Can your car get towed for no insurance in Texas? The answer is a resounding yes. Texas is a state that takes its insurance laws seriously, and driving without insurance can lead to a range of consequences, including vehicle towing. While the state requires drivers to have a minimum amount of liability insurance, the reality is that many drivers find themselves in situations where they are caught without it. Understanding the specifics of Texas’s insurance laws, towing procedures, and potential exceptions can help drivers avoid this unfortunate situation.

The state of Texas has a strict policy when it comes to driving without insurance. Failing to maintain the minimum required insurance can result in fines, license suspension, and even jail time. Moreover, law enforcement officers have the authority to tow vehicles found to be operating without valid insurance. This means that drivers who are caught driving without insurance face not only legal penalties but also the inconvenience and expense of having their car towed.

Texas Law on Driving Without Insurance

Texas law requires all drivers to have liability insurance to protect themselves and others in case of an accident. This ensures that individuals who are injured or whose property is damaged in an accident can be compensated for their losses.

Penalties for Driving Without Insurance

Driving without insurance in Texas is a serious offense, and you can face significant penalties, including:

- Fines: The fine for driving without insurance can range from $175 to $350, depending on the specific circumstances.

- License Suspension: Your driver’s license can be suspended for up to six months if you are caught driving without insurance.

- Jail Time: In some cases, you may even face jail time for driving without insurance, especially if you are involved in an accident.

Situations Where a Car Can Be Towed

If you are driving without insurance, your car can be towed in several situations, including:

- Traffic Stop: If a police officer pulls you over and discovers that you do not have insurance, they may tow your vehicle.

- Accident: If you are involved in an accident and do not have insurance, your car may be towed.

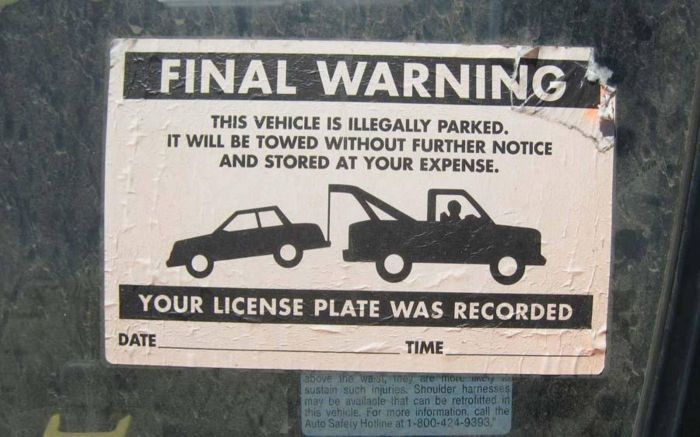

- Parking Violations: If you park your car illegally and it is towed, the towing company may refuse to release it until you provide proof of insurance.

Examples of Situations Where a Car Can Be Towed for Lack of Insurance, Can your car get towed for no insurance in texas

Imagine you are driving down the road when you get pulled over for speeding. The officer runs your license and discovers you do not have insurance. In this case, your car could be towed, and you could face the penalties described above.

Another example is if you are involved in a minor fender bender and do not have insurance. The other driver may call the police, and your car could be towed, even if the damage is minimal.

Towing Procedures in Texas: Can Your Car Get Towed For No Insurance In Texas

In Texas, the process of towing a vehicle is regulated by state law, ensuring both the rights of vehicle owners and the safety of the towing process. When a vehicle is towed in Texas, the involvement of law enforcement and licensed towing companies is crucial.

Vehicle Towing Process

The towing process in Texas typically begins with a law enforcement officer issuing a notice of violation to the vehicle owner. This notice may be for various reasons, including parking violations, abandoned vehicles, or driving without insurance. The officer will then contact a licensed towing company to remove the vehicle. The towing company is responsible for ensuring the vehicle is safely transported to a storage facility.

Rights of Vehicle Owners

Vehicle owners have specific rights when their car is towed in Texas. They have the right to retrieve their personal belongings from the vehicle before it is towed. However, this must be done within a reasonable timeframe and in a manner that does not disrupt the towing process. Additionally, owners have the right to challenge the tow by appealing the notice of violation issued by the law enforcement officer.

Towing Fees

Towing fees in Texas are regulated by the Texas Department of Transportation. These fees are calculated based on factors such as the distance the vehicle is towed, the type of vehicle, and the time of day.

Towing fees are typically higher for vehicles towed during nighttime hours or over longer distances.

Vehicle owners are responsible for paying the towing fees to the towing company. If the fees are not paid within a specified timeframe, the vehicle may be sold to recover the towing costs.

Last Point

Driving without insurance in Texas can be a costly mistake. Understanding the legal requirements, towing procedures, and potential exceptions is crucial for all drivers. By ensuring that you have valid insurance and adhering to the state’s laws, you can avoid the hassle and financial burden of having your car towed. Remember, it’s always best to be prepared and prioritize safe driving practices.

Clarifying Questions

What if I have proof of insurance but it was expired?

Even if you have proof of insurance, if it’s expired, you are still considered to be driving without insurance and could face the same consequences, including towing.

Can I get my car towed for not having insurance if I’m parked?

Generally, your car cannot be towed for lack of insurance if it’s parked. Towing laws primarily apply to vehicles actively being driven on public roads.

What are the towing fees in Texas?

Towing fees vary depending on the towing company and the distance the vehicle needs to be transported. However, you can expect to pay a minimum fee, and additional charges may apply for storage, administrative fees, and other services.

What if I’m involved in an accident without insurance?

If you’re involved in an accident without insurance, you will be held liable for any damages caused, and you could face additional penalties. It’s crucial to have insurance in place to protect yourself financially in such situations.