Can you transfer your life insurance to another company? It’s a question many people ask, especially if they’re looking for better rates, coverage, or features. Switching life insurance policies can be a smart move, but it’s important to understand the process and potential pitfalls before making a decision.

There are a few key factors to consider, including your current policy’s terms, your health status, and the policies offered by other companies. You’ll also want to weigh the costs associated with transferring, such as surrender charges or fees. Ultimately, the decision to transfer your life insurance policy should be based on a thorough analysis of your individual needs and financial situation.

Understanding Life Insurance Transfers

So, you’re thinking about switching your life insurance policy to a different company. Maybe you’ve found a better deal, or maybe your needs have changed. But before you jump into a new policy, it’s important to understand the ins and outs of transferring your life insurance.

Reasons for Transferring a Life Insurance Policy

Transferring your life insurance policy can be a big decision, but it might be worth it if you’re looking to get a better deal or improve your coverage. Here are some reasons why people might consider transferring their policy:

- Lower Premiums: Maybe you’ve found a company that offers lower premiums for your age and health. This could save you money in the long run.

- Better Coverage: Your life insurance needs might have changed. You might need more coverage to protect your family, or you might want to add riders or benefits to your policy.

- Improved Financial Stability: You might be concerned about the financial stability of your current insurance company. Switching to a company with a strong financial track record could give you peace of mind.

Potential Benefits of Transferring a Life Insurance Policy

Transferring your life insurance policy can offer some potential benefits, but it’s important to weigh them against the potential drawbacks.

- Lower Premiums: If you find a company with lower premiums, you could save a significant amount of money over the life of your policy.

- Improved Coverage: You might be able to get better coverage, such as additional riders or benefits, by transferring to a different company.

- Greater Flexibility: Some companies offer more flexibility in terms of policy features and options. You might be able to customize your policy to better meet your needs.

Potential Drawbacks of Transferring a Life Insurance Policy

While transferring your life insurance policy can offer some benefits, there are also some potential drawbacks to consider.

- Medical Underwriting: You’ll likely have to undergo medical underwriting when you transfer your policy. This means you’ll need to provide medical records and answer health questions. If your health has changed since you first got your policy, you might be denied coverage or offered a higher premium.

- Policy Fees: Some companies charge fees for transferring a policy. This could include a transfer fee or a new policy fee.

- Loss of Cash Value: If you have a cash value life insurance policy, you might lose some of the cash value when you transfer your policy.

Eligibility and Requirements

So, you’re thinking about switching life insurance companies? That’s great! But before you jump ship, you gotta make sure you’re eligible. Not all policies are created equal, and some companies have specific requirements for transfers.

Here’s the lowdown on what you need to know:

Policy Type

The first thing to consider is the type of policy you have. Not all life insurance policies are eligible for transfer. For example, some policies, like term life insurance, may be easier to transfer than others, like whole life insurance. This is because term life insurance policies are typically less complex and have shorter durations.

Age and Health Status

Your age and health status also play a role in eligibility. If you’re older or have a pre-existing medical condition, it might be more difficult to transfer your policy. This is because insurance companies evaluate your risk based on factors like age and health.

Policy Duration

Finally, the duration of your current policy can also impact your ability to transfer it. Policies that are relatively new or have been in effect for a longer period may be easier to transfer than policies that are close to their expiration date.

Steps for Transferring a Life Insurance Policy

Here’s the general process for transferring your life insurance policy:

- Contact the new insurance company: Start by reaching out to the insurance company you’re interested in transferring your policy to. They can tell you about their requirements and whether your current policy is eligible.

- Get a quote: The new insurance company will review your policy and provide you with a quote. This will include the premium you’ll pay and any coverage changes.

- Complete an application: If you’re happy with the quote, you’ll need to complete an application. This will include information about your health, finances, and the policy you’re transferring.

- Medical exam: Depending on your age and health, you may need to undergo a medical exam. This is to ensure that you’re still in good health and eligible for the new policy.

- Policy approval: Once the new insurance company has reviewed your application and medical exam (if required), they’ll decide whether to approve your policy transfer.

- Transfer of ownership: If your policy is approved, the ownership of your policy will be transferred to the new insurance company.

Policy Comparison and Evaluation

So, you’ve decided to switch life insurance companies, but you’re probably thinking, “Whoa, there are a lot of options out there! How do I choose the right one?” Don’t worry, you’re not alone. Comparing policies is crucial to finding the best deal for your needs.

Comparing Policy Features and Benefits

It’s like comparing apples to oranges – you need to know what you’re looking for. Each life insurance company has its own unique features and benefits, so you need to compare them side-by-side.

- Coverage Amount: How much coverage do you need? Consider your dependents’ financial needs, outstanding debts, and your lifestyle.

- Premium Costs: How much can you afford to pay monthly? Remember, lower premiums might mean less coverage, and vice versa.

- Policy Types: Do you need term life insurance (temporary coverage) or permanent life insurance (lifetime coverage)?

- Riders and Add-ons: These can enhance your policy, but they also add to the cost. Do you need additional benefits like accidental death coverage or long-term care riders?

- Company Reputation: Look for companies with a solid financial rating and a history of customer satisfaction.

Evaluating Policy Terms and Conditions

Think of this as the fine print – it’s crucial to read and understand everything. You don’t want to be surprised by hidden fees or restrictions later on.

- Grace Period: How long do you have to pay your premium before your policy lapses?

- Contestability Period: This is the time period during which the insurance company can investigate your application and potentially deny coverage if they find any inaccuracies or misrepresentations.

- Exclusions: Are there any specific conditions or activities that are not covered by the policy?

- Cash Value: If you choose a permanent life insurance policy, how does the cash value accumulate and how can you access it?

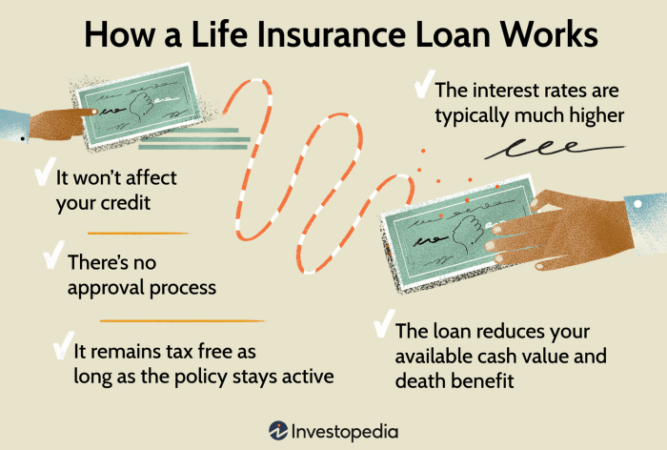

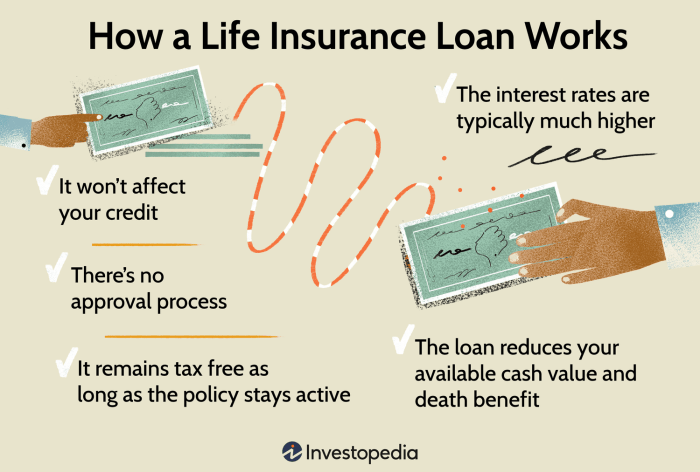

- Policy Loan Provisions: Can you borrow against the cash value of your policy? What are the interest rates and repayment terms?

Comparing Policies: A Sample Table, Can you transfer your life insurance to another company

Here’s a table that can help you visualize the key aspects of different policies:

| Company | Policy Type | Coverage Amount | Monthly Premium | Cash Value | Riders | Financial Rating |

|---|---|---|---|---|---|---|

| Company A | Term Life | $500,000 | $50 | N/A | Accidental Death | A+ |

| Company B | Whole Life | $250,000 | $100 | Yes | Long-Term Care | A |

| Company C | Universal Life | $300,000 | $75 | Yes | Waiver of Premium | A- |

Remember, this is just a sample table. You’ll need to research and compare the policies that are right for you.

Financial Considerations

Switching life insurance policies can have a big impact on your wallet, so it’s crucial to weigh the financial implications carefully. You need to consider the costs involved in transferring your policy and how it might affect your policy’s value.

Transfer Costs

The cost of transferring a life insurance policy can vary depending on the specific policy and the insurance company. Some common costs associated with transferring include:

- Surrender Charges: These are fees you may have to pay if you cancel your existing policy before it matures. Surrender charges are often highest in the early years of a policy and decrease over time. If you’re considering transferring a policy with high surrender charges, it’s important to factor those costs into your decision.

- Application Fees: Most insurance companies charge a fee to process your application for a new policy. This fee can range from a few hundred dollars to a few thousand dollars, depending on the policy type and the insurance company.

- Medical Exams: You may be required to undergo a medical exam as part of the application process for a new policy. The cost of a medical exam can vary depending on your health and the insurance company’s requirements.

Impact on Policy Value

Transferring a life insurance policy can also impact its value. Here’s what you need to consider:

- Cash Value: If you have a whole life insurance policy or a universal life insurance policy, your policy may have a cash value component. The cash value is the amount of money you can withdraw from your policy or borrow against it. If you transfer your policy, you may lose some or all of your cash value, depending on the terms of your new policy.

- Dividends: If you have a participating whole life insurance policy, you may receive dividends. Dividends are a share of the insurance company’s profits that are paid out to policyholders. If you transfer your policy, you may lose your right to receive dividends, depending on the terms of your new policy.

Potential Savings

While transferring a life insurance policy can involve costs, it can also potentially save you money in the long run. For example, you may be able to get a lower premium on a new policy, especially if your health has improved since you purchased your original policy. Additionally, you may be able to find a policy with better coverage or features than your current policy.

It’s important to weigh the potential costs and benefits of transferring a life insurance policy before making a decision. A financial advisor can help you determine if transferring is right for you.

Legal and Regulatory Aspects: Can You Transfer Your Life Insurance To Another Company

Transferring your life insurance policy to another company is a complex process that involves a number of legal and regulatory considerations. Understanding these aspects is crucial for making informed decisions and ensuring a smooth transition.

State Insurance Departments and Consumer Protection

State insurance departments play a significant role in regulating the life insurance industry, including policy transfers. They establish guidelines and regulations to protect consumers and ensure fair practices by insurance companies. These departments are responsible for:

- Licensing and supervising insurance companies.

- Investigating consumer complaints and resolving disputes.

- Enforcing state insurance laws and regulations.

- Educating consumers about their rights and responsibilities.

State insurance departments offer a range of consumer protection measures, including:

- Fair and equitable treatment: Ensuring that consumers are treated fairly and not discriminated against.

- Transparency and disclosure: Requiring insurance companies to provide clear and accurate information about their policies and practices.

- Consumer complaint resolution: Providing a mechanism for consumers to file complaints and seek resolution.

Potential Legal Issues and Challenges

While policy transfers can be beneficial, they also present potential legal issues and challenges. These include:

- Non-transferable policies: Some life insurance policies may contain clauses that restrict or prohibit transfers.

- Policy restrictions: Certain policies may have limitations on the transfer process, such as requiring specific conditions to be met or imposing fees.

- State regulations: Each state has its own set of insurance regulations that may affect the transfer process.

- Tax implications: Transferring a life insurance policy may trigger tax implications, such as capital gains taxes or income tax on the policy’s cash value.

- Legal disputes: In some cases, disputes may arise between the policyholder, the original insurance company, and the new insurance company, potentially leading to legal action.

Last Word

Transferring your life insurance policy can be a complex process, but it can also be a great way to secure better coverage and rates. Before making any decisions, it’s important to do your research, compare policies, and seek professional financial advice. With careful planning and consideration, you can find the right life insurance policy to protect your loved ones for years to come.

Commonly Asked Questions

Can I transfer my life insurance policy if I’m in poor health?

It depends on the specific policy and the insurer. Some companies may require a medical exam before transferring, while others may not. If you have a pre-existing health condition, you may need to pay higher premiums or be denied coverage altogether.

How long does it take to transfer a life insurance policy?

The transfer process can take anywhere from a few weeks to several months, depending on the insurer and the complexity of the policy. It’s important to start the process early to ensure a smooth transition.

What are the costs associated with transferring a life insurance policy?

You may have to pay surrender charges or fees, depending on your policy and the insurer. You may also have to pay application fees or medical exam costs. It’s important to factor in all of these costs before making a decision.