- Understanding Life Insurance Policy Transfers

- Types of Policy Transfers

- Eligibility and Requirements for Transfer: Can You Transfer Life Insurance Policies To Another Company

- Financial Considerations and Costs

- Impact on Policy Benefits and Coverage

- Tax Implications of Transferring a Policy

- Considerations for Policyholders

- Final Summary

- Clarifying Questions

Can you transfer life insurance policies to another company – Switching life insurance companies might sound like a wild idea, but it’s actually a pretty common move! Maybe you’ve got a new job, a family situation changed, or maybe you just found a better deal. There are a bunch of reasons why someone might want to transfer their life insurance policy, and it can be a smart move if you know what you’re doing.

It’s not always a walk in the park, though. You’ve gotta understand the different types of transfers, the rules, and the costs involved. Think of it like a level-up in your insurance game – you’ve got to learn the new moves to make sure you’re covered.

Understanding Life Insurance Policy Transfers

Switching life insurance policies to a different company might sound complicated, but it’s not as daunting as it seems. It’s a process that can be beneficial if you’re looking for better coverage, lower premiums, or a more suitable policy for your needs. Let’s break down the process and explore why someone might consider transferring their policy.

Reasons for Transferring a Life Insurance Policy

Transferring a life insurance policy to a different company is a decision that requires careful consideration. There are several reasons why someone might want to transfer their policy.

- Lower Premiums: As your circumstances change, you might find that your current life insurance policy is no longer the most cost-effective option. If you’ve improved your health or financial situation, you could qualify for lower premiums with a different company. This could save you money in the long run.

- Better Coverage: Life insurance policies can vary in terms of coverage and benefits. You might want to switch to a different policy that offers more comprehensive coverage, such as additional riders or a higher death benefit. This is especially important if your family’s needs have changed, or if you’ve taken on new financial responsibilities.

- Improved Financial Stability: Sometimes, transferring your policy can help you improve your financial stability. For example, if your current insurer is experiencing financial difficulties, you might want to switch to a company with a stronger financial track record.

Benefits and Drawbacks of Transferring a Life Insurance Policy

There are potential benefits and drawbacks to transferring a life insurance policy.

- Benefits:

- Lower Premiums: As mentioned earlier, you might be able to secure lower premiums with a different company. This could save you a significant amount of money over the life of the policy.

- Improved Coverage: You could find a policy that offers more comprehensive coverage, such as additional riders or a higher death benefit. This could provide greater peace of mind for your family.

- Enhanced Financial Stability: Transferring your policy to a financially sound company can help ensure that your beneficiaries will receive the death benefit when the time comes.

- Drawbacks:

- Medical Underwriting: You will likely have to undergo medical underwriting when you transfer your policy. This could involve a medical exam and a review of your medical history. If your health has deteriorated since you purchased your original policy, you may not qualify for the same coverage or premiums.

- Potential Fees: Some companies may charge fees for transferring a policy. These fees can vary depending on the company and the type of policy.

- Lost Policy Value: In some cases, you may lose some of the value of your current policy when you transfer it. This is because your policy may have accumulated cash value or other benefits that you may not be able to transfer.

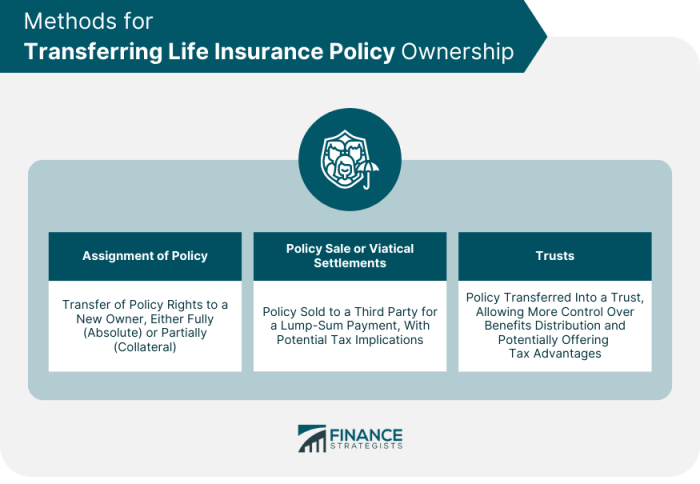

Types of Policy Transfers

So, you’ve got a life insurance policy, and you’re thinking about switching to a new company. But how do you actually transfer your policy? It’s not as simple as just calling up your new insurer and saying “move my policy over.” There are a few different ways to transfer a life insurance policy, each with its own set of advantages and disadvantages.

Policy Replacement

Policy replacement involves getting a new life insurance policy from a different company to replace your current policy. This can be a good option if you’re looking for better coverage, lower premiums, or more flexible features. However, it’s important to note that policy replacement can also be a complex process, and it’s crucial to understand the potential downsides.

- Requirements: Replacing your policy may involve a medical exam, especially if you’re older or have health issues. This could potentially affect your eligibility for the new policy or increase your premium.

- Potential Costs: There are potential costs associated with replacing your policy, such as surrender charges or fees for early termination. These costs can vary depending on the specific policy and the insurer.

- Loss of Cash Value: If you have a cash value life insurance policy, you may lose some of the accumulated cash value when you replace it. This is because you’re essentially starting over with a new policy.

- Potential for Higher Premiums: If your health has changed since you purchased your original policy, you may end up paying higher premiums for the new policy.

Policy Portability

Policy portability refers to the ability to transfer your existing life insurance policy to a different company without starting over. This is typically an option for policies that have a “portable” feature, and it’s often a more straightforward process than replacing your policy.

- Requirements: The specific requirements for policy portability vary depending on the insurer and the policy type. However, in general, you may need to meet certain health and financial requirements to be eligible for portability.

- Potential Costs: There may be fees associated with transferring your policy, but these are typically lower than the costs associated with replacing your policy.

- Preservation of Cash Value: If you have a cash value life insurance policy, you’ll likely be able to preserve the accumulated cash value when you transfer it.

- Potential for Lower Premiums: In some cases, you may be able to secure a lower premium for your transferred policy, especially if the new insurer offers more competitive rates.

Eligibility and Requirements for Transfer: Can You Transfer Life Insurance Policies To Another Company

Switching your life insurance policy to another company can be a smart move, but you need to know the rules of the game. Not every policy is eligible for a transfer, and the process has its own set of requirements. Think of it like a trade in your old car for a new one – you need to meet certain criteria to make the deal work.

Eligibility Criteria

To be eligible to transfer your life insurance policy, it needs to meet specific criteria. It’s like checking if your car passes inspection before you can trade it in. Here’s a rundown of the key factors:

* Policy Age: Most insurers have minimum age requirements for a policy to be eligible for transfer. This usually means the policy must be at least a year old, like waiting for your car to break in before selling it.

* Policy Type: The type of policy can also play a role in transfer eligibility. Policies like term life insurance are generally easier to transfer than permanent life insurance, which can be more complex.

* Policy Status: The policy must be in good standing, meaning all premiums are paid up-to-date, just like your car needs to be in good working order to be traded in.

* Health Status: Your health status can impact the transfer process. If your health has deteriorated since you bought the policy, the new insurer may require a medical exam, like taking your car to a mechanic for a pre-purchase inspection.

* Insurer Restrictions: Some insurers may have their own internal rules about transferring policies, so it’s crucial to check with them directly.

Required Documents and Information

To initiate the transfer process, you’ll need to gather some paperwork, like getting the necessary documents for your car trade-in. Here’s what you’ll typically need:

* Policy Documents: These include your policy contract, any riders, and any other relevant paperwork.

* Personal Information: You’ll need to provide your name, address, date of birth, and other personal details.

* Medical Information: Depending on the circumstances, you may need to provide medical records or complete a health questionnaire.

* Financial Information: You may need to provide information about your income, assets, and debts.

* Payment Information: You’ll need to provide information about your preferred payment method and any outstanding premiums.

Steps to Initiate a Policy Transfer

Ready to make the switch? Follow these steps to initiate the transfer process, like taking your car to the dealership for the trade-in:

* Contact the New Insurer: Start by contacting the life insurance company you want to transfer your policy to. They’ll walk you through the process and provide you with the necessary forms.

* Complete the Application: Fill out the application form completely and accurately, providing all the required information.

* Submit Required Documents: Gather all the necessary documents, including your policy documents and any other requested paperwork.

* Medical Exam (If Required): If the new insurer requires a medical exam, schedule it and complete it as instructed.

* Review and Approval: The new insurer will review your application and documents. If approved, they’ll issue you a new policy.

* Policy Cancellation: Once the new policy is in effect, you’ll need to contact your old insurer to cancel your existing policy.

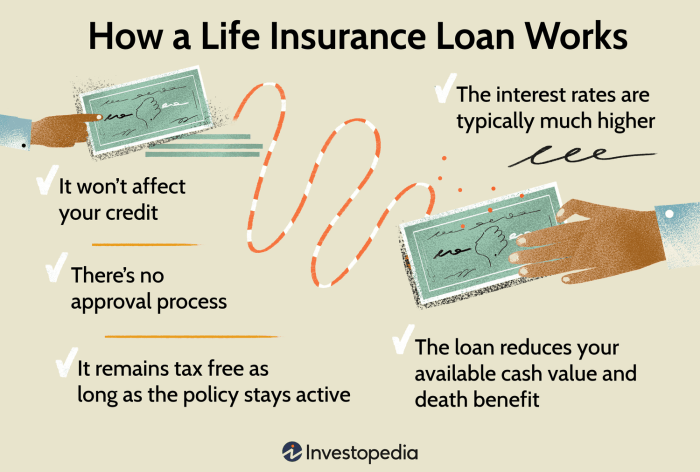

Financial Considerations and Costs

Transferring a life insurance policy can have a significant impact on your finances, both positive and negative. It’s crucial to carefully weigh the potential costs and benefits before making a decision.

Fees and Charges Associated with Policy Transfers

Transferring a life insurance policy often involves various fees and charges. These fees can vary depending on the insurance company, the type of policy, and the specific terms of the transfer.

- Surrender Charges: Many life insurance policies have surrender charges, which are penalties imposed when you cancel or surrender the policy before a certain period. These charges can be substantial, especially in the early years of the policy.

- Policy Fees: Life insurance policies often come with annual or monthly fees, which can be charged regardless of whether you transfer the policy. These fees can add up over time, so it’s essential to factor them into your calculations.

- Transfer Fees: Insurance companies may charge a fee to process the policy transfer. This fee can vary depending on the complexity of the transfer.

Financial Aspects of Transferring a Policy

The financial implications of transferring a life insurance policy can be complex. Here’s a table that summarizes the potential costs and benefits:

| Financial Aspect | Potential Costs | Potential Benefits |

|---|---|---|

| Premiums | Increased premiums if the new policy has higher rates. | Lower premiums if the new policy has lower rates. |

| Surrender Charges | Potential surrender charges if you cancel your existing policy. | Avoidance of surrender charges if the new policy allows for a smooth transfer. |

| Policy Fees | Increased policy fees if the new policy has higher fees. | Lower policy fees if the new policy has lower fees. |

| Transfer Fees | Fees associated with the transfer process. | |

| Cash Value | Potential loss of cash value if you surrender your existing policy. | Potential increase in cash value if the new policy offers better growth opportunities. |

Impact on Policy Benefits and Coverage

Switching life insurance policies can impact your death benefit, coverage amount, and other policy features. It’s crucial to carefully evaluate the potential changes before making a decision.

When transferring a policy, you’re essentially starting fresh with a new insurer. The new policy may offer different benefits, coverage levels, and premium costs compared to your existing policy.

Death Benefit

The death benefit is the amount of money your beneficiaries will receive upon your death. The death benefit in your new policy may be different from your existing policy, depending on several factors:

* Coverage amount: The new policy may offer a different coverage amount than your current policy. If you want to maintain the same death benefit, you may need to increase your coverage amount in the new policy.

* Premium: The new policy may have a different premium structure than your current policy. If the premium is higher, you may need to reduce your coverage amount to keep your monthly payments manageable.

* Policy type: The type of policy you choose can also affect the death benefit. For example, a whole life insurance policy typically has a fixed death benefit, while a term life insurance policy may have a decreasing death benefit.

Coverage Amount

The coverage amount is the maximum amount of money your beneficiaries will receive upon your death. The coverage amount in your new policy may be different from your existing policy due to factors like:

* Age: Your age at the time of transfer can impact the coverage amount offered by the new insurer. As you get older, you may be eligible for less coverage.

* Health: Your health status can also affect the coverage amount. If your health has deteriorated since you purchased your original policy, you may be offered less coverage in the new policy.

* Policy type: The type of policy you choose can also affect the coverage amount. For example, a term life insurance policy typically offers a lower coverage amount than a whole life insurance policy.

Other Policy Features

Other policy features that may be affected by a transfer include:

* Cash value: Some life insurance policies accumulate cash value over time, which can be borrowed against or withdrawn. The cash value in your new policy may be different from your existing policy.

* Riders: Riders are additional benefits that can be added to your policy, such as accidental death benefits or living benefits. The riders available in your new policy may be different from your existing policy.

* Premium payment options: The premium payment options available in your new policy may be different from your existing policy. For example, you may have the option to pay premiums monthly, quarterly, or annually in your new policy.

Illustration

Let’s say you have a $500,000 term life insurance policy with a monthly premium of $100. You’re considering transferring your policy to a new insurer that offers a $500,000 term life insurance policy with a monthly premium of $75.

In this scenario, you would be able to maintain the same death benefit but pay a lower premium. However, the new policy may have different riders, cash value options, or premium payment options than your existing policy. It’s important to carefully review the terms of both policies before making a decision.

Tax Implications of Transferring a Policy

Transferring a life insurance policy to another company can have tax implications. It’s crucial to understand these implications before making a decision. Depending on the type of transfer and the specific circumstances, there could be potential tax liabilities or benefits.

Tax Considerations for Policy Transfers, Can you transfer life insurance policies to another company

It’s important to consider the tax implications before transferring a life insurance policy. Here are some key tax considerations:

- Gain or Loss on Transfer: If you transfer your policy for a sum that exceeds the cost basis (the amount you’ve paid into the policy), you may have a taxable gain. Conversely, if the transfer amount is less than your cost basis, you might incur a taxable loss.

- Taxable Distributions: If you receive a lump sum payment from the policy transfer, this could be considered taxable income.

- Tax Treatment of Death Benefit: The death benefit of a life insurance policy is generally tax-free to the beneficiary. However, if the policy is transferred, the beneficiary may inherit the policy with a different cost basis, which could affect the tax treatment of the death benefit in the future.

- State Taxes: In addition to federal taxes, state taxes may also apply to life insurance policy transfers.

Tax Implications of Different Transfer Types

The tax implications of transferring a life insurance policy vary depending on the type of transfer.

| Transfer Type | Tax Implications |

|---|---|

| Policy Exchange | Generally, no tax implications if the exchange is done through a 1035 exchange, which allows you to transfer a life insurance policy to another policy without recognizing a gain or loss. |

| Policy Sale | If you sell your policy, you’ll need to report any gain or loss on the sale as capital gains or losses on your tax return. |

| Policy Assignment | If you assign your policy to another individual, the tax implications will depend on the specific terms of the assignment. |

Considerations for Policyholders

So, you’re thinking about transferring your life insurance policy? It’s a big decision, and there are a lot of factors to consider. This section will help you understand the key things to think about before you make a move.

Factors to Consider Before Transferring

The decision to transfer a life insurance policy is not a simple one. There are several factors that you should weigh carefully, including your age, health, financial situation, and the terms of your current policy.

- Age: As you age, your health may change, and your life insurance needs may evolve. If you’re older, you may have a more difficult time qualifying for a new policy, and the premiums may be higher. If you’re younger, you may be able to get a better rate on a new policy.

- Health: Your health status is a major factor in life insurance underwriting. If you have health problems, you may find it difficult to get approved for a new policy, or you may be offered a policy with higher premiums.

- Financial Situation: Your financial situation can also influence your decision. If you’re in a good financial position, you may be able to afford to pay higher premiums for a new policy. However, if you’re struggling financially, you may need to stick with your current policy, even if it’s not the best deal.

- Policy Terms: The terms of your current policy, such as the death benefit, premiums, and cash value, are important to consider. You should compare these terms to the terms of the new policy before making a decision.

Scenarios for Transferring

Let’s look at some situations where transferring a policy might be a good idea, or not.

- Scenario 1: You need a larger death benefit. If your life insurance needs have changed, such as getting married, having children, or taking on more debt, you may need a larger death benefit. Transferring to a new policy with a higher death benefit could be beneficial.

- Scenario 2: Your premiums are too high. If you’re finding it difficult to afford your current premiums, transferring to a new policy with lower premiums could save you money. This is especially true if your health has improved since you purchased your current policy.

- Scenario 3: Your policy is outdated. Life insurance policies can become outdated over time, especially if they were purchased many years ago. Transferring to a new policy with more modern features, such as a guaranteed insurability option, could be a good idea.

- Scenario 4: You’re not happy with your current insurer. If you’re unhappy with the customer service or financial stability of your current insurer, transferring to a new company could be a good idea.

Final Summary

Switching life insurance companies can be a real game-changer, but it’s important to weigh all the pros and cons. It’s like a financial makeover – sometimes it’s exactly what you need, but you’ve got to make sure you’re ready for the change. If you’re thinking about it, do your research, talk to a professional, and make sure you’re making the right move for your situation.

Clarifying Questions

What happens to my policy if I switch companies?

It depends on the type of transfer. Sometimes you’ll get a new policy, and sometimes you’ll just be moving your existing policy to a new company.

How much does it cost to switch companies?

There are usually fees involved, like surrender charges or application fees. It’s best to talk to a financial advisor to get a clear picture of the costs.

Is it better to switch to a different company?

It really depends on your individual situation. Sometimes it’s worth it, sometimes it’s not. You’ll need to do your research and compare the different options.