Can your insurance company drop you? It’s a question that might make you sweat a little, especially if you’ve ever had a fender bender or maybe forgot to pay a bill. But don’t worry, we’re here to break down the ins and outs of insurance policies and help you understand your rights and responsibilities. It’s all about knowing the rules of the game, right?

Insurance policies are basically contracts, and just like any contract, there are rules and regulations that both you and the insurance company need to follow. If you break those rules, it could mean your policy gets cancelled. But before you start freaking out, remember that insurance companies are businesses, and they have to make sure they’re not taking on too much risk. So, if you’re not following the terms of your policy, they might have to say “bye Felicia” to your coverage.

Understanding Insurance Contracts

Insurance contracts are the foundation of your coverage. They Artikel the agreement between you and your insurance company, laying out the terms and conditions of your policy.

Importance of Reviewing Policy Terms

It’s crucial to thoroughly review and understand your insurance policy. The terms and conditions of your policy determine your coverage, limits, and exclusions. This includes understanding what events are covered, the amount of coverage you have, and any situations where your coverage might be denied. Understanding your policy helps you avoid surprises and ensures you have the right coverage for your needs.

Common Clauses Related to Policy Cancellation

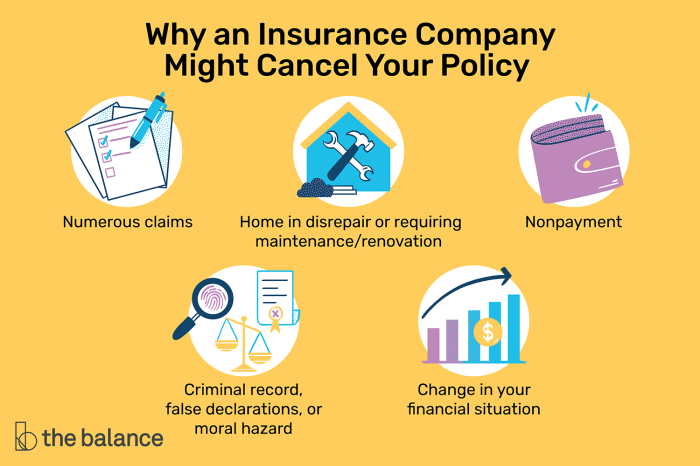

Insurance policies typically include clauses that address policy cancellation or termination. These clauses can be triggered by various factors, including:

- Non-payment of premiums: If you fail to pay your premiums on time, your insurance company may cancel your policy.

- Misrepresentation or fraud: If you provide false information or engage in fraudulent activities related to your policy, your insurance company can cancel it.

- Material changes in risk: If there are significant changes in the risk associated with your policy, such as moving to a high-risk area or changing your occupation, your insurance company may adjust your premium or cancel your policy.

- Violation of policy terms: If you violate the terms of your policy, such as driving without a valid license or engaging in risky activities, your insurance company may cancel your policy.

Consequences of Policy Cancellation

Getting your insurance policy cancelled can be a major headache, and it’s not something you want to experience. It can leave you exposed to financial ruin if you’re in an accident or face a covered event. But just how bad is it, really? Let’s break it down.

Impact on Different Types of Insurance

The consequences of policy cancellation can vary greatly depending on the type of insurance. Here’s a look at how it can affect you in different situations:

Auto Insurance

If your auto insurance is cancelled, you’ll be unable to drive legally. You’ll be forced to find new insurance, which can be difficult and expensive, especially if you have a history of cancellations. In addition, you could face legal penalties and fines if you’re caught driving without insurance. In some cases, you might even lose your driver’s license.

Health Insurance

Losing your health insurance can have devastating consequences, especially if you have pre-existing conditions. You’ll be forced to find new coverage, which can be challenging and costly, especially if you’re in between jobs or have a health issue. You might also have to pay higher premiums or be denied coverage altogether.

Home Insurance

If your home insurance is cancelled, you’ll be left vulnerable to financial disaster if your home is damaged or destroyed. You won’t have any coverage for repairs or rebuilding, and you’ll be responsible for covering the costs out of pocket. This can be a major financial burden, especially if you’re dealing with a significant event like a fire or flood.

Challenges of Obtaining New Insurance After Cancellation, Can your insurance company drop you

Getting new insurance after your policy has been cancelled can be a major challenge. Insurance companies are often hesitant to provide coverage to individuals who have had their policies cancelled, as it can be seen as a sign of risk. You may have to pay higher premiums, or you might even be denied coverage altogether.

Factors Affecting New Insurance Rates

Several factors can affect your ability to get new insurance after a cancellation, including:

- The reason for the cancellation: If your policy was cancelled for non-payment, you’ll likely have a harder time finding new coverage than if it was cancelled for another reason, like a lapse in coverage.

- Your driving record: If you have a history of accidents or traffic violations, insurance companies may be less likely to offer you coverage.

- Your credit score: Your credit score can also affect your insurance rates. A lower credit score may result in higher premiums.

Strategies for Obtaining New Coverage

Despite the challenges, there are strategies you can use to increase your chances of obtaining new insurance after a cancellation:

- Be transparent with insurance companies about the cancellation.

- Shop around and compare rates from multiple companies.

- Consider working with an insurance broker who can help you find coverage.

- Improve your credit score if it’s low.

Epilogue: Can Your Insurance Company Drop You

Knowing your rights and responsibilities when it comes to insurance is key to keeping your coverage intact. Make sure you’re paying your premiums on time, keeping your information updated, and following the terms of your policy. If you have any questions or concerns, don’t hesitate to reach out to your insurance company. It’s better to be safe than sorry, right? And remember, if you’re ever in a situation where your policy is cancelled, you have options. You can appeal the decision or even look for a new insurance company. Just remember to be prepared and proactive. It’s all about staying in the driver’s seat, both literally and figuratively.

Question & Answer Hub

What are some common reasons for policy cancellation?

Insurance companies can cancel policies for various reasons, such as non-payment of premiums, fraud, making changes to your risk profile (like adding a new driver to your car insurance), and violating the terms of your policy.

What should I do if my insurance company cancels my policy?

First, understand the reason for cancellation. Then, consider appealing the decision or seeking a review. You can also explore options for finding new insurance, but be prepared to share details about the cancellation.

Can I be denied insurance after a policy cancellation?

It’s possible, but not guaranteed. Insurance companies consider your past insurance history when evaluating your risk. Explain the circumstances of the cancellation and be transparent about your efforts to rectify the situation.

How can I avoid policy cancellation?

Pay premiums on time, maintain accurate information on your policy, and read the terms carefully. If you have any questions, contact your insurance company for clarification.