Can you sue a life insurance company? It’s a question that pops up when things go wrong with a claim. Life insurance is meant to provide financial security for your loved ones, but what happens when the company refuses to pay out? Understanding your policy and knowing your rights can make all the difference.

Life insurance contracts are legally binding agreements, and like any contract, they can be broken. If a company acts in bad faith, denying a legitimate claim or failing to fulfill its obligations, you might have grounds to sue. This could involve situations where the company misrepresented the policy terms, engaged in fraudulent practices, or wrongfully denied a claim based on incomplete or misleading information.

Understanding Life Insurance Contracts

Life insurance contracts are legally binding agreements between you and the insurance company. They Artikel the terms and conditions of your coverage, including how much you’ll pay in premiums and how much your beneficiaries will receive in the event of your death.

Key Elements of a Life Insurance Contract

Understanding the key elements of a life insurance contract is crucial to ensure you are adequately protected and that your beneficiaries will receive the benefits you intended.

- Policy Term: This defines the duration of your coverage. It can be a specific period (e.g., 10 years) or a lifetime policy.

- Death Benefit: This is the amount of money your beneficiaries will receive upon your death. It can be a lump sum or paid out in installments.

- Premium: This is the regular payment you make to maintain your coverage. The premium amount depends on factors like your age, health, and the amount of coverage you choose.

- Coverage Details: This section specifies the types of events covered by the policy, such as death from natural causes, accidents, or even specific illnesses.

- Exclusions: This section Artikels events or situations that are not covered by the policy. Common exclusions include death by suicide within a specific timeframe or death caused by illegal activities.

Common Clauses That May Be Grounds for a Lawsuit

While life insurance contracts are generally straightforward, certain clauses can be grounds for a lawsuit if they are ambiguous or unfair.

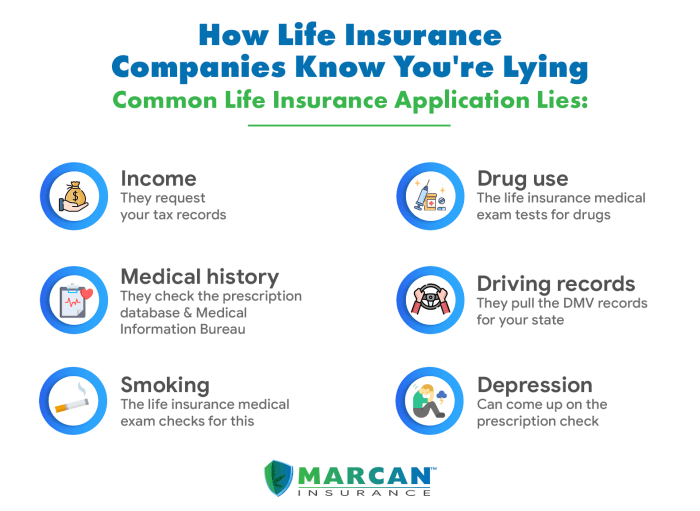

- Misrepresentation or Fraud: If the insurance company discovers that you provided false information on your application, they may deny your claim or reduce the death benefit.

- Unreasonable Exclusions: Some exclusions may be considered unreasonable or unfair, such as denying coverage for death due to pre-existing conditions.

- Lack of Transparency: If the contract contains hidden clauses or complex language that is difficult to understand, it may be grounds for a lawsuit.

- Bad Faith Practices: Insurance companies have a duty to act in good faith when dealing with policyholders. If they engage in practices like delaying claims or denying them without justification, this could be grounds for a lawsuit.

Reviewing and Understanding Your Policy, Can you sue a life insurance company

It is crucial to thoroughly review and understand your life insurance policy before signing it.

- Read the Entire Policy: Don’t just skim through it; read every word carefully. Pay close attention to the fine print, especially the exclusions and limitations.

- Ask Questions: If you have any questions or concerns about the policy, don’t hesitate to ask your insurance agent or a lawyer.

- Compare Policies: Before choosing a policy, compare different options from various companies to find the best coverage at a reasonable price.

Potential Outcomes and Considerations

So, you’re thinking about taking a life insurance company to court? It’s a big decision, and there’s no guarantee you’ll win. Let’s talk about what could happen and the factors that might influence the outcome.

Possible Outcomes

The possible outcomes of a lawsuit against a life insurance company can vary greatly. Here’s a breakdown of some potential scenarios:

| Outcome | Description |

|---|---|

| Settlement | The insurance company and the policyholder reach an agreement outside of court. This could involve a payment, a change in policy terms, or some other form of resolution. |

| Judgment in favor of the policyholder | The court finds in favor of the policyholder, and the insurance company is ordered to pay damages or specific relief. |

| Judgment in favor of the insurance company | The court finds in favor of the insurance company, and the policyholder’s claim is dismissed. |

| Appeal | Either party can appeal the court’s decision to a higher court. |

Factors Influencing Outcomes

A number of factors can influence the outcome of a lawsuit, including:

- The strength of the policyholder’s claim. This includes the evidence supporting the claim, the policy terms, and the actions of the insurance company.

- The insurance company’s reputation. A company with a history of bad faith practices may be more likely to settle a claim to avoid negative publicity.

- The legal arguments presented by both sides. This includes the interpretation of the policy terms, the applicable laws, and the relevant case law.

- The skill and experience of the attorneys involved.

- The judge’s rulings and decisions.

Costs and Risks

Pursuing legal action against a life insurance company can be costly and risky. Consider the following:

- Attorney fees. Legal representation can be expensive, especially for complex insurance disputes.

- Court costs. There are fees associated with filing lawsuits, taking depositions, and other legal proceedings.

- Time commitment. Litigation can take a significant amount of time, potentially delaying the resolution of the claim.

- Risk of losing the case. There’s no guarantee of success in a lawsuit, and you could end up losing the case and incurring significant costs.

Outcome Summary

Navigating the legal system can be a complex and challenging process, especially when dealing with a large corporation like a life insurance company. If you believe you have a valid claim, it’s crucial to seek legal advice from an experienced attorney who specializes in insurance law. They can help you understand your rights, gather evidence, and build a strong case. Remember, knowing your policy inside and out is the first step towards protecting your financial future and the well-being of your loved ones.

FAQ Summary: Can You Sue A Life Insurance Company

What are some common reasons for suing a life insurance company?

Common reasons include wrongful denial of claims, breach of contract, misrepresentation of policy terms, and fraudulent practices.

How do I know if I have a valid claim?

Consulting with an attorney who specializes in insurance law is crucial. They can assess your situation and advise you on the strength of your claim.

What are the potential costs and risks associated with suing a life insurance company?

Legal fees, court costs, and the possibility of losing your case are all factors to consider. It’s important to weigh the potential benefits against the risks before pursuing legal action.

What should I do if my life insurance claim is denied?

Review the denial letter carefully, understand the reasons provided, and consider appealing the decision. If you believe the denial is wrongful, seek legal counsel.

What are the time limits for filing a lawsuit against a life insurance company?

Statutes of limitations vary by state, so it’s essential to consult with an attorney to determine the applicable timeframe in your jurisdiction.