Car insurance average Florida is a crucial factor for any driver in the Sunshine State. Understanding the average costs, factors that influence premiums, and how to find affordable options can save you money and ensure you’re adequately protected on the road. This comprehensive guide delves into the intricacies of car insurance in Florida, providing insights into the different types of coverage, mandatory requirements, and strategies for securing the best rates.

From analyzing the average costs based on factors like age, driving history, and vehicle type to exploring the impact of location and driving habits, this article equips you with the knowledge to make informed decisions about your car insurance needs. Whether you’re a new driver or a seasoned motorist, navigating the complexities of car insurance in Florida can be daunting. This guide aims to simplify the process, empowering you to find the right coverage at the right price.

Understanding Car Insurance in Florida

Navigating the world of car insurance in Florida can seem complex, but understanding the different types of coverage and the state’s requirements is essential for every driver. This guide provides a comprehensive overview of car insurance in Florida, covering its intricacies and helping you make informed decisions.

Types of Car Insurance Coverage

Florida law requires all drivers to carry certain types of car insurance. These coverages provide financial protection in case of accidents, injuries, or damage to your vehicle or another person’s property.

- Liability Coverage: This essential coverage protects you financially if you cause an accident that injures another person or damages their property. It covers the other party’s medical expenses, lost wages, and property damage up to the limits of your policy. Liability coverage is divided into two parts: bodily injury liability and property damage liability.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. If you have a loan or lease on your vehicle, your lender may require collision coverage.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, fire, hail, or natural disasters. Comprehensive coverage is optional, but it can be beneficial if your vehicle is relatively new or has a high value.

- Personal Injury Protection (PIP): This coverage pays for your medical expenses, lost wages, and other related costs if you are injured in an accident, regardless of who is at fault. Florida requires all drivers to carry at least $10,000 in PIP coverage.

Mandatory Car Insurance Requirements in Florida

Florida law requires all drivers to carry a minimum amount of liability insurance:

- Bodily Injury Liability: $10,000 per person, $20,000 per accident

- Property Damage Liability: $10,000 per accident

- Personal Injury Protection (PIP): $10,000 per person

Failing to carry the required minimum car insurance in Florida can result in serious consequences, including fines, license suspension, and even jail time.

Factors Influencing Car Insurance Premiums

Several factors determine the cost of car insurance in Florida. These factors include:

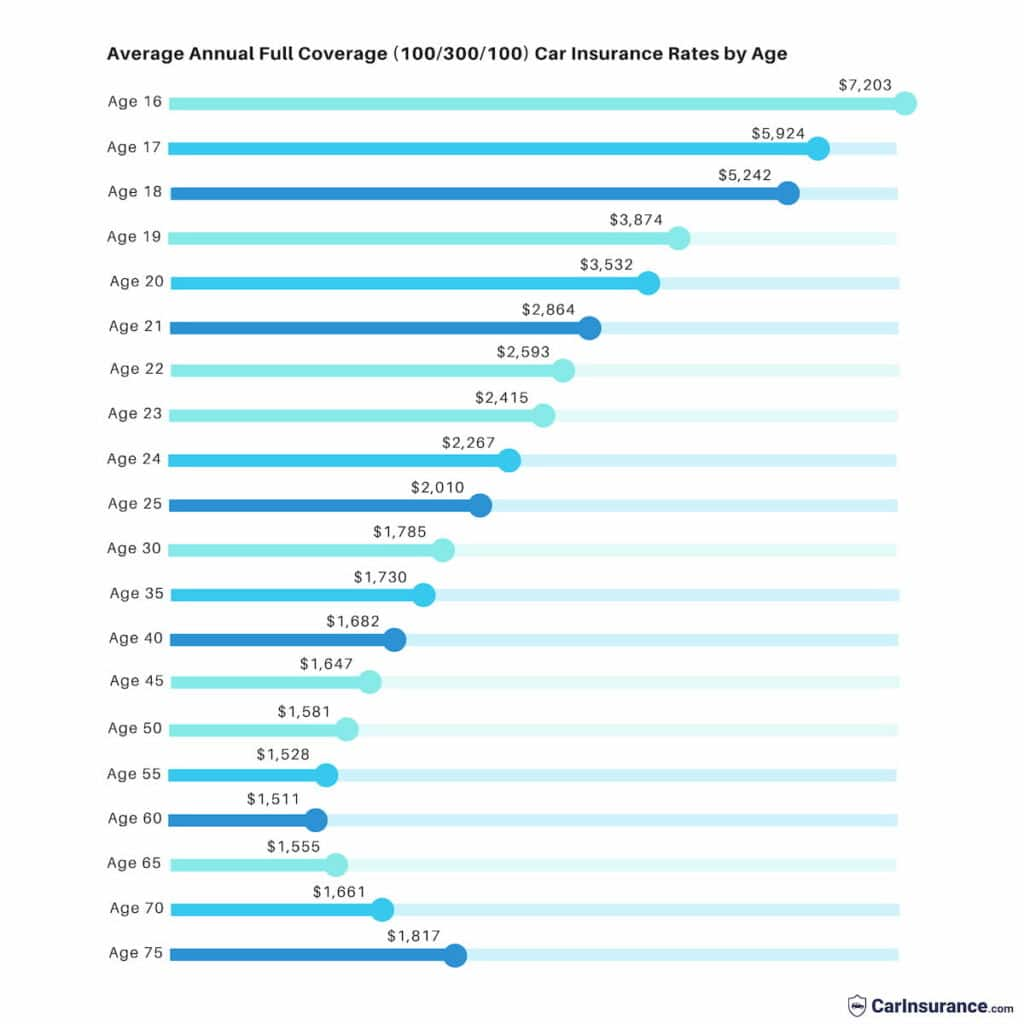

- Age: Younger drivers generally pay higher premiums due to their higher risk of accidents.

- Driving History: Drivers with a history of accidents, traffic violations, or DUI convictions will likely face higher premiums.

- Vehicle Type: The make, model, and year of your vehicle can affect your premium. Sports cars and luxury vehicles often have higher premiums due to their higher repair costs and potential for greater damage.

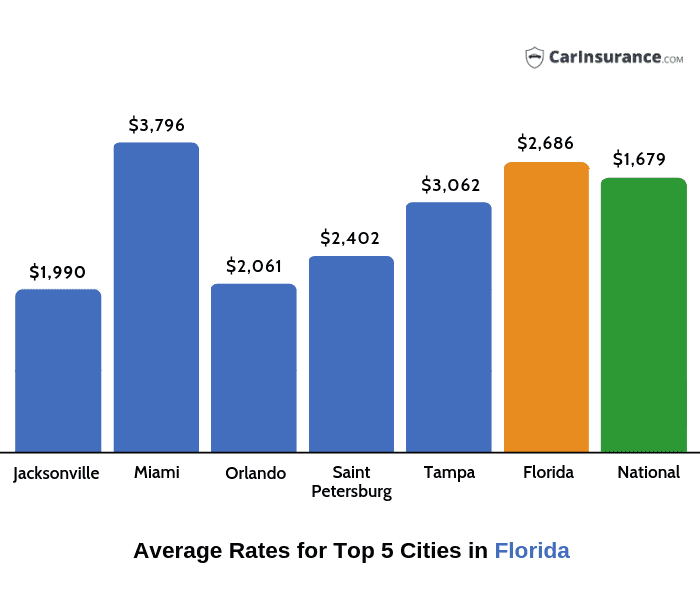

- Location: Car insurance premiums can vary depending on your location. Areas with higher accident rates or higher vehicle theft rates may have higher premiums.

- Credit Score: Some insurance companies consider your credit score when determining your premium. Drivers with good credit scores may qualify for lower premiums.

Average Car Insurance Costs in Florida

Florida is known for its warm weather, beautiful beaches, and, unfortunately, high car insurance rates. Several factors contribute to the higher costs, including a high number of uninsured drivers, a large number of accidents, and a high cost of living. While car insurance is a necessity, understanding the factors that influence its cost can help you find the best rates and save money.

Average Car Insurance Costs in Florida by Factor, Car insurance average florida

Florida’s average car insurance cost varies significantly depending on several factors. Understanding these factors can help you understand your individual premium and identify areas where you might be able to save.

Age

Younger drivers, particularly those under 25, often face higher premiums. This is due to their inexperience and higher risk of accidents. As drivers age and gain experience, their premiums tend to decrease.

Driving History

A clean driving record is essential for keeping car insurance costs down. Accidents, traffic violations, and DUI convictions can significantly increase your premiums. Maintaining a safe driving record is crucial for keeping your insurance affordable.

Vehicle Type

The type of vehicle you drive significantly impacts your car insurance cost. Expensive, high-performance cars, luxury vehicles, and vehicles with safety features are often more expensive to insure due to higher repair costs and greater potential for damage.

Location

Where you live in Florida can impact your car insurance rates. Urban areas with higher population densities and more traffic tend to have higher premiums due to increased accident risk.

Average Car Insurance Premiums in Florida

The following table shows average car insurance premiums for various car models and their associated coverage levels in Florida. Remember that these are just averages, and your actual premium may vary depending on the factors discussed earlier.

| Car Model | Coverage Level | Average Premium |

|—|—|—|

| Honda Civic | Liability Only | $1,200 |

| Toyota Camry | Full Coverage | $2,500 |

| Ford F-150 | Liability Only | $1,500 |

| Chevrolet Silverado | Full Coverage | $3,000 |

| Tesla Model 3 | Full Coverage | $4,000 |

Cost Fluctuations in Car Insurance Premiums

Your car insurance premiums can fluctuate based on various driving habits. Understanding these factors can help you make informed decisions that could potentially lower your costs.

Driving Distance

The more you drive, the higher your risk of being involved in an accident. Insurance companies often factor in your annual mileage when calculating your premium. Reducing your driving distance, especially for non-essential trips, can help lower your insurance costs.

Driving Frequency

Even if you drive a short distance, driving frequently can increase your risk of an accident. Insurance companies may consider your driving frequency, especially if you frequently drive during peak traffic hours.

Accident History

Your accident history plays a significant role in your car insurance premiums. Even minor accidents can lead to higher premiums. Driving safely and avoiding accidents is crucial for maintaining affordable insurance rates.

Factors Affecting Car Insurance Premiums

Your driving history, the type of vehicle you own, and where you live are just some of the factors that influence how much you pay for car insurance in Florida. Insurance companies use a complex algorithm to calculate your premium, taking into account a variety of factors.

Driving History

Your driving history is one of the most important factors that insurers consider when determining your car insurance premium. A clean driving record with no accidents or traffic violations will generally result in lower premiums. However, if you have been involved in accidents, received traffic tickets, or been convicted of DUI, your premiums are likely to be higher.

- Accidents: Insurance companies view accidents as a sign that you are a higher risk driver. The more accidents you have, the higher your premiums will be. The severity of the accident also matters. For example, a minor fender bender will likely have a smaller impact on your premium than a serious accident that resulted in injuries or property damage.

- Traffic Violations: Traffic violations, such as speeding tickets, running red lights, and reckless driving, can also increase your insurance premiums. Insurance companies see these violations as evidence of risky driving behavior. The severity of the violation will affect the impact on your premium. For example, a speeding ticket for exceeding the speed limit by 10 mph will likely have a smaller impact than a ticket for reckless driving.

- DUI Convictions: A DUI conviction is one of the most serious driving offenses, and it can have a significant impact on your insurance premiums. Insurance companies view DUI convictions as a sign of extreme risk-taking behavior. A DUI conviction can lead to a significant increase in your premium, or even result in your policy being canceled.

Vehicle Type

The type of vehicle you drive also plays a significant role in determining your car insurance premium. Insurance companies consider factors such as the vehicle’s age, make, model, and safety features.

- Vehicle Age: Older vehicles are generally considered to be higher risk than newer vehicles. This is because older vehicles may have more wear and tear, making them more likely to be involved in accidents. Also, older vehicles may not have the same safety features as newer vehicles, which can also increase the risk of accidents.

- Make and Model: Certain makes and models of vehicles are considered to be more expensive to repair or replace than others. These vehicles may also have a higher risk of being stolen or involved in accidents. For example, sports cars and luxury vehicles are often more expensive to insure than more affordable and practical vehicles.

- Safety Features: Vehicles with advanced safety features, such as anti-lock brakes, airbags, and electronic stability control, are generally considered to be safer and therefore less risky to insure. These features can help to prevent accidents or reduce the severity of injuries in the event of an accident. Insurance companies may offer discounts for vehicles with these features.

Location

Where you live can also affect your car insurance premiums. Insurance companies consider factors such as the geographic area, crime rates, and traffic congestion.

- Geographic Area: Insurance companies often charge higher premiums in areas with higher rates of accidents, theft, and vandalism. For example, premiums may be higher in urban areas with heavy traffic and high crime rates compared to rural areas with lower traffic and crime rates.

- Crime Rates: Areas with higher crime rates tend to have higher car insurance premiums. This is because insurance companies are more likely to have to pay out claims for stolen vehicles or vandalized vehicles in these areas.

- Traffic Congestion: Areas with heavy traffic congestion tend to have higher car insurance premiums. This is because heavy traffic increases the risk of accidents. The more cars on the road, the more likely it is that drivers will make mistakes that lead to accidents.

Finding Affordable Car Insurance in Florida

Finding the most affordable car insurance in Florida can be a challenging task, but with a bit of research and effort, you can secure a policy that fits your budget.

Obtaining Multiple Car Insurance Quotes

It is essential to obtain quotes from multiple insurance providers to compare prices and coverage options. You can easily do this by using online quote tools, visiting insurance agents, or calling insurance companies directly. Here’s a step-by-step guide:

- Gather your information: Before you start requesting quotes, have your driver’s license, vehicle information, and details about your driving history ready. This information is typically required to obtain accurate quotes.

- Use online quote tools: Many insurance companies offer online quote tools that allow you to compare prices and coverage options in minutes. Simply enter your information, and the tool will generate a personalized quote. Some popular online quote tools include:

- Bankrate

- NerdWallet

- Insurify

- Visit insurance agents: Insurance agents can provide personalized advice and help you find the best policy for your needs. They can also help you understand the different coverage options available and answer any questions you may have. To find an agent, you can use the Insurance Information Institute’s website or contact your local chamber of commerce.

- Call insurance companies directly: You can also contact insurance companies directly to request quotes. This can be a good option if you have specific questions or want to discuss your needs in detail.

Negotiating Car Insurance Premiums

Once you have received quotes from several insurance companies, you can start negotiating your premiums. Here are some tips for negotiating car insurance premiums:

- Shop around: Compare quotes from multiple insurance companies to find the best rates. By showing the insurance company that you are willing to shop around, you can increase your chances of getting a lower price.

- Ask about discounts: Many insurance companies offer discounts for good driving records, safe driving courses, and other factors. Ask about these discounts and see if you qualify.

- Consider increasing your deductible: A higher deductible means you will pay more out of pocket if you have an accident, but it can also lead to lower premiums.

For example: If you increase your deductible from $500 to $1,000, you could save 10-15% on your premium.

- Bundle your policies: If you have multiple insurance policies, such as homeowners or renters insurance, you can often get a discount by bundling them with your car insurance.

For example: Bundling your car and home insurance could save you up to 25% on your premiums.

- Be prepared to switch providers: If you are not satisfied with the price or coverage offered by your current insurer, be prepared to switch providers. The threat of losing a customer can sometimes encourage insurance companies to offer better rates.

Resources for Affordable Car Insurance

Several resources and organizations can help you find affordable car insurance in Florida. These resources can provide information, advice, and assistance in finding the best policy for your needs.

- Florida Office of Insurance Regulation (OIR): The OIR is the state agency responsible for regulating the insurance industry in Florida. The OIR website provides information about car insurance, including consumer guides, complaint procedures, and a directory of licensed insurance companies.

- Website: https://www.floir.com/

- Insurance Information Institute (III): The III is a non-profit organization that provides information about insurance to consumers. The III website offers articles, tips, and tools to help you understand car insurance and find the best policy for your needs.

- Website: https://www.iii.org/

- Florida Department of Motor Vehicles (DMV): The DMV website provides information about car insurance requirements in Florida, including the minimum coverage amounts required by law.

- Website: https://www.flhsmv.gov/

Understanding Car Insurance Discounts: Car Insurance Average Florida

Car insurance discounts can significantly reduce your premiums in Florida. By taking advantage of these discounts, you can save money on your car insurance policy. Florida car insurance companies offer a variety of discounts to policyholders, including safe driver discounts, good student discounts, and multi-policy discounts.

Safe Driver Discounts

Safe driver discounts are offered to drivers with a clean driving record. These discounts reward drivers who have not been involved in accidents or received traffic violations.

To qualify for a safe driver discount, you must have a clean driving record for a specific period, typically three to five years.

The specific requirements for safe driver discounts vary by insurance company. Some insurance companies may offer discounts for drivers who have completed defensive driving courses.

Good Student Discounts

Good student discounts are available to students who maintain a certain grade point average (GPA). These discounts reward students who demonstrate academic achievement and responsible behavior.

To qualify for a good student discount, you must be enrolled in high school or college and maintain a GPA of 3.0 or higher.

Some insurance companies may require students to provide proof of their GPA, such as a transcript.

Multi-Policy Discounts

Multi-policy discounts are offered to customers who bundle multiple insurance policies with the same insurance company. This can include car insurance, homeowners insurance, renters insurance, and other types of insurance.

To qualify for a multi-policy discount, you must bundle at least two insurance policies with the same insurance company.

The discount amount for multi-policy discounts can vary depending on the types of policies bundled.

Other Car Insurance Discounts in Florida

- Anti-theft Device Discount: This discount is offered to drivers who have installed anti-theft devices on their vehicles, such as alarms or tracking systems.

- Vehicle Safety Feature Discount: This discount is offered to drivers who have vehicles with advanced safety features, such as anti-lock brakes or airbags.

- Loyalty Discount: This discount is offered to drivers who have been customers of the insurance company for a certain period of time.

- Military Discount: This discount is offered to active military personnel and veterans.

- Early Payment Discount: This discount is offered to drivers who pay their car insurance premiums in full or make timely payments.

Conclusive Thoughts

Ultimately, understanding car insurance average Florida involves a multi-faceted approach that considers your individual circumstances and driving habits. By utilizing the insights provided in this guide, you can confidently navigate the world of car insurance in Florida, securing the right coverage at a price that fits your budget. Remember, proactive research and informed decisions are key to achieving peace of mind on the road.

FAQ Resource

What factors influence car insurance premiums in Florida?

Factors that influence car insurance premiums in Florida include age, driving history, vehicle type, location, driving habits, and credit score.

How can I get the best car insurance rates in Florida?

To get the best car insurance rates, compare quotes from multiple insurers, consider discounts, improve your driving record, and choose a safe vehicle.

What are some common car insurance discounts available in Florida?

Common car insurance discounts in Florida include safe driver, good student, multi-policy, and defensive driving course discounts.