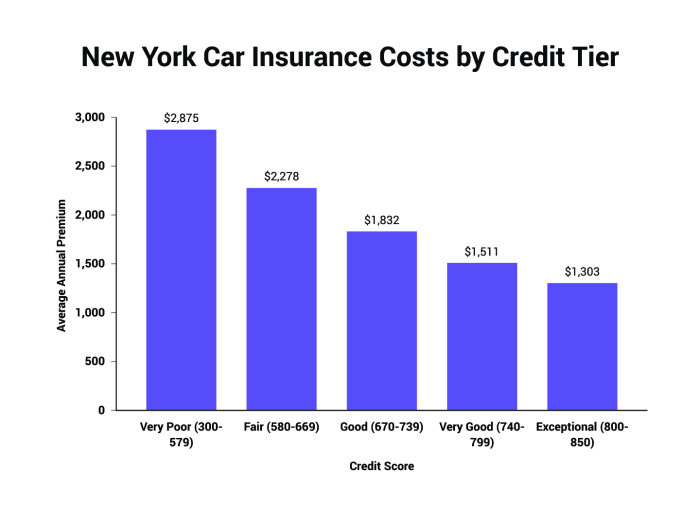

Credit Score

While it may seem unusual, your credit score can impact your non-owner car insurance rates in Florida.

- Credit History: Insurance companies use your credit score to assess your financial responsibility. A good credit score can lead to lower premiums, while a poor credit score may result in higher rates.

- Credit-Based Insurance Scores: Insurance companies use credit-based insurance scores (CBIS) to help predict the likelihood of claims. A higher CBIS score indicates a lower risk, which translates to lower premiums.

Vehicle Type and Usage

The type of vehicle you plan to drive and how you use it also affect your insurance rates.

- Vehicle Type: Sports cars and luxury vehicles are often more expensive to repair, leading to higher insurance premiums.

- Vehicle Usage: If you use the vehicle for commuting long distances or for business purposes, your insurance rates may be higher than if you use it for personal use only.

Final Review

Navigating the world of car insurance can be complex, especially when it comes to insuring a vehicle you don’t own. Florida has specific regulations and requirements that must be met to ensure you’re legally protected while driving. By understanding the different insurance options, factors affecting rates, and steps involved in obtaining coverage, you can confidently drive a car that’s not registered in your name. Remember to carefully review your policy and seek clarification on any uncertainties to avoid potential complications down the road.

Question Bank

What if I’m only driving the car for a short period?

Even for short-term use, you’ll still need to meet Florida’s insurance requirements. It’s essential to obtain the necessary coverage, regardless of the duration of your use.

Can I use my own personal car insurance policy?

In most cases, your personal car insurance policy won’t cover you while driving a car you don’t own. You’ll need to obtain separate coverage for the specific vehicle.

How much will insurance cost for a non-owner policy?

The cost of non-owner insurance varies depending on factors like your driving history, age, and the vehicle you’re insuring. It’s best to get quotes from multiple insurance providers to compare rates.